Embracing Gold as a Safe Haven Amid Market Volatility

In an era marked by unpredictable economic shifts and geopolitical uncertainties, gold remains a timeless refuge for investors seeking stability. Unlike conventional assets, gold’s intrinsic value and limited supply make it a unique hedge against inflation, currency devaluation, and financial market turbulence. Understanding the multifaceted strategies to invest in gold can empower investors to safeguard and grow wealth even when the economic horizon looks foggy.

Strategic Diversification: Beyond Physical Gold

While owning physical gold—such as coins and bars—offers tangible security, the spectrum of gold investment extends to ETFs, mutual funds, mining stocks, and futures. Each vehicle carries distinct risk profiles and market dynamics. For example, gold mining stocks versus ETFs present different exposure levels to operational risks and market liquidity. Strategic portfolio diversification, combining these instruments, can balance potential returns with risk mitigation.

Decoding Market Signals: How Central Banks and Demand Trends Influence Gold Prices

Gold prices are intricately linked to global economic indicators, including central bank purchases and shifting demand patterns. Central banks, especially in emerging markets, have been increasing their gold reserves as a safeguard against currency instability, a trend detailed in authoritative analyses of central bank gold purchases. Additionally, consumer demand in Asia and investment demand in Western markets dynamically shape price trajectories. Staying attuned to these patterns equips investors with foresight for timing investments effectively.

How Can Investors Leverage Gold as a Hedge Against Inflation and Economic Uncertainty?

Gold’s historical role as an inflation hedge is well-documented, yet the nuances of its performance during different economic cycles require careful consideration. Investors should analyze inflation indicators alongside monetary policies and geopolitical events, which can cause rapid shifts in gold’s value. Utilizing tools like gold futures for hedging or incorporating gold IRA options can enhance portfolio resilience. Comprehensive insights on this topic are available in proven gold investment strategies to hedge inflation.

Practical Wisdom: Authenticating and Safely Acquiring Physical Gold

Investing in physical gold demands vigilance to avoid counterfeit risks and ensure liquidity. Authentication techniques, storage solutions, and choosing reputable dealers are paramount. Guides like how to authenticate gold coins provide detailed methodologies that safeguard investors’ capital. Moreover, understanding the differences between coins and bars can influence investment decisions based on liquidity, premiums, and storage.

Engage with us by sharing your experiences or questions about gold investment strategies during volatile times—your insights enrich this community.

For authoritative perspectives on gold as a strategic asset, consider the comprehensive research from the World Gold Council, a leading authority on the global gold market here.

Exploring the Role of Gold Futures and Options in Sophisticated Portfolios

For seasoned investors, gold futures and options offer powerful tools to amplify returns and hedge against market fluctuations. Unlike physical gold or ETFs, these derivatives provide leverage and flexibility, enabling strategic positioning in anticipation of price movements. However, mastery over timing, contract specifications, and risk management is crucial to avoid significant losses. For those interested in learning the nuances, a detailed guide to gold futures offers foundational knowledge, while advanced trading techniques are covered in gold trading techniques for 2025.

Understanding Geopolitical Risks and Their Impact on Gold Prices

Geopolitical tensions—ranging from trade disputes to regional conflicts—often trigger spikes in gold demand as investors seek safe havens. These events can disrupt supply chains and currency stability, further elevating gold’s appeal. An astute investor monitors global political developments alongside economic data to anticipate these price surges. Resources like the key factors driving gold prices provide comprehensive insights into how geopolitics shape market dynamics.

What Are the Emerging Trends in Sustainable and Ethical Gold Investing?

As environmental, social, and governance (ESG) criteria gain prominence, sustainable gold investing is capturing investor attention. This trend involves prioritizing gold sourced from mines practicing responsible environmental stewardship and fair labor standards. ETFs and funds focusing on sustainable gold mining companies are becoming more prevalent, offering opportunities to align financial goals with ethical values. Investors should evaluate ESG ratings and certifications to ensure genuine impact. For further reading, explore top gold ETFs for sustainable growth in 2025.

Incorporating Gold into Retirement and Long-Term Wealth Strategies

Gold’s stability makes it an attractive component of retirement portfolios, particularly through vehicles like Gold IRAs that provide tax advantages and long-term growth potential. Allocating a percentage of retirement assets to gold can enhance diversification and protect purchasing power against inflationary pressures. Investors need to understand the rules governing Gold IRAs and select trustworthy custodians and dealers. Comprehensive guidance is available in the Gold IRA basics for beginners.

We invite you to share your perspectives on integrating gold into diversified portfolios or ask questions about advanced gold investment strategies. Engaging in this dialogue enriches our collective expertise.

For authoritative data and ongoing market updates, the World Gold Council remains an indispensable resource, accessible here.

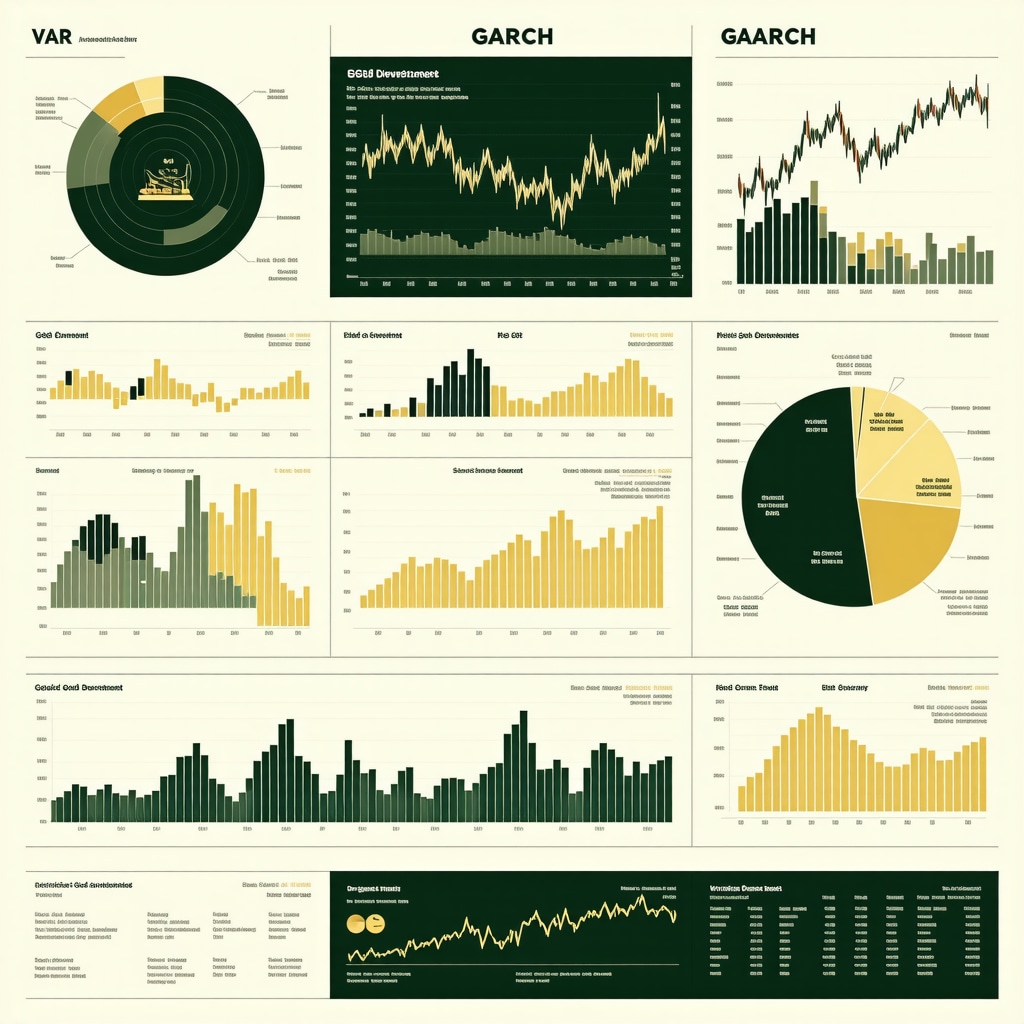

Leveraging Quantitative Models to Forecast Gold Price Movements

In an increasingly data-driven investment landscape, quantitative models have become indispensable tools for anticipating gold price fluctuations with greater precision. Advanced econometric techniques, including Vector Autoregression (VAR) and GARCH models, allow investors to analyze the dynamic interplay between gold prices and macroeconomic variables such as interest rates, inflation expectations, and currency indices. Incorporating machine learning algorithms further refines predictive accuracy by capturing nonlinear patterns and regime shifts that traditional models might overlook.

For example, VAR models can simultaneously assess the impact of Federal Reserve policy announcements and geopolitical tensions on gold’s volatility, enabling proactive portfolio adjustments. However, model overfitting and sensitivity to input data quality remain challenges requiring expert calibration and continuous validation.

How Can Advanced Statistical Techniques Enhance Gold Investment Decision-Making?

By harnessing statistical rigor, investors can quantify tail risks and stress-test portfolios under extreme market conditions. Techniques such as Monte Carlo simulations and Value at Risk (VaR) analyses help in understanding potential downside scenarios, especially when gold is used as a hedge against systemic shocks. Integrating these insights with fundamental analysis—like central bank activity and mining supply disruptions—creates a robust framework for both tactical trading and strategic asset allocation.

Resources such as the CFA Institute’s research on quantitative approaches to commodities investing provide in-depth methodologies tailored for sophisticated investors.

Optimizing Gold Exposure Through Portfolio Risk Metrics and Correlation Analysis

Gold’s effectiveness as a portfolio diversifier hinges on its correlation with other asset classes, which can fluctuate notably across economic cycles. Employing dynamic correlation matrices and rolling window analyses reveals periods when gold acts as a safe haven versus times it behaves more like a risk asset. Portfolio managers leverage metrics such as the Sharpe Ratio, Sortino Ratio, and Conditional Value at Risk (CVaR) to optimize gold allocation, balancing return enhancement with downside protection.

Moreover, advanced investors consider the implications of inflation-linked bonds, currency movements, and equity market regimes on gold’s correlation structure. This nuanced understanding facilitates tactical shifts in allocation that align with evolving macroeconomic environments.

Innovations in Gold Derivatives: Navigating Liquidity and Counterparty Risks

The derivatives market for gold has matured, offering a spectrum of instruments beyond traditional futures and options. Structured products, like gold-linked notes and exotic options (e.g., barrier and digital options), provide tailored risk-return profiles for institutional investors. While these instruments enhance strategy sophistication, they introduce complexities such as counterparty credit risk and liquidity constraints, particularly in stressed market conditions.

Risk mitigation strategies include rigorous due diligence on counterparties, use of central clearinghouses, and implementation of margining systems compliant with regulatory standards like the Dodd-Frank Act. Staying abreast of regulatory developments ensures compliance and preserves capital integrity.

We encourage portfolio managers and experienced investors to discuss their approaches to integrating these advanced derivatives into diversified strategies, sharing lessons learned and best practices.

Harnessing Cutting-Edge Quantitative Analytics for Gold Market Forecasting

In the evolving landscape of gold investment, leveraging sophisticated quantitative models transcends traditional analysis, enabling a granular understanding of price dynamics. Employing econometric frameworks such as Vector Autoregression (VAR) and Generalized Autoregressive Conditional Heteroskedasticity (GARCH) models facilitates capturing volatility clustering and interdependencies between gold prices and macroeconomic drivers like inflation expectations, real interest rates, and currency fluctuations. Additionally, integrating machine learning paradigms—such as random forests and neural networks—enhances predictive precision by modeling non-linear relationships and regime shifts, often overlooked by classical approaches.

However, the robust application of these models demands meticulous calibration to mitigate overfitting risks and requires continuous validation against evolving market conditions. When judiciously implemented, they empower investors to anticipate inflection points and optimize timing for entry and exit strategies.

How Can Advanced Statistical Techniques Enhance Gold Investment Decision-Making?

Advanced statistical methodologies offer a quantitative lens through which investors can rigorously assess portfolio risk and optimize allocation. Monte Carlo simulations enable scenario analyses that model a wide array of potential market outcomes, identifying tail risks and stress-testing gold’s hedging efficacy under extreme economic shocks. Value at Risk (VaR) and Conditional Value at Risk (CVaR) metrics quantify downside exposure, guiding risk-adjusted positioning.

Coupling these quantitative measures with fundamental factors—such as central bank gold acquisitions, geopolitical tensions, and mining supply disruptions—forms a comprehensive decision-making framework. This hybrid approach allows for tactical agility and strategic foresight, crucial in volatile markets.

For an in-depth exploration of these methodologies, the CFA Institute’s research on quantitative approaches to commodities investing stands as an authoritative resource, offering empirically tested models and practical implementation guidance for seasoned investors.

Innovative Gold Derivatives: Balancing Leverage with Counterparty and Liquidity Risk Management

The gold derivatives arena has witnessed remarkable innovation, providing investors with tailored instruments such as exotic options—including barrier and digital options—and gold-linked structured notes. These products facilitate nuanced exposure modulation, enabling strategies that capitalize on specific market views or risk tolerances. Nevertheless, their sophistication introduces complexities, notably counterparty credit risk and liquidity constraints, which can be exacerbated during periods of market stress.

Effective risk mitigation hinges on rigorous counterparty due diligence, engagement with central clearinghouses, and adherence to regulatory frameworks like the Dodd-Frank Act that enforce margining and transparency standards. Mastery of these elements is indispensable for institutional investors aiming to integrate derivatives without compromising portfolio integrity.

We invite experienced portfolio managers to share insights and best practices for incorporating these advanced derivatives into diversified investment strategies, fostering a community of expertise and innovation.

Dynamic Portfolio Optimization: Exploiting Correlation Structures and Risk Metrics to Maximize Gold’s Strategic Value

Gold’s role as a portfolio diversifier is inherently dynamic, influenced by macroeconomic regimes and asset class cycles. Employing rolling correlation analyses and dynamic conditional correlation (DCC) models reveals shifting relationships between gold and equities, bonds, and inflation-linked securities. Such insights enable tactical rebalancing to harness gold’s safe haven attributes when correlations rise and mitigate drawdowns.

Quantitative risk metrics—such as the Sharpe Ratio, Sortino Ratio, and CVaR—provide a multidimensional evaluation of gold’s contribution to portfolio efficiency. Incorporating inflation-indexed bonds and analyzing currency fluctuations enriches the context for gold allocation decisions, ensuring alignment with evolving economic landscapes.

Engage with us to explore advanced techniques in portfolio risk management and gold allocation strategies that transcend conventional paradigms.

Integrating ESG Principles into Gold Investment: Navigating Ethical Sourcing and Sustainable Growth Opportunities

As Environmental, Social, and Governance (ESG) considerations redefine investment paradigms, gold investors face the imperative to align capital deployment with sustainability imperatives. The proliferation of ESG-focused gold ETFs and funds reflects growing demand for assets sourced from responsible mining operations adhering to stringent environmental safeguards and fair labor practices.

Evaluating ESG ratings and certifications is critical to distinguish genuinely sustainable investments from greenwashed alternatives. This ethical dimension not only mitigates reputational risk but also captures emerging market segments prioritizing sustainability, potentially enhancing long-term returns.

For comprehensive analyses and curated lists of ESG-compliant gold investment vehicles, consult resources like Top Gold ETFs for Sustainable Growth in 2025.

Frequently Asked Questions (FAQ)

What are the primary benefits of incorporating gold into a diversified investment portfolio?

Gold serves as a strategic diversifier due to its historically low or negative correlation with traditional asset classes like equities and bonds. It acts as a hedge against inflation, currency depreciation, and geopolitical risks, thereby enhancing portfolio resilience during market volatility.

How do advanced quantitative models improve gold price forecasting?

Quantitative models such as VAR, GARCH, and machine learning algorithms analyze complex relationships between gold prices and macroeconomic factors like interest rates, inflation, and currency movements. These models capture volatility clustering and nonlinear dynamics, improving the accuracy of price predictions and enabling informed timing decisions.

What risks should investors consider when trading gold derivatives like futures and exotic options?

While gold derivatives offer leverage and strategic flexibility, they pose risks including counterparty credit risk, liquidity constraints, and potential for significant losses due to market volatility. Effective risk management entails due diligence on counterparties, regulatory compliance, and robust margining practices.

How does ESG investing influence gold investment choices?

ESG investing prioritizes gold sourced from mines with responsible environmental, social, and governance practices. Investors increasingly seek ESG-compliant ETFs and funds to align investments with ethical standards, reduce reputational risks, and capture sustainable growth opportunities within the gold sector.

Can gold effectively protect retirement portfolios against inflation?

Gold’s intrinsic value and inflation-hedging properties make it a valuable component in retirement portfolios, particularly through Gold IRAs that offer tax advantages. Allocating a portion of retirement assets to gold can preserve purchasing power over the long term, though investors should understand the specific rules and custody requirements.

How do geopolitical events impact gold prices?

Geopolitical tensions, such as conflicts or trade disputes, typically increase uncertainty, prompting investors to seek gold as a safe haven. These events can disrupt supply chains and currency stability, leading to upward pressure on gold prices.

What methodologies exist to authenticate physical gold and avoid counterfeits?

Authentication techniques include assay testing, X-ray fluorescence (XRF) analysis, and verifying hallmark stamps from reputable mints. Purchasing through trusted dealers and using secure storage solutions further mitigate risks associated with counterfeit gold.

How can investors optimize gold allocation using correlation and risk metrics?

Employing dynamic correlation analyses and risk-adjusted performance metrics like the Sharpe and Sortino ratios enables investors to identify periods when gold provides maximum diversification benefits. Tactical rebalancing based on these insights can enhance portfolio efficiency and downside protection.

What are the challenges in applying machine learning models to gold market forecasting?

Machine learning models require high-quality, extensive datasets and careful tuning to avoid overfitting. They may also lack interpretability, making it essential to combine them with fundamental analysis and continuous validation to maintain predictive reliability.

How do central bank gold purchases affect market dynamics?

Central bank acquisitions, especially by emerging economies, signal confidence in gold as a reserve asset, often driving demand and price appreciation. Monitoring these activities provides investors with insights into macroeconomic stability and currency risk perceptions.

Trusted External Sources

- World Gold Council: Offers comprehensive data on gold supply, demand, and market trends, including detailed reports on central bank activities and ESG initiatives, making it indispensable for investors seeking authoritative insights.

- CFA Institute: Provides rigorous research on quantitative investment methods, including advanced econometric and machine learning approaches to commodities investing, essential for sophisticated portfolio construction and risk management.

- London Bullion Market Association (LBMA): The LBMA sets global standards for gold trading and certification, offering vital information on market liquidity, pricing mechanisms, and ethical sourcing guidelines.

- U.S. Commodity Futures Trading Commission (CFTC): Regulates derivatives markets including gold futures and options, providing transparency on market participants, risk disclosures, and regulatory compliance frameworks critical for derivative investors.

- International Council on Mining and Metals (ICMM): Focuses on sustainable mining practices and ESG standards, delivering valuable resources for evaluating ethical gold sourcing and environmental stewardship.

Conclusion

Gold remains a multifaceted asset that offers strategic value through diversification, inflation protection, and safe-haven properties. This article explored sophisticated approaches to gold investing, emphasizing the integration of advanced quantitative models, dynamic portfolio optimization, and ESG considerations. By understanding the interplay of macroeconomic drivers, geopolitical risks, and innovative derivatives, investors can harness gold’s full potential to enhance portfolio resilience and pursue sustainable growth. We encourage readers to apply these expert insights, engage with our community discussions, and explore further expert content to refine their gold investment strategies in an ever-evolving market landscape.

The article’s emphasis on gold as a safe haven during economic uncertainty resonates strongly with what I’ve observed in recent years. I’ve found that while physical gold provides a tangible sense of security, diversifying into ETFs and mining stocks can offer exposure to growth opportunities, though with varying risk levels. What intrigued me most was how central bank activities and geopolitical events can ripple through gold prices, underscoring the importance of staying informed beyond just market charts. One challenge I’ve encountered is balancing the portfolio’s gold allocation to hedge against inflation yet avoid overexposure, especially as correlations with other assets evolve. The discussion around leveraging advanced quantitative models like VAR and GARCH for forecasting adds a compelling layer; however, for individual investors, such techniques can be complex to implement directly. It makes me wonder how accessible these tools are for smaller investors looking to optimize gold-related decisions. Has anyone here tried integrating more quantitative insights into their gold investment strategy? How do you navigate the trade-off between sophisticated analysis and practical portfolio management in this space?