Unlocking the Mysteries of Gold Futures: Your Gateway to Strategic Investing

Gold has long been revered as a safe haven asset, but diving into gold futures trading offers a unique avenue for investors seeking leveraged exposure and portfolio diversification. For beginners, the world of gold futures can seem daunting, filled with technical jargon and rapid market movements. However, with the right foundational knowledge, anyone can confidently explore this lucrative market segment.

Decoding Gold Futures: What Are You Really Trading?

At its core, a gold futures contract is a standardized agreement to buy or sell a specific quantity of gold at a predetermined price on a set future date. Unlike physical gold, futures trading doesn’t require immediate possession; instead, it allows investors to speculate on price movements or hedge against risks. This mechanism can amplify gains but also magnifies losses, making risk management crucial.

How Do Gold Futures Differ from Other Gold Investments?

Gold futures are distinct from purchasing physical gold, ETFs, or gold mining stocks. While physical gold offers tangible ownership and ETFs provide ease of trading with less volatility, futures engage traders with margin requirements and expiration dates, demanding active monitoring and strategic timing. This complexity adds layers of opportunity and risk that aren’t present in more passive gold investments.

Essential Tools and Platforms: Where Beginners Can Start Trading Gold Futures

To enter gold futures trading, beginners should first select a reputable futures brokerage platform that offers transparent pricing, robust user interfaces, and educational support. Platforms like the CME Group provide access to COMEX gold futures, the most liquid gold futures contracts globally. Additionally, leveraging real-time market data and analytical tools can empower traders to make informed decisions backed by technical and fundamental insights.

Risk Management Mastery: Guarding Your Portfolio in Volatile Markets

Gold futures trading is inherently volatile, influenced by geopolitical events, currency fluctuations, and macroeconomic trends. Beginners should employ stop-loss orders, position sizing, and diversify their trades to mitigate potential downsides. Furthermore, understanding how global gold demand trends affect price volatility can refine entry and exit strategies. For deeper insights, exploring how gold demand shapes market dynamics can be invaluable (source).

What Are the Key Market Indicators to Monitor When Trading Gold Futures?

Successful gold futures traders vigilantly track indicators such as the U.S. dollar strength, interest rate changes, inflation expectations, and central bank gold purchases. These factors directly impact gold’s spot and futures prices. Additionally, seasonal demand cycles and geopolitical tensions often create short-term price swings. Combining these insights with technical chart patterns offers a holistic trading approach.

Practical Steps for Beginners: Starting Your Gold Futures Journey

Begin by opening a futures trading account with a broker that offers educational resources tailored for novices. Practice with simulated trading accounts to understand order types and market behavior before committing real capital. Set clear trading goals, define acceptable risk levels, and keep a trading journal to analyze performance. Remember, patience and discipline are key virtues in mastering gold futures.

Are you ready to explore the strategic world of gold futures and elevate your investment portfolio? Share your thoughts or questions below, and join a community of savvy investors growing their expertise together.

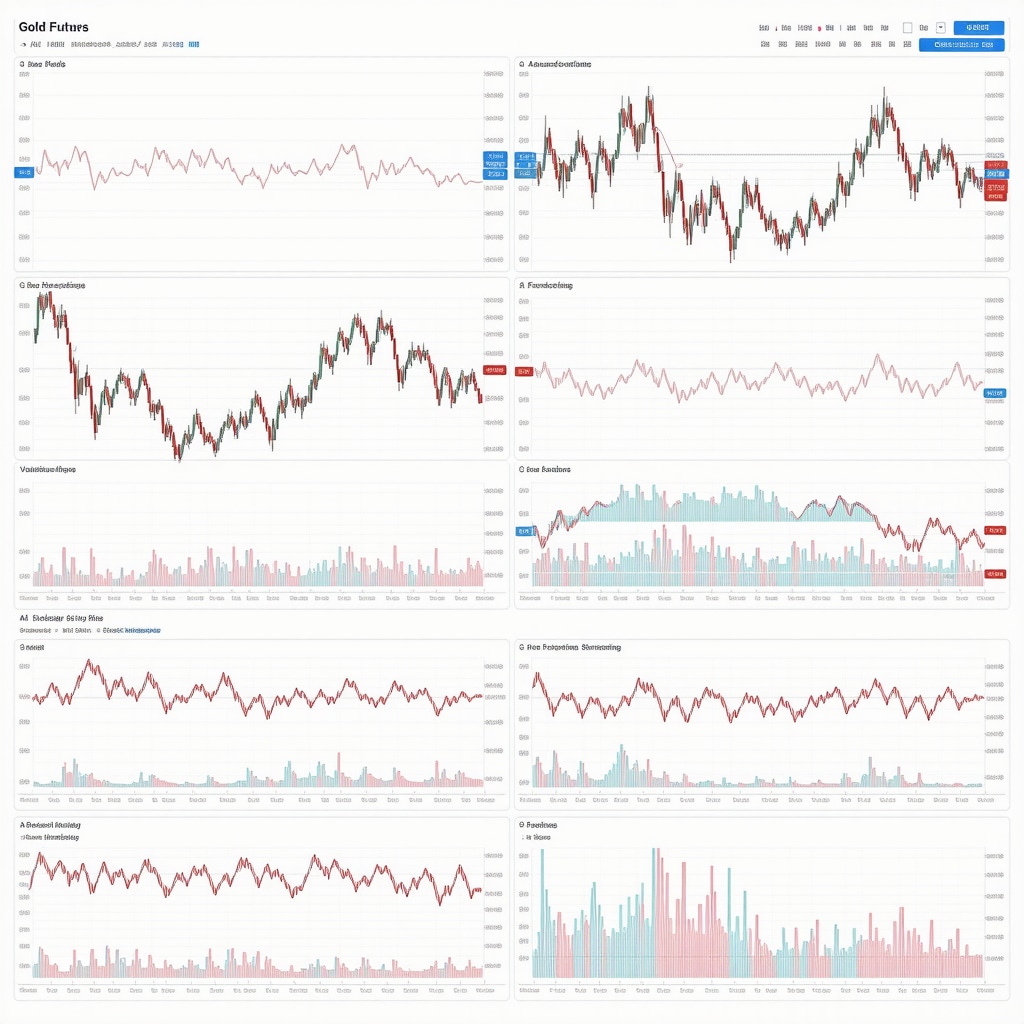

Leveraging Technical Analysis: Chart Patterns and Indicators for Gold Futures

Mastering gold futures trading requires a sophisticated grasp of technical analysis. Traders often rely on chart patterns such as head and shoulders, double tops and bottoms, and trend channels to anticipate price reversals and continuation. Additionally, indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands help quantify momentum and volatility, enabling more precise entry and exit points.

Incorporating volume analysis further refines signals by confirming the strength behind price moves. For example, rising prices accompanied by increasing volume suggest strong bullish conviction, whereas divergence between price and volume can warn of potential reversals. Beginners should progressively integrate these tools into their trading plans, complementing fundamental insights.

Fundamental Drivers: How Macroeconomic Events Shape Gold Futures Prices

Gold futures prices are intimately tied to macroeconomic conditions. Inflationary pressures, measured by CPI and PPI indexes, often drive investors toward gold as a hedge, pushing futures prices higher. Conversely, rising real interest rates can reduce gold’s appeal since gold does not yield interest. Central bank policies, especially quantitative easing and rate decisions by the Federal Reserve, also significantly influence gold markets.

Geopolitical crises and currency devaluations tend to increase safe-haven demand for gold futures. For instance, during periods of heightened geopolitical tension, traders often see increased volatility and upward price momentum. Staying abreast of economic calendars and global political developments is therefore indispensable for informed gold futures trading.

How Can Institutional Investors Influence Gold Futures Market Dynamics?

Institutional investors, including hedge funds, pension funds, and central banks, wield considerable influence over gold futures markets. Their large-volume trades can induce liquidity fluctuations and price swings. By carefully monitoring Commitment of Traders (COT) reports published by the Commodity Futures Trading Commission (CFTC), traders gain insights into the positioning and sentiment of these major market participants.

Understanding shifts in institutional sentiment helps anticipate potential trend changes or market corrections. For example, an unexpected surge in net long positions by institutional investors might presage a bullish breakout, while growing short interest could signal bearish pressure. Combining COT data with technical and fundamental analyses forms a comprehensive strategy for navigating gold futures.

Integrating Gold Futures Into a Diversified Portfolio: Balancing Risk and Reward

While gold futures offer leveraged exposure and potential for high returns, they should be balanced within a diversified portfolio to manage risk effectively. Allocating a portion of assets to gold futures can provide a hedge against market volatility and inflation, complementing equities, bonds, and other asset classes.

Investors should consider risk tolerance, investment horizon, and liquidity needs when determining gold futures allocation. For those seeking to diversify without direct futures exposure, related options include gold ETFs and mining stocks, which can offer different risk-return profiles. Exploring these alternatives can be beneficial for portfolio construction (source).

Practical Tips for Gold Futures Trading Success: Discipline, Education, and Adaptability

Successful gold futures trading hinges on continuous education, disciplined execution, and adaptability to evolving market conditions. Keeping a detailed trading journal helps identify patterns in decision-making and emotional responses, fostering improved strategies over time. Moreover, attending webinars, following market analysts, and leveraging simulation platforms are excellent ways to sharpen skills.

Risk management remains paramount; employing stop-loss orders and position sizing prevents catastrophic losses. Staying adaptable means adjusting strategies in response to shifting macroeconomic indicators, geopolitical developments, and technical signals, ensuring resilience in a complex trading environment.

For those ready to deepen their expertise, exploring gold trading techniques and winning strategies can provide actionable insights to elevate your trading game.

Engage with this discussion: What advanced strategies or indicators have you found most effective in gold futures trading? Share your experiences or questions below to foster a community of informed and strategic gold traders.

Institutional Footprints: Deciphering the Impact of Big Players on Gold Futures Liquidity and Volatility

Institutional investors wield outsized influence on gold futures markets, often shaping liquidity dynamics and price volatility through their substantial positions. Hedge funds, pension funds, central banks, and sovereign wealth funds execute large-volume trades that can trigger rapid market movements. Their strategies frequently involve complex hedging, arbitrage, and speculative techniques that are not always transparent to retail traders.

For instance, central banks, by adjusting their gold reserves or engaging in open market operations, can create directional pressure that echoes across futures contracts. Hedge funds might leverage macroeconomic forecasts to take contrarian or momentum-driven positions, amplifying short-term volatility. Recognizing these institutional footprints requires monitoring advanced market data streams and reports.

How Can Retail Traders Effectively Interpret Commitment of Traders (COT) Reports to Anticipate Institutional Moves?

The Commitment of Traders (COT) report, published weekly by the Commodity Futures Trading Commission (CFTC), breaks down open interest positions among commercial hedgers, large speculators, and retail traders. Retail traders can analyze shifts in these categories to gauge institutional sentiment and potential market direction.

For example, a significant increase in net long positions by large speculators might signal bullish sentiment ahead, while growing short positions could indicate anticipated downturns. However, interpreting COT data requires contextualizing it with price action and macroeconomic events to avoid false signals. Utilizing software tools that visualize COT trends alongside technical indicators can enhance decision-making precision.

According to research published in the Journal of Financial Markets, integrating COT data with volume and volatility metrics improves forecasting accuracy for gold futures prices, underscoring its strategic value for informed traders.

Strategic Portfolio Construction: Optimizing Gold Futures Allocation Amidst Market Complexity

Incorporating gold futures into a diversified portfolio demands nuanced balancing to optimize risk-adjusted returns. Unlike physical gold or ETFs, futures provide leverage, which can magnify gains but also exacerbate losses, necessitating vigilant risk management. Portfolio managers often allocate a modest percentage—typically between 5% to 15%—to gold futures, calibrating exposure based on market outlook and individual risk tolerance.

Advanced strategies include pairing gold futures with other commodities or fixed-income securities to hedge inflation risk while maintaining liquidity. Dynamic rebalancing, triggered by volatility thresholds or macroeconomic shifts, helps maintain target allocations without excessive trading costs. Moreover, employing options on gold futures can further tailor risk profiles, offering downside protection or enhancing income through premium collection.

Investors should also consider correlation dynamics; gold often exhibits negative correlation with equities during market downturns, providing a valuable diversification buffer. Yet, correlations can fluctuate, especially during systemic crises, highlighting the importance of continuous portfolio monitoring and adjustment. For a detailed framework on portfolio integration, see this comprehensive guide.

Advanced Risk Mitigation Techniques: Leveraging Options, Stop-Losses, and Position Sizing for Gold Futures

Risk management in gold futures transcends basic stop-loss orders. Sophisticated traders deploy layered techniques such as options strategies—including protective puts and covered calls—to hedge against adverse price movements while retaining upside potential. For example, purchasing put options on gold futures can cap downside risk during volatile periods without liquidating positions.

Furthermore, precise position sizing calibrated through volatility-adjusted metrics like Average True Range (ATR) ensures that no single trade disproportionately jeopardizes portfolio health. Combining these approaches with algorithmic alerts for stop-loss triggers enhances discipline and reduces emotional bias.

Backtesting risk strategies using historical gold futures data allows traders to optimize rules before live deployment, minimizing drawdowns. Platforms offering integrated risk analytics and scenario simulations provide invaluable support for this process.

Harnessing Cutting-Edge Analytics: AI and Machine Learning in Gold Futures Forecasting

Emerging technologies like artificial intelligence (AI) and machine learning (ML) are revolutionizing gold futures analysis. These tools process vast datasets, including real-time market feeds, macroeconomic indicators, and sentiment analysis from news and social media, uncovering complex patterns beyond human cognition.

ML models such as recurrent neural networks (RNNs) and long short-term memory (LSTM) networks excel in time-series forecasting, capturing nonlinear relationships and temporal dependencies inherent in gold price movements. Incorporating alternative data sources—like satellite imagery of mining activity or central bank gold holdings—further enriches predictive accuracy.

Despite their promise, AI-driven models require rigorous validation and continuous retraining to adapt to evolving market regimes. Retail traders should approach these technologies as complementary tools, integrating outputs with traditional fundamental and technical analysis.

Are you interested in exploring how AI can augment your gold futures trading strategy? Dive deeper into the intersection of technology and commodity markets with our upcoming expert series. Share your experiences or questions below to join the conversation on next-generation trading methodologies.

Decoding Institutional Behavior: The Hidden Signals Behind Market Movements

Institutional investors’ vast resources and sophisticated strategies often leave subtle footprints in gold futures markets. Their trading activities, encompassing large-scale hedging and speculative positions, can precipitate liquidity shifts and volatility spikes that savvy traders can exploit. Recognizing these patterns demands not only monitoring traditional data but also interpreting nuanced indicators such as volume anomalies and open interest fluctuations over multiple contract maturities.

Moreover, understanding the timing and rationale behind central banks’ gold reserve adjustments offers critical foresight. These maneuvers frequently reflect broader monetary policy shifts or geopolitical considerations, thus serving as early signals for impending market trends.

What Advanced Analytical Techniques Can Traders Use to Decode Institutional Trading Patterns?

Beyond the Commitment of Traders (COT) reports, traders can leverage high-frequency data analytics and order book dynamics to dissect institutional activity. Techniques like footprint charts, volume profile analysis, and order flow imbalance metrics provide granular views of buying and selling pressure. Combining these with sentiment analysis derived from news algorithms enables a multidimensional approach to anticipating institutional moves.

Research from the CFA Institute highlights how integrating order flow analytics with macroeconomic indicators significantly enhances predictive accuracy in commodity futures markets, underscoring the value of these sophisticated tools.

Dynamic Hedging Strategies: Navigating Risk with Options and Futures Combinations

Employing dynamic hedging frameworks that blend gold futures with options strategies allows traders to tailor risk exposure with exceptional precision. Protective puts can safeguard against abrupt downturns, while covered calls generate incremental income during sideways markets. Additionally, spread strategies such as calendar spreads exploit temporal price differentials to capitalize on volatility changes.

Traders utilizing volatility skew analysis can identify optimal strike prices and expiration dates, thereby enhancing hedge effectiveness. Regularly recalibrating hedge ratios in response to changing market volatility and correlation metrics ensures that portfolios remain resilient amid macroeconomic flux.

Integrating Machine Learning Models: From Data Overload to Actionable Gold Price Forecasts

Machine learning algorithms, particularly ensemble methods and deep learning architectures, have revolutionized gold futures forecasting by synthesizing heterogeneous data sources. These models assimilate macroeconomic releases, technical indicators, sentiment scores from social media, and even geopolitical event probabilities to generate robust price predictions.

However, the black-box nature of some models necessitates interpretability frameworks such as SHAP (SHapley Additive exPlanations) to elucidate feature contributions, thereby fostering trader trust and enabling informed decision-making.

For traders keen on harnessing AI, platforms like Kaggle offer datasets and community-driven modeling challenges that can accelerate proficiency in this domain.

Quantifying Volatility Regimes: Tailoring Trading Tactics to Market Environment Shifts

Gold futures markets oscillate between distinct volatility regimes, each demanding tailored strategic responses. Identifying regime shifts through statistical methods like Hidden Markov Models (HMM) or GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models enables traders to adapt position sizing, leverage, and entry timing accordingly.

During high-volatility regimes, emphasizing protective measures and reduced leverage can mitigate drawdowns, whereas low-volatility phases may invite more aggressive positioning to capture trending moves. Continual regime assessment thus functions as a cornerstone of advanced risk management.

Invitation to Engage: Elevate Your Gold Futures Mastery

Embracing these advanced methodologies can profoundly enhance your gold futures trading acumen. We invite you to delve into institutional analytics, dynamic hedging, and AI-powered forecasting to transform challenges into opportunities. Share your insights, experiences, or queries below and contribute to a collective elevation of strategic gold trading expertise.

Frequently Asked Questions (FAQ)

What distinguishes gold futures from other gold investment vehicles like ETFs or physical gold?

Gold futures are standardized contracts obligating the purchase or sale of gold at a predetermined price and date, offering leverage and requiring margin, unlike ETFs or physical gold that provide direct or indirect ownership without expiration or margin requirements. Futures trading demands active management and exposes traders to amplified risk and reward profiles.

How can beginners effectively manage risk when trading gold futures?

Beginners should employ stop-loss orders, practice position sizing aligned with their risk tolerance, diversify trades, and use simulated trading platforms to gain experience. Additionally, understanding macroeconomic indicators and maintaining discipline with trading journals enhances risk mitigation and decision-making.

What role do institutional investors play in gold futures market dynamics?

Institutional investors, such as hedge funds and central banks, significantly impact liquidity, volatility, and price trends through large-volume trades and strategic positioning. Their activity can be tracked via Commitment of Traders (COT) reports and advanced analytics, providing insights into market sentiment and potential movements.

How can Commitment of Traders (COT) reports be used to anticipate market trends?

COT reports reveal open interest distribution among commercial hedgers, large speculators, and retail traders. By analyzing shifts in net positions, traders can infer bullish or bearish institutional sentiment. Combining COT data with technical and fundamental analysis helps avoid false signals and improves market timing.

In what ways do macroeconomic events influence gold futures prices?

Factors like inflation rates, real interest rates, central bank policies, geopolitical tensions, and currency fluctuations directly affect gold’s appeal as a safe haven, driving futures prices. Staying updated on economic calendars and global events is essential for informed trading decisions.

What advanced strategies exist for hedging risk in gold futures trading?

Advanced hedging involves combining gold futures with options strategies such as protective puts and covered calls, dynamic rebalancing of positions, and volatility skew analysis. These methods allow traders to customize risk exposure, protect against adverse movements, and generate income.

How is artificial intelligence transforming gold futures market forecasting?

AI and machine learning models analyze vast, diverse datasets—including market data, macroeconomic indicators, and sentiment analysis—to detect complex patterns and improve price predictions. While promising, these models require ongoing validation and should complement traditional analysis techniques.

What are volatility regimes, and how do they affect gold futures trading tactics?

Volatility regimes represent periods of distinct market volatility levels identified through statistical models like HMM or GARCH. Recognizing regime shifts enables traders to adjust leverage, position sizing, and strategy aggressiveness to optimize returns and manage risk effectively.

How can retail traders interpret institutional footprints beyond COT reports?

Retail traders can use high-frequency data analytics, order flow analysis, footprint charts, and volume profile metrics to gain granular insights into institutional buying and selling pressure. Coupling these with sentiment and news analysis offers a multidimensional perspective on market movements.

What factors should be considered when integrating gold futures into a diversified portfolio?

Investors should assess their risk tolerance, investment horizon, and liquidity needs. Allocating typically 5-15% to gold futures can hedge against inflation and market downturns. Considering correlations, dynamic rebalancing, and complementary assets like gold ETFs or mining stocks ensures balanced portfolio construction.

Trusted External Sources

- Chicago Mercantile Exchange (CME) Group: Provides authoritative data and contract specifications for COMEX gold futures, essential for understanding market mechanics and liquidity.

- Commodity Futures Trading Commission (CFTC): Publishes the Commitment of Traders (COT) reports, a critical resource for tracking institutional positioning and market sentiment.

- Journal of Financial Markets: Offers peer-reviewed research on futures market behavior and forecasting methodologies, underpinning advanced analytical approaches.

- CFA Institute Research Foundation: Delivers in-depth insights into order flow analytics, risk management techniques, and institutional trading impacts in commodity markets.

- Federal Reserve Economic Data (FRED): Supplies comprehensive macroeconomic indicators such as interest rates and inflation metrics, vital for fundamental gold futures analysis.

Conclusion

Gold futures trading represents a sophisticated yet rewarding avenue for investors seeking leveraged exposure to the gold market. This article has explored foundational concepts, risk management essentials, and the profound influence of institutional investors on market dynamics. Integrating technical analysis with macroeconomic insights and emerging technologies like AI empowers traders to navigate volatility and capitalize on strategic opportunities.

Understanding how to interpret Commitment of Traders reports, harness advanced hedging strategies, and adapt to volatility regimes can substantially elevate trading effectiveness. Moreover, thoughtful portfolio integration balances risk and reward, leveraging gold futures as a potent diversification tool.

Embarking on or advancing your gold futures journey requires continuous education, discipline, and adaptability. Engage with the community by sharing your experiences, questions, or strategies, and explore related expert content to deepen your mastery. Unlock the full potential of gold futures trading and transform your investment approach today.

What struck me most about gold futures trading, especially for beginners, is the delicate balance between opportunity and risk. The leverage effect can indeed amplify gains, but it can just as easily magnify losses if not managed carefully. In my early days exploring futures, I underestimated the importance of stop-loss orders and position sizing, which led to some avoidable setbacks. This article’s emphasis on disciplined risk management resonates deeply—practicing with simulation accounts before committing real money is a step many overlook but is invaluable.

Another aspect I appreciated is the focus on understanding macroeconomic indicators like inflation and interest rates, which directly influence gold prices. It’s not just about reading charts but grasping the broader economic picture. I’m curious, has anyone here found particular macroeconomic signals or technical indicators more reliable in their gold futures strategy? For example, have you leaned more on RSI and MACD, or do you prioritize COT reports to anticipate moves by institutional players? Sharing how you balance fundamental and technical analysis could really enrich this community’s collective expertise.