Gold Fever 2025: A Glittering Crystal Ball

Imagine a world where the shimmering allure of gold continues to captivate hearts and industries alike—2025 promises to be a fascinating chapter in this shiny saga. As a seasoned columnist with a penchant for uncovering hidden truths, I’ve been pondering: what exactly will fuel the demand for gold in jewelry and industrial sectors next year? Will it be economic shifts, technological innovations, or perhaps something entirely unexpected? Buckle up, because the golden future is calling!

Why Should We Even Care About Gold Demand?

Gold isn’t just a pretty face; it’s a barometer of global financial health and a cornerstone of technological progress. From sparkling wedding rings to cutting-edge electronics, the demand for gold reflects broader trends—economic confidence, consumer behavior, and technological advancements. As the world navigates post-pandemic recovery and geopolitical tensions, gold’s role as a safe haven becomes even more critical.

Jewelry: The Everlasting Charm or a Passing Fad?

One might wonder, is jewelry demand for gold a relic of tradition or a vibrant market that evolves with fashion? According to industry analysis, jewelry remains the largest driver of gold demand, accounting for roughly 50% of annual consumption. In 2025, we could see a renaissance fueled by emerging markets—particularly India and China—where rising disposable incomes and cultural affinity for gold keep the sparkle alive. Yet, shifting tastes, sustainability concerns, and digital payment options might influence the size and shape of this demand.

Industrial Gold: The Silent Powerhouse

Meanwhile, industrial applications are quietly becoming the unsung heroes of gold demand. From electronics to aerospace, gold’s excellent conductivity and resistance to corrosion make it indispensable. Interestingly, advancements in green technology—like solar panels—are set to boost industrial demand. The question is: will innovation sustain or even accelerate this trend amidst potential supply chain disruptions?

Is Gold Still the Ultimate Hedge in 2025?

Many investors see gold as a tried-and-true hedge against inflation and market volatility. But with crypto and other digital assets gaining ground, will gold maintain its supremacy? Experts suggest that in uncertain times, physical gold and gold ETFs will continue to shine, especially as central banks and institutional investors diversify their portfolios. To learn more about smart gold investment strategies, check out these tips for beginners.

As we approach 2025, one thing is clear: understanding the nuances of gold demand—from jewelry to industry—is key to navigating this glittering landscape. Whether you’re a savvy investor or a curious observer, staying informed will keep you ahead of the curve. So, what do you think? Will gold’s luminous appeal continue to burn bright in 2025? Share your thoughts below!

Unveiling the Hidden Forces Behind Gold’s Bright Future

As we peer into the crystal ball of 2025, one question remains at the forefront: what hidden currents will shape gold demand in the coming year? While traditional factors like jewelry and industrial use continue to drive the market, emerging influences—such as geopolitical shifts, technological breakthroughs, and sustainability trends—are poised to redefine gold’s role. For instance, the rise of green energy solutions and advancements in electronics could significantly accelerate industrial gold consumption, especially as industries seek sustainable and corrosion-resistant materials.

Consider the impact of central banks—who are increasingly turning to gold to diversify their reserves amid economic uncertainties. According to analysts, central bank buying has reached levels not seen in decades, signaling a strategic move to hedge against potential currency devaluations and inflationary pressures. This trend raises a vital question: will the continued accumulation of gold by governments elevate its status as a global reserve asset, or will market saturation curb its appeal? Exploring this dynamic is essential for investors aiming to navigate the complex landscape of gold investments.

Moreover, the intersection of technological innovation and consumer behavior offers intriguing possibilities. The digitalization of gold—through blockchain verified coins and ETFs—makes gold more accessible and transparent, potentially broadening its appeal among younger investors. But can these digital avenues truly replace physical gold in terms of security and long-term value preservation? For guidance on balancing these options, check out this comparison of gold ETFs and physical gold.

Finally, the role of sustainability cannot be overlooked. As environmental concerns mount, demand for ethically sourced gold is rising, prompting miners and jewelers to adopt greener practices. Will this shift lead to a premium for responsibly mined gold, or will supply chain complexities dampen growth? The answers lie in ongoing industry innovations and regulatory frameworks that aim to balance ecological integrity with market needs.

So, the big question for 2025: how will these multifaceted forces converge to shape gold demand, and what opportunities or risks will they present? Share your insights below, and if you’re eager to deepen your understanding, explore detailed strategies for investing in gold at this beginner’s guide. The future of gold is shimmering with potential—are you ready to seize it?

Unraveling the Complex Web of Gold’s Industrial Renaissance in 2025

As we delve deeper into the unfolding landscape of 2025, one cannot ignore the transformative role of technological innovation in reshaping gold’s industrial applications. From the integration of nanotechnology to the burgeoning sector of green energy, gold’s unique properties are unlocking new frontiers of demand that challenge traditional perceptions.

Take, for instance, the rapid advancements in quantum computing. Gold’s exceptional conductivity and stability make it an ideal material for the delicate circuitry of quantum processors. According to a study published in Advanced Materials (2022), researchers are exploring ultra-thin gold nanowires to improve the efficiency and scalability of quantum hardware. This not only signifies a leap in technological capability but also hints at a sustained increase in industrial gold consumption, potentially offsetting declines in jewelry markets.

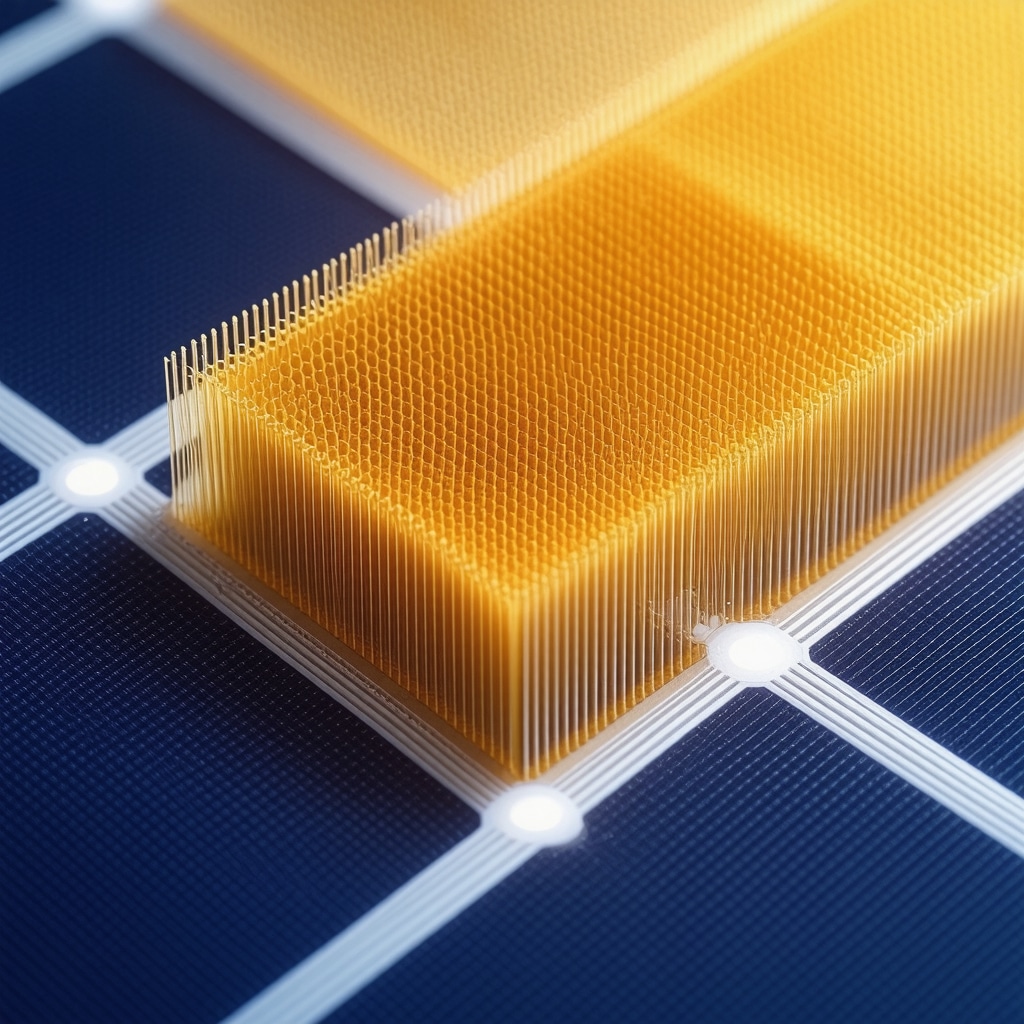

Moreover, the push towards sustainable energy solutions is creating fresh demand streams. Solar technology, especially in the development of perovskite solar cells, leverages gold electrodes to enhance energy conversion efficiency. As solar deployment accelerates globally—particularly in emerging markets—industrial demand for gold could see a significant uptick. The IEA’s 2023 report forecasts a 15% increase in solar capacity installation annually, which correlates with increased gold usage in manufacturing processes.

How Will Geopolitical Shifts Influence Gold’s Industrial and Reserve Roles?

Geopolitical tensions often serve as catalysts for shifts in gold’s strategic importance. Countries are increasingly viewing gold as a safe harbor and a buffer against currency volatility. A notable trend is the accumulation of gold reserves by central banks in Asia and the Middle East, which reflects a strategic diversification away from the US dollar.

For example, China’s recent surge in gold reserves, as reported by the World Gold Council (2023), demonstrates a calculated move to bolster economic sovereignty amidst global uncertainties. This raises a nuanced question: can sovereign accumulation of gold catalyze a long-term increase in demand, or will it lead to market saturation and price stabilization? Understanding these dynamics is crucial for investors and policymakers alike.

Simultaneously, the geopolitical landscape influences supply chains—disruptions in mining operations due to regional conflicts or environmental policies can constrict supply, elevating prices and reinforcing gold’s role as a hedge. Analyzing these interconnected factors provides a comprehensive view of how geopolitical currents will continue to shape gold’s future.

To stay ahead in this evolving market, consider engaging with authoritative industry reports and expert analyses, which offer insights into the delicate balance of supply, demand, and geopolitical risk. For further reading, consult the detailed evaluations provided by the World Gold Council’s Market Trends.

Are you prepared to navigate the intricate web of emerging gold demand drivers? Deepening your understanding now will empower you to make strategic decisions as the landscape shifts. Stay tuned for our next deep dive into technological innovations transforming gold’s value in 2025—because in this glittering arena, knowledge is truly power.

Unlocking Gold’s Next Chapter: Expert Perspectives on the 2025 Demand Surge

As we venture further into 2025, industry experts are emphasizing the multifaceted forces shaping gold’s trajectory—beyond simple supply and demand metrics. The integration of cutting-edge nanotechnology in electronics, coupled with increasing geopolitical tensions, is fostering a renaissance in gold’s industrial applications. This renaissance is not only a testament to gold’s enduring versatility but also a strategic response to the global push for sustainable and resilient technological infrastructure.

How Will Gold’s Role Evolve in Next-Gen Tech and Green Energy?

Recent advancements in nanotechnology, particularly in the development of ultra-conductive nanowires, are opening new horizons for gold in quantum computing and flexible electronics. According to Advanced Materials, researchers are optimizing gold nanostructures to enhance the efficiency of quantum processors, thereby significantly increasing industrial demand. Simultaneously, the surge in renewable energy initiatives—especially in solar technology—relies heavily on gold electrodes to maximize energy conversion. The International Energy Agency’s 2023 report projects a persistent annual growth in solar capacity, translating directly into elevated gold usage in manufacturing processes.

Can Central Bank Accumulation Sustain Long-Term Gold Prices?

Central banks worldwide are strategically increasing their gold reserves, viewing the metal as a safeguard against macroeconomic instability. The World Gold Council’s recent analysis highlights unprecedented levels of reserves accumulated by nations in Asia and the Middle East, reflecting a calculated diversification from traditional fiat currencies. This trend prompts the question: will sovereign reserve policies serve as a stabilizing factor or lead to market saturation? Experts suggest that sustained central bank buying could underpin higher price floors, especially amid geopolitical uncertainties and potential supply disruptions. For investors, understanding these reserve dynamics is crucial—those interested in aligning their portfolios with macroeconomic trends should explore this in-depth analysis.

Furthermore, digital gold instruments, such as blockchain-verified coins and ETFs, are broadening access and transparency—appealing to a new generation of investors. The challenge remains: how do these digital assets compare with physical gold in terms of security and long-term value retention? For insights, see this comprehensive comparison.

Addressing the sustainability aspect, ethically sourced gold is gaining prominence, prompting industry players to adopt greener mining practices. Will this shift create a premium for responsibly mined gold, or will regulatory hurdles and supply chain complexities hinder growth? Industry reports indicate that responsible sourcing could become a key differentiator, influencing both consumer choices and investor sentiment. The evolving landscape demands vigilance and strategic planning for those looking to capitalize on sustainable gold trends.

In conclusion, the convergence of technological innovation, geopolitical strategies, and sustainability initiatives makes 2025 a pivotal year for gold. Stakeholders—whether investors, manufacturers, or policymakers—must stay informed about these trends to navigate potential opportunities and risks effectively. Are you ready to leverage these insights? Share your thoughts below or explore more at this beginner’s guide to gold investment strategies.

Expert Insights & Advanced Considerations

1. Strategic Reserve Diversification by Central Banks Will Accelerate

As central banks continue to diversify their reserves, gold’s role as a safe haven and reserve asset will strengthen, potentially stabilizing prices amid geopolitical uncertainties. Experts suggest monitoring reserve accumulation trends in Asia and the Middle East to anticipate long-term demand shifts.

2. Technological Innovations Will Drive Industrial Demand to New Heights

Breakthroughs in nanotechnology and green energy, such as quantum computing components and solar energy enhancements, are expected to significantly boost industrial gold consumption, offsetting fluctuations in jewelry markets and elevating gold’s industrial importance.

3. Digital Gold Instruments Will Broaden Investor Access

Blockchain-verified gold coins and ETFs are making gold more accessible and transparent, attracting younger investors. However, understanding the security and long-term value of digital versus physical gold remains crucial for strategic asset allocation.

4. Sustainability Trends Will Create Premiums for Ethically Sourced Gold

The rising demand for responsibly mined gold will push the industry toward greener practices, potentially creating market premiums for ethically sourced gold and influencing supply chain dynamics in 2025.

5. Geopolitical Tensions Will Continue to Influence Supply and Demand

Regional conflicts and environmental policies may disrupt supply chains, leading to price volatility and increased demand for gold as a hedge, especially as nations stockpile reserves to bolster economic sovereignty.

Curated Expert Resources

- World Gold Council’s Market Trends: An authoritative source for current market analysis, supply-demand dynamics, and geopolitical impacts on gold prices.

- Advanced Materials Journal: Cutting-edge research on nanotechnology applications in electronics and quantum computing, highlighting gold’s industrial innovations.

- International Energy Agency (IEA) Reports: Insights into renewable energy deployments, especially solar technology, driving industrial demand for gold.

- Buy Gold Now Blog: Expert guidance on gold investment strategies, including digital assets, ethical sourcing, and secure storage practices.

Final Expert Perspective

In 2025, gold demand will be shaped by a confluence of strategic reserve policies, technological breakthroughs, and sustainability initiatives. As an expert in precious metals, I see a future where gold’s multifaceted roles—investment hedge, industrial catalyst, and ethical asset—are more intertwined than ever. Staying informed through authoritative sources and understanding these advanced trends will empower investors and industry leaders alike to navigate this shimmering landscape confidently. Engage with these insights, share your perspectives, and explore tailored strategies at this comprehensive guide.