Why Trusting Your Gold Isn’t Just About the Shine

Imagine holding a shiny gold bar that promises wealth and security, only to discover it’s a cleverly disguised counterfeit. The world of physical gold investments sparkles with opportunity, but beneath that gleam lurk pitfalls that even seasoned investors can stumble over. When you’re investing in physical gold, verifying authenticity isn’t just a precaution—it’s your financial lifeline.

Golden Rules: How Do You Tell Real Gold From Fool’s Gold?

Let’s face it: gold has been the ultimate symbol of value for centuries, but its allure also attracts fraudsters. So, what’s a savvy investor to do? The art and science of authenticity verification range from simple at-home tests to high-tech professional analyses. Here’s a taste of what can keep you from falling prey to fakes.

Is That Gold Bar Really Worth Its Weight or Just Heavy Metal Impersonation?

One of the classics is the magnet test. Real gold isn’t magnetic—if your bar or coin sticks to a magnet, it’s a red flag screaming “fake!” Then, there’s the density test, measuring gold’s heft against its size. Gold’s density is roughly 19.32 grams per cubic centimeter, so any noticeable discrepancy hints at impurity or forgery.

Another clever trick is the acid test, which involves applying nitric acid to a small scratch on the gold piece. This test can reveal if the item is pure or plated. While effective, handle with care or better yet, entrust this to a professional.

When DIY Isn’t Enough: Trusting the Experts

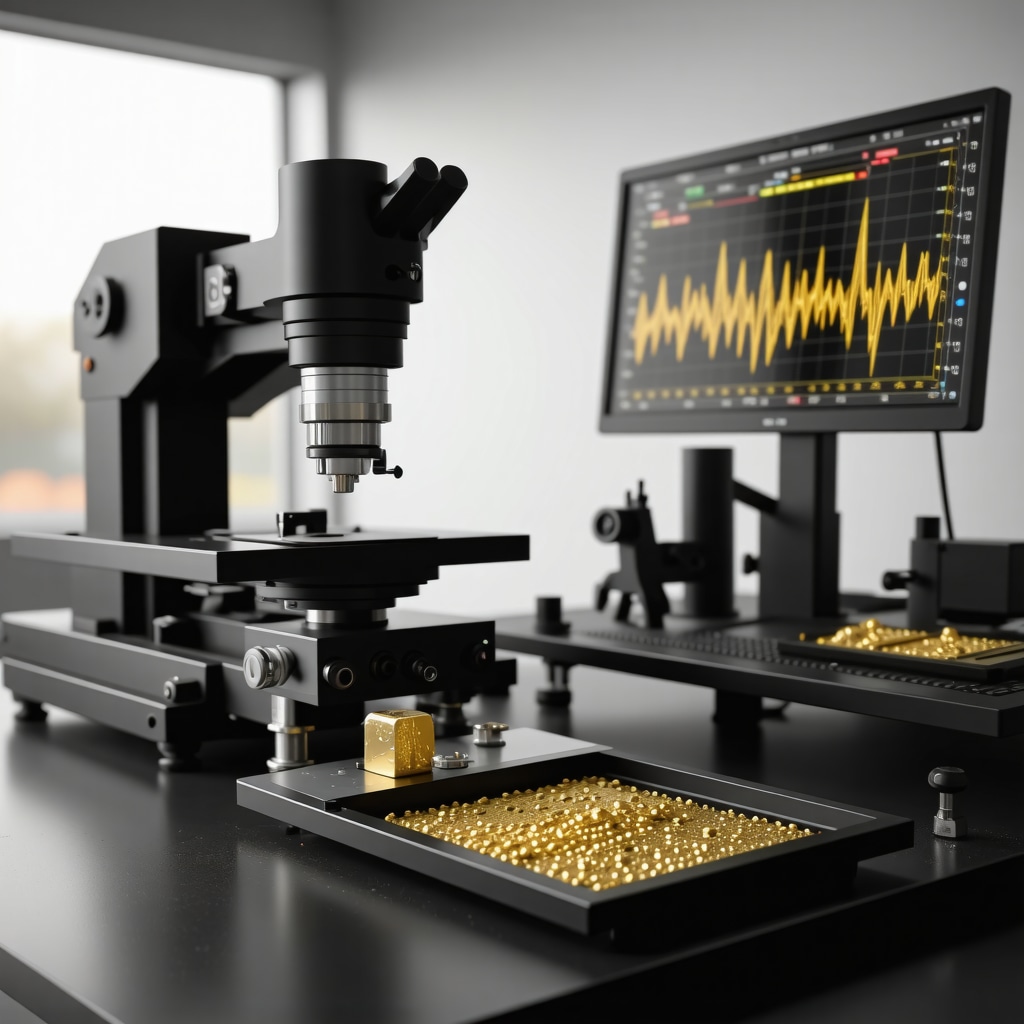

If you’re serious about physical gold investments, relying solely on home tests is like reading stock charts in the dark. Professional assays, including X-ray fluorescence (XRF) analysis, can verify purity without damaging your gold. Certified dealers and assayers use these technologies to give you peace of mind.

Remember, buying from reputable dealers can significantly reduce your risk. You might want to check out resources like trusted gold dealers for secure physical purchases for guidance on where to shop smart.

But Wait, Is Authenticity the Only Battle in Gold Investing?

Authenticity is just the opening act. Understanding gold supply and demand dynamics can arm you with the foresight to buy at the right time. The market is a living beast, influenced by global economic shifts, central bank purchases, and geopolitical tensions. In fact, according to the World Gold Council, gold demand has been historically robust during economic uncertainty (source).

So, verifying your gold’s authenticity is essential, but coupling that with a solid understanding of market trends turns your shiny asset into a smart investment.

Ready to Share Your Golden Stories or Ask a Burning Question?

Your experience could be the nugget of wisdom another investor needs. Drop your thoughts or queries in the comments below. And if you’re hungry for more savvy gold investment tips, explore our top tips for secure physical gold ownership and keep your portfolio gleaming with confidence!

Advanced Techniques to Authenticate Gold: What Every Investor Should Know

While basic tests like magnet checks and acid assays offer a good starting point, truly safeguarding your physical gold investment requires a nuanced approach. Professional verification methods such as ultrasound testing and electronic gold testers provide non-destructive and highly accurate purity assessments that surpass traditional techniques. Ultrasound testing analyzes the internal structure of the gold item, detecting any inconsistencies or hidden cores, while electronic testers measure electrical conductivity to confirm karat levels with precision.

Engaging with certified laboratories or reputable assay offices ensures your gold’s authenticity is validated by globally recognized standards. This level of scrutiny is especially crucial for investors dealing with high-value bars or rare collectible coins, where the stakes are considerably higher.

How Do Global Economic Factors and Central Bank Policies Shape Gold Authenticity Concerns?

Understanding the market context is equally important. As central bank gold purchases intensify, the demand for verified, high-purity gold surges. This dynamic increases the circulation of certified bullion, reducing the risk of counterfeit products in official channels but simultaneously elevating the stakes in private transactions.

Moreover, geopolitical tensions and currency fluctuations often drive investors toward physical gold as a safe haven, amplifying market activity and, regrettably, counterfeit risks. Staying informed about these macroeconomic influences helps investors time their acquisitions and choose trusted sources more judiciously.

Could Emerging Technologies Revolutionize How We Verify Gold Authenticity?

One exciting frontier is the integration of blockchain and digital certification in gold trading. Imagine a future where every gold bar or coin is paired with an immutable digital certificate that guarantees its provenance and purity, accessible instantly to buyers worldwide. This could drastically reduce fraud and increase transparency across the supply chain.

Additionally, handheld spectrometers with AI capabilities are becoming more accessible, empowering individual investors to perform sophisticated verification on the spot. These advancements promise to democratize authenticity checks and enhance investor confidence significantly.

For those eager to deepen their understanding, our analysis of gold supply and demand offers detailed insights into how market forces intersect with authenticity concerns.

Expert Insight: Why Trustworthy Authentication Is the Cornerstone of Gold Investment

According to the World Gold Council, stringent authentication protocols not only protect investors but also uphold market integrity and sustain long-term confidence in gold as an asset class (source). Their research underscores that as gold’s role in portfolios evolves, so does the complexity of ensuring its genuineness.

Investors who align their strategies with expert authentication methods and market awareness are best positioned to capitalize on gold’s enduring value while mitigating risks related to counterfeit and market volatility.

Join the Conversation: Share Your Strategies or Questions on Gold Authentication

How do you verify the authenticity of your physical gold investments? Have you explored advanced technologies or stuck with traditional methods? Your insights could illuminate best practices for fellow investors navigating this complex landscape. Drop your thoughts in the comments below, share this article with your investment community, and continue exploring expert advice on gold verification by visiting our top tips for secure physical gold ownership.

Decoding the Nuances of Gold Authentication: Beyond the Basics

While traditional gold verification methods establish a solid foundation, today’s discerning investors demand elevated strategies to navigate the sophisticated counterfeiting landscape. Advanced authentication doesn’t just detect fakes — it reveals subtle nuances in alloy composition, microstructural integrity, and provenance, aspects critical for high-value acquisitions.

Techniques such as laser-induced breakdown spectroscopy (LIBS) enable rapid elemental analysis by vaporizing micro-samples and analyzing emitted light spectra. This method offers near-instant, non-contact verification of karat purity and trace elements, invaluable for distinguishing legitimate bullion from cleverly disguised counterfeits.

Moreover, neutron activation analysis (NAA) is revered in specialized labs for its unparalleled sensitivity to elemental composition without compromising the gold’s physical integrity. Although cost-prohibitive for casual investors, its precision is paramount for institutional buyers and collectors of rare numismatic pieces.

How Can Investors Integrate Blockchain to Enhance Gold Provenance and Authentication?

Blockchain technology is revolutionizing authenticity assurance by embedding immutable provenance records directly into the gold supply chain. Each bar or coin can be linked to a unique digital certificate encoded on a decentralized ledger, ensuring transparency from mine to market.

This integration mitigates risks of tampering and forgery, empowering investors to verify origin data and assay results instantly via smartphone applications. Platforms like Tracr, endorsed by industry leaders, exemplify how blockchain fosters trust and traceability in precious metals trading.

Adopting such digital certification solutions enables investors to align with evolving market standards, reduces due diligence friction, and elevates confidence in physical gold ownership.

Macro-Economic Forces: Orchestrating Gold’s Authenticity and Market Dynamics

Gold’s role as a strategic asset is inextricably linked to macroeconomic currents. Central bank policies, inflation trends, and geopolitical upheavals can dramatically influence both demand and the urgency for authenticated bullion.

For instance, during periods of quantitative easing or currency depreciation, gold’s allure as a hedge intensifies, often triggering surges in demand for certified, high-purity bullion. This phenomenon was markedly evident during the 2008 financial crisis and recent global economic uncertainties, as documented by the World Gold Council.

Investors attuned to these signals can strategically time acquisitions, prioritizing gold verified through stringent assay standards to safeguard against counterfeit influxes that tend to proliferate amidst heightened market activity.

What Are the Limitations and Challenges of Current Gold Verification Technologies?

Despite impressive advancements, no single authentication method is infallible. Techniques like XRF spectrometry may struggle with surface plating disguises or layered compositions, while electronic testers can be influenced by environmental variables and operator expertise.

Furthermore, high-end methods such as NAA and LIBS require specialized equipment and trained personnel, limiting accessibility. Blockchain solutions, while promising, face hurdles related to universal adoption, interoperability among stakeholders, and ensuring data entry integrity.

Consequently, a multi-layered verification approach—combining physical assays, technological diagnostics, and provenance tracking—remains the gold standard in ensuring authenticity.

For investors committed to mastering the art and science of gold authentication, exploring these complex methodologies and their practical applications is essential. Dive deeper into these topics through our detailed analysis in Advanced Gold Authentication Techniques.

Unlocking the Full Spectrum of Gold Verification: Beyond Traditional Methods

When securing your physical gold investment, resting solely on conventional tests like magnetism or acid assays may leave critical vulnerabilities unchecked. Savvy investors increasingly embrace a multi-faceted approach combining precision technologies with digital provenance to outmaneuver sophisticated counterfeiters. This elevated vigilance reflects the growing complexity of precious metals markets and the necessity to protect capital with unassailable evidence of authenticity.

What Role Does Laser-Induced Breakdown Spectroscopy (LIBS) Play in Precision Gold Authentication?

Laser-Induced Breakdown Spectroscopy (LIBS) represents a cutting-edge analytical technique, allowing near-instant elemental profiling by vaporizing microscopically small samples of gold and analyzing emitted spectral lines. This method is particularly adept at distinguishing subtle differences in alloy composition and trace impurities that traditional methods might overlook. While LIBS requires specialized equipment typically found in certified labs, its ability to provide rapid, non-contact, and highly detailed purity assessments makes it invaluable for institutional investors and collectors of rare numismatic gold.

Integrating LIBS into your gold authentication toolkit can significantly reduce the margin of error inherent in simpler tests, offering an additional layer of confidence when verifying high-value acquisitions. For investors interested in the scientific underpinnings and practical applications of LIBS, exploring detailed technical resources can be an illuminating next step.

Harnessing Blockchain: Transforming Gold Provenance Into a Trustworthy Digital Ledger

Emerging blockchain platforms are redefining how authenticity is tracked across the gold supply chain. By pairing physical gold bars or coins with immutable digital certificates recorded on decentralized ledgers, provenance data becomes transparent, tamper-proof, and accessible globally in real time. This innovation mitigates traditional risks of forgery and misrepresentation, providing investors with instant verification through user-friendly smartphone applications.

Solutions such as Tracr exemplify industry-leading blockchain initiatives endorsed by major mining and trading entities, fostering an ecosystem of trust from mine to market. As blockchain adoption expands, investors will benefit from enhanced due diligence capabilities and streamlined transactional confidence, especially in private sales often vulnerable to authenticity gaps.

To appreciate how blockchain integrates with broader market forces, consider reviewing our analysis of gold supply and demand, which contextualizes provenance solutions within evolving economic dynamics.

Macro-Economic Trends Amplifying the Imperative for Verified Gold

The interplay of global economic variables profoundly shapes the need for rigorous gold authentication. As central banks intensify their bullion acquisitions to diversify reserves, the demand for certified, assay-verified gold surges, tightening supply chains and elevating market standards. According to the World Gold Council, such periods of heightened demand correlate with greater investor scrutiny and increased counterfeit vigilance.

Simultaneously, geopolitical tensions and inflationary pressures drive individual and institutional investors toward physical gold as a safeguard, intensifying transactional volume and inadvertently incentivizing counterfeiters. Understanding these macro trends enables investors to time purchases strategically and prioritize gold authenticated through robust, multi-layered verification processes.

What Are the Best Practices for Combining Multiple Authentication Techniques to Mitigate Risks?

No single authentication technology offers absolute certainty. Challenges such as surface plating evasion or layered composites require layered defenses. Experts recommend an integrated strategy: starting with non-destructive tests like XRF and ultrasound, advancing to LIBS or NAA where feasible, and complementing with blockchain-verified provenance records. This synergy of physical assays, technological diagnostics, and digital certification forms a robust shield against sophisticated fraud.

Adopting a multi-tiered approach not only enhances authenticity assurance but also signals to the market a commitment to transparency and quality, potentially influencing resale value and liquidity.

Engage and Elevate Your Gold Investment Journey

How have you adapted your gold verification methods in response to evolving market complexities? Have you embraced advanced techniques or explored blockchain-enabled provenance? Share your experiences or questions in the comments below to enrich our collective understanding. For deeper dives into gold market forces and authentication strategies, explore our authoritative resources like the ultimate guide to understanding gold supply and demand and stay ahead in your investment game.

Expert Insights & Advanced Considerations

Integrating Multi-Modal Authentication Enhances Security

Relying on a single verification method is no longer sufficient in today’s complex gold market. Combining physical assays like XRF and ultrasound with advanced techniques such as LIBS and neutron activation analysis (NAA) creates a robust defense against sophisticated counterfeiting. This layered approach mitigates the limitations inherent to each technology, ensuring a more comprehensive evaluation of your gold’s authenticity and purity.

Blockchain Provenance as a Game-Changer for Transparency

Blockchain’s immutable digital ledgers are revolutionizing how provenance is tracked, providing investors with instant access to verified assay data and ownership history. Platforms like Tracr exemplify this shift, increasing transparency and reducing fraud risks. Adopting blockchain-certified gold empowers investors to transact with confidence, especially in private and secondary markets where verification gaps are prevalent.

Macroeconomic Trends Intensify the Need for Verified Gold

Central bank buying, inflationary pressures, and geopolitical uncertainties heighten demand for certified bullion, often tightening supply chains and increasing counterfeit risks. Investors who align their acquisition timing with these macroeconomic signals and prioritize authenticated gold minimize exposure to fraud while optimizing portfolio resilience. Understanding these dynamics is crucial for strategic investment decisions.

Emerging Technologies Empower Individual Investors

Handheld spectrometers with AI capabilities are democratizing access to sophisticated verification tools, allowing individual investors to perform on-the-spot assessments with high accuracy. This technological empowerment complements professional assays and enhances due diligence, fostering greater confidence in physical gold investments across all market segments.

Strategic Authentication Boosts Market Liquidity and Value

Demonstrating rigorous authenticity through multi-layered verification not only protects your investment but also signals quality to future buyers, potentially enhancing resale value and liquidity. In an increasingly vigilant market, transparent provenance and advanced authentication become competitive advantages, especially for high-value gold bars and collectible coins.

Curated Expert Resources

- World Gold Council Research Hub: An authoritative source offering comprehensive data on gold demand trends, market dynamics, and investment insights. Essential for understanding macroeconomic impacts on gold authenticity and pricing (source).

- Tracr Blockchain Platform: Industry-leading blockchain solution for gold provenance, providing real-time, tamper-proof certification that enhances transparency and trust across the supply chain (Tracr).

- BuyingGoldNow’s Advanced Authentication Techniques: A detailed guide explaining cutting-edge verification methods including LIBS, NAA, and digital certifications, tailored for serious investors seeking heightened security (Advanced Gold Authentication Techniques).

- Ultimate Guide to Understanding Gold Supply and Demand: This resource provides foundational knowledge on how macroeconomic forces and market trends influence gold investment strategies and the importance of verified bullion (Ultimate Guide).

- How Central Bank Gold Purchases Affect Price Volatility: Insightful analysis of how institutional buying shapes bullion market dynamics and authenticity considerations for investors (Central Bank Gold Purchases).

Final Expert Perspective

In the evolving landscape of physical gold investments, authenticity verification transcends traditional tests, demanding a sophisticated, multi-layered strategy that integrates advanced scientific methods and blockchain-enabled provenance. This approach not only thwarts increasingly clever counterfeiters but also aligns with macroeconomic realities that drive demand and market volatility. By embracing these expert insights and leveraging authoritative resources, investors can transform gold from a mere shiny asset into a resilient, trustworthy pillar of their portfolio. Engage with these advanced strategies, share your professional experiences, and continue exploring nuanced market forces through our comprehensive guides to elevate your gold investment acumen.

This article does a great job highlighting the importance of multiple verification methods when investing in physical gold. I recently learned firsthand how tempting it is to rely solely on simple tests like the magnet or density check, but nothing beats comprehensive verification, especially for high-value pieces. I’ve started exploring more advanced techniques like XRF and even blockchain-based provenance, which initially seemed daunting but now see as essential for modern investors. It’s interesting how emerging technologies like handheld spectrometers with AI are making sophisticated tools more accessible to individual investors, democratizing gold verification. Personally, I’ve found that combining physical tests with digital certificates provides the greatest peace of mind when making large purchases. Have others here used blockchain verification yet, and if so, what has been your experience with its practical application? I’d love to hear more about how these solutions are integrating into real-world transactions and how they compare to traditional methods.