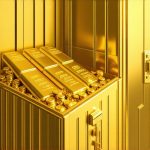

Physical Gold Investments in 2025: How to Secure Your Wealth with Coins & Bars

Unlocking the Future of Wealth: Why Gold Remains a Critical Asset in 2025 As global economic uncertainties persist, understanding the nuanced role of physical gold investments becomes essential for sophisticated investors seeking to safeguard and grow their wealth. In 2025, the strategic allocation towards gold coins and bars is not merely about diversification but about…