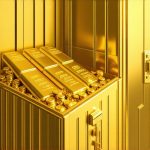

Top Gold Coins & Bars to Buy Now for Wealth Preservation in 2025

Strategic Insights into Gold Investment: Navigating the 2025 Market Dynamics In an era where economic volatility and geopolitical uncertainties continue to challenge traditional investment paradigms, gold remains a quintessential asset for wealth preservation. As we approach 2025, understanding the nuanced landscape of gold coins and bars is crucial for discerning investors aiming to safeguard their…