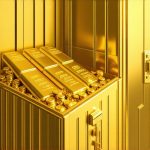

Physical Gold Investment: Best Storage Practices in 2026

Strategic Imperatives in Physical Gold Storage for 2026 Investors As physical gold continues to serve as a cornerstone of diversified portfolios amid volatile global markets, the imperative to adopt best storage practices becomes paramount for safeguarding asset integrity and liquidity. In 2026, seasoned investors must navigate increasingly sophisticated security challenges and evolving custodial solutions to…