Unlocking the Potential of Gold Futures: A Strategic Perspective for 2025

As we approach 2025, gold futures trading emerges as a sophisticated instrument for seasoned investors aiming to diversify their portfolios and hedge against economic volatility. Unlike traditional gold investing, futures contracts offer leverage and strategic flexibility, but require a nuanced understanding of market dynamics and timing. In this article, we delve into advanced techniques to optimize gains in gold futures trading, grounded in economic indicators, geopolitical factors, and market sentiment analysis.

Understanding the Complex Interplay of Supply, Demand, and Macro Factors

Successful futures trading hinges on a comprehensive grasp of fundamental drivers such as supply-demand imbalances, central bank policies, and geopolitical tensions. For instance, recent data indicates that central banks are increasing gold purchases as part of their reserve diversification strategies, which could catalyze upward price momentum in 2025 (source). Investors must analyze these macroeconomic signals alongside technical indicators like moving averages and Fibonacci retracements for precise entry and exit points.

Leveraging Technical Analysis and Market Timing for Maximum Profitability

Market timing remains crucial in futures trading. Advanced traders utilize tools such as oscillator divergences, volume analysis, and macro trend confirmations to anticipate short-term swings and long-term shifts. Effective timing can significantly amplify returns, especially during periods of heightened volatility, which is often driven by geopolitical developments or monetary policy shifts. Techniques such as the effective use of stop-loss orders and scaling in/out can help manage risk and lock in profits.

Expert Insight: What Are the Key Indicators for 2025?

How will geopolitical tensions and monetary policies shape gold futures prices in 2025?

This question reflects ongoing debates among market analysts. The consensus suggests that geopolitical instability, combined with accommodative monetary policies, will sustain gold’s appeal as a safe haven. Continuous monitoring of indicators such as the U.S. Federal Reserve’s interest rate trajectory, inflation expectations, and global political events is essential for informed trading decisions.

For comprehensive strategies, consider exploring proven techniques for 2025 and stay updated with expert analyses on future price trends. Engaging with professional insights and contributing your experience can refine your strategy and improve outcomes in this complex market environment.

In conclusion, mastering gold futures trading in 2025 demands a layered approach—integrating macroeconomic analysis, technical precision, and strategic risk management. The evolving geopolitical landscape and central bank policies will continue to influence price trajectories, making it imperative for traders to adapt dynamically.

Refining Your Gold Futures Strategy: Beyond the Basics

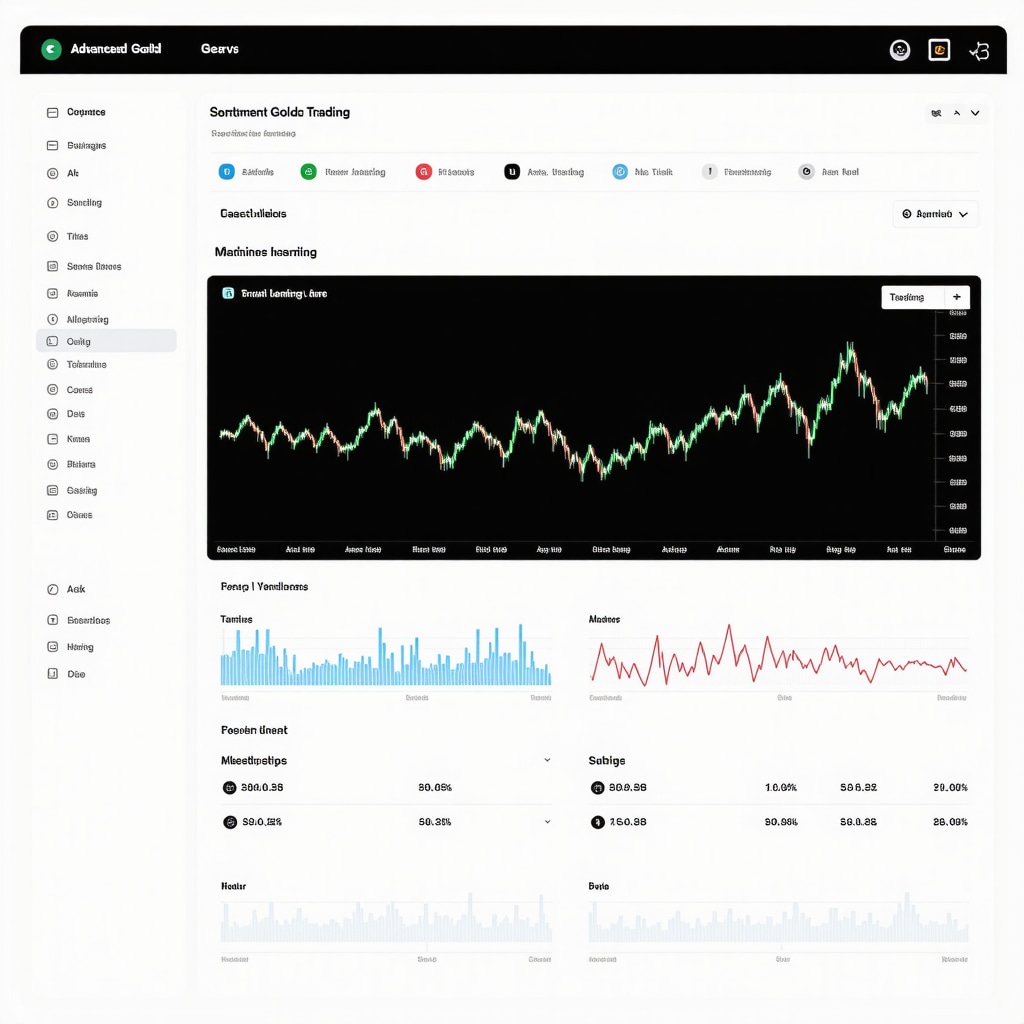

As we navigate the intricate landscape of 2025, experienced traders recognize that success in gold futures hinges on a comprehensive integration of macroeconomic insights, technical expertise, and strategic agility. One often overlooked aspect is the role of **market sentiment analysis**, which can offer early signals of trend reversals or continuations. By employing tools such as sentiment indices, news sentiment tracking, and social media analytics, investors can gain a nuanced understanding of market psychology and position themselves advantageously.

Advanced Tools and Frameworks for Precision Trading

Incorporating quantitative models, like machine learning algorithms and predictive analytics, can significantly enhance decision-making accuracy. These models analyze vast datasets — including historical prices, macroeconomic indicators, and geopolitical events — to identify subtle patterns and forecast future movements. For instance, integrating comprehensive market analysis can help traders anticipate shifts driven by supply-demand dynamics, especially with the increasing influence of central bank gold purchases, which are expected to shape prices in 2025.

Question for the Expert: How Can Market Sentiment and Quantitative Models Be Combined for Optimal Gold Futures Trading in 2025?

This is a pivotal question for traders aiming to refine their approach. Combining sentiment analysis with quantitative forecasting creates a layered risk management system, allowing traders to respond swiftly to emerging signals. For example, if sentiment metrics indicate rising fear or uncertainty, while quantitative models forecast a short-term correction, traders can adjust their positions proactively, minimizing losses and maximizing gains.

For a deeper dive into strategic execution, consider exploring proven techniques for 2025 and stay connected with expert insights on future market drivers. Sharing your experiences or questions can foster a community of informed investors, enhancing collective decision-making.

Market Dynamics and External Drivers to Watch

One critical external driver is the evolving geopolitical landscape, which continues to influence safe-haven assets like gold. Additionally, monetary policies, especially interest rate trajectories set by major central banks, will play a decisive role. As demand trends shift across sectors, understanding these macro trends becomes essential for timing your trades effectively.

Harnessing Sentiment and Quantitative Models: The Next Frontier in Gold Futures

As the gold market evolves amidst geopolitical tensions and shifting monetary policies, the integration of market sentiment analysis with advanced quantitative forecasting models offers traders a formidable edge. While traditional technical analysis provides valuable signals, combining it with real-time sentiment metrics—such as news sentiment indices, social media analytics, and investor confidence surveys—can unveil early signs of trend reversals or accelerations.

For example, during periods of heightened geopolitical uncertainty, sentiment indices often reflect increased fear or risk aversion, which can precede price surges in gold. When paired with predictive analytics that analyze macroeconomic data, traders can proactively adjust their positions. This layered approach enables a nuanced understanding of market psychology and improves timing accuracy, especially in volatile environments.

Integrating Machine Learning for Precision in Gold Price Predictions

In recent years, machine learning algorithms have gained prominence for their ability to analyze vast datasets and identify subtle patterns invisible to traditional analysis. These models incorporate macroeconomic indicators such as inflation rates, currency fluctuations, interest rate trajectories, and geopolitical event data to generate probabilistic forecasts of gold price movements.

For instance, a neural network trained on historical gold prices combined with real-time economic indicators can predict short-term price swings with remarkable accuracy. Incorporating these insights into your trading strategy allows for more precise entry and exit points, while also enhancing risk management through probabilistic scenario analysis. To deepen your understanding, explore resources like advanced analytics in gold trading.

How Can Combining Sentiment and Machine Learning Models Optimize Gold Futures Trading in 2025?

This question addresses a cutting-edge approach. By synthesizing sentiment data with machine learning forecasts, traders can develop a multi-layered decision-making framework. For example, if sentiment analysis indicates rising market anxiety, and a machine learning model forecasts a short-term correction, traders might choose to reduce exposure or set tighter stop-loss levels. Conversely, positive sentiment combined with bullish predictive signals could trigger strategic position increases. This synergy enhances responsiveness and helps mitigate risks during unpredictable market conditions.

Engaging with these sophisticated tools requires continuous learning and adaptation. Consider participating in specialized courses or webinars offered by industry experts, and stay updated with the latest research in quantitative finance and behavioral economics.

External Drivers and Future Market Dynamics

Looking ahead, the dynamic interplay of external factors such as geopolitical developments, central bank policies, and global economic health will exert significant influence on gold futures. For instance, the trajectory of U.S. Federal Reserve interest rates not only affects the dollar but also the attractiveness of gold as an alternative asset. Similarly, political instability in key regions or trade tensions can amplify safe-haven demand.

Staying abreast of these external drivers through continuous macroeconomic monitoring and adapting your models accordingly will be essential for maintaining a competitive advantage in 2025 and beyond. The integration of sentiment analysis, machine learning, and macroeconomic insights represents the frontier of expert-level gold trading strategies.

Harnessing Cross-Disciplinary Approaches to Gold Futures Trading

As we venture further into 2025, integrating insights from behavioral economics, data science, and geopolitical analysis becomes imperative for sophisticated traders aiming to optimize their positions in gold futures. Understanding the psychological underpinnings of market sentiment, alongside cutting-edge quantitative models, allows traders to anticipate market reversals with higher precision. For example, leveraging social media sentiment indices in conjunction with macroeconomic indicators can reveal early signs of trend exhaustion or acceleration, providing a strategic edge.

Innovative Quantitative Techniques: From Deep Learning to Ensemble Models

Beyond traditional machine learning, deep learning architectures such as recurrent neural networks (RNNs) and transformer models are increasingly capable of capturing complex temporal patterns in financial data. These models analyze sequential data—like macroeconomic releases, geopolitical events, and price movements—to forecast short-term volatility and long-term trends with remarkable accuracy. Employing ensemble methods, which combine multiple predictive models, further enhances robustness against outliers and market noise, thus refining entry and exit strategies.

What Are the Most Promising External Drivers for Gold in 2025?

How will evolving geopolitical tensions and central bank policies influence gold futures prices?

This question remains central to market forecasting. According to the Bank of International Settlements’ latest report, geopolitical conflicts and monetary easing measures are expected to sustain safe-haven demand for gold, particularly if inflationary pressures persist or interest rate hikes stall. Continuous monitoring of geopolitical hotspots, trade negotiations, and policy shifts by major central banks will be crucial for timely tactical adjustments.

For a deeper understanding, consult authoritative analyses such as the BIS report on global financial stability and gold demand trends.

Engaging with these advanced insights enables traders to develop resilient, adaptive strategies that respond proactively to external stimuli, securing a competitive advantage in this dynamic environment.

Integrating Sentiment Data with Predictive Analytics: A Paradigm Shift in Gold Trading

The future of gold futures trading lies in the seamless integration of real-time sentiment analysis with sophisticated predictive analytics. Sentiment indices derived from news analytics, social media, and investor surveys serve as early warning signals of market psychology shifts. When combined with predictive models that incorporate macroeconomic data, traders can construct multi-layered decision frameworks, effectively navigating volatility and capitalizing on emerging trends.

For example, a spike in global economic uncertainty, coupled with negative news sentiment, often precedes upward moves in gold prices. Recognizing these patterns early allows traders to position themselves advantageously, optimizing risk-reward ratios.

How Can Multi-Source Data Fusion Enhance Gold Price Forecasts?

This question underscores the importance of holistic data integration. Combining macroeconomic indicators, sentiment metrics, geopolitical risk assessments, and technical signals into unified models enables a comprehensive view of the market landscape. Data fusion techniques, such as Bayesian networks or multi-view learning algorithms, synthesize disparate data streams into actionable insights, helping traders to anticipate shifts with higher confidence and execute more precise trades.

To stay ahead, practitioners should explore emerging research and tools in data fusion methodologies, which are rapidly transforming quantitative finance.

External Factors: Navigating the Unpredictable Terrain

While technological and analytical advances provide a strategic edge, external factors such as geopolitical upheavals, trade policies, and macroeconomic shocks continue to inject unpredictability into the gold market. The evolving landscape demands continuous vigilance and agility, with traders frequently recalibrating their models and assumptions. As the World Gold Council emphasizes, staying informed through real-time news feeds, geopolitical risk assessments, and central bank communications is vital for maintaining strategic flexibility.

Expert Insights & Advanced Considerations

1. The Growing Influence of Geopolitical Risks

Geopolitical tensions continue to shape gold futures markets, with expert analysis indicating that conflicts and political instability in key regions can trigger significant price swings. Traders should monitor international developments closely and incorporate geopolitical risk assessments into their strategic planning.

2. The Role of Central Bank Policies in Price Dynamics

Central banks’ gold purchase and sale activities are pivotal in 2025. Understanding the implications of monetary easing or tightening measures helps investors anticipate market movements. Staying informed through resources like central bank activity reports is essential for strategic positioning.

3. Leveraging Sentiment and Quantitative Models

Combining market sentiment analysis with advanced quantitative models—such as machine learning algorithms—offers a robust approach to forecasting short-term price movements. This layered strategy enhances decision-making accuracy, especially amid market volatility.

4. The Significance of Supply-Demand Dynamics

In-depth understanding of supply-demand trends, including jewelry industry consumption and mining output, provides critical insights into future price trajectories. Resources like demand trend analyses are instrumental for informed trading.

5. External Factors and External Data Fusion

Integrating macroeconomic indicators, geopolitical risk assessments, and technical signals through data fusion techniques enhances forecast precision. This comprehensive approach allows traders to navigate external uncertainties more effectively.

Curated Expert Resources

- Bank of International Settlements Report: Offers authoritative insights on global financial stability and gold demand trends, critical for macroeconomic analysis.

- Buy Gold Now Articles: Provides expert-level strategies on gold investment, market analysis, and technical trading techniques tailored for 2025.

- Academic Journals on Quantitative Finance: Include latest research on machine learning applications and data fusion in financial forecasting, essential for cutting-edge traders.

Final Expert Perspective

In 2025, mastering gold futures trading demands a sophisticated blend of geopolitical awareness, macroeconomic insight, and advanced predictive analytics. The integration of sentiment analysis with machine learning models represents the frontier of high-level trading strategies, enabling professionals to stay ahead in a volatile environment. To deepen your expertise, explore resources like proven techniques for 2025 and engage with industry communities. Continuous learning and strategic agility remain the keys to sustained success in this dynamic market.

This article offers a comprehensive look at the complexities involved in gold futures trading for 2025. I appreciate the emphasis on combining macroeconomic analysis with technical and sentiment-based insights. From my experience, integrating machine learning at an operational level can really help identify subtle market signals that traditional methods might overlook. However, I wonder how individual traders can practically implement these advanced models without access to huge datasets and computational resources. Also, in volatile environments driven by geopolitical shifts, how reliable are these predictive models? It’s a fascinating field that seems to be advancing quickly, and I’d love to hear perspectives on the best tools or platforms that democratize access to these sophisticated analytics for retail traders.