Mastering Gold Investment Strategies in a Shifting Global Economy

As one of the most resilient yet complex assets, gold’s role in modern investment portfolios demands a nuanced understanding of demand trends, geopolitical influences, and innovative vehicle options such as gold ETFs and mutual funds. In 2026, discerning savvy investors are compelled to go beyond surface metrics, integrating macroeconomic indicators with granular market analysis to optimize wealth preservation strategies.

Gold Demand Fluctuations and Their Impact on Portfolio Optimization

Recent analyses reveal that shifts in global gold demand often precede significant price movements, influenced by factors such as central bank policies, technological demand, and geopolitical stability. Understanding gold demand trends enables investors to anticipate potential price floors and capitalize on emerging opportunities, particularly within gold futures and physical holdings.

Are Gold Coins Still a Reliable Wealth Preservation Method for 2026?

While gold coins have historically served as a tangible hedge against inflation, their liquidity and premium dynamics require careful consideration. Experts advise examining premium fluctuations, storage costs, and authenticity verification, especially amidst rising counterfeit concerns. Incorporating gold coins as part of a diversified strategy enhances resilience but mandates strict due diligence.

Balancing Gold ETF Investments with Physical Gold: Which Approach Combines Safety and Growth?

The debate between investing in gold ETFs versus physical gold hinges on liquidity needs, inflation hedging, and storage considerations. Physical gold’s superiority as an inflation hedge persists, but ETFs offer liquidity and accessibility, making them suitable for tactical allocations. A strategic blend can optimize risk-adjusted returns.

What Are the Most Promising Gold Investment Strategies for Conservative and Aggressive Portfolios?

Conservative investors benefit from allocating a percentage to bullion-backed ETFs and gold mutual funds, emphasizing safety and liquidity. Conversely, aggressive investors might explore leveraged gold futures or mining stocks to amplify gains, cognizant of the inherent risks. Monitoring demand trends and supply constraints, such as those driven by central bank hoarding, is crucial for timing and strategic positioning.

How Can Investors Effectively Identify Signs of Market Overextension in Gold to Prevent Overpaying?

Spotting overextensions involves analyzing technical indicators, market sentiment, and demand anomalies. Notably, divergence between physical demand and ETF inflows can signal a bubble or correction point. Regularly reviewing authoritative analyses, like those from the gold demand reports, keeps investors ahead of market shifts.

For professional insights on navigating complex gold markets, consider engaging with expert forums or specialized publications. Continuous education not only sharpens strategic acumen but also fosters trust and transparency—cornerstones of sustainable wealth growth.

Reference: Academic Analysis of Gold Price Dynamics

Embracing the Surge: Why Central Bank Gold Buying Signals a Bullish Future

Recent data indicate unprecedented levels of central bank gold acquisitions, a trend that suggests a strategic shift away from fiat currencies amid geopolitical tensions and economic uncertainties. This robust demand from sovereign entities often foreshadows sustained upward momentum in gold prices, reinforcing its status as a critical hedge during turbulent times. Investors who monitor these macroeconomic shifts can position their portfolios for potential gains, tapping into growth avenues such as bullish signals indicating gold reaching $4,500 in 2026.

Leveraging Spot Price Surges with Tactical Scalping and Gains

In the volatile landscape of 2026, mastering scalping strategies tailored for gold can generate quick profits, especially when volatile price swings present lucrative entry and exit points. Implementing these tactics requires a keen understanding of technical analysis, market sentiment, and sudden demand shifts, often driven by geopolitical events or Federal Reserve policy announcements. The key remains in balancing such short-term trading with long-term holdings to optimize overall wealth growth.

Can Gold Outperform Traditional Assets During the Next Economic Crisis?

While stocks and bonds have traditionally served as core portfolio components, gold’s performance during market downturns often surpasses these assets—especially when inflation spirals or currency devaluations occur. Recognized by financial experts for its resilience, gold’s role as a ’disaster hedge’ becomes increasingly vital amid ongoing global instability. Incorporating a combination of physical gold, ETFs, and strategic mining stocks allows investors to diversify risk while maintaining exposure to potential rebounds.

What Are the Hidden Costs That Could Erode Your Gold Investment Returns in 2026?

Beyond the obvious purchase price, investors must account for fees such as dealer premiums, storage costs, and potential tax implications. For instance, excessive premiums on coins can substantially diminish returns, especially if market conditions fluctuate unexpectedly. Moreover, high storage fees for physical gold can eat into gains if not carefully managed. To guard against these pitfalls, consulting authoritative sources like expert advice on hidden costs becomes essential for informed decision-making.

Engaging with seasoned dealers and leveraging flexible storage options can significantly improve net yields. Sharing your experiences or questions in specialized forums helps refine your strategies and deepen your understanding of market intricacies.

Unveiling the Hidden Patterns Behind Gold Price Fluctuations

At the heart of successful gold investing lies the ability to recognize subtle cyclical patterns that often precede market shifts. Expert analysts utilize a combination of Elliot Wave theory, Fibonacci retracements, and macroeconomic indicators to forecast potential turning points. By meticulously studying historical cycles—such as the decade-long bull markets interrupted by brief corrections—investors can position themselves strategically, leveraging both technical and fundamental signals.

What Is the Role of Geopolitical Risks in Accelerating Gold Market Dynamics?

Geopolitical tensions, such as trade disputes, conflicts, and diplomatic breakdowns, have historically acted as catalysts for gold rallies. Recent research, including a detailed report by the IMF, emphasizes that during periods of heightened uncertainty, gold’s safe-haven appeal amplifies due to its liquidity and intrinsic value. Investors attuned to geopolitical developments can capitalize on these moments by adjusting allocations, ensuring resilience against currency shocks and monetary destabilization.

Advanced Strategies for Timing Entry and Exit: Moving Beyond Basic Indicators

While simple moving averages and RSI signals suffice for general guidance, sophisticated investors employ volume-weighted analysis, order book monitoring, and sentiment analysis drawn from social media and news sentiment data. Integrating machine learning algorithms can further refine timing accuracy, identifying subtle anomalies signaling upcoming market corrections or rallies. For example, leveraging predictive analytics can uncover divergence patterns that predict short-term surges before conventional indicators confirm the trend.

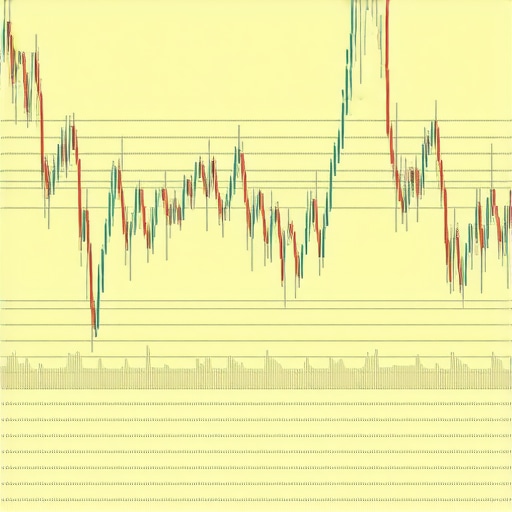

Visualize intricate gold market cyclic patterns with expert-designed charts highlighting key turning points predicted using advanced analytical tools.

Choosing Between Physical Gold and Digital Alternatives for Diverse Portfolios

The debate extends beyond mere preference—it encompasses considerations of security, liquidity, and technological convenience. Digital gold platforms, employing blockchain verification, offer seamless access and fractional ownership, appealing to younger investors seeking agility. Meanwhile, physical gold remains a trusted hedge against technological failures or cyber risks. A balanced approach involves allocating portions of wealth to both, tailored to risk appetite and liquidity needs, supported by comprehensive due diligence.

Expert Tips for Diversifying Gold Investments to Avoid Pitfalls

To prevent overconcentration and mitigate risks, diversification across multiple investment vehicles is essential. Strategically blending bullion, coins, ETFs, and mining stocks creates a hedge against specific vulnerabilities—such as premium inflation or supply shocks. Regular portfolio reviews, informed by real-time market analytics, help adjust holdings in response to demand trends or geopolitical developments. Additionally, establishing relationships with reputable dealers and custodians can prevent counterparty risk and ensure authenticity and secure storage.

How Can Investors Stay Ahead in the Rapidly Evolving Gold Market Ecosystem?

Staying ahead requires continuous education and adaptation. Engaging with exclusive reports from leading market research firms like Gold Insights or participating in specialized webinars hosted by industry veterans can deepen understanding of emerging trends. Building a network within professional forums accelerates information exchange, fostering timely responses to market signals. As markets evolve, so too must strategies—embracing innovation while grounded in rigorous analysis ensures sustained advantage in gold investments.

The Hidden Psychological Traps that Can Sabotage Your Gold Portfolio

Even seasoned investors fall prey to cognitive biases that distort market perception. Failing to recognize herd mentality during surges or panic-selling during dips can erode gains. Incorporating behavioral finance principles, such as contrarian investing and bias mitigation techniques, enhances decision-making. Advanced investors often consult neuroeconomic studies to understand these patterns better, enabling disciplined entry and exit points amid volatile conditions.

How Cutting-Edge Blockchain Technologies Are Transforming Gold Tracking and Ownership

The integration of blockchain platforms like EOS Gold or DigixDAO brings unprecedented transparency and security to gold ownership. Tokenization allows fractional ownership, streamlining transfers and reducing counterparty risks. This technological innovation supports compliance, auditability, and ease of liquidation, making gold investment more accessible and trustworthy for global investors. As regulatory frameworks evolve, leveraging such platforms can provide a competitive edge in portfolio management.

What Expert Techniques Enable Precise Timing for Gold Asset Reallocations?

Utilizing multifactor technical analysis, including order book analysis and real-time sentiment metrics, offers superior foresight. Quantitative models, especially those employing machine learning algorithms, detect subtle anomalies before they manifest in price movements. Investors integrating these sophisticated tools can micro-tune their allocations, capitalizing on short-lived opportunities and avoiding prolonged exposure to downside risks, thus refining portfolio agility.

Mitigating Political Instability’s Impact on Gold Prices with Strategic Diversification

Geopolitical upheavals, from trade wars to regional conflicts, often spike gold demand unpredictably. To guard against abrupt price shocks, experts recommend layered diversification—blending traditional safe-havens with unconventional assets such as sovereignty-linked cryptocurrencies or precious metals from emerging markets. Creating a resilient mosaic aligns with dynamic political landscapes and minimizes systemic vulnerabilities, ensuring that one crisis does not disproportionately affect the entire portfolio.

Diversify Beyond Gold: Exploring Niche Assets for Tactical Advantage

Incorporating alternative precious metals like platinum, palladium, or even rare earth elements can provide strategic leverage. These commodities often outperform gold during specific industrial or technological booms and can serve as hedge against commodity-specific shocks. Employing options strategies, such as collar structures or straddles on these metals, further facilitates risk management while exploiting volatility for profit.

Why Precision in Cost Analysis Could Be the Deciding Factor in 2026

Hidden transaction costs, including high premiums, unfair buy-back fees, and tax inefficiencies, can stealthily erode overall returns. Advanced investors perform meticulous cost-benefit analyses, sometimes employing AI-powered tools that simulate various scenarios, accounting for fluctuating premiums, storage, and tax policies. This level of precision ensures that gains are not negated by avoidable expenses, preserving capital for reinvestment or strategic repositioning.

Decoding the Interplay Between Dollar Trends and Gold Pricing

The inverse relationship between the US dollar index and gold prices remains a critical indicator. Expert traders monitor macroeconomic indicators, such as Federal Reserve interest rate policies, inflation expectations, and global trade balances, to anticipate shifts. Leveraging derivative markets, like gold futures options, provides the agility to hedge or leverage these trends effectively, turning macroeconomic insights into tactical advantage.

Harnessing the Power of Sentiment for Tactical Gold Trades

Beyond quantitative analysis, capturing market sentiment through AI-driven social media analytics, news Scraping tools, and sentiment indices like the MMI (Market Mood Indicator) offers a nuanced edge. Recognizing early signs of bullish fervor or complacency aids in timing trades precisely. Combining sentiment data with technical signals creates a comprehensive framework for strategic entry and exit decisions, especially during transient market upheavals.

Expert Insights & Advanced Considerations

Stay Ahead of Demand Cycles

By monitoring macroeconomic trends and geopolitical shifts, investors can anticipate demand surges that often precede price rallies, ensuring timely entries and exits in gold markets.

Leverage Cutting-Edge Technology for Precise Timing

Utilizing machine learning models and sentiment analysis tools provides a competitive edge by detecting early signals of market overextensions or corrections, optimizing portfolio adjustments.

Recognize the Power of Sovereign Demand

Central bank buying patterns signal confidence in gold’s role as a reserve asset, often foreshadowing bullish trends—monitoring these can inform strategic accumulation.

Integrate Alternative Assets for Resilience

Diversifying with niche assets like platinum or rare earth elements alongside gold reduces systemic risks and capitalizes on sector-specific growth, safeguarding wealth amidst volatility.

Evaluate the Impact of Blockchain on Ownership and Liquidity

Tokenized gold assets and blockchain verification streamline transfers, enhance transparency, and broaden access—adapting portfolios to these innovations can improve liquidity and security.

Curated Expert Resources

- Gold Demand Reports from IMF: Offers comprehensive insights into sovereign and industrial demand trends, essential for macro-level positioning.

- Gold Price Forecasting Platforms: Advanced analytics and predictive models aid in anticipating market turning points with higher accuracy.

- Blockchain Platforms like DigixDAO: Pioneering reforms in gold ownership, enabling fractional and transparent holdings, aligning with modern digital asset strategies.

- Market Sentiment Analysis Tools: Real-time social media and news sentiment feeds provide early warnings of market shifts, crucial for tactical decision-making.

- Specialized Financial Journals and Forums: Engaging with expert communities enhances understanding of emerging trends and innovative investment approaches.

A Reflection for the Discerning Investor

Mastering gold investment in 2026 involves synthesizing macroeconomic signals, technological advancements, and geopolitical intelligence into a cohesive strategy. This approach ensures resilience and growth amid fluctuating demand patterns and evolving market dynamics. Dive deeper into these insights by actively engaging with dedicated resources, sharing your experiences within expert communities, and continuously refining your tactics. The future of gold wealth preservation demands foresight, sophistication, and action—embrace these principles to secure your financial legacy.