Unlocking the Future of Gold Trading: A Strategic Perspective for 2025

As the global economy navigates unprecedented shifts, the role of gold as a resilient asset class becomes more critical for sophisticated investors. In 2025, leveraging advanced gold futures and technical analysis will be paramount for achieving optimal portfolio performance. This guide synthesizes expert insights, market trends, and analytical frameworks to empower traders and investors aiming for precision and profitability in gold markets.

The Evolution of Gold Futures Trading in 2025: From Traditional to Tactical

Gold futures have historically served as a hedge against inflation and currency devaluation. In 2025, the integration of algorithmic trading and machine learning models enhances predictive accuracy, transforming futures into dynamic tools for risk management and speculative gains. Market participants must adopt a nuanced understanding of global economic factors that influence futures prices, including geopolitical tensions, central bank policies, and monetary supply fluctuations.

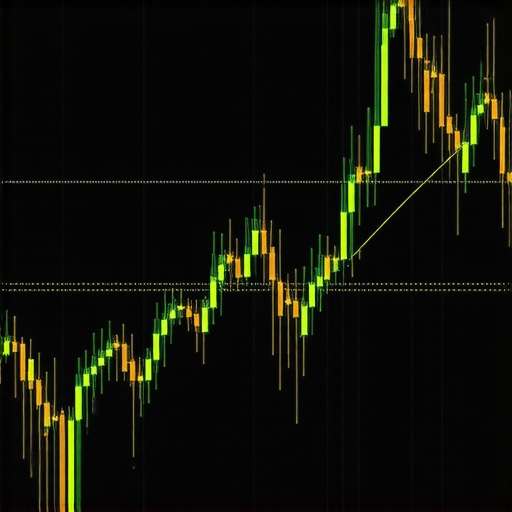

Advanced Technical Analysis Techniques: Navigating Market Volatility with Precision

In the context of 2025’s heightened volatility, traders must employ sophisticated technical indicators—such as relative strength index (RSI), Fibonacci retracements, and Elliott Wave theory—to identify trend reversals and entry/exit points. Combining these with volume analysis and market breadth indicators enhances decision-making robustness. An expert approach involves developing customized trading algorithms that adapt to evolving market signals, thus optimizing profit margins amidst unpredictable swings.

How Can Investors Integrate Fundamental and Technical Insights for 2025?

Optimal strategies involve a synergistic approach: fundamental analysis provides macroeconomic context—such as demand trends and supply dynamics—while technical analysis fine-tunes entry points. This dual methodology reduces risk exposure and enhances timing accuracy. For example, monitoring price trend predictions helps anticipate breakout scenarios, critical for strategic positioning.

What are the key challenges in applying technical analysis to gold futures in 2025?

Despite technological advancements, challenges persist, including false signals during periods of market noise and the need for continuous adaptation to new data patterns. Traders must maintain rigorous back-testing and validation, alongside real-time monitoring of macro events, to mitigate these risks.

If you seek to deepen your understanding, explore our comprehensive guide on gold trading techniques. Sharing your insights or experiences can also contribute to a richer market dialogue—your expertise may help shape future trading paradigms.

Sources such as the International Monetary Fund’s white paper reinforce the importance of macroeconomic stability in gold price dynamics, emphasizing the need for an integrated analytical approach.

Harnessing Data-Driven Insights: The New Frontier in Gold Market Analysis

As we delve deeper into 2025, the importance of integrating advanced data analytics into gold investment strategies becomes undeniable. Traditional methods alone no longer suffice; instead, investors must leverage big data, machine learning, and real-time market feeds to anticipate price movements with greater accuracy. This approach empowers traders to identify emerging trends before they become mainstream, optimizing entry and exit points and enhancing overall portfolio performance.

Can Artificial Intelligence Revolutionize Gold Trading in 2025?

Emerging AI tools are transforming how investors interpret market signals. Sophisticated algorithms analyze vast datasets, including geopolitical developments, currency fluctuations, commodity demand, and central bank activities, to generate predictive models. According to a recent report from Buying Gold Now, these AI-driven insights can significantly reduce the lag between market changes and trader reactions, providing a competitive edge. For example, by monitoring demand trends and supply chain disruptions, investors can better forecast short-term price swings and long-term shifts.

What Are the Limitations of Relying on Quantitative Models for Gold Investment?

Despite their sophistication, quantitative models are not without flaws. Market anomalies, black swan events, and sudden geopolitical crises can produce unpredictable deviations from model predictions. Investors must maintain a nuanced perspective, combining quantitative insights with qualitative assessments—such as political stability and macroeconomic policies—so as to avoid over-reliance on any single analytical framework. Continuous back-testing and validation against historical data are crucial to ensure models remain relevant and reliable in an ever-evolving market landscape.

Enhancing Your Analysis: Practical Tools for 2025 Investors

To stay ahead in the complex world of gold trading, consider integrating platforms that offer real-time analytics, sentiment analysis, and macroeconomic forecasting. Tools like market analysis platforms can help decipher the underlying drivers of price movements. Additionally, subscribing to expert newsletters and participating in online forums fosters a continuous learning environment and allows for the exchange of innovative strategies among seasoned traders.

What advanced analytical techniques can help mitigate risks in volatile markets?

Techniques such as Monte Carlo simulations, scenario analysis, and Bayesian updating enable investors to model multiple potential outcomes, thereby preparing for various market conditions. These methods help quantify uncertainty and guide decision-making during turbulent periods, ensuring that risk exposure is managed proactively rather than reactively. Developing expertise in these areas can substantially improve the resilience of your gold investment portfolio.

If you’re eager to refine your analytical toolkit, explore our comprehensive guide to advanced trading techniques. Sharing your insights or questions about these methods can spark valuable discussions—your experiences might influence the evolution of smarter trading practices.

For a deeper dive into how macroeconomic factors shape gold prices, consider reviewing the work published by the International Monetary Fund. Their research underscores the importance of holistic analysis, combining data-driven insights with macroeconomic context to craft resilient investment strategies in 2025 and beyond.

Integrating Quantitative and Qualitative Analyses: The Next Step in Gold Market Forecasting

As gold trading evolves into a more sophisticated domain, the integration of quantitative models with qualitative assessments becomes imperative. Quantitative models, including machine learning algorithms and statistical simulations, provide valuable numerical forecasts but can fall short during unexpected geopolitical upheavals or macroeconomic shocks. Conversely, qualitative insights—such as geopolitical risk evaluations, policy shifts, and market sentiment—offer context that numbers alone cannot capture. Combining these approaches involves establishing a dynamic framework where real-time data feeds inform models, and expert judgment calibrates outputs. This hybrid methodology enhances the robustness of predictions, especially during volatile or unprecedented market conditions.

Harnessing Machine Learning for Predictive Precision in Gold Prices

Machine learning (ML) techniques are revolutionizing gold market analysis by uncovering complex patterns within vast datasets. Supervised learning models, such as random forests and gradient boosting machines, can predict short-term price movements by analyzing features like macroeconomic indicators, currency fluctuations, and supply chain disruptions. Unsupervised learning, including clustering algorithms, helps identify emerging market regimes and investor behavior clusters. One of the most promising developments is the use of deep learning architectures—like recurrent neural networks (RNNs) and Long Short-Term Memory (LSTM) networks—which excel at capturing temporal dependencies and sequential patterns in financial time series data. According to a study published in the Journal of Financial Data Science (2024), integrating ML-driven insights significantly enhances trading accuracy when combined with traditional technical analysis.

How can traders ensure the interpretability of complex ML models in gold trading?

Interpretability remains a challenge with advanced ML models. Techniques such as SHAP (SHapley Additive exPlanations) values and LIME (Local Interpretable Model-agnostic Explanations) are crucial for understanding feature importance and decision pathways. By employing these methods, traders can ensure that model predictions are not only accurate but also transparent, facilitating better risk management and strategic decision-making. Moreover, maintaining a rigorous validation process, including cross-validation and out-of-sample testing, helps prevent overfitting and ensures models remain relevant across different market conditions.

Real-Time Data Analytics Platforms: Transforming Decision-Making in Gold Investment

In the fast-paced realm of 2025’s gold markets, real-time analytics platforms are indispensable. These tools aggregate data from multiple sources—such as geopolitical news feeds, economic indicators, social media sentiment, and market depth—and process them through sophisticated algorithms to generate actionable insights. Platforms like Gold Market Insight and Fintech Analytics facilitate rapid response to emerging trends, enabling traders to capitalize on fleeting opportunities or mitigate potential losses. Integration of AI-driven sentiment analysis further refines the decision-making process, providing a nuanced understanding of market psychology.

What Ethical Considerations Are Evolving with AI-Driven Gold Trading?

As AI becomes more embedded in gold trading, ethical concerns around transparency, data privacy, and algorithmic bias intensify. Ensuring that trading algorithms do not perpetuate market manipulation or unfair advantages is critical. Regulatory frameworks are gradually evolving to address these issues, emphasizing the need for transparency in algorithm design and decision rationale. Traders and developers must prioritize ethical AI practices, including bias mitigation, robust validation, and compliance with international standards, to foster trust and stability within the market ecosystem.

Interested in implementing these cutting-edge strategies? Explore our comprehensive guide on advanced gold trading techniques for 2025. Engaging with a community of experts and continuously refining your analytical toolkit will position you at the forefront of the evolving gold market landscape. Your expertise and curiosity could be the catalyst for innovative solutions and smarter trading paradigms.

Harnessing Quantitative and Qualitative Data for Superior Gold Market Predictions

In the sophisticated landscape of 2025, successful traders integrate quantitative models—such as neural networks and Bayesian models—with qualitative insights including geopolitical risk assessments and macroeconomic policy analyses. This dual approach enables a comprehensive understanding of market dynamics, allowing for more accurate forecasts and strategic positioning. For instance, real-time geopolitical risk indicators can calibrate quantitative models, enhancing their predictive validity during turbulent periods.

Implementing Cutting-Edge Deep Learning Architectures to Capture Market Nuances

Deep learning models like Transformer networks and convolutional neural networks (CNNs) are increasingly employed to decipher complex, non-linear relationships in gold price data. These models excel at identifying subtle patterns within vast datasets, such as macroeconomic indicators, currency movements, and supply chain disruptions. According to a 2024 publication in the Journal of Financial Data Science, deploying LSTM and Transformer-based models significantly improves short-term predictive accuracy, giving traders a decisive edge.

What Are the Best Practices for Ensuring Model Transparency and Trustworthiness?

Complex models, particularly deep learning architectures, often suffer from interpretability issues. Techniques like SHAP (SHapley Additive exPlanations) and LIME (Local Interpretable Model-agnostic Explanations) are vital tools for elucidating feature importance and decision pathways. Ensuring transparency fosters trust and facilitates compliance with evolving regulatory standards, such as those proposed by the European Securities and Markets Authority (ESMA). Regular validation, cross-validation, and out-of-sample testing are also essential to maintain model relevance amidst market volatility.

Advancing Market Analysis with Real-Time Sentiment and Macro Data Integration

Modern trading platforms now incorporate sentiment analysis derived from news feeds, social media, and expert commentary. When combined with macroeconomic data—like interest rate announcements and inflation reports—this creates a multidimensional view of market conditions. Platforms such as Fintech Analytics enable traders to react swiftly, capitalizing on fleeting opportunities or avoiding emerging risks, thus elevating strategic decision-making to an expert level.

How Can Ethical AI Practices be Ensured in Automated Gold Trading?

As AI-driven trading becomes more prevalent, ethical considerations surrounding transparency, bias mitigation, and data privacy are paramount. Developing algorithms with explainability in mind and adhering to international standards such as the IEEE Global Initiative on Ethics of Autonomous and Intelligent Systems ensures responsible use. Regulatory oversight, combined with internal governance, helps prevent market manipulation and fosters trust among market participants.

Engage with Future-Ready Strategies to Elevate Your Gold Trading Expertise

To stay at the forefront of innovation, professionals should continually update their analytical frameworks and participate in specialized training. Exploring resources like advanced gold trading techniques will empower you to refine your strategies. Sharing insights and experiences within expert communities can catalyze new approaches, shaping the future of gold trading.

Expert Insights & Advanced Considerations

1. Adaptive Algorithmic Strategies Are Key

In 2025, traders leveraging adaptive algorithms that incorporate real-time macroeconomic data will achieve superior risk management and profitability. Continuous refinement of these models ensures resilience against unpredictable market shocks, making them indispensable for sophisticated investors.

2. Integrating Macro and Micro Market Signals Enhances Accuracy

Combining macroeconomic indicators with micro-level technical signals, such as volume and order flow analysis, provides a nuanced view of gold price movements. This dual approach reduces false signals and improves timing for entries and exits.

3. Ethical AI and Data Privacy Are Critical

As AI-driven trading intensifies, maintaining transparency, minimizing biases, and ensuring data privacy are paramount. Adopting ethical AI frameworks sustains market integrity and builds trust among stakeholders.

4. The Role of Geopolitical Risk Assessment

Advanced geopolitical risk assessment tools, integrated into trading platforms, allow investors to anticipate market volatility stemming from geopolitical tensions, enabling strategic hedging and position adjustments.

5. Embracing Multi-Source Data Analytics Platforms

Utilizing platforms that synthesize news sentiment, social media trends, macroeconomic reports, and technical data empowers traders to respond swiftly to emerging market opportunities, maintaining a competitive edge.

Curated Expert Resources

- International Monetary Fund (IMF) Publications: Offers comprehensive macroeconomic analyses that underpin strategic decision-making in gold trading.

- Journal of Financial Data Science: Provides cutting-edge research on machine learning models and their application to financial markets, including gold.

- European Securities and Markets Authority (ESMA) Guidelines: Ensures compliance and transparency in AI-driven trading practices, fostering sustainable market environments.

- Fintech Platforms for Market Analytics: Advanced tools offering real-time data feeds, sentiment analysis, and macroeconomic insights for active traders.

- Expert Community Forums: Platforms like TradingView and MarketWatch facilitate knowledge exchange and peer-reviewed strategies among professionals.

Final Expert Perspective

As we look toward 2025, mastering the intricacies of gold trading demands a blend of technological innovation, ethical standards, and comprehensive analysis. Integrating cutting-edge data analytics with macroeconomic insights will be essential for those seeking to optimize their portfolios and navigate volatility confidently. For dedicated investors and traders, engaging with authoritative resources and community discourse will refine strategies and uphold the highest standards of professionalism. Now is the time to deepen your expertise and embrace the sophisticated tools shaping the future of gold markets.