The Golden Dilemma: Why Buy Gold Bars in the First Place?

Imagine this: you’re at a crossroads where financial chaos meets the timeless allure of gold. The world’s economies wobble, inflation lurks in shadowy corners, and suddenly, cold hard gold bars gleam like the ultimate safe haven. But how do you, the savvy investor, navigate this glittering maze without falling prey to scams or pitfalls? Welcome to your ultimate physical investment guide where safety meets savvy.

Trust but Verify: Finding Your Gold Dealer Without Losing Your Shirt

Buying gold bars isn’t like picking up groceries. You can’t just stroll into any store and expect to walk out with a genuine 24-karat treasure. The key? Look for trusted gold dealers with sterling reputations and transparent dealings. It’s worth diving into resources like how to find trusted gold dealers for safe purchases to arm yourself with insider knowledge and avoid the common traps.

Is It Really Gold or Just Fool’s Gold?

Here’s where many stumble: distinguishing authenticity from cunning counterfeits. Remember, a shiny bar might sparkle but not all that glitters is gold. Always check for hallmark stamps, assay certificates, and buy from sources that offer verifiable provenance. Testing kits and professional appraisals are your best friends in this golden quest.

Storage and Security: Because You Can’t Just Hide It Under the Mattress

Once you’ve secured your gold bars, the next challenge looms large — safe storage. Stashing them under your bed might sound quaint but is hardly foolproof. Consider secure vaults or bank safety deposit boxes to protect your investment from theft or damage. It’s an often-overlooked step but one that makes all the difference between peace of mind and nightmares.

The Price is Right? Navigating Gold Market Trends and Price Fluctuations

Gold prices dance to the tune of global economic moods, central bank moves, and supply-demand shifts. Staying informed with expert gold price forecasts can help you time your purchases more strategically. After all, buying gold bars safely isn’t just about the physical transaction but understanding the market currents that influence your treasure’s value.

For those hungry to dive deeper into physical gold investment strategies, this guide on tips for physical gold investments offers a treasure trove of actionable advice.

Feeling the Golden Glow Yet? Join the Conversation!

Have you ever bought gold bars or considered it? What challenges did you face, or what insider tips do you swear by? Drop your thoughts below and let’s turn this golden guide into a vibrant community exchange.

As Forbes highlights, “Physical gold remains a reliable hedge in times of economic uncertainty,” underscoring why a cautious, informed approach to buying gold bars is more relevant than ever. Source: Forbes

Beyond the Basics: How to Evaluate Gold Bar Purity and Certification Like a Pro

When investing in gold bars, understanding the nuances of purity and certification can dramatically influence the security and value of your investment. While 24-karat gold is the purest form, not all bars are created equal. Look for bars that are stamped with precise purity levels such as .9999 fine gold, which offers the highest assurance. Certifications from reputable institutions like the London Bullion Market Association (LBMA) or the American Numismatic Association lend credibility and ease of resale. These certifications ensure your gold is recognized globally and can shield you from unscrupulous sellers.

Gold Bar Sizes and Their Impact on Liquidity and Storage

Choosing the right gold bar size is more than a matter of budget; it also affects liquidity and storage ease. Larger bars, like the standard 1-kilogram bars, are typically more cost-efficient per gram but can be harder to sell quickly in smaller increments. Conversely, smaller bars, such as 1-ounce or 10-gram bars, offer better flexibility for gradual liquidation but come with higher premiums. Balancing between size, storage convenience, and resale potential is crucial for any physical gold investor looking for both safety and agility in their portfolio.

How Do Market Dynamics Influence Your Timing to Buy Gold Bars?

Deciding when to purchase gold bars requires a keen eye on market trends and geopolitical factors. Gold prices are influenced by inflation rates, currency fluctuations, central bank purchases, and global economic uncertainty. For instance, during periods of high inflation or geopolitical turmoil, gold often acts as a safe haven, driving prices upward. Conversely, when markets stabilize, prices might cool off. Monitoring expert gold price forecasts and staying informed on central bank gold acquisitions can give you an edge in timing your investments effectively.

Understanding the Role of Central Banks in Gold Market Stability

Central banks are among the largest holders and buyers of gold globally. Their purchasing patterns significantly impact the gold market’s liquidity and price stability. When central banks increase their gold reserves, it signals confidence in gold as a long-term store of value, often leading to price appreciation. Conversely, significant sell-offs or reduced buying activity can add downward pressure. For savvy investors, keeping tabs on official reports and analyses, such as those featured in the central bank gold purchase market impact studies, is essential for anticipating market shifts.

Physical Gold vs. Digital Gold: What’s the Safest Bet for 2025?

With the rise of digital gold platforms and gold-backed ETFs, investors face choices beyond physical bars. While digital gold offers convenience and ease of transaction, it carries risks like counterparty default and regulatory changes. Physical gold bars, in contrast, provide tangible ownership and are less susceptible to digital vulnerabilities but require secure storage and authentication. Weighing these factors against your investment goals and risk tolerance is key to crafting a resilient portfolio.

For a comprehensive breakdown, consider exploring types of gold investments to find the best fit for your 2025 strategy.

Join the Discussion: What’s Your Strategy for Buying Gold Bars Safely in Today’s Market?

Are you leaning toward physical gold bars, ETFs, or a diversified approach? Have you faced challenges securing authentic bars or managing storage risks? Share your experiences and insights in the comments below. Your input helps build a knowledgeable community equipped to navigate gold investments confidently.

According to the World Gold Council, “Understanding supply-demand dynamics and central bank activities is critical for investors seeking to maximize gold’s potential as a portfolio diversifier.” Source: World Gold Council

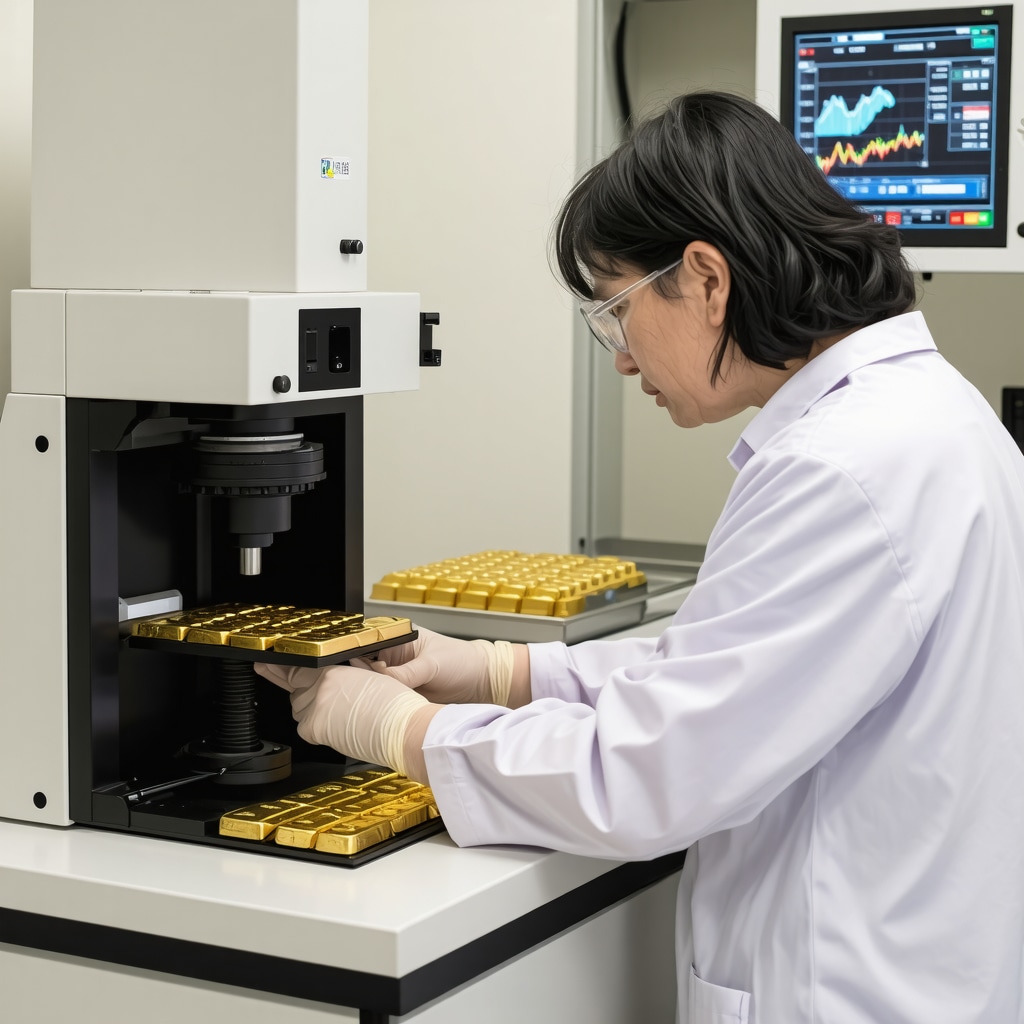

Advanced Authentication Techniques: Beyond Basic Visual Inspection

While hallmark stamps and assay certificates form the foundation for verifying gold bars, seasoned investors know that these can sometimes be forged or manipulated. To truly master authentication, one must delve into advanced testing methods such as X-ray fluorescence (XRF) spectrometry, ultrasonic thickness measurement, and density analysis. XRF allows for a non-destructive elemental analysis, revealing the precise composition of the bar and ensuring it matches the declared purity. Ultrasonic testing detects internal inconsistencies or voids that counterfeit bars often exhibit, while density checks confirm the metal’s mass-to-volume ratio, a critical indicator of genuine gold.

Engaging with specialized laboratories or accredited refineries for these tests can provide an extra layer of confidence. For example, the London Bullion Market Association (LBMA) accredits refineries and assay offices that adhere to rigorous standards, serving as a benchmark for trustworthy certification.

Decoding the Chemistry and Metallurgy Behind Gold Bar Quality

Understanding the metallurgical nuances that affect gold bar quality elevates an investor’s ability to spot subtleties missed by surface-level inspection. Pure 24-karat gold, designated as 99.99% purity, is soft and malleable, often alloyed slightly in industrial bars to enhance durability. Recognizing these alloy patterns and their impact on physical properties can prevent costly mistakes. For instance, counterfeiters may insert tungsten due to its density similarity to gold, but tungsten drastically alters the electromagnetic and acoustic signature detectable by expert tools.

Moreover, the manufacturing process—be it cast, minted, or poured bars—leaves distinct microstructures and surface textures. Experienced appraisers use magnification and microscopy to identify these unique fingerprints. Such high-level scrutiny ensures your gold bar is not just authentic but also aligns with your investment objectives regarding purity and craftsmanship.

Can Independent Assay Certificates Be Trusted Over Manufacturer Certification?

This nuanced question challenges investors to evaluate certification sources critically. Manufacturer certificates, while standard, sometimes lack impartiality, especially in less regulated markets. Independent assay certificates, issued by third-party labs, provide unbiased verification but may come at an additional cost and require trusting the assay laboratory’s reputation. Weighing these factors is crucial, particularly when dealing with high-value bars or when planning to resell.

Experts often recommend combining both: purchasing gold bars certified by reputable manufacturers and validating them through independent assays to mitigate any risk of counterfeiting or misrepresentation. This dual approach maximizes security in your gold investment portfolio.

Innovations in Gold Bar Security: Embedded Technologies and Future Trends

In response to rising sophisticated fraud, the gold industry is embracing cutting-edge technologies to enhance bar security. Innovations include micro-engraving, laser marking, and embedded RFID chips that enable instant verification through digital scanners. These embedded security features create tamper-proof identifiers that are difficult to replicate, providing a new frontier for provenance assurance.

Smart contracts linked with blockchain technology are also emerging, storing immutable records of ownership and transaction history, reducing counterparty risk. Although still nascent, these technologies promise to revolutionize how physical gold ownership is authenticated and transferred.

For investors keen to stay ahead, monitoring these technological advancements can offer a competitive advantage and greater peace of mind.

Where Can I Find Trusted Laboratories for Gold Bar Verification?

Identifying a credible laboratory for gold bar verification involves considering accreditation, expertise, and transparency. Institutions certified by the International Organization for Standardization (ISO), such as ISO/IEC 17025 for testing and calibration laboratories, are preferred. Examples include Gemological Institute of America (GIA) and SGS Group, renowned for their rigorous testing procedures and global presence.

Choosing a lab with a strong track record, clear reporting standards, and advanced analytical capabilities will ensure your gold bars undergo the most reliable and sophisticated assessments available.

Invitation to Engage: Share Your Gold Authentication Experiences and Questions

Have you employed advanced testing methods to verify your gold bars? What challenges or successes have you encountered in navigating certifications and cutting-edge security features? Join the conversation below to exchange insights and deepen your mastery of gold investment safety.

According to the London Bullion Market Association (LBMA), “Accurate verification and certification are paramount to maintaining integrity in the global gold market.”

Mastering Gold Bar Authentication: Cutting-Edge Techniques and Future-Proof Security

In the sophisticated world of physical gold investment, basic visual inspections and hallmark checks are no longer sufficient to guarantee authenticity. As counterfeiters employ increasingly advanced methods, investors must adopt a multi-faceted approach to authentication that blends traditional expertise with modern technology. Beyond standard assay certificates, advanced techniques such as X-ray fluorescence (XRF) spectrometry, ultrasonic thickness measurements, and precise density analysis emerge as indispensable tools. These methods provide non-destructive, scientific verification of elemental composition and structural integrity, ensuring your gold bar is exactly as claimed.

Partnering with accredited laboratories like those certified by the London Bullion Market Association (LBMA) not only reinforces trust but also facilitates smoother resale processes globally. Their stringent standards act as a bulwark against fraud and misrepresentation, a reassurance every serious investor craves.

Innovative Security Features: How Technology is Reinventing Gold Bar Provenance

Responding to the challenges posed by counterfeit gold, the precious metals industry is rapidly embracing technological innovations to safeguard authenticity and provenance. Micro-engraving and laser marking add microscopic identifiers that are virtually impossible to replicate, while embedded RFID chips enable instant digital verification with handheld scanners. This fusion of physical craftsmanship and digital technology creates tamper-evident gold bars, elevating investor confidence to new heights.

Moreover, blockchain-enabled smart contracts are pioneering immutable ownership records, providing transparent transaction histories and reducing risks of fraud or theft. Though still emerging, these futuristic approaches promise to revolutionize ownership verification and transferability, making them a critical consideration for forward-thinking investors.

How Can Investors Balance Cost and Security When Choosing Authentication Methods?

While advanced authentication techniques offer unmatched security, they often come with additional costs that may seem daunting, especially for newcomers or those with smaller portfolios. Striking the right balance between cost-effectiveness and thorough verification is crucial. Experts recommend a tiered approach: start with trusted dealers and LBMA-accredited bars to minimize initial risk, then selectively employ advanced testing for higher-value purchases or when resale is anticipated.

Independent assays can provide a valuable second opinion, particularly in markets with less stringent oversight. However, investors should assess the credibility and accreditation of the testing laboratories to avoid false assurances. For a comprehensive understanding of safe purchasing and authentication strategies, delve into our tips for physical gold investments and explore the latest gold price forecasts to time your investments strategically.

Where to Find Trusted Laboratories for Next-Level Gold Bar Verification?

Choosing the right laboratory for in-depth gold authentication is paramount. Accredited institutions such as the Gemological Institute of America (GIA) and the SGS Group offer ISO/IEC 17025-certified testing services renowned for rigor and impartiality. These labs utilize state-of-the-art analytical technologies and provide detailed reports that can substantiate your gold bar’s legitimacy during resale or insurance claims.

Engaging with such reputable laboratories not only safeguards your investment but also enhances your negotiating power in the marketplace, transforming you from a casual buyer into a discerning, informed participant.

Engage with Us: What Are Your Experiences or Questions About Gold Bar Authentication?

Have you ever utilized advanced techniques like XRF or blockchain verification for your gold bars? What hurdles or insights have shaped your investment journey? Share your stories and questions in the comments below to foster a vibrant community of informed investors. For further guidance, explore our comprehensive physical gold investment tips and stay ahead with expert market forecasts.

As noted by the London Bullion Market Association (LBMA), “Accurate verification and certification are paramount to maintaining integrity in the global gold market.” This underscores the critical importance of embracing advanced authentication methods in today’s evolving landscape.

Expert Insights & Advanced Considerations

The Nuances of Dual Certification Elevate Security

Combining manufacturer and independent assay certifications is not just a precaution, but a strategic imperative for serious gold investors. While manufacturer certificates validate origin and basic purity, independent assays offer impartial verification that can uncover subtle discrepancies or forged documentation. This layered approach significantly mitigates counterfeiting risks and enhances resale confidence in volatile markets.

Technological Innovations Are Reshaping Gold Provenance Verification

Embedded RFID chips, micro-engraving, and blockchain-enabled smart contracts represent a paradigm shift in gold bar authentication. These innovations provide tamper-evident features and immutable ownership records that traditional methods cannot match. Investors who embrace these technologies gain unparalleled assurance and market agility, especially as counterfeit sophistication escalates.

Market Dynamics Demand Timely and Informed Purchase Decisions

Understanding the interplay between central bank gold acquisitions, inflation trends, and geopolitical instability is critical for timing physical gold purchases. Leveraging expert gold price forecasts and monitoring supply-demand fluctuations empower investors to optimize entry points and safeguard portfolio value effectively.

Balancing Liquidity and Storage Practicalities Through Bar Size Selection

The choice of gold bar size directly impacts liquidity and storage logistics. Smaller bars facilitate gradual liquidation and flexible portfolio adjustments but incur higher premiums, whereas larger bars offer cost efficiency but reduced divisibility. Savvy investors tailor size selection to their investment horizon and liquidity needs, integrating insights from comprehensive guides like tips for physical gold investments.

Curated Expert Resources

London Bullion Market Association (LBMA): The definitive authority on gold bar standards, accreditation, and global market integrity. Their resources provide critical frameworks for evaluating certification and refinery credibility.

Gemological Institute of America (GIA): Renowned for rigorous ISO/IEC 17025-certified testing, GIA offers detailed compositional analyses vital for authenticating gold bars beyond surface-level inspection.

SGS Group: A global leader in independent assay services, SGS’s advanced analytical techniques and transparent reporting make it indispensable for investors seeking third-party verification.

BuyingGoldNow.com Expert Guides: Comprehensive resources such as safe gold bar purchasing tips and gold price forecasts deliver actionable insights grounded in current market realities.

World Gold Council: Offers in-depth research on gold demand trends and central bank activities, essential for understanding macroeconomic influences on gold valuation.

Final Expert Perspective

Safely buying gold bars today transcends mere possession of precious metal; it demands a sophisticated blend of authentication mastery, technological awareness, and market acumen. The evolving landscape necessitates investors to adopt layered verification strategies, harness emerging security innovations, and remain vigilant about macroeconomic signals influencing gold’s intrinsic and market value. Integrating these advanced insights ensures that your gold bar investment not only preserves wealth but thrives amid uncertainty.

For those ready to deepen their expertise, exploring detailed physical gold investment tips and staying abreast of expert gold price forecasts are indispensable next steps. Engage with this dynamic community, share your professional insights, and fortify your portfolio with confidence built on knowledge and rigor.

This article really highlights the importance of thorough authentication and proper storage when investing in physical gold. I’ve personally learned the hard way that relying solely on hallmark stamps isn’t enough, especially with increasingly sophisticated counterfeit methods. Advanced techniques like XRF spectrometry and micro-engraving seem to be game changers for verifying authenticity, although I wonder about the accessibility for everyday investors. Do you think the average person can realistically incorporate these technologies into their due diligence, or should they mainly trust established reputable dealers and labs? Also, I’d love to hear others’ experiences with using third-party verification — has anyone here found a reliable lab that offers comprehensive and affordable testing? These added security measures might seem costly upfront, but considering potential fraud, they seem to be a worthwhile investment. How do you all decide where to draw the line when it comes to investing in such advanced authentication methods versus just relying on trusted sources? Looking forward to hearing your thoughts!