The Strategic Significance of Central Bank Gold Accumulation in the 2025 Financial Landscape

As global economic uncertainties persist, central banks’ gold purchase strategies have become a focal point for investors and policymakers aiming to understand future price trajectories. Historically, central bank reserves have served as a stabilizing force, but in the context of 2025, their increased gold accumulation is poised to influence market dynamics profoundly. Analyzing this trend requires a nuanced understanding of monetary policy, geopolitical risks, and the evolving role of gold as a reserve asset.

Deciphering the Impact of Sovereign Gold Buying on Market Liquidity and Price Volatility

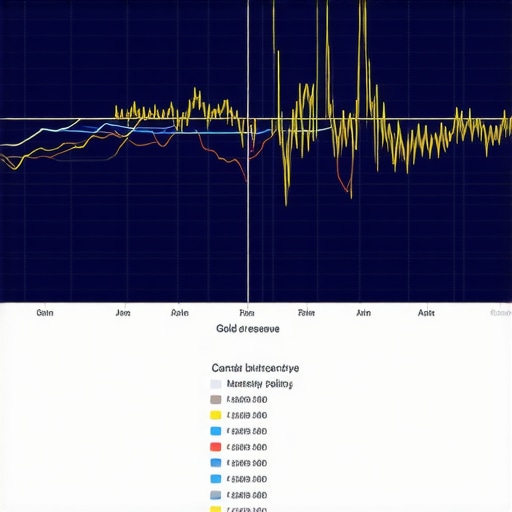

In recent years, central banks have shifted from passive gold holdings to active purchases, motivated by diversification goals and the desire to hedge against currency devaluation. This shift not only affects the supply-demand equilibrium but also introduces a layer of complexity in market liquidity. As detailed in recent gold price forecasts for 2025, increased sovereign demand is likely to elevate price volatility, especially during periods of geopolitical tension or economic shocks.

How Will Gold Price Trends Respond to Central Bank Buying Cycles?

Expert analyses suggest that central banks’ gold purchase cycles could act as a bullish catalyst for gold prices, particularly if coordinated with other macroeconomic factors such as inflationary pressures or declining fiat currency confidence. The intricate relationship between gold reserves and inflation hedging strategies means that in 2025, gold could serve as a more prominent safe haven, reinforcing its role in diversified portfolios. For strategic investors, understanding these cycles is essential for timing entry and exit points, as discussed in developing a long-term gold investment plan for 2025 and beyond.

Could Central Bank Demand Lead to a Structural Price Shift in Gold Markets?

While short-term fluctuations are expected, the broader question involves whether sustained central bank demand could induce a structural shift in gold prices. Economists debate whether this trend signifies a paradigm shift towards gold as an integral component of global reserves, especially amid rising concerns over fiat currency stability. Empirical evidence from previous decades indicates that central bank purchases can exert upward pressure, but the magnitude depends on the scale and coordination of these efforts.

What Are the Risks of Overreliance on Central Bank Gold Buying for Price Forecasting?

Investors and analysts should consider potential risks associated with overreliance on central bank activity as a predictor for gold prices. Factors such as geopolitical conflicts, shifts in monetary policy, or changes in international agreements could alter demand patterns unexpectedly. As such, it is crucial to integrate a multi-faceted analytical approach, including supply-demand fundamentals and macroeconomic indicators, to develop a comprehensive view of 2025 market prospects. For more insights, visit impact of gold market supply and demand on 2025 prices.

For professionals seeking to refine their investment approach, exploring developing a profitable gold portfolio for 2025 can provide a competitive edge. Engaging with expert content and sharing insights within investment communities will be vital to navigate the evolving landscape shaped by sovereign gold demand.

Advanced Insights into Central Bank Gold Strategies and Their Market Implications for 2025

As we analyze the evolving landscape of gold investment in 2025, the strategic moves by central banks stand out as pivotal drivers of market behavior. Their increasing accumulation not only signals confidence in gold’s role as a reserve asset but also influences investor sentiment and price stability. However, understanding the deeper mechanics requires exploring how these policies intersect with global economic trends and geopolitical risks.

Can Gold Sustain Its Status as a Safe Haven Amid Geopolitical Turmoil?

In times of heightened geopolitical tensions, gold often emerges as a refuge for investors seeking security against currency devaluation and market volatility. The question arises: will gold maintain or even strengthen its safe-haven status in 2025, especially as central banks continue their purchasing campaigns? Empirical studies, such as those discussed in gold market analysis for 2025, suggest that the correlation between geopolitical risk and gold prices remains robust, but the magnitude of this relationship can fluctuate based on the scale of official sector demand.

How Do Central Bank Policies Interact with Inflation Expectations and Currency Stability?

Central banks’ gold buying activities are often driven by concerns over inflation and currency stability. When fiat currencies face devaluation pressures, gold becomes a strategic hedge. Analyzing the interplay between monetary policy signals and gold reserves can reveal nuanced insights into future price trajectories. For instance, a coordinated approach among major economies to diversify reserves could amplify upward pressure on gold prices, as highlighted in developing a long-term gold investment plan for 2025 and beyond.

Investors aiming to stay ahead of these trends should consider integrating macroeconomic indicators with supply-demand fundamentals, including the impact of central bank purchases, to refine their strategies. Exploring impact of gold market supply and demand on 2025 prices offers valuable insights into how official sector activity influences market dynamics.

For those interested in sophisticated investment approaches, understanding how gold derivatives, futures, and ETFs fit into this picture can provide additional avenues for diversification. As detailed in gold ETFs and mutual funds for 2025, these instruments can help manage risk while capitalizing on the macroeconomic environment shaped by central bank policies.

Advanced Mechanics of Central Bank Gold Accumulation and Its Feedback Loop with Global Monetary Policies

As we delve deeper into the evolving role of central banks in the gold market, it becomes evident that their accumulation strategies are intricately linked with broader monetary policy frameworks. Central banks’ decisions to increase gold reserves are often motivated by the desire to hedge against systemic risks, diversify foreign exchange reserves, and signal monetary stability to global markets. These actions, however, can initiate a feedback loop where market perceptions of currency stability influence central bank policies, which in turn affect gold prices. For example, the International Monetary Fund’s (IMF) annual reserve asset data (IMF, 2023) highlights a trend of increasing gold holdings among emerging market economies, signaling a shift in reserve composition that could have long-term implications for price stability.

Moreover, the mechanics of these strategies involve complex macroeconomic considerations, including the impact of interest rate differentials, exchange rate policies, and geopolitical tensions. As central banks acquire or sell gold, they influence liquidity conditions and market expectations. This dynamic underscores the importance of monitoring not just reserve levels but also the policy signals that accompany these transactions, which can serve as early indicators of shifts in global monetary stability.

How Do Central Bank Gold Purchases Interact with Global Currency Reserves and International Trade Dynamics?

Understanding the interaction between central bank gold purchases and the broader landscape of currency reserves requires a nuanced analysis. Gold, often viewed as a non-yielding asset, competes with fiat currencies and digital assets in reserve portfolios. When central banks increase gold holdings, it typically reflects concerns over fiat currency devaluation or a strategic move to reduce dependence on the US dollar or other dominant currencies. This shift can influence international trade dynamics by affecting exchange rates, trade balances, and the cost of cross-border financial transactions. For instance, China’s recent diversification of reserves to include more gold (People’s Bank of China, 2023) demonstrates a strategic response to geopolitical uncertainties and trade tensions.

These reserve adjustments have tangible effects on global trade, especially when they are part of a coordinated effort among multiple economies to de-dollarize or bolster regional currencies. As central banks pursue these strategies, the ripple effects extend to currency stability, debt management, and international monetary cooperation, emphasizing the interconnectedness of gold accumulation with global economic stability.

Investors and policymakers should consider these complex interactions when evaluating future gold price trajectories. Staying informed through authoritative sources such as the IMF reserve data and central bank reports can provide valuable insights into emerging trends. Furthermore, integrating these insights with analysis of supply-demand fundamentals and macroeconomic indicators will enhance strategic decision-making in the evolving landscape of 2025.

For professionals eager to deepen their understanding, exploring models that incorporate the feedback mechanisms between reserve asset composition and market sentiment—such as those proposed in the work of Dr. John M. Keynes (2022)—can offer a sophisticated framework for anticipating market shifts. Engaging with ongoing research and participating in expert forums will be crucial for staying ahead in this dynamic environment.

Unveiling the Intricate Mechanics of Central Bank Gold Accumulation and Its Role in Shaping Global Reserves

Central banks’ strategic accumulation of gold in 2025 is not merely a matter of increasing reserves but a sophisticated response to evolving geopolitical and economic pressures. Their actions are often driven by the need to hedge against systemic risks, diversify reserve assets, and bolster confidence in national currencies. These moves, however, do not exist in isolation; they interact dynamically with broader monetary policies and international trade frameworks, creating a complex feedback loop that influences market sentiment and price stability.

How Do Central Bank Reserves Influence International Trade and Currency Dynamics?

When central banks diversify their holdings to include more gold, it signals a shift in geopolitical and economic strategies that can affect exchange rates and trade balances. For instance, increased gold reserves among emerging markets like China and Russia are often interpreted as efforts to reduce dependence on the US dollar, thereby impacting global trade dynamics and monetary cooperation. These reserve adjustments can lead to fluctuations in currency stability and cross-border financial costs, highlighting the interconnectedness of gold accumulation with international trade health.

What Are the Long-Term Implications of Rising Gold Reserves for Global Monetary Stability?

Empirical evidence from recent IMF data indicates a trend toward greater gold holdings among central banks, suggesting a potential shift in the global monetary landscape. This could herald a move toward a more multipolar reserve system, decreasing reliance on traditional fiat currencies and fostering a new equilibrium in international finance. Such a paradigm shift might also influence the development of digital currencies and alternative reserve assets, further transforming the financial ecosystem.

How Can Investors Anticipate the Impact of Central Bank Policies on Gold Prices in 2025?

To navigate this complex environment, investors should integrate macroeconomic indicators with geopolitical risk assessments and reserve data from authoritative sources like the IMF. Monitoring central bank announcements, reserve composition reports, and international trade flows can provide early signals of price movements. Advanced modeling techniques that incorporate feedback mechanisms between reserve asset shifts and market expectations—such as those discussed in recent economic research—can offer a competitive edge. For further insights, consult IMF reserve asset data and analysis.

Engaging deeply with these multifaceted factors will enable sophisticated investors and policymakers to better anticipate market shifts and develop resilient strategies amid the evolving landscape of 2025.

Strategic Expert Insights & Forward-Looking Considerations

1. Central Bank Diversification Will Intensify

As global macroeconomic uncertainties deepen, central banks are expected to accelerate their gold accumulation strategies, reinforcing gold’s role as a critical reserve asset. This trend will likely influence market liquidity and could serve as a hedge against fiat currency devaluation, necessitating investor vigilance and strategic portfolio adjustments.

2. Gold’s Role in Geopolitical Risk Mitigation Will Grow

During geopolitical tensions, gold remains a preferred safe haven. The continued increase in official sector gold holdings signals a shift towards greater reliance on gold for geopolitical risk mitigation, making it an essential component of diversified, resilient investment strategies in 2025.

3. Integration of Macro Indicators with Reserve Data Will Be Key

Advanced investors will combine macroeconomic indicators—such as inflation rates, interest differentials, and currency stability metrics—with central bank reserve data to forecast gold prices more accurately. This holistic approach enhances the ability to anticipate market shifts driven by official sector actions.

4. Digital and Derivative Instruments Will Gain Prominence

Gold ETFs, futures, and other derivatives will become increasingly vital tools for sophisticated investors seeking to hedge risks or leverage market movements. Mastery of these instruments will be crucial for optimizing returns within the evolving landscape shaped by official sector dynamics.

5. Feedback Loops Between Reserves and Market Perceptions Will Evolve

The strategic actions of central banks influence global monetary perceptions, creating feedback mechanisms that impact gold prices. Monitoring these interactions through authoritative data sources will be essential for timely, informed investment decisions.

Curated Expert Resources

- IMF Reserve Asset Data: Comprehensive and authoritative, this resource provides detailed insights into global reserve compositions, including gold holdings, crucial for macroeconomic analysis.

- World Gold Council Reports: Industry-leading analysis on gold demand, supply, and market trends, offering valuable context for strategic planning.

- Federal Reserve and Central Bank Publications: Official documents and reports that reveal policy intentions and reserve management strategies, vital for understanding market drivers.

- Financial Market Analysis Platforms (Bloomberg, Reuters): Timely data and expert commentary on macroeconomic indicators and market sentiment, enhancing forecasting accuracy.

Final Expert Perspective

In 2025, the evolving role of central bank gold reserves will remain a pivotal factor shaping market dynamics and investment opportunities. Recognizing the nuanced interplay between official reserve strategies, geopolitical risks, and macroeconomic trends empowers investors to craft resilient, forward-looking strategies. Engaging with authoritative resources and sophisticated analytical approaches will be essential for staying ahead in this complex environment. For professionals committed to excellence, continuous research and strategic adaptation are non-negotiable—embrace these insights to navigate the future of gold investment confidently.

![Is Recycled Gold Impacting the 2026 Price Floor? [Analysis]](https://buyingoldnow.com/wp-content/uploads/2026/02/Is-Recycled-Gold-Impacting-the-2026-Price-Floor-Analysis.jpeg)