Unlocking the Golden Gateway: Why Trade Gold Futures?

Trading gold futures offers a unique avenue for investors to capitalize on the precious metal’s price movements without owning physical gold. Unlike traditional investment forms, gold futures contracts allow traders to leverage positions, hedge against market volatility, and gain access to highly liquid markets. This dynamic trading instrument is especially valuable amidst economic uncertainty, inflationary pressures, and fluctuating currency values, making it an essential tool for savvy investors seeking profitable returns.

Strategic Blueprints: Time-Tested Approaches to Gold Futures Trading

Success in gold futures trading hinges on a blend of technical mastery, market insight, and disciplined risk management. Among the most effective strategies is trend following, which involves identifying and riding the momentum of gold price movements using indicators like moving averages and MACD. Another potent approach is spread trading, exploiting the price differentials between contracts with different expiration dates to capture market inefficiencies.

Moreover, seasoned traders often employ hedging techniques to protect portfolios from adverse price swings, especially during geopolitical tensions or economic downturns. This multifaceted strategy framework, combined with rigorous market analysis, lays the foundation for consistent profitability in gold futures markets.

Decoding the Market Pulse: Leveraging Fundamental and Technical Insights

Interpreting gold futures prices requires a dual lens: fundamental analysis and technical charting. Key fundamental drivers include central bank gold purchases, inflation data, and currency strength—factors that influence supply-demand dynamics and investor sentiment. For instance, significant acquisitions by central banks can tighten supply, pushing prices upward, a trend substantiated by reports from the World Gold Council.

Technical indicators such as Relative Strength Index (RSI) and Fibonacci retracements help pinpoint entry and exit points with precision. By synthesizing these insights, traders can anticipate potential reversals or breakouts, optimizing trade timing and enhancing risk-adjusted returns.

What Are the Risk Management Best Practices for Gold Futures Traders?

Effective risk management is pivotal in gold futures given their leverage and volatility. Traders should set stop-loss orders based on technical support levels to cap potential losses and avoid emotional decision-making. Position sizing aligned with portfolio risk tolerance ensures no single trade jeopardizes overall capital. Additionally, regular portfolio reviews and adapting to evolving market conditions fortify resilience against unexpected downturns.

Real-World Application: A Case Study in Gold Futures Profitability

Consider a trader who, anticipating inflationary pressures in 2024, initiated a long position on gold futures contracts expiring in mid-2025. By combining macroeconomic analysis with technical signals indicating an upward trend, the trader capitalized on a 12% price increase over six months. This example underscores the importance of integrating both analytical approaches and maintaining disciplined trade execution.

For traders interested in expanding their knowledge and refining techniques, exploring resources such as the Gold Futures Trading Guide offers comprehensive strategies tailored for consistent gains.

If this expert insight into gold futures trading piqued your interest, feel free to share your thoughts or questions in the comments below to foster a deeper discussion on profitable trading strategies.

Reference: World Gold Council – Gold Demand Trends

Integrating Macroeconomic Indicators into Gold Futures Strategies

Seasoned gold futures traders recognize that beyond technical signals, macroeconomic indicators are pivotal in shaping price trajectories. Indicators such as real interest rates, geopolitical tensions, and global monetary policies critically influence gold’s appeal as a safe haven. For example, a rise in real interest rates often dampens gold prices as alternative yield-bearing assets become more attractive, whereas escalating geopolitical risks typically drive investors toward gold, propelling futures prices upward.

Moreover, monitoring central bank policies—both in developed and emerging markets—can reveal shifts in gold reserve accumulation or liquidation. This nuanced understanding allows traders to anticipate market sentiment shifts before they manifest in price action, enhancing strategic entry and exit points.

Leveraging Algorithmic Models for Enhanced Gold Futures Trading

Incorporating algorithmic trading models has become increasingly prevalent among expert traders. These models, powered by machine learning and quantitative analytics, analyze vast datasets to identify subtle patterns and correlations in gold price movements. By automating trade execution based on predefined criteria, traders can minimize emotional biases and capitalize on fleeting market inefficiencies.

For instance, combining sentiment analysis from financial news with technical indicators can improve prediction accuracy for short-term gold futures price fluctuations. However, algorithmic strategies require rigorous backtesting and continuous refinement to remain effective amid evolving market dynamics.

How Can Traders Effectively Balance Automation with Human Judgment in Gold Futures?

While automation boosts efficiency and consistency, human oversight remains indispensable. Traders must calibrate algorithms with real-world context—such as unexpected geopolitical events or sudden policy changes—that models might not fully capture. This hybrid approach ensures adaptive decision-making, blending quantitative insights with qualitative expertise to optimize trade outcomes.

The Role of Seasonal Trends and Market Cycles in Gold Futures

Seasonality plays a subtle yet impactful role in gold futures trading. Historical data reveals recurring patterns, such as increased gold demand during festival seasons in India or elevated jewelry purchases preceding major holidays, which can influence short-term price movements. Additionally, cyclical factors like mining output fluctuations and technological demand shifts contribute to supply-demand imbalances that savvy traders monitor closely.

Understanding these temporal dynamics enables traders to position themselves advantageously, capitalizing on predictable demand surges or supply constraints.

Experts looking to deepen their understanding of gold market cycles and related trading tactics can explore comprehensive analyses such as the Gold Market Analysis 2025.

Reference: Investopedia – How Macroeconomic Factors Affect Gold Prices

Have you experimented with integrating macroeconomic data or algorithmic tools in your gold futures trades? Share your experiences or questions in the comments to enrich this expert dialogue.

Decoding Complex Risk Layers: Advanced Techniques for Gold Futures Traders

Beyond the foundational best practices of risk management, expert gold futures traders employ sophisticated techniques to navigate the intricate volatility landscape inherent in precious metals markets. One such advanced method is the use of dynamic hedging, where traders continuously adjust their hedge ratios in response to market volatility and evolving correlations between gold and other asset classes. This approach helps in minimizing basis risk and ensures portfolio protection without sacrificing upside potential.

In addition, option overlays on futures positions serve as a refined risk control mechanism. For instance, purchasing put options against long futures positions can cap downside risk, while selling covered calls can generate incremental income, balancing risk and reward. Integrating volatility forecasting models, such as GARCH (Generalized Autoregressive Conditional Heteroskedasticity), enables traders to anticipate periods of heightened price fluctuations and adjust exposure accordingly.

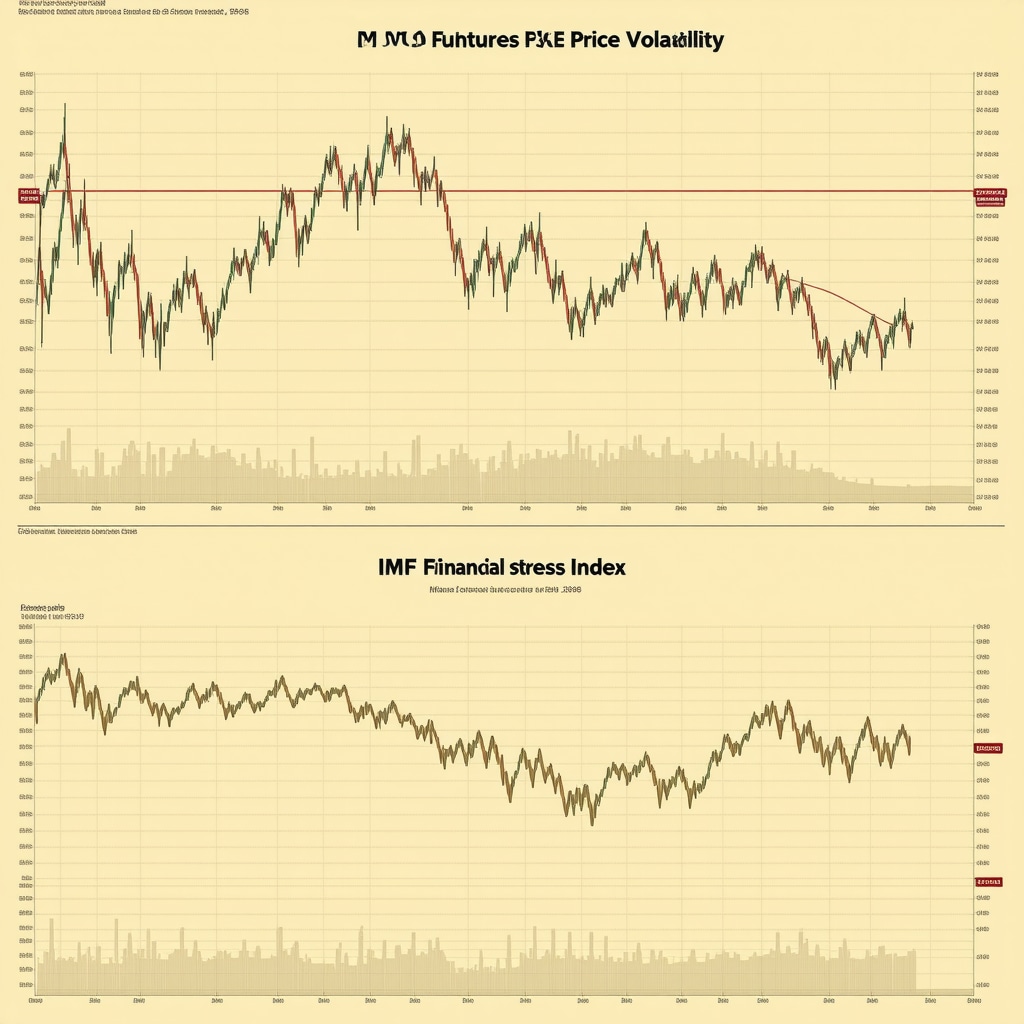

How Do Macro-Financial Stress Indicators Influence Gold Futures Risk Calibration?

Macro-financial stress indicators, including the IMF Financial Stress Index, provide real-time gauges of systemic risk that profoundly affect gold’s safe-haven demand. Elevated stress levels often correlate with increased volatility in gold futures prices, necessitating tighter risk controls and more conservative position sizing. Traders adept at interpreting these signals can preemptively recalibrate their risk frameworks, optimizing capital preservation during turbulent periods while remaining poised to exploit upside surges.

Integrating Behavioral Finance Insights: Cognitive Biases and Market Sentiment in Gold Futures

Market psychology plays a pivotal role in gold futures price dynamics. Behavioral finance elucidates how cognitive biases—such as herding, anchoring, and confirmation bias—can precipitate exaggerated price swings and abrupt reversals. For example, herd behavior during geopolitical crises can amplify gold buying, inflating futures prices beyond fundamental valuations.

Incorporating sentiment analysis tools that parse social media, news flow, and investor surveys adds an invaluable dimension to traditional technical and fundamental analysis. These insights allow traders to detect shifts in collective psychology ahead of price movements, facilitating anticipatory positioning rather than reactive trading.

Advanced Statistical Models: Enhancing Predictive Accuracy in Gold Futures Pricing

Recent advancements in econometric and machine learning methodologies offer promising avenues for gold futures price forecasting. Techniques such as vector autoregression (VAR) models capture interdependencies between gold prices and macroeconomic variables, while long short-term memory (LSTM) neural networks excel at modeling temporal sequences and nonlinearities inherent in market data.

Employing ensemble methods that combine multiple models can further enhance robustness and predictive power. However, practitioners must remain vigilant against overfitting and ensure models are regularly recalibrated with fresh data to sustain efficacy amid shifting market regimes.

Strategic Implications: Navigating Seasonality and Structural Shifts in Global Gold Markets

Seasonal patterns, while historically persistent, are increasingly influenced by structural changes such as evolving consumer behavior in emerging markets, technological disruptions in mining, and shifting central bank policies. Advanced traders incorporate scenario analysis and stress testing to evaluate how these factors might alter traditional seasonality effects, thereby refining timing strategies for futures entry and exit.

Moreover, integrating geopolitical risk assessments with supply chain analytics offers a comprehensive view of potential supply shocks and demand surges, enabling proactive positioning. This multidimensional approach distinguishes expert traders who not only react to market movements but anticipate transformational shifts.

For a deeper dive into these complex dynamics, consider exploring specialized research and data-driven analyses tailored for professional gold futures market participants.

Reference: International Monetary Fund – IMF Financial Stress Index

Are you leveraging advanced risk mitigation or behavioral analytics in your gold futures strategy? Join the conversation below to exchange insights with fellow experts.

Synergizing Quantitative Precision with Market Psychology for Superior Gold Futures Outcomes

Advanced gold futures traders increasingly recognize that integrating rigorous quantitative models with nuanced behavioral finance insights yields a powerful edge. While statistical techniques distill complex market data into actionable forecasts, understanding the cognitive underpinnings of market participant behavior helps anticipate price anomalies and sentiment-driven volatility. This fusion enhances strategic agility in navigating the multifaceted gold futures landscape.

Elevating Predictive Models: From Theoretical Constructs to Practical Deployment

Deploying sophisticated econometric frameworks, such as regime-switching models, enables traders to detect shifts between bull and bear market states more effectively. These models, coupled with machine learning classifiers trained on macroeconomic indicators and sentiment scores, refine signal precision for entry and exit points. Notably, incorporating real-time alternative data streams—like commodity inventory reports and social media analytics—further enriches predictive robustness, positioning traders ahead of conventional market curves.

What Role Does Sentiment Analysis Play in Refining Gold Futures Trading Algorithms?

Sentiment analysis acts as a critical complement to price-based algorithms by quantifying market mood and investor expectations. By parsing vast textual data from financial news, social platforms, and expert commentaries, sentiment metrics serve as early warning indicators for potential price reversals or momentum continuations. Integrating these insights allows algorithmic strategies to adapt dynamically, mitigating risks associated with sudden sentiment shifts that purely technical models might overlook.

For a comprehensive exploration of sentiment-driven algorithmic approaches, refer to the CFA Institute’s research on Quantifying Investor Sentiment, which offers empirically validated methodologies and practical frameworks.

Leveraging Multi-Dimensional Risk Frameworks to Optimize Capital Preservation

Beyond traditional stop-loss and position-sizing techniques, expert traders implement multi-dimensional risk frameworks incorporating volatility clustering, drawdown controls, and liquidity stress tests. Such frameworks enable dynamic adjustment of exposure in response to evolving market conditions, balancing opportunity capture with stringent downside protection. Complementary tools like scenario simulations and Monte Carlo analyses facilitate understanding of tail risk behaviors inherent in gold futures portfolios.

Harnessing Technological Innovations: Blockchain and Smart Contracts in Gold Futures Settlements

Emerging technologies like blockchain are revolutionizing the operational aspects of gold futures trading. Smart contracts automate settlement processes, ensuring transparency, reducing counterparty risk, and accelerating transaction finality. Additionally, digital ledger technologies enhance auditability and compliance, which are particularly valuable in complex derivative markets. Traders and institutions adopting these innovations position themselves at the forefront of a rapidly evolving ecosystem.

Engage with Expert Insights: Elevate Your Gold Futures Strategy Today

We invite seasoned traders and market analysts to delve deeper into these advanced methodologies and share their experiences. How have you integrated behavioral analytics or cutting-edge quantitative tools into your gold futures trading? Join the dialogue below to exchange insights and refine your strategic approach alongside fellow experts.

Frequently Asked Questions (FAQ)

What distinguishes gold futures trading from buying physical gold?

Gold futures trading involves contracts to buy or sell gold at a predetermined price and date, allowing leveraged exposure without holding the physical metal. This contrasts with buying physical gold, which entails storage, liquidity constraints, and no leverage. Futures provide flexibility for hedging, speculative strategies, and rapid market entry or exit.

How do macroeconomic indicators influence gold futures prices?

Indicators such as real interest rates, inflation, central bank policies, and geopolitical tensions directly affect gold’s supply-demand dynamics and safe-haven appeal. For example, rising inflation often elevates gold prices as investors seek value preservation, while higher real interest rates can reduce gold’s attractiveness compared to yield-bearing assets.

What are the best risk management practices for gold futures traders?

Effective risk management includes setting stop-loss orders at technical support levels, careful position sizing aligned with portfolio risk tolerance, and dynamic hedging to adapt to volatility changes. Incorporating option overlays and volatility forecasting models further mitigates downside while preserving upside potential.

Can algorithmic trading improve gold futures profitability?

Yes. Algorithmic trading models leverage quantitative analytics and machine learning to identify subtle price patterns and execute trades with precision and discipline. Combining these with sentiment analysis and continuous backtesting enhances adaptability and reduces emotional bias, though human oversight remains critical for contextual judgment.

How does behavioral finance impact gold futures market movements?

Cognitive biases like herding and anchoring can cause exaggerated price swings and abrupt reversals in gold futures. Integrating market sentiment analysis — via news, social media, and investor surveys — helps anticipate these psychological-driven shifts, enabling proactive positioning rather than reactive trading.

What role does seasonality play in gold futures trading strategies?

Seasonality reflects predictable demand surges linked to cultural events, jewelry buying seasons, and mining cycles. Skilled traders incorporate these temporal trends alongside structural market shifts to optimize timing, capitalizing on recurring price patterns and supply-demand imbalances.

How can traders balance automation with human insight in gold futures?

While automation enhances consistency and speed, unexpected geopolitical events or policy changes often require human judgment. A hybrid approach, where algorithms guide execution but traders apply qualitative analysis for strategic decisions, yields optimal results.

What advanced statistical models help forecast gold futures prices?

Models such as vector autoregression (VAR), long short-term memory (LSTM) neural networks, and regime-switching frameworks capture complex dependencies and market regime shifts. Ensemble methods combining these models improve predictive accuracy but demand regular recalibration to avoid overfitting.

How do technological innovations like blockchain impact gold futures trading?

Blockchain and smart contracts streamline settlements by automating transaction finality, enhancing transparency, reducing counterparty risk, and improving auditability. These technologies modernize operational workflows, offering competitive advantages to early adopters in the futures market.

What is the significance of multi-dimensional risk frameworks in gold futures?

Such frameworks extend beyond simple stop-losses by incorporating volatility clustering, drawdown control, and liquidity stress testing. They facilitate dynamic position adjustments in response to market conditions, balancing opportunity capture with robust capital preservation.

Trusted External Sources

- World Gold Council (WGC): A leading authority offering in-depth data on gold demand trends, central bank activities, and market fundamentals essential for understanding gold’s macroeconomic drivers.

- International Monetary Fund (IMF) Financial Stress Index: Provides real-time systemic risk indicators that help traders assess macro-financial stress impacting gold’s safe-haven status and volatility.

- CFA Institute Research: Delivers empirical studies on investor sentiment quantification and algorithmic trading frameworks, enriching quantitative strategies with validated methodologies.

- Investopedia: Offers comprehensive educational resources on how macroeconomic factors influence gold prices, supporting foundational and advanced trader knowledge.

- Specialized Market Analysis Reports (e.g., Gold Market Analysis 2025): Provide scenario analyses and structural insights into seasonality, geopolitical risks, and emerging market trends crucial for strategic futures trading.

Conclusion

Gold futures trading represents a sophisticated investment arena where deep understanding of market mechanics, macroeconomic factors, and behavioral dynamics converges with advanced quantitative tools to unlock consistent profitability. By integrating fundamental and technical analyses, leveraging algorithmic models enhanced with sentiment data, and applying multi-dimensional risk management, traders can navigate the inherent volatility and complexity with precision and confidence.

Seasonal patterns and structural market shifts further refine strategic timing, while emerging technologies like blockchain promise to revolutionize operational efficiency. Ultimately, mastering gold futures demands a holistic, adaptive approach that synthesizes rigorous data-driven insights with nuanced market psychology.

We encourage you to apply these expert strategies, engage with fellow traders by sharing your experiences or questions, and explore related advanced content to deepen your mastery of gold futures trading. Your journey toward refined strategy and optimized returns begins here.