Understanding the Strategic Role of Gold and Stocks in Portfolio Construction

In the intricate world of investment portfolio management, the juxtaposition of gold and stocks represents a classic dilemma for investors seeking optimized returns while mitigating risk. Gold, traditionally revered as a safe haven asset, offers intrinsic value preservation amid economic turbulence, inflation, and currency devaluation. Conversely, stocks embody growth potential through corporate earnings and market expansion but carry inherent volatility tied to economic cycles and company performance. Effective portfolio construction demands a sophisticated understanding of these asset classes’ complementary dynamics, risk profiles, and market behaviors.

Advanced Risk-Return Analysis: Leveraging Gold’s Stability with Stocks’ Growth Potential

From an expert perspective, integrating gold alongside equities enhances portfolio diversification by reducing overall volatility and cushioning downside risk. Gold’s low correlation with stocks, especially during market downturns, acts as a hedge against systemic shocks. However, the opportunity cost of holding non-yielding gold versus dividend-paying stocks necessitates a calibrated allocation strategy. Quantitative portfolio optimization models often recommend a gold allocation ranging between 5% to 15%, tailored to investor risk tolerance and macroeconomic outlook. This balance optimizes the Sharpe ratio, enhancing risk-adjusted returns without sacrificing growth potential.

How Do Macroeconomic Variables Influence Gold and Stock Allocation Decisions?

Macroeconomic factors such as inflation expectations, interest rates, monetary policy, and geopolitical tensions critically shape the relative attractiveness of gold versus stocks. Rising inflation and negative real interest rates typically boost gold’s appeal as a tangible asset immune to currency debasement, whereas stable economic growth and favorable corporate earnings drive stock market performance. Central bank actions, including gold purchases and interest rate adjustments, further modulate market dynamics. For instance, understanding central bank gold purchases and their impact on prices is essential for anticipating gold market movements within a diversified portfolio framework.

Structural Portfolio Design: Balancing Liquidity, Volatility, and Inflation Protection

Expert portfolio architects must also consider liquidity constraints and volatility profiles when blending gold and stocks. Gold, whether held as physical bullion, ETFs, or futures, offers varying liquidity and storage considerations that affect portfolio rebalancing frequency and cost efficiency. Equities, while liquid, manifest higher beta and susceptibility to market sentiment shifts. Strategic inclusion of gold ETFs and exposure to select gold mining stocks can bridge the dichotomy, combining physical asset stability with equity growth potential. Insightful investors may explore best strategies to balance gold and stocks in portfolios to refine allocation models aligned with long-term growth and inflation hedging.

Professional Considerations: Navigating Portfolio Adjustments Amid Market Volatility

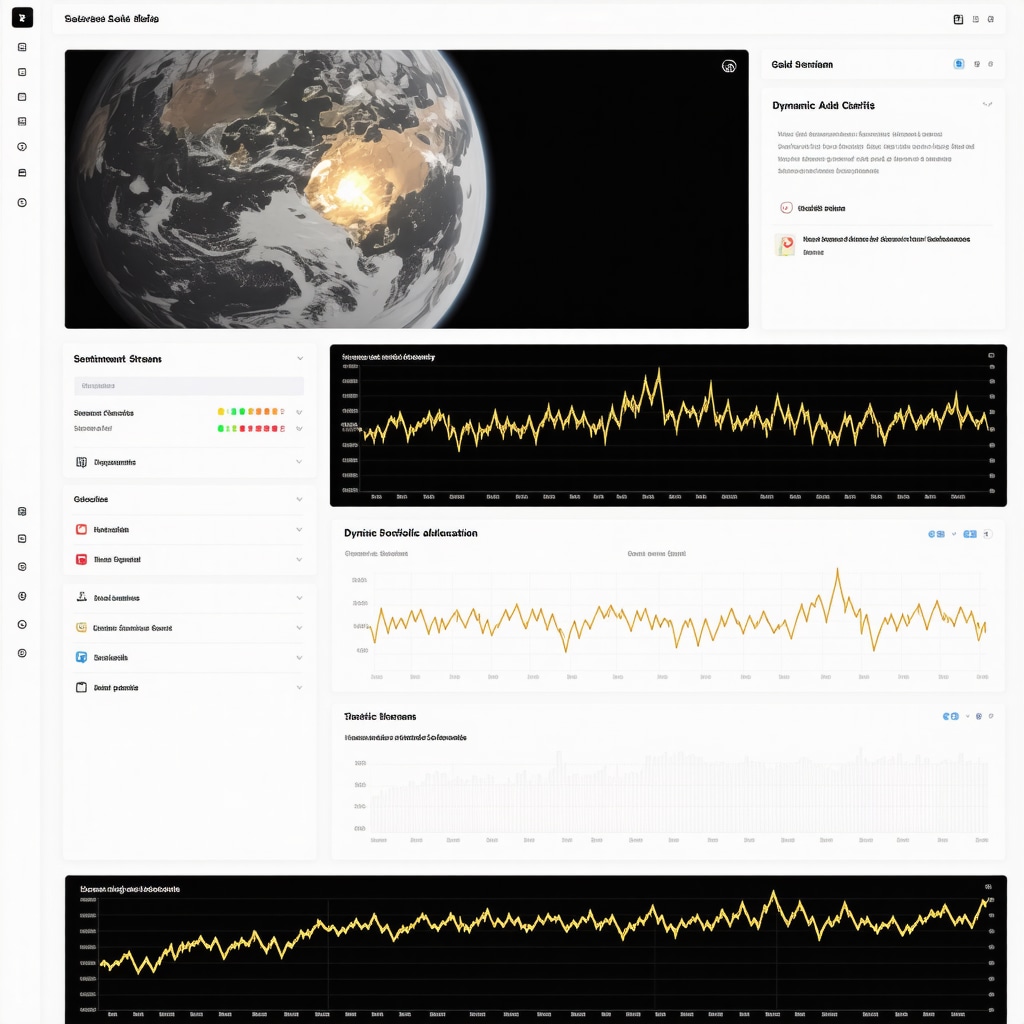

Incorporating gold and stocks demands continuous evaluation of market signals and portfolio performance metrics. Dynamic reallocation strategies leveraging volatility indices and inflation forecasts can optimize portfolio resilience. For example, increasing gold exposure during geopolitical crises or anticipated inflation spikes while capitalizing on stock market rallies during economic upswings exemplifies tactical asset allocation. Such nuanced approaches underscore the importance of expertise and experience in portfolio management, supported by reliable market intelligence and analytical tools.

Explore Further: Deepen Your Expertise on Gold and Stock Investment Strategies

For investors and professionals eager to enhance their portfolio construction acumen, exploring detailed analyses on how to build a balanced gold portfolio for maximum growth provides actionable insights. Contributing your experiences or engaging with expert communities can further refine strategic approaches in this evolving investment landscape.

Source: World Gold Council, “Gold and Asset Allocation,” 2023 (https://www.gold.org/goldhub/research/gold-and-asset-allocation).

Dynamic Portfolio Optimization: Integrating Quantitative Models for Gold and Stock Allocation

Beyond traditional heuristics, contemporary portfolio managers increasingly employ sophisticated quantitative optimization techniques to refine the balance between gold and stocks. These models incorporate advanced risk metrics such as Conditional Value at Risk (CVaR) and Factor-based risk attribution to capture tail risks and systemic exposures more accurately. By simulating multiple economic scenarios—including inflation surges, recessions, and geopolitical upheavals—investors can calibrate allocations dynamically, ensuring the portfolio adapts to evolving market conditions. This approach transcends static asset allocation, leveraging machine learning algorithms and real-time data feeds to optimize the risk-return trade-off continuously.

Gold’s Role in Tail Risk Hedging and Crisis Alpha Generation

While gold’s reputation as a safe haven is well-established, its function in tail risk hedging and crisis alpha generation deserves nuanced appreciation. Tail risks—extreme market events with low probability but high impact—often trigger sharp equity drawdowns. During such episodes, gold historically exhibits positive price dislocations, providing liquidity and capital preservation benefits. However, this relationship is not guaranteed; dynamic correlations between gold and stocks can shift, influenced by macroeconomic policy responses and investor sentiment. As such, a strategic tilt towards gold during periods of anticipated tail risk can enhance portfolio resilience and capitalize on crisis alpha opportunities.

What Emerging Macro-Financial Indicators Should Guide Gold Versus Stock Allocation?

In the quest to anticipate optimal gold and stock allocations, discerning experts focus on emerging macro-financial indicators beyond conventional metrics. These include real yield curves, gold lease rates, central bank balance sheet expansions, and geopolitical risk indices. For instance, a flattening or inverted real yield curve combined with rising geopolitical tensions signals a potential shift favoring gold allocations. Similarly, elevated gold lease rates can indicate increased demand for physical gold lending, presaging price movements. Incorporating these indicators into allocation frameworks allows for a forward-looking strategy that anticipates market inflections rather than merely reacting to them.

For an in-depth exploration of how global events affect gold prices and demand trends, refer to gold market analysis and price movement insights for 2025.

Practical Portfolio Construction: Combining Gold ETFs, Mining Stocks, and Physical Bullion

Constructing a robust portfolio that leverages gold’s diversification benefits involves more than just physical bullion. Gold ETFs provide liquidity and cost efficiency, while gold mining stocks offer leveraged exposure to gold price appreciation, albeit with higher volatility and operational risks. A judicious blend of these instruments enables investors to tailor risk profiles and liquidity preferences. For instance, during volatile markets, increasing physical gold holdings can mitigate counterparty risks, while ETFs can facilitate tactical repositioning. Mining stocks serve as a growth-oriented complement, capitalizing on operational leverage and exploration successes.

Incorporating Behavioral Finance Insights to Optimize Gold and Stock Investment Decisions

Behavioral biases significantly influence investment decisions involving gold and stocks. Anchoring, loss aversion, and herd behavior can lead to suboptimal timing and allocation. Experts recommend integrating behavioral finance frameworks into portfolio management to counteract these pitfalls. Techniques such as systematic rebalancing, pre-commitment strategies, and scenario planning help mitigate emotional decision-making. Understanding investor psychology surrounding gold’s symbolic value and stocks’ growth narratives is crucial to maintaining disciplined adherence to strategic asset allocation plans.

Engage with the Community: Share Your Strategies or Learn More

We invite investors and portfolio managers to share their experiences balancing gold and stocks in dynamic markets. Your insights can enrich collective understanding and refine strategic approaches. Additionally, explore comprehensive resources like best strategies to balance gold and stocks in portfolios to deepen your expertise.

Source: CFA Institute, “Gold in Portfolio Construction: Risk Management and Return Enhancement,” 2024 (https://www.cfainstitute.org/en/research/articles/2024/gold-in-portfolio-construction).

Innovative Machine Learning Techniques Revolutionizing Gold and Stock Allocation

The advent of machine learning (ML) has transformed portfolio management, especially in dynamically balancing gold and stock allocations. Unlike traditional static models, ML algorithms analyze vast datasets encompassing macroeconomic indicators, market sentiment, and geopolitical events in real time. Techniques such as reinforcement learning enable portfolios to adaptively optimize asset weights by learning from evolving market conditions, enhancing responsiveness to regime shifts.

Moreover, ensemble models combining decision trees, neural networks, and support vector machines improve prediction accuracy for gold price movements and stock returns. These models identify nonlinear dependencies and subtle patterns undetectable by conventional econometric methods. For instance, integrating alternative data such as satellite imagery of mining activity or social media sentiment can provide early signals for mining stock performance, thereby fine-tuning exposure within the portfolio.

How Can Reinforcement Learning Specifically Enhance Tactical Gold and Stock Rebalancing?

Reinforcement learning (RL) frameworks treat portfolio allocation as a sequential decision-making problem under uncertainty, where the ‘agent’ learns an optimal policy through trial and error to maximize cumulative returns adjusted for risk. Applying RL to gold and stock portfolios allows dynamic reallocation responding to fluctuating risk premia, inflation expectations, and market volatility.

For example, RL agents can learn to increase gold holdings proactively during periods forecasted for rising inflation or geopolitical instability, while shifting towards equities during expected economic expansions. This adaptability surpasses fixed-threshold rules by continuously refining strategies based on reward feedback, thereby achieving superior risk-adjusted performance over time.

Incorporating Behavioral Economics: Mitigating Cognitive Biases in Asset Allocation

Behavioral economics insights are crucial for refining investment decisions involving gold and stocks, as investor biases often distort market outcomes. Anchoring biases might cause investors to cling to outdated price levels of gold, while herd behavior can exacerbate stock market bubbles. By integrating behavioral models into quantitative frameworks, portfolio managers can design guardrails against these psychological pitfalls.

For instance, employing systematic rebalancing protocols based on objective triggers can counteract loss aversion-driven reluctance to reduce gold holdings after price drops. Scenario analysis incorporating behavioral reaction functions also helps anticipate market overreactions, enabling preemptive tactical adjustments.

Complexities in Modeling Gold-Stock Correlations During Crisis Periods

While gold generally exhibits negative or low correlation with stocks, this relationship is neither static nor perfectly reliable—especially during financial crises. Stress periods often trigger regime shifts where correlations spike due to liquidity crunches or simultaneous risk aversion. Advanced copula-based models and time-varying correlation frameworks capture these nonlinear dependencies more accurately than traditional Pearson correlations.

Understanding these dynamics is essential for calibrating tail risk hedging strategies. For example, during the 2008 financial crisis, gold initially correlated positively with equities due to forced liquidations but later decoupled and surged as a safe haven. Anticipating such regime-dependent correlation behaviors allows investors to fine-tune allocations and hedge effectively without overcommitting to gold.

What Are the Leading Quantitative Methods to Capture Time-Varying Gold-Stock Correlations?

Experts utilize Dynamic Conditional Correlation (DCC) models, regime-switching Markov models, and copula-based dependency structures to measure how gold-stock correlations evolve over time and across market states. DCC models estimate correlations adaptively, responsive to new data, while regime-switching approaches identify discrete market environments driving correlation shifts. Copulas enable flexible modeling of tail dependencies, crucial for assessing joint extreme events risk.

These advanced statistical tools empower portfolio managers to dynamically adjust hedge ratios and optimize diversification benefits even when market conditions are volatile and unpredictable.

Exploring Sustainable Investing: ESG Integration in Gold and Stock Portfolios

The rising emphasis on Environmental, Social, and Governance (ESG) criteria is reshaping asset selection in gold and stock portfolios. Incorporating ESG metrics helps align investments with ethical standards and mitigates risks related to regulatory changes, reputational damage, and environmental liabilities.

Within gold investments, ESG considerations affect choices between physical bullion sourced from conflict-free mines versus mining stocks subject to operational and social governance scrutiny. ESG-focused funds increasingly offer screened options for both asset classes, enabling investors to maintain diversification while adhering to sustainability goals.

Balancing ESG objectives with traditional risk-return optimization requires specialized frameworks that integrate non-financial data into quantitative allocation models, a frontier area of portfolio management research and practice.

Engage with Cutting-Edge Research and Tools to Elevate Your Portfolio Strategy

For portfolio managers and sophisticated investors striving to master the interplay of gold and stocks through advanced analytics and behavioral insights, exploring resources such as the CFA Institute’s latest research on gold in portfolio construction offers invaluable guidance. Engaging with expert forums and data science communities can further enhance your strategic toolkit.

Harnessing Predictive Analytics to Navigate Market Regimes in Gold and Stock Allocation

As global markets evolve with unprecedented speed and complexity, traditional static asset allocation models often fall short in capturing the multifaceted interactions between gold and equities. Cutting-edge predictive analytics, powered by ensemble machine learning and advanced econometric techniques, enable portfolio managers to discern subtle regime shifts and cyclical inflections earlier than ever before. By leveraging alternative data streams—ranging from macroeconomic sentiment indices to real-time commodity flows—these models refine the timing and magnitude of gold-stock rebalancing, thereby unlocking incremental alpha and enhancing drawdown control.

Deciphering Behavioral Nuances: Psychological Drivers Behind Gold versus Equity Allocations

Beyond quantitative models, a nuanced grasp of investor psychology offers a distinct edge in portfolio construction. Gold’s archetypal role as a safe haven often triggers reflexive behavioral biases such as status quo bias and the endowment effect, which can impede timely reallocation during market inflections. Conversely, equities appeal to growth-oriented cognitive frames but are vulnerable to herd mentality-induced bubbles. Integrating behavioral finance principles with algorithmic triggers—such as sentiment-adjusted rebalancing thresholds—can mitigate these pitfalls, fostering disciplined investment adherence and optimizing long-term risk-adjusted returns.

How Can Regime-Switching Models and Sentiment Analysis Synergize to Optimize Gold and Stock Weightings?

Regime-switching frameworks identify discrete market states—expansionary, recessionary, inflationary, or volatile crises—and adjust allocations to gold and stocks accordingly. When augmented with granular sentiment analysis extracted from news analytics and social media, these models gain a forward-looking dimension, capturing investor mood swings that precede price actions. For example, a sudden spike in geopolitical risk sentiment coupled with a regime shift to inflationary conditions may signal a tactical overweight in gold. This hybrid approach enhances responsiveness and reduces lag inherent in purely historical data-driven methods.

For practitioners seeking to integrate such methodologies, the CFA Institute’s research on gold in portfolio construction offers comprehensive frameworks and empirical validations.

Integrating ESG Considerations with Quantitative and Behavioral Insights for Sustainable Gold-Stock Portfolios

Incorporating Environmental, Social, and Governance (ESG) criteria into gold and stock portfolios introduces an additional layer of complexity that demands harmonization with quantitative and behavioral strategies. ESG metrics influence not only asset selection but also risk premiums and liquidity profiles—especially for mining equities exposed to operational and reputational risks. Advanced portfolio models now embed ESG scoring as a risk factor, dynamically adjusting allocations to reflect sustainability-driven market shifts. Behavioral insights further guide investor engagement, addressing potential cognitive dissonance when balancing ethical mandates with performance objectives.

Leveraging Alternative Data to Anticipate Gold Supply-Demand Dynamics and Influence Portfolio Positioning

Alternative data sources such as satellite imagery of mining operations, freight and shipping logs, and transactional blockchain metadata provide unprecedented visibility into gold supply chains. Analyzing these data streams with AI algorithms reveals early indicators of supply constraints or surpluses, enabling proactive portfolio adjustments ahead of conventional market signals. When integrated with macroeconomic models and sentiment indicators, this approach refines the timing of gold allocation changes relative to equity exposures, particularly in sectors sensitive to inflation or geopolitical disruptions.

What Are the Practical Steps to Incorporate Real-Time Alternative Data and Behavioral Metrics into Portfolio Rebalancing Models?

Implementing real-time alternative data integration involves establishing robust data pipelines, employing feature engineering to extract actionable signals, and embedding these within machine learning frameworks that accommodate behavioral metrics such as investor sentiment and risk appetite indices. Portfolio managers should collaborate with data scientists and behavioral economists to calibrate model parameters and validate predictive accuracy. Regular backtesting and scenario analysis ensure resilience across diverse market environments.

Engage with leading-edge research and practitioner forums to stay abreast of innovations in this domain, transforming your portfolio construction paradigm.

Source: CFA Institute, “Gold in Portfolio Construction: Risk Management and Return Enhancement,” 2024 (https://www.cfainstitute.org/en/research/articles/2024/gold-in-portfolio-construction).

Call to Action: Elevate Your Portfolio Strategy with Integrated Quantitative and Behavioral Expertise

Unlock the full potential of your gold and stock allocations by embracing advanced quantitative modeling, real-time alternative data, and behavioral finance insights. Join specialized forums, participate in expert webinars, and explore cutting-edge research repositories to continuously refine your strategic approach. The convergence of these disciplines promises superior risk-adjusted returns and robust portfolio resilience amid evolving market complexities.

Expert Insights & Advanced Considerations

Dynamic Correlation Patterns Between Gold and Stocks Demand Adaptive Allocation

While gold traditionally serves as a hedge with low or negative correlation to equities, this relationship fluctuates notably during crises and regime shifts. Portfolio managers must deploy regime-switching models and continuous correlation monitoring to dynamically adjust allocations, thereby optimizing diversification and tail risk mitigation rather than relying on static assumptions.

Integrating Behavioral Finance Enhances Discipline and Mitigates Cognitive Biases

Investor psychology greatly influences gold and stock investment decisions. Recognizing biases such as anchoring and loss aversion—and embedding systematic rebalancing protocols informed by behavioral models—fosters disciplined adherence to strategic asset allocation, preventing emotionally driven missteps during market volatility.

Leveraging Real-Time Alternative Data Provides a Tactical Edge

Incorporating alternative datasets like satellite imagery of mining activity, gold lease rates, and geopolitical risk indices empowers early detection of supply-demand imbalances and investor sentiment shifts. When fused with machine learning algorithms, these inputs refine tactical gold-stock positioning to capture alpha in evolving market environments.

Machine Learning and Reinforcement Learning Revolutionize Tactical Rebalancing

Advanced ML frameworks, particularly reinforcement learning, enable portfolios to adaptively optimize gold and stock weights by learning from complex market feedback loops. This continuous learning approach outperforms traditional fixed-rule models, especially under non-linear market conditions and rapidly changing macro-financial landscapes.

ESG Integration Adds Complexity but Aligns Portfolios with Sustainable Goals

Embedding ESG criteria into gold and equity allocations requires balancing ethical considerations with risk-return objectives. Utilizing ESG scoring within quantitative frameworks and addressing behavioral dissonance enhances portfolio resilience and relevance amid growing sustainability mandates.

Curated Expert Resources

- World Gold Council – Gold and Asset Allocation Research: Provides comprehensive data and analysis on gold’s portfolio role, essential for understanding diversification benefits and market dynamics (https://www.gold.org/goldhub/research/gold-and-asset-allocation).

- CFA Institute – Gold in Portfolio Construction: Risk Management and Return Enhancement: Offers advanced quantitative methodologies and behavioral finance insights tailored to gold and stock allocations (https://www.cfainstitute.org/en/research/articles/2024/gold-in-portfolio-construction).

- BuyingGoldNow – Best Strategies to Balance Gold and Stocks in Portfolios: A practical guide detailing tactical and strategic approaches for blending gold and equities effectively (https://buyingoldnow.com/gold-vs-stocks-best-strategies-to-balance-your-portfolio).

- BuyingGoldNow – Gold Market Analysis: Understanding Price Movements This Year: In-depth look at macroeconomic influences and price drivers essential for timely allocation adjustments (https://buyingoldnow.com/gold-market-analysis-understanding-price-movements-this-year).

- BuyingGoldNow – Top Gold Trading Techniques for Maximizing Profits in 2025: Tactical trading insights that complement portfolio allocation strategies, enhancing responsiveness to market volatility (https://buyingoldnow.com/top-gold-trading-techniques-for-maximizing-profits-in-2025).

Final Expert Perspective

Mastering the balance between gold and stocks requires embracing complexity—dynamic correlations, behavioral nuances, cutting-edge data, and sustainability considerations all converge to shape optimal portfolio construction. The advanced methodologies and insights outlined here underscore that gold is not merely a static hedge but a fluid strategic asset capable of enhancing risk-adjusted returns amid diverse market regimes. Investors and professionals who integrate quantitative innovation with behavioral discipline and ESG awareness position themselves to navigate uncertainty with confidence and foresight.

Engage more deeply by sharing your experiences or exploring authoritative resources such as the best strategies to balance gold and stocks in portfolios, and unlock new dimensions in portfolio resilience and growth.

This comprehensive post really clarifies the nuanced role gold plays in a diversified portfolio, especially when you consider macroeconomic factors like inflation and geopolitical risks. I’ve found that during times of rising inflation, reallocating a small portion of assets into gold ETFs helped cushion sharp downturns while maintaining liquidity. The insights about dynamic rebalancing and machine learning models are particularly fascinating, as they seem to offer practical ways to adapt swiftly to market regime changes. I wonder, for example, how small individual investors can most effectively incorporate these advanced techniques without access to institutional-level tools. Do you believe that implementing simpler, rule-based approaches informed by macro indicators could approximate some benefits of these sophisticated models? Given the increasing availability of real-time data, I’d love to hear if others have experimented with hybrid strategies that balance complexity with practicality. Also, how do you see ESG considerations influencing the optimal allocation to gold, particularly given the environmental concerns surrounding mining activities? Overall, this post has deepened my understanding of how behavioral and quantitative factors intertwine in managing gold and stocks effectively.

This post provides a comprehensive overview of integrating gold and stocks within a portfolio, especially highlighting how macroeconomic variables like inflation and interest rates influence asset allocation. I’ve personally experienced that during periods of rising inflation, increasing gold holdings as a hedge not only preserved capital but also reduced overall portfolio volatility. The emphasis on advanced risk metrics like CVaR and machine learning models for dynamic rebalancing captured my interest because these approaches seem increasingly accessible with the proliferation of FinTech tools.

However, I wonder about the practical application of such models for individual investors who might not have access to high-end data analytics or AI systems. Do you think simple, rule-based frameworks—for example, setting thresholds based on inflation rates or yield curve movements—can offer comparable benefits? Also, considering ESG factors, I am curious about how investors can balance the desire for sustainability with the need for liquidity and tangible safety provided by physical gold. Looking ahead, do you see a role for ESG-screened gold instruments in this complex puzzle? It seems that combining these strategies thoughtfully could really enhance resilience, especially during unpredictable market regimes.