Unlocking the Future: Why Gold Price Forecasts Matter More Than Ever in 2025

As the global economy navigates through uncertainty, the intrigue surrounding gold price forecast 2025 intensifies. Investors seeking to safeguard and grow their wealth are turning to gold, a historically reliable hedge against inflation and market volatility. But what exactly shapes gold’s trajectory in the coming year? This article dives deep into the nuanced factors that will influence gold prices, empowering you to make informed investment decisions.

Beyond the Surface: Key Drivers Steering Gold Prices Towards 2025

Gold prices do not move in isolation; they are the product of a complex interplay of economic, geopolitical, and market dynamics. Central bank policies, especially quantitative easing and interest rate adjustments, exert considerable influence. For instance, when real interest rates decline, gold tends to shine brighter as a non-yielding asset becomes more attractive. Additionally, geopolitical tensions—such as trade disputes and regional conflicts—typically push investors towards the safety of gold, increasing demand and prices.

Emerging market demand, especially from countries like India and China where cultural affinity for gold persists, also plays a pivotal role. Supply-side constraints, including mining output limitations and increased production costs, further tighten the market, potentially driving prices higher. Understanding these elements offers investors an edge in anticipating market movements.

Strategic Gold Investments: What Portfolio Diversification Experts Recommend for 2025

Given gold’s multifaceted appeal, modern portfolios often integrate various forms of gold exposure to balance risk and return. Physical gold, such as bars and coins, offers tangible security and protection against systemic risks. For those interested in liquidity and ease of trading, gold ETFs and mutual funds provide diversified access to the gold market without the challenges of physical storage. Investors can explore detailed guidance on gold ETFs versus physical gold to tailor their holdings effectively.

How Can Investors Navigate Volatile Markets Using Gold in 2025?

In volatile market conditions, gold’s reputation as a safe haven asset becomes particularly valuable. Investors should consider employing gold as a hedge against inflation and currency depreciation. Strategic allocation, typically between 5% to 15% of a diversified portfolio, can reduce overall risk without sacrificing growth potential. Advanced investors might also explore gold futures trading for more active exposure, leveraging strategies found in specialized guides like gold futures trading techniques.

However, it’s crucial to recognize that gold prices can be influenced by unpredictable macroeconomic shifts and market sentiment, necessitating ongoing vigilance and flexibility.

Expert Perspective: The Intricate Dance Between Inflation and Gold Prices

Inflation expectations profoundly affect gold’s price dynamics. Historically, gold has outperformed during periods of rising inflation because it preserves purchasing power. But this relationship is not linear; factors such as real interest rates and currency strength modulate gold’s response. Recent data analyzed by the World Gold Council illustrates how these variables interact, emphasizing the importance of a comprehensive approach when forecasting prices.

Investors who grasp this complexity can better anticipate price swings and optimize timing for entry or exit points, rather than relying on simplistic inflation correlations.

If you found these insights valuable, consider sharing this article with fellow investors or leave a comment below to spark a discussion on your gold investment strategies for 2025.

Supply Chain Dynamics and Their Underestimated Impact on Gold Prices

While traditional factors like inflation and geopolitical tensions dominate gold price discussions, the role of supply chain disruptions cannot be overlooked in 2025. Global challenges such as transportation bottlenecks, energy cost fluctuations, and labor shortages in mining regions directly affect gold production and distribution costs. These factors often create short-term supply constraints, pushing prices upward even without immediate demand surges. Investors who monitor these logistical elements gain a nuanced edge in timing their acquisitions or disposals.

Central Bank Gold Reserves: Silent Drivers of Market Sentiment

Central banks continue to be significant players in the gold market, not only through their physical purchasing but also via strategic reserve adjustments that signal economic outlooks. In 2025, many central banks are cautiously increasing their gold reserves to diversify away from fiat currencies amidst persistent uncertainties. Such accumulation tends to tighten supply and may catalyze broader market movements. Monitoring official reports and central bank communications is vital for investors aiming to anticipate these subtle yet powerful influences.

What Role Does Technological Innovation Play in Shaping Gold Market Dynamics Today?

Technological advances in mining and trading platforms are reshaping the gold market landscape. Automation and improved extraction techniques enhance mining efficiency and reduce costs, potentially increasing supply. Meanwhile, digital trading platforms offer faster, more transparent gold transactions, broadening investor access and liquidity. Understanding how these innovations affect supply-demand balances and price volatility is essential for sophisticated investors seeking strategic advantage.

According to the World Gold Council’s research on technology in gold mining, technological progress is expected to sustainably improve output and operational efficiency, influencing supply trends in the medium to long term.

For those interested in mastering gold market intricacies, exploring resources on gold market analysis in 2025 offers comprehensive insights into factors driving prices and demand shifts.

We invite you to share your perspectives or questions about gold investment strategies in the comments section below. Engaging with fellow experts can deepen understanding and reveal emerging trends crucial for successful portfolio management.

Decoding the Influence of Global Currency Trends on Gold’s 2025 Trajectory

The intricate relationship between global currency fluctuations and gold prices is often underestimated but remains a pivotal factor in forecasting gold’s path for 2025. Gold is traditionally priced in US dollars, so dollar strength or weakness directly impacts gold’s appeal and valuation in international markets. When the US dollar weakens against other major currencies, gold typically becomes cheaper for holders of foreign currencies, thereby stimulating demand and pushing prices upward. Conversely, a stronger dollar can dampen gold’s allure.

However, the dynamics extend beyond mere exchange rates. Emerging market currencies’ volatility, especially in gold-consuming giants like India and China, can alter local demand patterns significantly. In addition, the rise of digital currencies and central bank digital currencies (CBDCs) introduces novel complexities. These digital assets may either compete with or complement gold’s role as a store of value, depending on adoption rates and regulatory frameworks.

How Will Central Bank Digital Currencies (CBDCs) Shape Gold Demand and Price Stability in 2025?

CBDCs represent a transformative shift in the global monetary landscape. Their rollout could influence gold demand in multiple ways. On one hand, CBDCs may strengthen fiat currency trust by enhancing transparency and reducing transaction costs, potentially diminishing gold’s traditional appeal as a safe haven. On the other hand, uncertainties during the transition period might elevate gold’s status as a risk mitigator.

Moreover, CBDCs might facilitate faster, more secure gold trading platforms, increasing liquidity and market efficiency. Industry experts from the International Monetary Fund (IMF) emphasize that central banks must carefully calibrate CBDC policies to avoid unintended disruptions to gold markets. For investors, keeping abreast of regulatory developments and technological integrations is crucial to leverage emerging opportunities.

Quantitative Easing’s Residual Effects: A Sophisticated Lens on Gold Price Volatility

While many anticipate a tapering of quantitative easing (QE) programs globally, the lingering aftereffects continue to ripple through gold markets. QE injects liquidity, often lowering real yields and inflation-adjusted interest rates, which historically buoy gold prices. Yet, the timing and scale of QE withdrawal introduce uncertainty, contributing to price volatility.

Investors with an advanced understanding recognize that gold price movements during QE transitions are not uniform. They depend on market expectations, central bank communications, and concurrent macroeconomic indicators. Sophisticated modeling techniques, such as vector autoregressions (VAR) and regime-switching models, help capture these nonlinear relationships, providing more accurate forecasts. Academic literature, including studies published in the Journal of International Money and Finance, offers valuable insights into these dynamics.

Integrating ESG Considerations: How Sustainability Trends Influence Gold Investment Strategies in 2025

Environmental, Social, and Governance (ESG) criteria are reshaping investment paradigms, and gold mining is no exception. Increasing scrutiny of mining practices—ranging from carbon emissions to community impact—affects supply-side considerations and investor sentiment. Mines adopting sustainable technologies or demonstrating strong social responsibility often achieve premium valuations and attract ESG-focused funds.

Investors contemplating gold exposure in 2025 should factor ESG scores into their selection process. This approach not only aligns with broader ethical imperatives but may also mitigate risks associated with regulatory penalties or reputational damage. Leading ESG rating agencies now provide detailed gold sector assessments, enabling a more nuanced portfolio construction.

For a deep dive into how ESG factors are transforming precious metals investing, visit Sustainalytics’ precious metals ESG reports.

What Advanced Risk Management Techniques Can Optimize Gold Portfolio Performance Amid 2025’s Uncertainties?

Managing risk in gold investments requires more than traditional diversification. Techniques such as dynamic hedging, options strategies including calls and puts, and volatility targeting are increasingly employed by institutional investors to fine-tune exposure. Scenario analysis and stress testing under varied macroeconomic shocks help in anticipating adverse movements.

Moreover, integrating machine learning models to analyze market sentiment, macro data, and technical indicators can enhance predictive accuracy. These approaches empower investors to adjust allocations proactively rather than reactively, optimizing risk-adjusted returns.

Exploring specialized resources on algorithmic trading and risk analytics, such as those offered by CFA Institute, can elevate your investment strategy.

We encourage readers to engage with these advanced topics by sharing your experiences or posing questions in the comments below to foster a community of expert-level discourse on gold investment strategies in 2025.

Harnessing Macro-Financial Synergies: Navigating Gold Price Fluctuations Beyond Conventional Wisdom

While the foundational drivers of gold prices in 2025 remain rooted in inflation, geopolitical tensions, and central bank policies, a deeper understanding emerges from assessing macro-financial synergies. For instance, the interplay between sovereign debt levels and monetary policy stances across key economies shapes real interest rates and currency stability, thereby influencing gold’s appeal. Sophisticated investors scrutinize cross-asset correlations, including the relationship between gold and bond yields, to develop anticipatory models that transcend linear causality.

Behavioral Finance and Gold: How Investor Psychology Impacts Price Volatility in 2025

Beyond quantitative metrics, investor sentiment and cognitive biases critically modulate gold price volatility. Herd behavior during economic uncertainty can amplify price spikes, while overreactions to central bank announcements or geopolitical news may create transient dislocations. Advanced analytics leveraging sentiment analysis from social media and news feeds provide nuanced signals to anticipate short-term market moves. Integrating these behavioral insights with fundamental analysis enables a more robust forecasting framework.

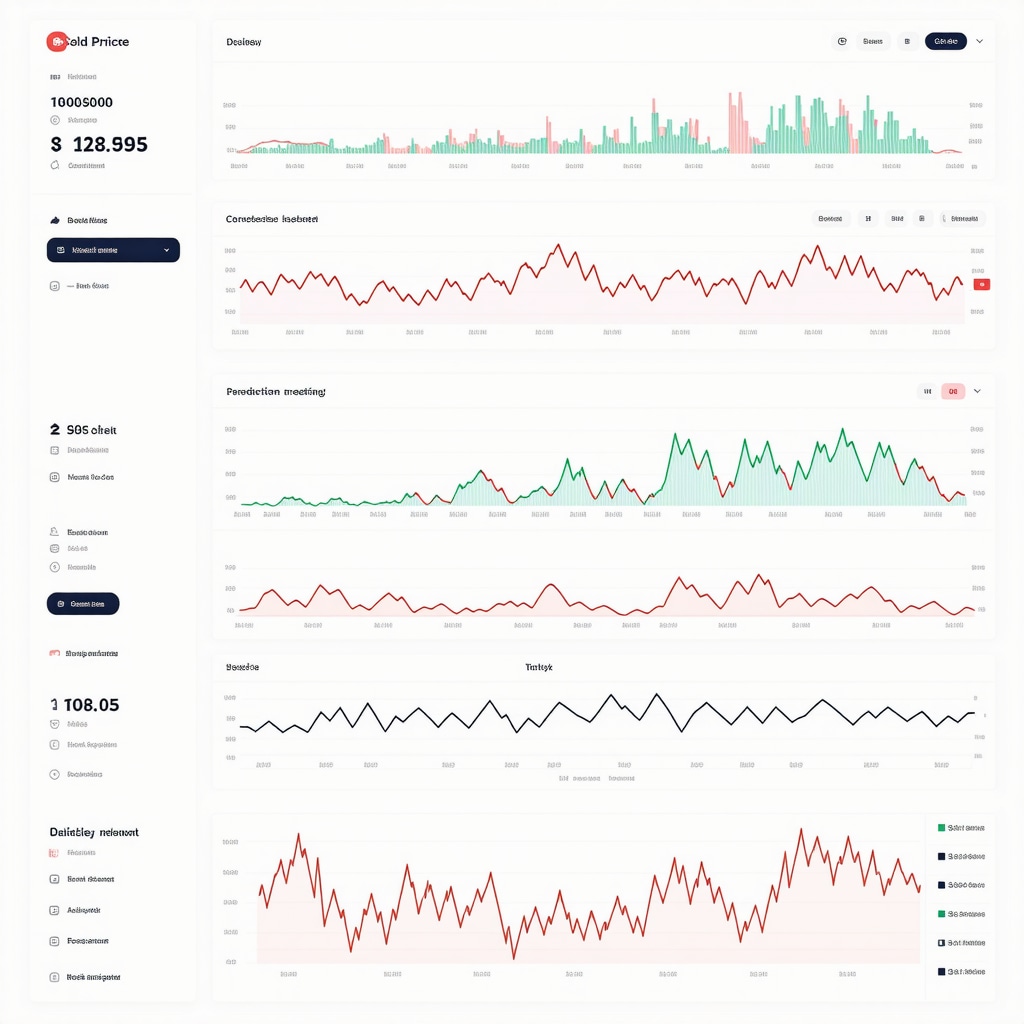

What Are the Cutting-Edge Analytical Tools for Predicting Gold Price Movements in 2025?

In 2025, predictive analytics for gold prices increasingly rely on machine learning algorithms and artificial intelligence (AI) frameworks that ingest multifaceted datasets—from macroeconomic indicators and supply chain metrics to real-time market sentiment and geopolitical event probabilities. Techniques such as recurrent neural networks (RNNs) and ensemble learning models capture complex temporal dependencies and non-linearities inherent in gold markets. Tools integrating alternative data sources, including satellite imagery for mining activity and blockchain transaction flows, offer unprecedented granularity. Utilizing platforms like Bloomberg Terminal’s AI-driven analytics or specialized fintech solutions equips investors with a competitive edge in dynamic environments.

Regulatory Landscape Evolution: Implications for Gold Market Transparency and Investor Security

Emerging regulatory frameworks globally emphasize enhanced transparency, anti-money laundering (AML) protocols, and environmental compliance in gold trading and production. These reforms aim to curtail illicit gold flows and promote sustainable mining practices, thus influencing market liquidity and price formation. Investors should vigilantly monitor updates from entities such as the Financial Action Task Force (FATF) and regional regulators. Compliance adherence not only mitigates legal risks but also enhances asset credibility in ESG-conscious portfolios.

Strategic Engagement: Leveraging Expert Intelligence for Dynamic Gold Investment Decisions

Capitalizing on the intricate factors shaping gold prices in 2025 demands continuous learning and adaptive strategy formulation. Engaging with cutting-edge research, market intelligence platforms, and expert communities fosters the agility needed to respond proactively to evolving conditions. We encourage you to deepen your expertise by exploring resources such as the World Gold Council for authoritative data and insights.

Share your perspectives or advanced inquiries in the comments below to join a vibrant dialogue with fellow connoisseurs of gold investment strategy.

Frequently Asked Questions (FAQ)

What are the primary factors influencing gold prices in 2025?

The main drivers include central bank policies, especially interest rate changes and quantitative easing; geopolitical tensions that increase demand for safe-haven assets; supply chain disruptions impacting mining and distribution; demand trends in emerging markets like India and China; and evolving macro-financial synergies such as sovereign debt levels and currency fluctuations. Additionally, technological advancements and ESG considerations increasingly shape both supply and investor preferences.

How does inflation affect gold prices, and is this relationship straightforward?

Gold is traditionally seen as a hedge against inflation, often appreciating when inflation rises. However, the relationship is complex and influenced by real interest rates, currency strength, and market sentiment. For example, if nominal rates rise faster than inflation, the real yield increases, potentially reducing gold’s appeal. Thus, investors must consider these interrelated factors rather than viewing inflation in isolation.

What role do central banks play in gold markets in 2025?

Central banks actively manage gold reserves to diversify their portfolios and signal economic confidence. Their buying or selling can tighten supply or inject liquidity, influencing market sentiment and price volatility. Moreover, the cautious accumulation of gold reserves amidst global uncertainties can create upward pressure on prices. Monitoring official central bank reports and communications is essential for anticipating these effects.

How are technological innovations impacting gold mining and trading?

Advances in automated mining techniques and extraction technologies improve efficiency and reduce production costs, potentially increasing supply. On the trading side, digital platforms and AI-driven analytics enhance liquidity, transparency, and predictive capabilities. These innovations reshape market dynamics by improving operational sustainability and enabling sophisticated investment strategies.

What is the impact of global currency trends and digital currencies on gold prices?

Since gold is priced primarily in US dollars, dollar strength typically suppresses gold prices, while dollar weakness boosts demand. Volatility in emerging market currencies also affects local gold demand. The rise of Central Bank Digital Currencies (CBDCs) introduces new dynamics: they may either strengthen fiat currencies, reducing gold’s safe-haven appeal, or increase gold trading efficiency. Regulatory and adoption trends around digital currencies will significantly influence gold’s future role.

How should investors strategically allocate gold in their portfolios in 2025?

Experts recommend a strategic allocation of 5% to 15% in gold to hedge against inflation, currency depreciation, and market volatility. Choices include physical gold for tangible security, ETFs for liquidity, and futures for active exposure. Incorporating ESG-rated gold assets and employing advanced risk management techniques like dynamic hedging and machine learning-based analytics can optimize performance amid uncertainties.

What advanced analytical tools are available for forecasting gold prices?

Cutting-edge tools include machine learning models such as recurrent neural networks (RNNs) and ensemble methods that analyze diverse datasets—from macroeconomic indicators and supply chain data to sentiment analysis and satellite imagery of mining activity. Platforms like Bloomberg Terminal integrate AI-driven analytics to enhance predictive accuracy and capture complex nonlinear market behaviors.

How do ESG considerations influence gold investment decisions?

ESG factors are increasingly critical, affecting mining operations’ environmental impact, social responsibility, and governance standards. Mines with strong ESG profiles attract premium valuations and ESG-focused funds, while poor ESG practices carry reputational and regulatory risks. Integrating ESG ratings into gold selection aligns investments with sustainability goals and risk mitigation.

What risk management techniques optimize gold portfolio performance in volatile environments?

Beyond traditional diversification, techniques such as options strategies, dynamic hedging, scenario analysis, stress testing, and volatility targeting are essential. Incorporating algorithmic trading and machine learning enhances responsiveness to market shifts. These approaches help investors proactively manage risk and enhance risk-adjusted returns.

How does investor psychology impact gold price volatility?

Behavioral finance shows that herd behavior, overreactions to news, and sentiment-driven trading amplify gold price swings. Advanced sentiment analysis using social media and news analytics provides early signals of market sentiment shifts. Combining these insights with fundamental analysis allows for more robust forecasting and timely decision-making.

Trusted External Sources

- World Gold Council – Provides authoritative data on gold demand, supply, technological innovations, and ESG trends, essential for understanding market fundamentals and investment strategies.

- International Monetary Fund (IMF) – Offers research on monetary policies, Central Bank Digital Currencies, and their implications for gold asset market dynamics, informing macroeconomic perspectives.

- Journal of International Money and Finance – Publishes academic studies on quantitative easing, interest rates, and gold price volatility, supporting deeper theoretical and empirical understanding.

- CFA Institute – Supplies advanced resources on risk management techniques, portfolio optimization, and algorithmic trading relevant to gold investment strategies.

- Sustainalytics – Delivers detailed ESG ratings and reports on precious metals mining, guiding investors in integrating sustainability factors into portfolio decisions.

Conclusion

Forecasting gold prices in 2025 demands a multifaceted approach that integrates economic indicators, geopolitical developments, supply chain realities, technological progress, and evolving regulatory landscapes. Gold remains a vital hedge against inflation and market volatility, yet its price dynamics are increasingly nuanced by macro-financial synergies, behavioral factors, and sustainability imperatives. Advanced analytical tools and sophisticated risk management strategies empower investors to navigate this complexity with confidence. By staying informed through trusted sources and engaging in expert discourse, investors can strategically position themselves to harness gold’s enduring value in uncertain times. Share your thoughts, questions, or strategies below and explore related expert content to deepen your mastery of gold investment in 2025 and beyond.