Unveiling the 2025 Gold Price Trajectory: An Expert Perspective

As we approach the mid-2020s, the gold market stands at a complex crossroads shaped by macroeconomic forces, geopolitical tensions, and evolving investor sentiment. Drawing on decades of market analysis and recent data, this forecast synthesizes expert insights to illuminate the nuanced trajectory of gold prices in 2025. The dynamic interplay of central bank policies, inflation expectations, and global economic stability will serve as critical determinants in shaping gold’s market performance.

Deciphering the Key Drivers of Gold Price Movements in 2025

How Will Central Bank Gold Purchases Influence 2025 Prices?

Central banks worldwide have been actively accumulating gold reserves as part of their strategic reserves diversification. According to recent analyses from the Understanding Central Bank Gold Purchases report, this ongoing accumulation trend is likely to exert upward pressure on gold prices, especially if geopolitical uncertainties persist. The strategic motives—ranging from currency devaluation hedges to geopolitical signaling—amplify gold’s role as a safe haven.

Market Dynamics and Investor Behavior: A Deep Dive

The influence of retail and institutional investors remains pivotal. The shift towards gold ETFs and physical holdings continues to reflect a cautious yet optimistic outlook amid inflation fears and dollar fluctuations. Analyzing recent market dynamics, experts forecast a potential volatility corridor, with strategic entry points becoming more critical for investors aiming to capitalize on price swings.

Expert Predictions and Market Outlook for 2025

Market analysts project a broad range for gold prices in 2025, with estimates varying between $2,000 and $2,500 per ounce. This projection considers inflation trajectories, US dollar trends, and emerging geopolitical risks. Furthermore, the evolving landscape of gold demand—particularly in jewelry and technology sectors—may introduce supply-side constraints, adding a further layer of complexity to the forecast.

What Advanced Strategies Should Investors Consider for 2025?

To optimize returns, investors should explore diversified approaches such as developing a robust gold IRA portfolio, engaging in tactical trading using technical analysis, and understanding global economic indicators. For comprehensive strategies, visit our expert tips on gold trading techniques.

In conclusion, navigating the 2025 gold market requires a sophisticated understanding of macroeconomic trends, geopolitical developments, and technical market signals. Staying informed through credible sources and strategic diversification remains paramount for investors aiming to secure long-term wealth in this volatile landscape.

For further insights, explore the latest gold price forecasts and engage with financial experts to tailor your investment approach.

Unlocking the Secrets of Gold Demand in 2025: A Nuanced Perspective

While traditional analyses focus heavily on macroeconomic factors, emerging demand sectors such as technology and jewelry are gaining prominence in influencing gold prices. According to a detailed report by the World Gold Council, shifts in consumer preferences and technological applications could significantly alter supply-demand dynamics in 2025, creating new opportunities and risks for investors. Understanding these evolving patterns requires a deep dive into global demand trends, which can be explored further in our comprehensive guide to gold demand trends.

Deciphering the Impact of Geopolitical Shifts on Gold Valuations in 2025

As geopolitical tensions escalate globally, the ripple effects on gold prices become increasingly pronounced. Experts indicate that unresolved conflicts and diplomatic uncertainties tend to bolster gold’s safe-haven appeal, propelling prices upward. According to the International Monetary Fund’s (IMF) 2024 World Economic Outlook, geopolitical risks remain elevated, with potential to trigger short-term volatility while reinforcing long-term investment narratives around gold.

How Do Geopolitical Risks Interact with Currency Fluctuations to Influence Gold?

Currency dynamics, particularly the US dollar’s strength, play a pivotal role in gold pricing. A weakening dollar typically correlates with rising gold prices, as gold becomes more affordable for international buyers. Conversely, a strong dollar can suppress gold demand. This inverse relationship is well-documented in recent research published in the Journal of International Financial Markets, which emphasizes that strategic currency hedging by central banks and large investors can significantly sway gold’s trajectory in 2025.

Advanced Investment Strategies for Navigating the 2025 Gold Market

In an environment characterized by volatility and sophisticated market forces, traditional buy-and-hold strategies may fall short. Instead, investors should consider deploying options hedging, leveraging technical analysis for timing entries and exits, and engaging in algorithmic trading systems that adapt to real-time market signals. Moreover, diversifying holdings across physical gold, ETFs, and futures contracts can mitigate risks and optimize returns. For in-depth tactical approaches, consult our comprehensive guide to advanced gold investing.

What Emerging Technologies Are Shaping the Future of Gold Demand?

Innovations in technology—such as blockchain, wearable electronics, and green energy solutions—are expanding gold’s application spectrum beyond traditional jewelry and investment. The World Gold Council reports a notable increase in demand for gold in technological sectors, which could influence supply chain dynamics in 2025. This technological shift underscores the importance of understanding not just macroeconomic indicators but also sector-specific trends that could reshape gold’s market fundamentals.

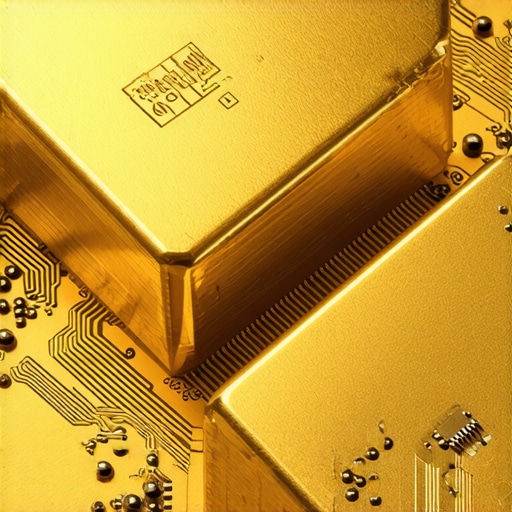

Illustration of gold in modern technology applications, such as electronics and renewable energy components.

To deepen your understanding of these multifaceted factors, consider engaging with industry reports and expert analysis that explore the intersection of technological innovation and precious metal markets. Staying ahead requires a nuanced grasp of evolving demand patterns and supply constraints, which can significantly inform strategic investment decisions.

Decoding the Future of Gold Prices in 2025: An Advanced Market Perspective

As the global economy navigates an era of unprecedented complexity, understanding the intricate factors influencing gold prices in 2025 requires a sophisticated approach rooted in macroeconomic analysis, geopolitical intelligence, and technological advancements. This article delves into the nuanced dynamics shaping gold’s trajectory, offering expert-level insights for seasoned investors and industry professionals.

How Will Central Bank Policies and Gold Reserves Impact 2025?

Central banks’ strategic accumulation and divestment of gold reserves serve as pivotal indicators of market direction. Recent data from the European Central Bank’s gold reserve reports reveal a trend towards increased holdings in response to geopolitical tensions and currency devaluation fears. Such shifts are likely to sustain upward pressure on gold prices, especially if coordinated global monetary policies introduce volatility.

Can Technological Innovations Reshape Gold Demand in 2025?

Emerging technologies, particularly blockchain, IoT, and green energy components, are expanding gold’s application beyond traditional sectors. The World Gold Council’s recent publication highlights a surge in demand for gold in electronics and sustainable energy solutions. This technological diversification not only enhances demand stability but also introduces new supply chain considerations, influencing price dynamics.

What Role Do Geopolitical Tensions and Currency Fluctuations Play?

Geopolitical uncertainties, from regional conflicts to trade disputes, tend to bolster gold’s safe-haven appeal. Coupled with currency fluctuations, particularly US dollar movements, these factors create a complex environment where gold prices can experience significant short-term volatility. The IMF’s World Economic Outlook emphasizes that strategic currency hedging and geopolitical risk management are essential for investors aiming to navigate these turbulent waters effectively.

What Sophisticated Investment Strategies Should Experts Prioritize?

In light of evolving market conditions, advanced investors should consider deploying options strategies for risk mitigation, leveraging algorithmic trading for precise entry and exit points, and diversifying across physical gold, ETFs, and futures contracts. For comprehensive tactical frameworks, consult our expert guide to gold investment tactics.

How Are Sectoral Demand Trends and Supply Chain Disruptions Interconnected?

Demand from sectors such as technology, healthcare, and renewable energy is increasingly influencing supply chains. Disruptions in mining, geopolitical sanctions, and environmental regulations can constrain supply, adding a layer of complexity to price forecasts. The World Gold Council’s comprehensive report offers an in-depth analysis of these interconnected factors, vital for strategic foresight.

< >

>

Illustration depicting gold’s integration into advanced technological applications, including electronics, renewable energy, and blockchain systems.

Stay ahead of the curve by engaging with industry-leading research, leveraging quantitative models, and continuously updating your strategic frameworks to adapt to the evolving landscape of gold markets in 2025. Our expert insights serve as a foundation for making informed, high-impact investment decisions.

Expert Insights & Advanced Considerations

Strategic Central Bank Holdings Will Continue to Drive Prices

Central bank gold reserve accumulations are poised to be a pivotal factor in 2025, reflecting geopolitical risk mitigation and currency devaluation hedging strategies. Monitoring reports like the Understanding Central Bank Gold Purchases provides invaluable insights into reserve shifts and their market implications.

Technological Innovation Will Diversify Gold Demand

Emerging sectors such as blockchain, electronics, and renewable energy are expanding gold’s application spectrum, potentially stabilizing demand amidst macroeconomic fluctuations. For in-depth analysis, the Emerging Gold Demand Trends report offers comprehensive insights into sector-specific influences.

Geopolitical and Currency Dynamics Will Create Price Volatility

Geopolitical tensions and US dollar fluctuations will continue to influence gold’s safe-haven appeal, with strategic currency hedging becoming essential for investors. The Global Economic Factors report deepens understanding of these complex interactions.

Advanced Investment Strategies Are Necessary for 2025

Utilizing options, algorithmic trading, and diversified holdings across physical gold, ETFs, and futures will be critical. Our Effective Gold Trading Techniques guide provides tactical approaches suited for high-level investors.

Technological and Sectoral Demand Will Reshape Supply Dynamics

Innovations in blockchain, IoT, and green energy applications are expanding demand, which could affect supply chains and pricing structures. The Tech Demand Shifts report explores these transformative trends.

Curated Expert Resources

- Understanding Central Bank Gold Purchases: Offers detailed analysis of reserve shifts and their market impact, crucial for macroeconomic strategy planning.

- Emerging Gold Demand Trends: Provides sector-specific insights into technological and jewelry demand, essential for supply-demand forecasting.

- Global Economic Factors: Deep dives into geopolitical risks and currency fluctuations, vital for risk management.

- Effective Gold Trading Techniques: Tactical guides on leveraging technical analysis and options for optimal returns.

- Technical Demand Shifts in Gold Market: Focuses on technological innovations shaping future supply and demand landscapes.

Final Expert Perspective

The 2025 gold price forecast underscores the importance of a nuanced, multi-faceted approach that incorporates macroeconomic analysis, sectoral demand insights, and technological innovations. Staying informed through authoritative resources and employing sophisticated investment strategies will position investors to navigate this complex landscape effectively. Engage with these expert insights and continuously refine your approach—your strategic foresight today will define your wealth preservation tomorrow.