Unearthing Potential: Why Gold Mining Stocks Are Gaining Investor Spotlight

In an era marked by economic uncertainty and volatile markets, gold mining stocks emerge as compelling avenues for investors seeking growth combined with a tangible asset connection. Unlike physical gold, these stocks offer exposure to the precious metal’s upside while providing leverage through operational efficiencies and exploration successes. Understanding the nuances behind these stocks can unlock opportunities rarely available in traditional asset classes.

Mining the Market: Key Drivers Fueling Gold Mining Stock Growth

Several critical factors influence the trajectory of gold mining stocks. First, global gold prices, shaped by macroeconomic trends, central bank policies, and geopolitical tensions, form the bedrock of profitability. Additionally, technological advancements in extraction and processing reduce costs and enhance yield, directly impacting margins. Environmental, social, and governance (ESG) considerations are increasingly pivotal; companies embracing sustainable practices often enjoy better investor confidence and regulatory goodwill.

How Do Investors Identify the Most Promising Gold Mining Stocks in 2029?

Identifying growth leaders within gold mining stocks requires a multifaceted approach. Investors should analyze reserves quality, production costs, and geopolitical risk exposure. For example, companies with low-cost operations in politically stable regions tend to outperform peers during price downturns. Monitoring exploration pipelines offers insight into future growth potential. Furthermore, evaluating management teams’ track records in navigating market cycles and operational challenges provides crucial qualitative context. Tools like comprehensive market analysis and specialized reports, such as those featured on BuyingOldNow’s gold mining stocks analysis, can significantly enhance decision-making.

Strategic Approaches: Balancing Risk and Reward in Your Gold Mining Stock Portfolio

Diversification across different mining companies, geographical regions, and production scales mitigates inherent risks. Investors might consider blending established producers with junior miners offering higher growth potential but increased volatility. Staying abreast of broader market dynamics, including gold supply-demand trends and central bank purchasing patterns, sharpens timing strategies. For those seeking to complement stocks, exploring gold ETFs or mutual funds provides additional layers of diversification and liquidity.

Seeing Beyond the Veil: Practical Insights from Experienced Investors

Seasoned investors often recount scenarios where due diligence on mining operations’ environmental compliance averted costly pitfalls. Understanding local regulatory environments and community relations often spells the difference between sustained growth and operational disruption. A vivid example includes a mid-tier miner in Canada that surged after successfully implementing renewable energy solutions, reducing operational costs and enhancing ESG appeal—factors that attracted institutional investments.

For readers eager to deepen their understanding of gold investments and related strategies, exploring resources like gold investment strategies for volatile markets can provide invaluable guidance.

Join the Conversation: Share Your Insights or Questions on Gold Mining Investments

Are you currently exploring gold mining stocks or considering them for your portfolio? Share your experiences or questions in the comments below to foster a community of informed investors. Engaging with diverse perspectives can enrich your investment strategy and uncover overlooked opportunities.

Source: For a comprehensive understanding of market forces shaping gold mining stock performance, consider the detailed insights offered by the World Gold Council, a leading authority on gold market trends and analysis: World Gold Council Research.

Learning from Experience: Navigating Gold Mining Stocks’ Twists and Turns

Reflecting on my early days investing in gold mining stocks, I recall the steep learning curve as market swings tested both my patience and strategy. One memorable lesson came when a promising junior miner announced a new gold discovery, only for the stock to dip amid broader market fears. This experience taught me that news alone doesn’t guarantee immediate gains—context matters. Understanding operational timelines, permitting processes, and geopolitical nuances proved vital. Over time, blending patience with continuous research has been key to navigating this sector’s volatility.

Sustainability as a Game-Changer: How ESG Shapes Gold Mining Stocks’ Future

In recent years, ESG factors have moved from a peripheral concern to a central pillar in evaluating gold mining companies. From my conversations with industry insiders and reading reports from the World Gold Council, it’s clear that investors increasingly reward miners committed to reducing environmental impact, fostering community trust, and maintaining governance transparency. Companies integrating renewable energy, minimizing water usage, and engaging fairly with local communities tend to outperform peers not just ethically but financially. This shift has prompted me to prioritize ESG metrics alongside traditional financial indicators when selecting stocks.

What Are the Most Overlooked Risks in Gold Mining Stocks That New Investors Should Watch For?

This question often arises in my discussions with fellow investors. Beyond the usual suspects like price fluctuations and geopolitical risks, I’ve learned that operational disruptions—such as labor strikes, equipment failures, or unexpected regulatory changes—can severely impact a company’s stock value. These events might not always be front-page news but can erode investor confidence quickly. Consequently, I recommend new investors dig deeper into company disclosures, local news, and even social media channels to gauge on-the-ground realities. A proactive approach to risk assessment helps avoid surprises and aligns with a more resilient portfolio strategy.

Integrating Gold Mining Stocks into a Balanced Portfolio

From personal experience, diversifying with gold mining stocks has complemented my broader investment mix by offering both growth potential and a hedge against inflation. However, I pair these holdings with physical gold or gold ETFs to balance liquidity and risk. For those interested in exploring diversified options, resources like best gold ETFs to diversify your portfolio in 2029 provide practical insights. This hybrid approach has helped me maintain steadier returns amid market swings while staying connected to gold’s intrinsic value.

Have you had experiences with gold mining stocks or other gold investments? I’d love to hear your stories or questions—drop a comment below and let’s continue this conversation. Sharing diverse perspectives not only enriches our understanding but might reveal opportunities others have missed.

Technological Innovations Revolutionizing Gold Mining Efficiency and Profitability

Gold mining companies are increasingly leveraging cutting-edge technologies to enhance extraction efficiency and reduce operational costs, which directly boosts stock valuations. Innovations such as autonomous drilling systems, real-time data analytics, and AI-powered predictive maintenance are becoming standard in leading mining operations. These advancements not only optimize resource allocation but also minimize downtime, enabling companies to maintain stable production even in challenging geological settings. For investors, tracking firms that adopt these technologies early can uncover opportunities for outsized returns as operational leverage improves.

Moreover, blockchain technology is beginning to influence supply chain transparency in the gold sector, ensuring provenance and ethical sourcing, which further strengthens ESG credentials and investor appeal. The integration of such disruptive tech exemplifies how gold mining is no longer just about resource extraction but also about digital transformation.

How Can Sophisticated Investors Quantify the Impact of ESG Metrics on Gold Mining Stock Performance?

Quantifying ESG impact requires a multifactor analysis combining traditional financial metrics with qualitative assessments of environmental stewardship, social responsibility, and governance quality. Advanced investors utilize ESG rating frameworks provided by agencies such as Sustainalytics or MSCI, which incorporate carbon footprint, water usage, community engagement, and board diversity into composite scores. Correlating these scores with stock performance over time reveals nuanced patterns—companies scoring higher on ESG indices often enjoy reduced cost of capital, fewer regulatory interruptions, and stronger brand loyalty.[1] Incorporating these metrics into financial models enables investors to forecast not just risk mitigation but also value creation potential, transforming ESG from a check-box exercise into a robust investment thesis.

Geopolitical Risk Modeling: Navigating Complexities in Global Gold Mining Operations

Gold mining enterprises are inherently exposed to geopolitical risks given their operations across diverse jurisdictions. Sophisticated risk modeling involves evaluating political stability indices, regulatory environment volatility, and socio-economic factors that could disrupt mining activities. Investors increasingly deploy scenario analysis and Monte Carlo simulations to assess the potential impact of events such as expropriation, civil unrest, or sudden policy shifts on production forecasts and profitability.

For instance, mines in politically volatile regions might carry higher risk premiums but also offer substantial upside if stability improves. Conversely, firms with mines in stable jurisdictions provide lower risk but may face constraints in rapid expansion. Balancing these aspects within a portfolio requires deep due diligence and dynamic risk-adjusted return projections.

What Advanced Analytical Tools Do Experts Use to Forecast Gold Mining Stock Volatility Amid Market Turbulence?

Experts often combine quantitative approaches like GARCH (Generalized Autoregressive Conditional Heteroskedasticity) models with machine learning algorithms to capture complex volatility patterns in gold mining stocks. These tools analyze historical price data, trading volumes, and macroeconomic indicators to generate real-time volatility forecasts. Integrating sentiment analysis from news and social media feeds further refines predictions by capturing market psychology shifts. This sophisticated modeling allows portfolio managers to adjust exposure proactively, hedge risks efficiently, and capitalize on volatility-driven trading opportunities.

Additionally, factor-based investing strategies incorporating gold price dynamics, currency fluctuations, and interest rate movements complement volatility forecasts, offering a comprehensive toolkit for navigating complex market environments.

For readers seeking to deepen their mastery of these advanced analytical techniques, I recommend exploring resources such as the CFA Institute’s research digest, which regularly publishes cutting-edge insights into financial modeling and risk management.

Engage with these nuanced approaches and share your experiences or queries to elevate our collective expertise in gold mining stock investment.

Harnessing Predictive Analytics: The Frontier of Gold Mining Stock Forecasting

In the rapidly evolving landscape of gold mining equities, predictive analytics has become an indispensable tool for discerning investors. Leveraging vast datasets encompassing geological surveys, production metrics, and macroeconomic indicators, these models transcend traditional analysis by incorporating machine learning and artificial intelligence algorithms. This synergy facilitates nuanced forecasts of production output fluctuations and market responsiveness, enabling precise timing for entry and exit positions.

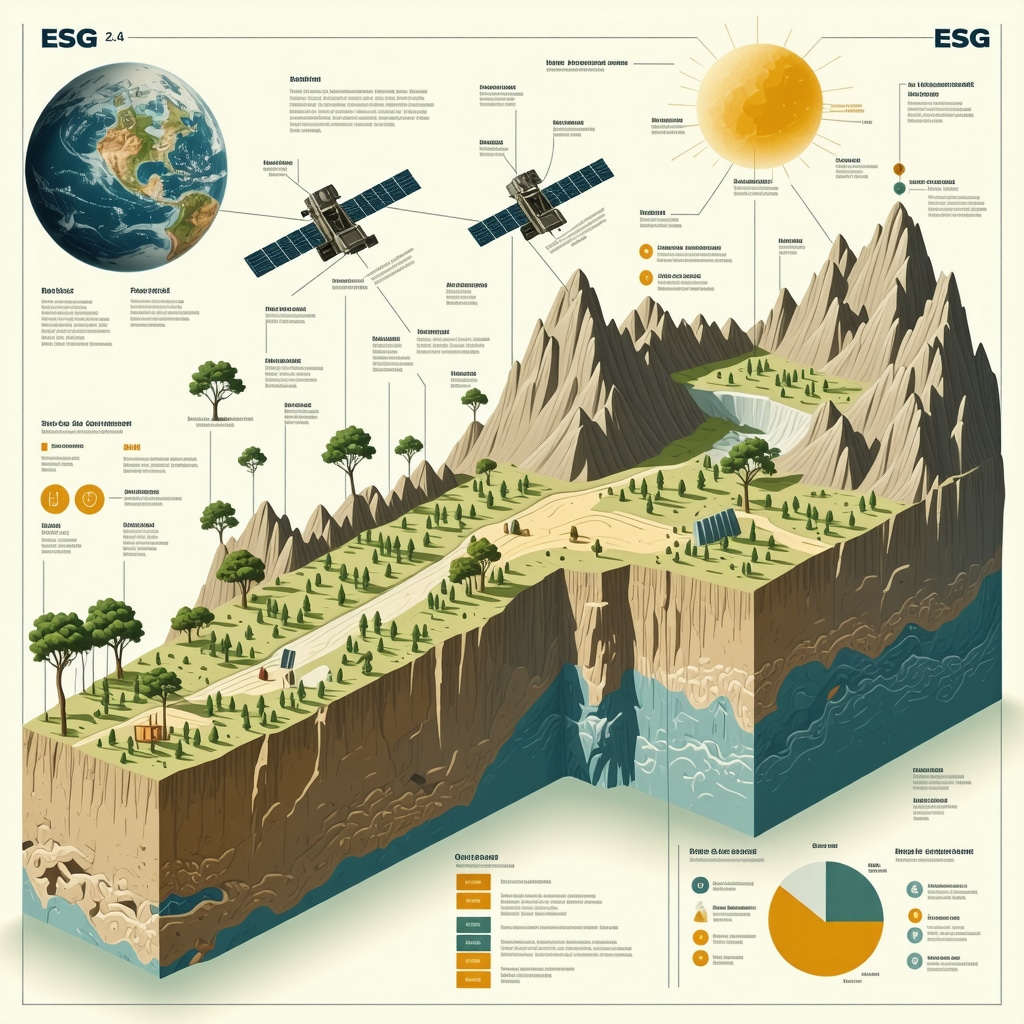

How Do Emerging Satellite Technologies Enhance Operational Transparency and Investment Confidence in Gold Mining?

Recent advancements in satellite imagery and remote sensing provide investors unparalleled visibility into mining activities worldwide. High-resolution multispectral data allows for real-time monitoring of environmental compliance, tailings storage integrity, and land rehabilitation progress. Such transparency mitigates information asymmetry, empowering stakeholders to detect potential operational or regulatory risks early. Companies integrating satellite-derived insights into their ESG reporting frameworks demonstrate heightened accountability, often correlating with increased investor trust and premium valuations.

Integrating these technologies aligns with findings from the World Gold Council’s research on satellite applications in mining, which underscores their transformative impact on risk management and sustainable mining practices.

Decoding the Nuances of Capital Allocation: Balancing Exploration, Expansion, and Shareholder Returns

Expert investors recognize that the strategic deployment of capital within gold mining firms significantly influences long-term stock performance. Prioritizing exploration budgets can unlock new reserves, but excessive allocation may strain cash flows. Conversely, focusing on expansion of existing high-grade mines often yields more immediate production gains. Furthermore, companies adept at returning value through dividends and share buybacks tend to attract a broader investor base, enhancing liquidity and market perception. A comprehensive evaluation of capital allocation policies, contextualized within commodity cycle phases, can reveal hidden growth catalysts or red flags.

Environmental Remediation and Its Emerging Role in Investment Valuation

The financial implications of environmental remediation initiatives are gaining prominence among sophisticated investors. Gold mining companies proactively engaging in site reclamation and pollution mitigation not only comply with tightening regulations but also reduce long-term liabilities. This proactive stance often translates into lower discount rates applied by analysts, reflecting diminished risk profiles. Evaluating the scope and effectiveness of remediation programs through technical disclosures and third-party audits offers an additional dimension to due diligence processes.

What Quantitative Frameworks Best Capture the Value of Sustainable Practices in Gold Mining Stock Analysis?

Leading-edge investment frameworks adopt integrated valuation models that incorporate Environmental, Social, and Governance (ESG) factors as quantifiable inputs influencing discount rates, cash flow projections, and terminal values. Tools like the Discounted Cash Flow (DCF) model augmented by ESG adjustment multipliers provide a rigorous approach to capturing sustainability’s impact on intrinsic value. Additionally, scenario analysis exploring regulatory tightening or carbon pricing effects can stress-test valuation assumptions. These methodologies align with practices recommended by the MSCI ESG Research, a benchmark authority on sustainable investment analytics.

Amplifying Returns Through Tactical Use of Derivatives and Hedging Strategies

Advanced investors often employ derivatives such as options and futures contracts to hedge against gold price volatility inherent in mining stocks or to speculate on directional moves with controlled risk exposure. Utilizing collars, puts, and call spreads tailored to specific portfolio sensitivities can mitigate downside while preserving upside potential. Moreover, cross-asset hedging involving currency forwards or interest rate swaps can address ancillary risks associated with multinational operations and financing structures. Mastery of these complex instruments demands robust quantitative acumen and continuous market surveillance.

For those intent on deepening their expertise in derivatives strategies within the gold mining sector, the CFA Institute’s research digest offers comprehensive analyses and case studies elucidating these techniques.

Engage and Elevate: Share Your Advanced Insights or Challenges on Gold Mining Stock Investment

Have you integrated advanced analytics or sustainable valuation models into your gold mining stock strategies? What successes or hurdles have you encountered employing derivatives for risk management? Your contributions can sharpen collective understanding and drive innovation within our investment community. Comment below to exchange sophisticated perspectives and explore collaborative solutions tailored to the complexities of gold mining investments.

Frequently Asked Questions (FAQ)

What distinguishes gold mining stocks from investing in physical gold?

Gold mining stocks provide leveraged exposure to gold prices through company operations, meaning stock prices can amplify gold price movements due to operational efficiencies, production costs, and exploration success. Unlike physical gold, stocks offer dividends, liquidity, and growth potential but also carry corporate and geopolitical risks absent in bullion ownership.

How do ESG factors influence gold mining stock valuations?

Environmental, Social, and Governance (ESG) metrics have become critical in assessing gold mining companies. Firms demonstrating strong ESG performance often enjoy lower capital costs, better regulatory relationships, and enhanced investor trust, which can translate into premium valuations and reduced operational risks compared to peers neglecting sustainability.

What are common operational risks that can impact gold mining stocks unexpectedly?

Operational risks include labor strikes, equipment failures, environmental incidents, and sudden regulatory changes. These factors can disrupt production and erode investor confidence even without widespread media coverage. Vigilant monitoring of company disclosures and local conditions is essential to mitigate such risks.

How can predictive analytics improve investment decisions in gold mining stocks?

Predictive analytics leverage machine learning and large datasets (geology, production, macroeconomics) to forecast production trends and market reactions, improving timing for buy or sell decisions. Integrating real-time data and sentiment analysis refines volatility forecasts, enabling proactive risk management and opportunity identification.

Why is geopolitical risk modeling vital for gold mining investments?

Gold mining operations span diverse geopolitical environments. Modeling political stability, regulatory changes, and socio-economic factors helps investors anticipate disruptions or opportunities. This risk-adjusted approach balances potential high returns from volatile regions against the stability and predictability of established jurisdictions.

What role do technological innovations play in enhancing gold mining stock performance?

Technologies like autonomous drilling, AI predictive maintenance, and satellite monitoring improve operational efficiency, reduce costs, and enhance ESG transparency. Early adopters of such innovations often gain competitive advantages, increasing profitability and investor appeal.

How should investors balance exploration, expansion, and shareholder returns in evaluating mining companies?

Effective capital allocation prioritizes sustainable growth: exploration to replenish reserves, expansion to increase production, and shareholder returns via dividends or buybacks. An optimal balance depends on commodity cycle phases and company strategy, influencing long-term stock performance.

What quantitative frameworks assess the financial impact of sustainability in mining stocks?

Integrated models augment traditional Discounted Cash Flow (DCF) analyses with ESG-adjusted discount rates and scenario stress tests reflecting regulatory changes or carbon pricing. This quantifies sustainability’s contribution to intrinsic value and risk mitigation, offering a more holistic investment appraisal.

How can derivatives be tactically used with gold mining stocks?

Options and futures can hedge gold price volatility or speculate with defined risk. Strategies like collars and spreads help protect downside while preserving upside. Cross-asset hedging addresses currency and interest rate exposures, requiring advanced knowledge but enhancing portfolio resilience.

What resources can investors use to deepen expertise in gold mining stock analytics?

Valuable sources include the CFA Institute’s research digest for financial modeling and derivatives, MSCI ESG Research for sustainability analytics, and the World Gold Council for market trends and satellite technology applications, providing comprehensive and authoritative insights.

Trusted External Sources

- World Gold Council Research (gold.org): Offers detailed analyses of gold market dynamics, ESG trends, and technological advancements impacting gold mining stocks.

- MSCI ESG Research (msci.com): Provides authoritative ESG ratings and frameworks critical for integrating sustainability into investment decisions.

- CFA Institute Research Digest (cfainstitute.org): Features cutting-edge research on financial modeling, derivatives strategies, and risk management pertinent to gold mining stock investments.

- Satellite Technology and Mining – World Gold Council (gold.org): Highlights innovations in remote sensing that enhance operational transparency and ESG compliance.

Conclusion

Gold mining stocks represent a sophisticated investment class offering amplified exposure to gold’s intrinsic value combined with operational leverage and growth potential. Navigating this sector demands a nuanced understanding of macroeconomic drivers, geopolitical risks, ESG integration, and technological innovations shaping profitability and risk profiles. Advanced analytical tools—from predictive modeling to ESG-adjusted valuations—empower investors to make informed, strategic decisions amid market volatility. Balancing exploration, expansion, and shareholder returns within a diversified portfolio enhances resilience and return potential. Embracing these expert insights can transform gold mining stock investing from speculation into a refined, dynamic discipline. Share your perspectives, ask questions, and continue exploring our expert resources to deepen your mastery in this compelling market segment.

![Is Recycled Gold Impacting the 2026 Price Floor? [Analysis]](https://buyingoldnow.com/wp-content/uploads/2026/02/Is-Recycled-Gold-Impacting-the-2026-Price-Floor-Analysis.jpeg)