Deciphering the Complex Dynamics of Gold and Stock Market Interplay

In the evolving landscape of wealth preservation, discerning investors recognize the nuanced relationship between gold and stocks. While traditionally viewed as hedge assets, their correlation fluctuates amidst geopolitical upheavals and monetary policy shifts. Analyzing recent data reveals that during periods of inflationary pressure, central bank gold purchases often surge, influencing gold market liquidity and pricing trends. For instance, according to the World Gold Council, central banks added approximately 1,136 tonnes of gold in 2022, a pivotal factor shaping the 2025 gold demand outlook.

Harnessing Advanced Gold Investment Strategies Amid Market Uncertainty

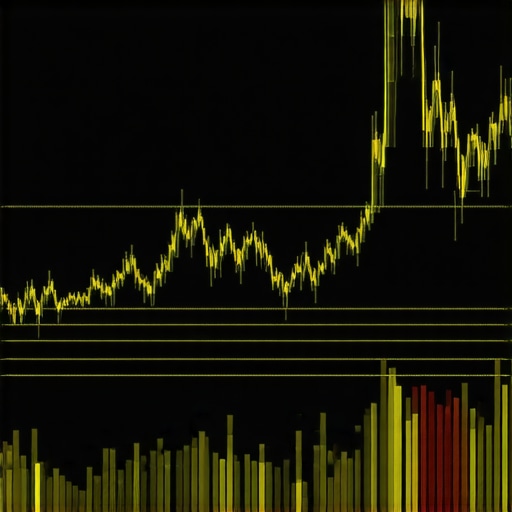

Effective gold investment strategies extend beyond simple buy-and-hold approaches. Diversification through gold ETFs, futures contracts, and gold mining stocks can optimize portfolio resilience. Expert analysts advise scrutinizing gold futures, considering their leverage potential and market volatility, to capitalize on short-term price movements. Leveraging technical analysis, including key support and resistance levels, equips investors to navigate the anticipated volatility in gold prices forecasted for 2025.

Identifying Emerging Demand Trends and Supply Chain Disruptions

Gold demand trends are increasingly influenced by macroeconomic factors such as inflation expectations, safe haven demand, and jewelry consumption patterns. Additionally, supply chain disruptions, notably logistic bottlenecks and mining productivity constraints, have caused fluctuations in gold supply, affecting market equilibrium. Understanding these dynamics enables investors to anticipate price shifts and adjust their holdings proactively.

What Are the Predicted Long-Term Outcomes for Gold Versus Stocks?

Projections for 2025 underscore the importance of strategic timing and asset allocation. While stocks may offer growth potential, gold’s role as a store of value becomes particularly compelling during inflationary surges. Combining these assets in a balanced portfolio can mitigate risks, especially as geopolitical tensions and monetary policies diverge globally. Research from the Harvard Business Review suggests that an optimal mix enhances risk-adjusted returns over extended periods.

Can Gold Maintain Its Hedging Power in a Post-Pandemic Economy? Insights from Market Experts

This question remains central to investment debates. As economies recover unevenly post-pandemic, the efficacy of gold as a hedge against inflation and currency devaluation warrants scrutiny. Market analysis indicates that increased central bank gold purchases signal a strategic shift among policymakers aiming to stabilize currencies and curb inflation, thereby reinforcing gold’s protective function.

How Can Newcomers Navigate Gold Investments in a Volatile Market?

For beginners, understanding core principles such as dollar-cost averaging, risk management, and fundamental market analysis is crucial. Educational resources like [Buying Gold Now’s comprehensive guides](https://buyingoldnow.com/buy-gold-now-top-investment-tips-market-trends-2025) offer valuable insights to build a resilient investment foundation.

Explore more about mastering gold demand trends and refining your investment approach by consulting authoritative sources like the World Gold Council, which provides in-depth research on global gold market dynamics.

Engaging with expert-level content and contributing your insights can help shape a more robust strategy, ensuring your financial growth aligns with anticipated market developments in 2025 and beyond.

Why Diversification with Gold Will Define Smarter Portfolios

In the realm of high-stakes investing, diversification remains a cornerstone for risk mitigation. As traditional equities encounter volatility driven by geopolitical and economic shifts, integrating various gold assets—such as physical coins, ETFs, and mining stocks—can provide a strategic cushion. Experts recommend evaluating the distinct risk-return profiles of each investment type; for instance, gold ETFs offer liquidity and ease of trading, while mining stocks can leverage operational efficiencies and exploration breakthroughs. For those aiming to optimize their exposure, consulting comprehensive guides like top gold investment strategies for 2025 can clarify allocation frameworks that align with your financial goals.

What Role Will Central Bank Purchases Play in Shaping Gold’s Trajectory in 2025?

Recent trends show that central banks are becoming pivotal players in gold markets, often buying in anticipation of currency fluctuations and macroeconomic stability measures. As highlighted in a recent report by the Gold Market Analysis, their strategic accumulation can act as a bullish indicator, potentially setting the tone for retail investors. This shift not only influences short-term price movements but also signals overarching macroeconomic sentiments about gold’s role as a reserve asset. Investors who monitor these policies closely can better anticipate demand surges, particularly if geopolitical tensions escalate or fiat currencies weaken.

Harnessing Data-Driven Insights for Asset Optimization

Advanced investors leverage quantitative models and real-time market analytics to refine their gold investment tactics. Machine learning algorithms now enable pattern recognition in gold price fluctuations, revealing predictors rooted in global supply-demand dynamics and macroeconomic indicators. Integrating such data-driven tools with traditional analysis can uncover nuanced entry and exit points, particularly during volatile periods forecasted for 2025. For in-depth methodologies, consider resources like gold market analysis for 2025 that merge technical insights with fundamental trends.

If you’re eager to deepen your understanding of how emerging data techniques can revolutionize your gold strategies, exploring authoritative research and engaging with industry forums can turn theory into actionable plans—empowering you to navigate the complexities of the 2025 market landscape effectively.

} } Would you like to explore specific tools or strategies tailored for building a resilient gold portfolio? Sharing your questions or experiences can help foster a community of informed investors navigating the 2025 landscape.**

} Would you like to explore specific tools or strategies tailored for building a resilient gold portfolio? Sharing your questions or experiences can help foster a community of informed investors navigating the 2025 landscape.**

Maximize Gains with Tactical Positioning in Gold Markets

Investors seeking to optimize their gold holdings in 2025 must integrate tactical positioning strategies that respond dynamically to shifting macroeconomic signals. Rather than static allocations, a proactive stance involves deploying options hedging and short-term futures to capitalize on anticipated volatility spikes. For example, engaging in calendar spreads within gold futures can mitigate downside risk while providing upside potential during anticipated corrections or rallies. Such sophisticated maneuvers demand a nuanced understanding of derivatives and market timing, making close monitoring of global policy shifts and supply-demand indicators indispensable.

Decoding Central Bank Behaviors to Foresee Price Movements

Central bank actions often presage major market shifts, yet their motives can be complex and multifaceted. A detailed analysis involves tracking not only official gold purchase reports but also scrutinizing currency reserves adjustments, monetary policy statements, and geopolitical signals. Recent research indicates that central banks in emerging markets are increasingly accumulating gold to diversify reserve portfolios and hedge against dollar dominance, a trend documented extensively by the World Gold Council’s Central Bank Demand Report. Recognizing these signals enables investors to position ahead of broader market moves, effectively translating institutional trends into strategic advantages.

Can Sovereign Gold Reserves Signal Future Market Bullishness?

This nuanced question addresses whether rising sovereign holdings consistently precede bullish phases in gold prices. Empirical analysis by GoldCore suggests a strong correlation over multiple cycles, although causality remains complex, often intertwined with macroeconomic fragility. Sovereign accumulation often reflects geopolitical uncertainties or currency devaluations, serving as a leading indicator for retail and institutional sentiment. Investors can utilize this information by integrating sovereign reserve movements into their technical analysis framework, enhancing timing decisions for entry and exit points.

Leveraging Emerging Technologies to Elevate Investment Precision

Cutting-edge technological tools have begun transforming resource allocation strategies. Blockchain-based tracking ensures transparency in gold supply chains, reducing counterparty risks, while AI-driven sentiment analysis captures real-time market psychology shifts. Platforms integrating these innovations facilitate rapid adjustment of portfolio allocations, allowing traders to respond swiftly to geopolitical or macroeconomic shocks. For instance, deploying machine learning models trained on historical demand spikes can forecast potential surges, guiding preemptive buying or hedging strategies—turning data into actionable intelligence that shapes your 2025 investment trajectory.

Insider Expert Tips for Resilient Gold Portfolio Design

Designing a resilient portfolio involves balancing physical gold, ETFs, and mining stocks, each with unique risk profiles and liquidity characteristics. Expert investors advocate for deploying a core-satellite approach, where core holdings of physical gold anchor stability, while satellite positions in exploration stocks and derivatives capture speculative upside. Regular rebalancing aligned with macroeconomic developments, coupled with stress-testing against scenarios like inflation spikes or currency collapses, ensures adaptability. Engaging with seasoned advisors and multidisciplinary research enhances strategic foresight, allowing your gold investments to withstand unforeseen shocks.

Projected Impact of Geopolitical Developments on 2025 Gold Prices

Recent geopolitical flashpoints, such as escalating tensions in Eurasian regions and trade disputes impacting supply chains, are poised to influence gold’s trajectory significantly. A comprehensive forecast, supported by geopolitical risk assessments from institutions like the Council on Foreign Relations, indicates increased demand for safe-haven assets amidst instability. Understanding these complex risk layers helps investors align their positions proactively, ensuring exposure benefits from market turbulence rather than suffering unintended losses. Exploring detailed scenario analyses can further refine your investment blueprint, helping you anticipate and navigate the turbulent waters ahead.

Incorporating these advanced strategies and insights into your gold investment approach requires continuous education and adaptation. Stay engaged with industry reports, participate in expert forums, and consider leveraging financial tech solutions that translate macroeconomic intelligence into actionable trades. The complexities of 2025 demand nothing less than strategic expertise and vigilant execution—do you have the right tools and insights to stay ahead of the curve?

,

Why Recognizing Macro Drivers Can Supercharge Your Gold Portfolio

In the sophisticated realm of bullion investment, understanding the macroeconomic factors influencing gold demand provides an unparalleled edge. Shifts in global monetary policies, currency reserve realignments, and fiscal strategies directly affect gold’s valuation landscape. For instance, rising concerns over fiat currency devaluation often prompt central banks to diversify reserves with gold, a trend meticulously documented by the World Gold Council’s Central Bank Demand Report. Incorporating these indicators into your analytical framework enables strategic positioning ahead of market moves, optimizing risk-adjusted returns during turbulent times.

How Do Sovereign Reserves Signal Potential Bull Runs in Gold Markets?

Sovereign reserve movements are emerging as a subtle yet potent indicator of impending bullish phases. Research from GoldCore illustrates that substantial increases in national gold holdings often precede marked price ascents, reflecting geopolitical hesitations and monetary policy shifts. A nuanced grasp of these patterns allows investors to anticipate price rallies and adjust their allocations preemptively, turning macroeconomic intelligence into actionable investment advantage.

Harnessing Cutting-Edge Technologies to Pinpoint Entry and Exit Points

Emerging tech innovations are revolutionizing gold market analysis. Quantum computing models decode complex supply-demand interactions, while AI-driven sentiment analysis captures real-time geopolitical tensions impacting gold prices. Blockchain transparency reduces counterparty risks, enhancing trust in physical gold transactions. Leveraging these tools facilitates precision timing for trades, especially pertinent in the volatile outlook of 2025, where traditional technical analysis may falter amid unforeseen macro shocks.

Injecting Sophistication into Portfolio Allocation

Novice investors often undervalue the importance of a diversified yet cohesive asset mix in bullion strategies. Top-tier portfolio design involves a layered approach: physical gold provides stability, ETFs offer liquidity, and exploration stocks yield high-growth opportunities. Employing tactical rebalancing—guided by macroeconomic signals, technical indicators, and geopolitical events—can dramatically improve resilience. Regularly stress-testing asset allocations against scenarios like currency crises or inflation spikes ensures your strategy remains robust in an unpredictable global economy.

Can Innovation Catalyze Breakthroughs in Gold Investment Efficiency?

Absolutely. The integration of robotics in mining operations, for instance, has enhanced resource extraction efficiency, impacting supply dynamics. Similarly, advanced predictive analytics now forecast demand spikes with greater accuracy, allowing timely portfolio adjustments. Engaging with these technological advancements ensures your investing edge stays ahead of conventional traders still relying on rudimentary analysis, markedly improving potential gains in 2025.

The Influence of Geopolitical Tensions on Gold’s Safe-Haven Status

Protracted geopolitical conflicts and rising trade tensions tend to amplify gold’s appeal as a safe haven. Recent events in Eurasia and trade negotiations between major economies underscore this trend, as detailed by recent insights from the Foreign Policy Journal. By tracking such developments, astute investors can position their portfolios to capitalize on safe-haven inflows, often preceding visible price rallies. Recognizing the subtle signals embedded in geopolitical discourse enhances strategic responsiveness and risk mitigation.

Innovative Risk Management for Volatile Markets

Complex derivatives, such as structured notes linked to gold, are gaining traction among sophisticated investors seeking downside protection. Sophisticated algorithms, combining volatility forecasts and macroeconomic indicators, execute dynamic hedging strategies that adapt in real-time. This prudent approach buffers against unexpected price swings, ensuring that even amidst market upheavals, your portfolio retains stability and growth prospects. Partnering with experts proficient in these complex instruments can unlock a new tier of risk management sophistication.

By integrating macroeconomic intelligence, emerging technologies, and innovative asset management strategies, investors can establish a resilient, dynamic gold investment framework for 2025’s unpredictable landscape. Continual education, leveraging authoritative research, and engaging with industry pioneers are essential to stay ahead—are you prepared to evolve your approach into a strategic advantage in the gold markets of tomorrow?

,

Expert Recommendations for Navigating Gold Markets

Leverage Macro Indicators for Precise Timing

Monitoring central bank gold acquisitions, currency reserve shifts, and geopolitical tensions provides invaluable signals for optimal entry and exit points. Integrating these macro drivers into your analytical framework enables proactive positioning in volatile markets.

Adopt a Diversified Approach to Gold Assets

Blending physical gold, ETFs, and mining stocks offers a resilient portfolio capable of withstanding market shocks. Understanding the distinct risk profiles of each asset class is essential for building a balanced strategy aligned with your risk appetite.

Harness Cutting-Edge Technologies for Market Edge

Utilize AI-driven market analytics, blockchain transparency, and supply chain tracking to enhance decision-making accuracy. These tools turn macroeconomic and demand-supply insights into actionable investment moves, particularly crucial in the unpredictable landscape of 2025.

Stay Ahead with Deep Market Analysis

Regularly consult authoritative reports like the World Gold Council’s Central Bank Demand Report and comprehensive research on gold demand trends. These sources deliver advanced intelligence, sharpening your competitive edge in gold investing.

Curated Resources for Elevated Expertise

- World Gold Council Publications: In-depth research reports on supply-demand dynamics, central bank activity, and market forecasts provide a foundational knowledge base for serious investors.

- Industry Analysis Platforms like Investing.com: Real-time market data, expert commentary, and technical analysis tools support swift, informed decision-making.

- Advanced Analytical Tools: Leverage software integrating machine learning and big data to decode complex market patterns, enhancing prediction accuracy and timing precision.

- Authoritative Financial Advisors and Forums: Engage with seasoned experts through dedicated forums and advisory services to refine strategies and stay updated on emerging trends.

The Future of Gold Investment Demands Innovation and Vigilance

As we anticipate the nuanced interplay of macroeconomic factors, geopolitical developments, and technological advancements, the key to successful gold investing lies in a sophisticated, adaptive approach. Harnessing expert insights, leveraging top-tier resources, and embracing innovative analytical tools will empower you to navigate the 2025 market landscape effectively. Are you ready to elevate your gold investment strategy and share your insights with a community of forward-thinking investors? Your next move could define your financial resilience in an uncertain global economy.