Unlocking the Secrets of Gold Futures: A Strategic Approach to Consistency

Gold futures trading offers an alluring gateway to capitalize on the precious metal’s volatility, but consistent success demands more than just luck. Traders must deploy refined techniques, combining market insight with disciplined execution to navigate the nuances of gold’s price movements. In this article, we dive deep into expert strategies and lesser-known tips that elevate your gold futures trading beyond the basics, aiming for persistent profitability.

Crafting a Robust Trading Framework: The Foundation of Success

Before entering the gold futures market, establishing a clear trading framework is paramount. This includes defining your risk tolerance, position sizing, and exit strategies. For instance, employing a fixed percentage rule—risking only 1-2% of your capital per trade—helps preserve capital during inevitable drawdowns. Moreover, integrating stop-loss orders aligned with technical support levels can shield your investments from sudden market reversals.

How Can Technical Analysis Enhance Gold Futures Trading Results?

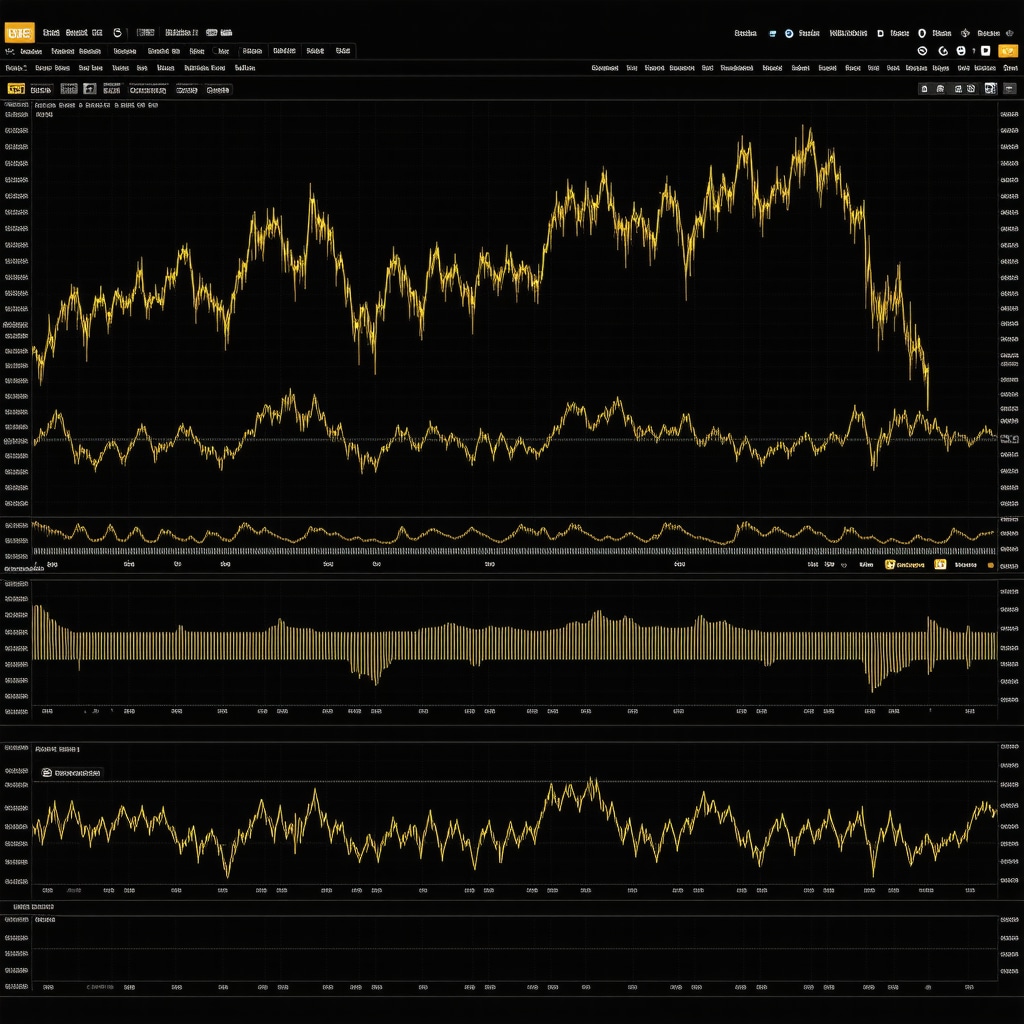

Technical analysis remains a cornerstone for gold futures traders seeking precision. Utilizing tools such as Fibonacci retracements, moving averages, and Relative Strength Index (RSI) can pinpoint entry and exit points with greater confidence. For example, a confluence of a 50-day moving average crossover with an RSI below 30 may signal a buying opportunity in oversold conditions. However, coupling technical signals with fundamental insights—like geopolitical tensions or central bank policies—further sharpens trade decisions.

Mastering Momentum and Volume: The Market’s Pulse

Momentum indicators coupled with volume analysis reveal the strength behind price movements. A surge in gold futures volume accompanying an upward price trend suggests institutional buying, which often precedes sustained rallies. Conversely, diminishing volume during price advances could warn of weakening momentum. Seasoned traders leverage these signals to avoid false breakouts and optimize entry timing.

Risk Management Beyond the Obvious: Hedging and Diversification

While stop-losses are fundamental, advanced traders explore hedging techniques to mitigate risk. For instance, pairing gold futures positions with gold ETFs or mining stocks can create a diversified exposure that balances volatility. This approach aligns with insights from authoritative sources such as the CME Group’s Futures Education, which emphasizes comprehensive risk strategies for futures markets.

Behavioral Discipline: The Trader’s Edge in High-Stakes Markets

Consistent winning also hinges on psychological resilience. Avoiding emotional decisions—like chasing losses or overleveraging—requires strict adherence to your trading plan. Journaling trades and reviewing outcomes systematically can reveal behavioral patterns that undermine profitability, enabling corrective action.

For traders eager to deepen their expertise, exploring a step-by-step guide to gold trading strategies offers structured insights that complement these pro tips.

Have you implemented any of these advanced gold futures trading techniques? Share your experiences and join the conversation to refine your approach!

Incorporating Macro-Economic Indicators for Strategic Advantage

Beyond chart patterns and volume spikes, gold futures traders who integrate macro-economic indicators often gain a competitive edge. Factors such as interest rate changes, inflation data, and currency fluctuations directly influence gold’s appeal as a safe haven. For example, rising inflation typically boosts gold prices as investors seek to preserve purchasing power. Monitoring Federal Reserve announcements or global economic shifts helps anticipate market sentiment, enabling more informed entry and exit timing.

This macro perspective complements technical analysis and is vital in volatile environments where fundamental dynamics drive price swings.

Leveraging Algorithmic Tools: When Technology Meets Expertise

Advanced traders increasingly adopt algorithmic tools and machine learning models to analyze vast datasets and detect subtle trading signals. Automated systems can execute trades at optimal speeds, reducing emotional biases and capitalizing on fleeting opportunities. However, successful integration requires a robust understanding of both programming and market mechanics to avoid overfitting or misinterpretation of data.

Combining algorithmic insights with human discretion fosters a balanced approach, enhancing consistency in gold futures trading.

What Role Do Seasonal Patterns Play in Gold Futures Profitability?

Seasonal trends in gold prices, driven by factors such as jewelry demand during festivals or fiscal year-end portfolio adjustments, present recurring opportunities. Historical data reveals that certain months or quarters tend to exhibit increased volatility or directional bias. For instance, gold prices often experience rallies in the first quarter due to increased demand in Asian markets.

Integrating seasonal analysis with technical and fundamental factors can refine trade setups and timing.

Understanding the Impact of Geopolitical Risks on Gold Futures

Geopolitical tensions frequently drive gold prices higher, as investors flock to its perceived safety. Events like conflicts, trade disputes, or unexpected policy shifts can trigger rapid price movements. Traders who stay abreast of global news and assess risk levels can position themselves advantageously.

Maintaining flexibility and adjusting stop-loss levels based on evolving geopolitical landscapes reduces exposure to sudden shocks.

Exploring Diversification Within Precious Metals: Beyond Gold Futures

While gold futures offer direct exposure to gold price movements, diversification into related assets such as silver futures, platinum, or precious metals ETFs can mitigate risks. This approach spreads volatility and taps into correlated but distinct market drivers.

For investors seeking balanced portfolios, exploring how to build a balanced portfolio with gold stocks and ETFs provides valuable guidance.

According to the CME Group’s Futures Education, understanding the interplay between different commodities enhances risk-adjusted returns in futures trading.

Interested in refining your gold futures trading strategy with these advanced insights? Share your questions or experiences below, and explore more expert strategies to elevate your trading journey!

Harnessing Market Sentiment Analysis: Decoding the Crowd for Enhanced Gold Futures Accuracy

While technical and fundamental analyses form the backbone of gold futures trading, incorporating market sentiment analysis offers a sophisticated layer of insight. Sentiment indicators, derived from sources such as Commitment of Traders (COT) reports, social media analytics, and options market data, reveal collective trader psychology that often precedes price reversals or trend continuations. For example, an extreme bullish reading in the COT report could signal an overextended market vulnerable to corrections, while a surge in negative sentiment on social platforms might indicate a contrarian buying opportunity.

Advanced traders leverage sentiment alongside price action to refine entry and exit points, blending quantitative data with qualitative nuances. This hybrid approach mitigates common pitfalls like herd mentality and emotional bias, yielding more consistent trade outcomes.

How Can Adaptive Position Sizing Based on Volatility Improve Gold Futures Risk Management?

Traditional fixed position sizing can expose traders to disproportionate risk during periods of heightened volatility. Adaptive position sizing dynamically adjusts trade size in response to current market volatility measures, such as Average True Range (ATR) or historical volatility indices. When volatility spikes, reducing position size preserves capital and limits downside risk; conversely, in calmer markets, increasing size can enhance profit potential without excessive risk.

Implementing an ATR-based position sizing model requires calculating the ATR over a relevant timeframe and scaling position sizes inversely proportional to volatility. This technique aligns risk exposure more precisely with prevailing market conditions and is endorsed in advanced trading literature, including NYU Stern’s guide on volatility-adjusted position sizing.

Integrating Machine Learning for Predictive Gold Price Modeling: Opportunities and Caveats

Machine learning (ML) algorithms offer powerful capabilities for modeling complex, non-linear relationships inherent in gold price movements. Techniques such as Random Forests, Support Vector Machines, and Long Short-Term Memory (LSTM) networks can ingest diverse inputs—ranging from macroeconomic indicators to sentiment metrics—to forecast price trends or volatility regimes.

However, the efficacy of ML models hinges on meticulous data preprocessing, feature engineering, and validation to avoid pitfalls like overfitting or spurious correlations. Moreover, the dynamic nature of financial markets demands continuous model retraining and performance monitoring.

Coupling ML-generated signals with expert domain knowledge and risk controls fosters a robust framework that leverages technology without succumbing to its limitations.

Exploiting Options Market Data: Volatility Skew and Implied Volatility as Strategic Tools

The options market for gold futures offers a treasure trove of information about trader expectations and risk perceptions. Key metrics like implied volatility (IV) and volatility skew provide clues about anticipated price movement magnitude and directional bias.

For instance, a steep volatility skew indicating higher premiums for out-of-the-money puts versus calls may reflect heightened downside fear, suggesting a cautious stance. Traders who monitor changes in IV can anticipate volatility expansions that often precede sharp price moves, allowing preemptive positioning.

Integrating options data analysis with futures trading strategies enhances situational awareness and the ability to capitalize on nuanced market dynamics.

What Are the Best Practices for Combining Sentiment, Technical, and Volatility Indicators in a Cohesive Gold Futures Strategy?

Developing a multifaceted strategy requires harmonizing diverse data streams without overcomplication. Best practices include:

- Signal Confirmation: Use sentiment indicators to validate technical patterns before committing capital.

- Dynamic Risk Adjustment: Employ volatility measures to modulate position sizes and stop-loss levels.

- Continuous Backtesting: Regularly test combined indicators against historical data to refine parameter settings.

- Automation with Oversight: Leverage algorithmic execution for consistency but maintain discretionary controls for unexpected market events.

This integrative methodology fosters a disciplined yet adaptable trading approach, essential for thriving in gold futures markets.

For traders committed to pushing their expertise further, exploring advanced sentiment analytics tools and volatility-based money management systems can be transformative. Dive deeper into these concepts with specialized literature and real-world case studies to elevate your trading precision.

Synergizing Diverse Data Streams: Crafting a Holistic Gold Futures Blueprint

Elevating gold futures trading to a consistently profitable level necessitates the seamless integration of multifarious data sources. This amalgamation transcends mere technical charting or fundamental analysis, embracing a sophisticated tapestry of sentiment metrics, volatility indices, and machine learning insights. By weaving these strands into a cohesive strategy, traders can navigate the market’s intricate rhythms with heightened acuity and adaptive precision.

How Can Traders Effectively Synthesize Sentiment, Technical, and Volatility Indicators to Optimize Gold Futures Performance?

Addressing this complex question involves deploying a multi-layered approach:

- Sentiment as a Compass: Utilize Commitment of Traders (COT) reports and social sentiment analytics to gauge prevailing market psychology, identifying potential overbought or oversold extremes.

- Technical Patterns as the Framework: Confirm entries and exits through robust technical signals such as moving average crossovers, Fibonacci retracements, and momentum oscillators.

- Volatility for Dynamic Risk Control: Implement adaptive position sizing and stop-loss adjustments based on metrics like Average True Range (ATR) and implied volatility from options markets.

- Continuous Feedback Loop: Employ rigorous backtesting and forward-testing methodologies to validate the interplay of indicators, ensuring the strategy remains resilient amid evolving market conditions.

This integrative protocol mitigates the pitfalls of relying on isolated indicators, fostering a nuanced comprehension of gold’s multifactorial price drivers.

Harnessing Cutting-Edge Machine Learning Models for Predictive Precision

Recent advances in algorithmic modeling empower traders to unravel the complex, non-linear dynamics governing gold futures. Techniques such as Long Short-Term Memory (LSTM) networks and ensemble methods like Random Forests offer predictive capabilities that surpass traditional statistical models, capturing latent patterns from heterogeneous datasets.

However, the efficacy of these models is contingent upon meticulous feature engineering and vigilant overfitting prevention. Incorporating domain expertise remains indispensable, as blind reliance on machine outputs can precipitate costly misjudgments.

Volatility Skew and Options-Derived Insights: Unlocking Hidden Market Sentiments

Options market data provides a nuanced lens into trader expectations and risk appetites. Analyzing volatility skew—disparities in implied volatility between calls and puts—can reveal directional biases and anticipated price shock probabilities. For example, a pronounced skew favoring puts often signals underlying unease, inviting contrarian or protective positioning.

Incorporating these insights into futures strategies enables traders to anticipate volatility expansions and adjust their tactical approaches accordingly.

Expert Recommendations Backed by Reputable Research

According to a comprehensive study by the CFA Institute, integrating technical, fundamental, and sentiment analyses significantly enhances forecasting accuracy and reduces drawdown risk. Their findings endorse a balanced methodology that leverages the strengths of each analytical domain while acknowledging their inherent limitations.

Call to Action: Amplify Your Trading Edge with a Multifaceted Approach

Embracing an advanced, integrative gold futures strategy is not merely an academic exercise but a pragmatic pathway to sustained profitability. We invite seasoned traders to experiment with combining sentiment analytics, volatility-adaptive position sizing, and machine learning tools within their existing frameworks. Share your experiences or challenges encountered while implementing these techniques to foster a vibrant community of expert practitioners driving the evolution of gold futures trading.

Frequently Asked Questions (FAQ)

What are the key risk management techniques specific to gold futures trading?

Effective risk management in gold futures includes setting disciplined stop-loss orders aligned with technical support levels, employing adaptive position sizing based on volatility metrics like Average True Range (ATR), and diversifying exposure across related assets such as gold ETFs and mining stocks. Additionally, advanced hedging strategies that combine futures with options or correlated instruments can further reduce downside risk.

How does integrating macro-economic indicators improve gold futures trading decisions?

Macro-economic indicators such as inflation rates, interest rate announcements, and currency fluctuations directly influence gold’s safe-haven appeal and price dynamics. Traders who monitor these data points can anticipate trend shifts or volatility spikes, supplementing technical signals with fundamental insights to optimize entry and exit timing.

Can machine learning models reliably forecast gold price movements?

Machine learning models, including LSTM networks and ensemble methods like Random Forests, can capture complex, non-linear patterns in gold price data by integrating diverse inputs such as macroeconomic variables and sentiment metrics. However, their reliability depends on rigorous data preprocessing, ongoing validation, and incorporating domain expertise to prevent overfitting and misinterpretation.

What role does market sentiment analysis play in refining gold futures strategies?

Market sentiment analysis, derived from Commitment of Traders (COT) reports, social media analytics, and options market data, reveals collective trader psychology. Recognizing extremes in bullishness or bearishness helps traders identify potential reversals or trend continuations, enabling more timely and informed trade decisions when combined with technical and volatility indicators.

How can options market data enhance gold futures trading?

Options data provides insights into implied volatility and volatility skew, reflecting market expectations and risk appetite. For example, a pronounced skew favoring puts may indicate downside concerns. Incorporating these signals allows traders to anticipate volatility expansions and adjust position sizing or protective stops accordingly.

What are the best practices for combining different analytical approaches in gold futures trading?

Best practices involve confirming trade signals across sentiment, technical, and volatility indicators; dynamically adjusting risk exposure based on real-time volatility; conducting continuous backtesting to validate strategy robustness; and automating execution while maintaining discretionary oversight to handle unexpected market conditions.

How do seasonal patterns affect gold futures profitability?

Seasonal trends, driven by factors like festival demand or fiscal year-end portfolio rebalancing, create recurring periods of increased volatility or directional bias. Recognizing these patterns allows traders to anticipate favorable trading windows and align strategies with historical price behaviors.

What psychological factors should traders manage for consistent success in gold futures?

Traders must cultivate emotional discipline, avoiding impulsive decisions such as chasing losses or overleveraging. Maintaining a detailed trading journal and systematically reviewing performance helps identify detrimental behavioral patterns, supporting continuous improvement and resilience in volatile markets.

Is diversification within precious metals advisable alongside gold futures trading?

Yes, diversification into related precious metals like silver, platinum, or ETFs can mitigate volatility and exploit correlated but distinct market drivers. This approach enhances portfolio resilience and can improve risk-adjusted returns when combined with gold futures positions.

How can adaptive position sizing improve risk control in varying market conditions?

Adaptive position sizing adjusts trade sizes in response to current market volatility, reducing exposure during turbulent periods and increasing it when markets are calmer. This dynamic approach aligns risk more precisely with prevailing conditions, preserving capital and optimizing profit potential.

Trusted External Sources

- CME Group Futures Education – Provides authoritative, practical insights into futures trading mechanics, risk management strategies, and market structure essential for gold futures traders.

- CFA Institute Research – Offers rigorous academic and practitioner research on integrating technical, fundamental, and sentiment analysis to enhance forecasting accuracy and manage drawdowns.

- NYU Stern School of Business – ATR-Based Position Sizing Guide – A detailed resource explaining volatility-adjusted position sizing methods that improve risk management in futures trading.

- Commitment of Traders (COT) Reports – Published by the Commodity Futures Trading Commission (CFTC), these reports provide critical data on trader positioning and sentiment in gold futures markets.

- Specialized Financial Journals on Machine Learning in Finance – Peer-reviewed publications highlighting advances, challenges, and best practices in applying machine learning for predictive modeling in commodity markets.

Conclusion

Mastering gold futures trading requires a sophisticated, multifaceted approach that transcends simple technical analysis. By harmonizing macro-economic awareness, behavioral discipline, sentiment analytics, adaptive risk management, and cutting-edge machine learning tools, traders can enhance consistency and profitability in this dynamic market. Leveraging options market insights and seasonal patterns further refines timing and positioning. Ultimately, the integration of diverse data streams into a coherent and adaptable strategy empowers traders to navigate gold’s complex price drivers with confidence and precision.

We encourage you to apply these expert strategies, share your experiences, and engage with the community to continuously evolve your gold futures trading proficiency. Explore our related expert content to deepen your knowledge and stay ahead in the ever-changing precious metals landscape.

The emphasis on crafting a robust trading framework really resonates with me. Early in my trading journey, I underestimated how critical it was to strictly define risk tolerance and position sizing before diving into the fast-paced gold futures market. Applying a fixed percentage rule for risk per trade helped me avoid significant drawdowns, which is something every trader should seriously consider. I also found combining technical analysis tools like the 50-day moving average with RSI provided better timing for entries and exits, rather than relying on just one indicator. However, integrating fundamental insights, especially geopolitical developments, brought an extra layer of precision that pure technical setups sometimes lacked. What I’m curious about is how other traders balance the sometimes conflicting signals between fundamental and technical data? Has anyone found a consistent method to weigh these inputs effectively, especially during periods of heightened market volatility? Also, the behavioral discipline topic can’t be overstated — journaling trades exposed my emotional biases more than I expected. I’d love to hear how others maintain psychological resilience when faced with sudden market shocks or unexpected losses.