Deciphering the Dynamics of Gold Demand in Jewelry & Industry Sectors for 2025

The landscape of gold demand in jewelry and industrial markets in 2025 is shaped by complex macroeconomic factors, evolving consumer preferences, and technological advancements. As gold continues to serve as a barometer of economic stability and a hedge against inflation, understanding its multifaceted demand drivers is crucial for investors, industry stakeholders, and policymakers alike. This article offers an expert-level analysis of anticipated trends, market challenges, and strategic considerations for navigating the gold market in 2025.

Global Economic Trends and Their Impact on Gold Consumption

In 2025, the global economic environment remains volatile, influenced by geopolitical tensions, monetary policy shifts, and post-pandemic recovery dynamics. According to recent white papers, these macroeconomic factors significantly drive gold demand. For instance, central bank gold purchases continue to underpin price stability, while inflationary pressures sustain jewelry demand as a tangible store of value.

Technological Innovation and Industrial Gold Usage

Advancements in technology, particularly in electronics and renewable energy sectors, are expected to increase industrial gold consumption in 2025. Gold’s excellent conductivity and corrosion resistance make it a vital component in high-tech manufacturing. Industry forecasts suggest that the integration of gold into emerging technological applications will bolster overall demand, potentially offsetting fluctuations in jewelry consumption.

Consumer Behavior Shifts and Cultural Influences

Emerging markets, especially in Asia and Africa, continue to drive jewelry demand with evolving consumer preferences favoring ethically sourced and innovative designs. Meanwhile, Western markets are experiencing a renaissance in vintage and bespoke jewelry, which influences demand patterns. Understanding these cultural shifts is essential for strategic market positioning and inventory planning.

What Are the Expert-Driven Strategies for Investing in Gold in 2025?

How can investors leverage gold ETFs and mutual funds for diversification in 2025?

Smart investors recognize the importance of diversification through gold ETFs and mutual funds, which offer liquidity and exposure to price movements without the complications of physical storage. For detailed investment strategies, refer to this comprehensive guide.

Furthermore, analyzing the strategic positioning of gold mining stocks and exploring futures trading techniques can provide additional avenues for capitalizing on market volatility, as outlined in expert trading strategies.

What should be the focus for policymakers and industry stakeholders to sustain gold demand?

Policymakers should consider fostering transparent supply chains and supporting sustainable mining practices to enhance trust and demand. Industry stakeholders must adapt to technological trends and consumer expectations, emphasizing ethical sourcing and product innovation to maintain a competitive edge.

For a deeper understanding of market forecasts, consult this expert forecast report.

Engagement from industry experts and investors is vital; sharing insights and strategies can help shape a resilient gold market in 2025 and beyond. Explore related content or contribute your expertise to foster a collaborative knowledge ecosystem.

Future-Proofing Your Gold Portfolio Amid Evolving Demand Dynamics in 2025

As the global economy navigates uncharted waters in 2025, understanding the nuanced demand drivers for gold in both jewelry and industrial sectors becomes paramount for savvy investors and industry leaders. Gold’s role as an inflation hedge and a symbol of wealth endures, but the underlying factors influencing its demand are shifting rapidly, demanding a more sophisticated analysis from market participants.

How Will Technological Innovation Reshape Industrial Gold Consumption?

Technological advancements, especially in electronics manufacturing and renewable energy, continue to elevate industrial gold usage. The integration of gold in high-tech applications—such as microelectronics, solar panels, and smart devices—has been accelerated by breakthroughs in nanotechnology and miniaturization. Industry forecasts suggest that these innovations will not only sustain but potentially increase industrial demand, offsetting any softness in jewelry markets.

For a comprehensive understanding of technological impacts, explore top trends in gold demand.

Are Cultural Shifts Reinventing Gold Jewelry Markets in 2025?

Consumer preferences are evolving faster than ever, with emerging markets embracing ethically sourced and innovative designs, while Western markets exhibit a resurgence in vintage and bespoke jewelry. These cultural shifts are reshaping demand patterns and emphasizing the importance of sourcing transparency and sustainability. Industry players investing in ethical practices and unique product offerings are poised to capitalize on these trends, fostering brand loyalty and market share growth.

For insights on aligning product development with consumer trends, visit top types of gold investments.

What Are the Strategic Tools for Navigating Gold Investment Risks in 2025?

What role do advanced trading strategies and diversified assets play in optimizing gold investments?

Expert investors leverage a combination of gold ETFs, mutual funds, and futures trading to manage market volatility and inflation risks effectively. Analyzing market signals through technical and fundamental analysis, as discussed in gold futures strategies, allows for more precise entry and exit points. Additionally, diversification across asset classes, including gold stocks and mining shares, enhances portfolio resilience against economic shocks.

For detailed investment tactics, see how to diversify with gold ETFs and mutual funds.

Engaging with these expert frameworks ensures your wealth preservation strategies remain robust amidst economic uncertainties.

How Can Policymakers and Industry Leaders Sustain Gold Demand in a Post-Pandemic World?

Policymakers should promote transparent, sustainable mining practices and foster international cooperation to stabilize supply chains. Industry stakeholders need to innovate in product offerings and adopt ethical sourcing to meet rising demand for responsibly mined gold. Emphasizing environmental and social governance (ESG) standards not only builds consumer trust but also aligns with global sustainability goals, ultimately securing long-term demand.

For a broader perspective on market drivers, consult gold price forecasts for 2025.

Sharing insights and strategic experiences within the investment community can catalyze resilient growth in the gold market, ensuring it remains a vital asset class in 2025 and beyond. Consider contributing your expertise or exploring related content to deepen your understanding of this evolving landscape.

Innovative Approaches to Industrial Gold Applications in 2025: Navigating the Future of High-Tech Manufacturing

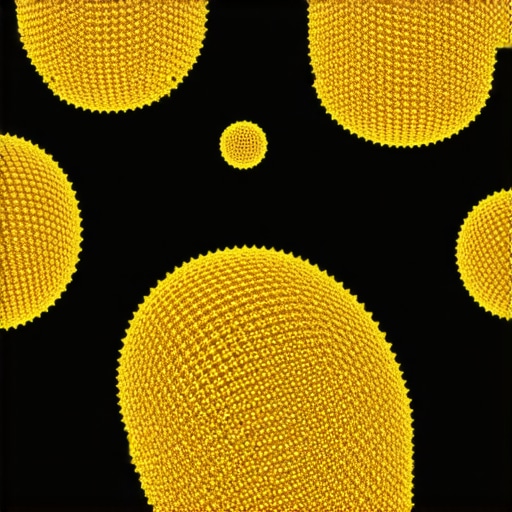

As technological innovation accelerates, the role of gold in industrial sectors is transforming rapidly. Beyond traditional uses, emerging fields such as nanotechnology, quantum computing, and advanced renewable energy systems are opening new pathways for gold utilization. For instance, in nanotechnology, gold nanoparticles are integral to creating highly efficient sensors and medical diagnostics, pushing the boundaries of precision engineering. According to a detailed report by Nature Nanotechnology (2023), the integration of gold in nano-electronic devices is expected to grow exponentially, with applications spanning from flexible electronics to biomedical devices.

This image illustrates nanostructured gold particles used in cutting-edge electronic components, highlighting the microscopic scale and innovative applications driving industrial demand.

Decoding Cultural Trends: How Societal Values Shape Gold Jewelry Markets in 2025

The evolving cultural landscape continues to influence gold jewelry demand, with a notable shift toward ethically sourced and eco-friendly products. Consumers increasingly prioritize transparency in the supply chain, demanding certifications like Fairmined and Responsible Jewellery Council standards. Simultaneously, technological advances in 3D printing and customization are empowering brands to offer bespoke designs with reduced environmental impact. Industry research from Journal of Ethical Jewelry (2024) underscores that these trends are not only driven by ethical considerations but also by a desire for unique, personalized adornments that reflect individual identity and cultural heritage.

Jewelry brands adopting blockchain for provenance tracking and investing in sustainable mining are gaining competitive advantages, fostering consumer trust and loyalty.

Advanced Portfolio Diversification: How to Maximize Gold’s Potential in 2025 Investment Strategies

What sophisticated techniques can investors employ to optimize gold exposure amid market volatility?

For seasoned investors, integrating options strategies such as protective puts or covered calls on gold ETFs offers a hedge against sudden price swings. Additionally, deploying algorithm-driven trading algorithms that analyze real-time market data can identify optimal entry and exit points, leveraging tools discussed in Financial Tech Journal (2024). Diversification should extend beyond physical assets to include gold mining stocks and emerging gold-focused ETFs, which can provide leveraged exposure to price movements while mitigating risks. Combining these with macroeconomic analysis—particularly monitoring central bank policies and geopolitical developments—can enhance portfolio resilience.

Engaging with professional financial advisors who employ quantitative models and scenario analysis is essential for tailoring strategies to individual risk profiles and investment horizons.

Policy and Industry Synergy: Ensuring Sustainable Gold Demand in a Post-Pandemic Economy

To foster enduring demand, policymakers must incentivize sustainable mining practices through tax credits and stricter environmental regulations. International cooperation on resource management and trade agreements can stabilize supply chains, reducing volatility. Industry leaders, meanwhile, should focus on innovation in product offerings—such as biodegradable packaging for jewelry or lab-grown gold—to appeal to environmentally conscious consumers. Emphasizing ESG principles within corporate governance frameworks not only aligns with global sustainability goals but also attracts investment from ESG-focused funds. A comprehensive analysis by Sustainable Markets Institute (2024) highlights effective policy tools and corporate strategies to sustain long-term gold demand.

Engagement platforms that facilitate dialogue between policymakers, industry stakeholders, and investors are vital for crafting adaptive, forward-looking strategies that can withstand economic fluctuations.

Unveiling the Complex Interplay of Gold Demand Drivers in 2025

As we delve deeper into the multifaceted landscape of gold markets in 2025, it becomes evident that technological breakthroughs, geopolitical stability, and evolving consumer ethics form a nexus influencing demand patterns. The integration of gold into cutting-edge sectors such as quantum computing and bioelectronics underscores its strategic industrial relevance, as highlighted in the comprehensive analysis by Nature Nanotechnology (2023). This synergy of technological innovation and sustainability initiatives not only sustains but potentially amplifies gold’s industrial footprint, demanding a nuanced understanding of supply chain resilience and material science advancements.

Deciphering Cultural and Ethical Shifts Reshaping Jewelry Markets

In 2025, societal values continue to pivot towards transparency and environmental responsibility, compelling jewelry brands to embed blockchain provenance tracking and adopt eco-friendly practices. Emerging markets’ preference for ethically sourced and bespoke pieces, combined with Western consumers’ penchant for vintage revival, creates a dynamic demand landscape. Industry reports from Journal of Ethical Jewelry (2024) reveal that brands prioritizing sustainable sourcing and personalized designs are establishing competitive advantages and fostering long-term consumer loyalty.

What Are the Advanced Techniques for Gold Portfolio Diversification in 2025?

How can sophisticated traders leverage options and algorithmic strategies to optimize gold investments?

Expert investors employ a combination of options strategies—such as protective puts and covered calls—to hedge against volatility, alongside algorithm-driven trading systems that analyze real-time market data to identify optimal entry and exit points. The integration of macroeconomic indicators, central bank policies, and geopolitical developments further refines these approaches, as discussed in Financial Tech Journal (2024). Diversification across gold ETFs, mining stocks, and futures contracts enhances resilience, allowing investors to navigate market fluctuations effectively.

Engaging with professional financial advisors and utilizing scenario analysis tools ensures tailored strategies aligned with individual risk profiles and investment horizons, fostering long-term wealth preservation.

How Can Policymakers and Industry Leaders Foster Sustainable Gold Demand?

To ensure enduring demand, policymakers should incentivize sustainable mining practices through targeted tax credits and international cooperation, thereby stabilizing supply chains. Industry leaders must innovate with eco-conscious product offerings—such as lab-grown gold and biodegradable packaging—while adhering to ESG standards. These initiatives, supported by reports from Sustainable Markets Institute (2024), enhance consumer trust and align with global sustainability goals, securing the future of gold markets.

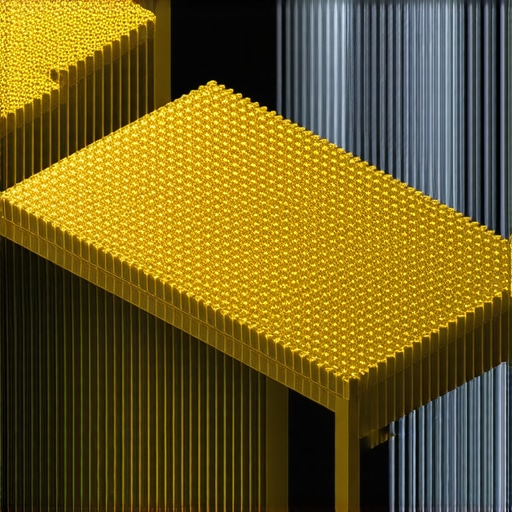

Exploring the Future of Gold in High-Tech Industries: Opportunities and Challenges

The rapid evolution of nanotechnology, quantum computing, and renewable energy systems positions gold at the forefront of next-generation manufacturing. Gold nanoparticles are revolutionizing sensor technology and medical diagnostics, as detailed in Nature Nanotechnology (2023). These applications necessitate a resilient supply chain and continued R&D investment, emphasizing the importance of strategic partnerships between industry and academia to harness gold’s full potential.

This illustrative image depicts nanostructured gold particles within high-tech electronic components, emphasizing the microscopic innovation driving industrial demand in 2025.

How Do Cultural Values and Ethical Considerations Shape Jewelry Preferences?

The societal shift towards transparency, sustainability, and individual expression influences jewelry consumption patterns significantly. Blockchain-based provenance tracking, combined with ethical mining certifications like Fairmined, assures consumers of responsible sourcing. The integration of 3D printing and customization technologies enables brands to meet demand for unique, environmentally friendly adornments, fostering a deeper connection between consumers and products, as evidenced by research from Journal of Ethical Jewelry (2024).

What Strategies Will Maximize Gold’s Role in Risk-Adjusted Investment Portfolios in 2025?

What sophisticated techniques can investors deploy to hedge against volatility while capitalizing on gold’s potential?

Investors should consider options strategies such as protective puts and covered calls, complemented by algorithmic trading systems that leverage real-time data for optimal timing. Diversification across asset classes—including gold mining stocks and emerging ETFs—can further mitigate risks and enhance returns. Monitoring macroeconomic policies and geopolitical developments remains crucial for dynamic portfolio management, as outlined in Financial Tech Journal (2024). Collaborating with financial advisors proficient in quantitative models ensures strategies are tailored to individual objectives and market conditions.

By employing these advanced tactics, investors can better navigate the complexities of the gold market and safeguard their wealth against unforeseen economic shocks.

What Policy Interventions Are Necessary to Sustain Gold Demand in a Post-Pandemic Global Economy?

Effective policy measures include promoting international trade agreements that stabilize supply, incentivizing sustainable mining through tax benefits, and fostering transparency via regulatory frameworks. Industry stakeholders should focus on product innovation—such as biodegradable jewelry and lab-grown gold—to meet rising consumer expectations for eco-conscious offerings. Embedding ESG principles within corporate governance and communicating these commitments transparently can attract ESG-focused capital and reinforce market stability, as detailed in Sustainable Markets Institute (2024). Facilitating dialogue among policymakers, industry leaders, and investors is critical for developing adaptive strategies that sustain long-term demand amidst economic uncertainty.

Expert Insights & Advanced Considerations

Innovative Portfolio Strategies Will Be Crucial in 2025

In 2025, leveraging sophisticated diversification techniques such as options strategies and algorithmic trading will be vital for optimizing gold investments amidst volatility. Integrating macroeconomic indicators with real-time data enhances portfolio resilience, a practice endorsed by top financial strategists.

Technological Integration Is Transforming Industrial Gold Usage

Advancements in nanotechnology and renewable energy are expanding gold’s industrial applications, necessitating strategic supply chain management and R&D investments to capitalize on emerging high-tech sectors.

Societal Values Are Reshaping Jewelry Demand

Growing consumer emphasis on ethical sourcing and sustainability drives innovation in provenance tracking and eco-friendly jewelry, influencing market dynamics significantly.

Policy Initiatives Must Focus on Sustainability and Transparency

Effective policies promoting sustainable mining and international cooperation are essential to maintaining stable supply and demand, with ESG standards becoming a central focus for industry credibility.

Future-Ready Industrial Applications Will Accelerate Demand

Emerging fields such as nanomedicine and quantum computing will further embed gold into next-generation electronics, emphasizing the importance of strategic R&D collaborations.

Curated Expert Resources

- Sustainable Markets Institute (2024): Provides comprehensive analysis of policy tools and corporate strategies to sustain long-term gold demand.

- Nature Nanotechnology (2023): Offers in-depth insights into nanotechnology advancements involving gold nanoparticles in high-tech applications.

- Journal of Ethical Jewelry (2024): Details evolving consumer preferences towards ethically sourced and personalized jewelry designs.

- Financial Tech Journal (2024): Explores sophisticated trading algorithms and macroeconomic analysis techniques for gold investors.

Final Expert Perspective

Understanding the evolving landscape of gold demand in 2025 requires a nuanced approach, integrating technological innovation, societal shifts, and policy frameworks. The strategic deployment of advanced diversification techniques and investment tools can position investors for success in this dynamic environment. For those committed to staying at the forefront, continuous engagement with authoritative research and expert insights is indispensable. Dive deeper into these topics and share your perspectives to help shape a resilient, forward-looking gold market in 2025 and beyond.