Rethinking Gold Acquisition Strategies Amid Fluctuating Premiums

The dynamics of gold premiums, especially concerning physical gold like coins and bars, have become a critical focal point for investors seeking to optimize portfolio diversification and hedge against economic uncertainties. As we approach 2026, understanding the nuances of gold demand trends and their impact on premiums is essential for sophisticated investors aiming to navigate the complex landscape of precious metal markets effectively.

Deciphering the Shift Toward Gold Bars Over Coins

Traditionally, gold coins have enjoyed popularity among retail investors due to their liquidity, recognition, and portability. However, recent market analysis indicates a paradigm shift where physical gold bars are emerging as a more strategic choice, driven by several factors including lower premiums, better purity standards, and cultivating institutional acceptance. The key lies in analyzing hidden advantages of gold bars that are compelling investors to reconsider their allocations.

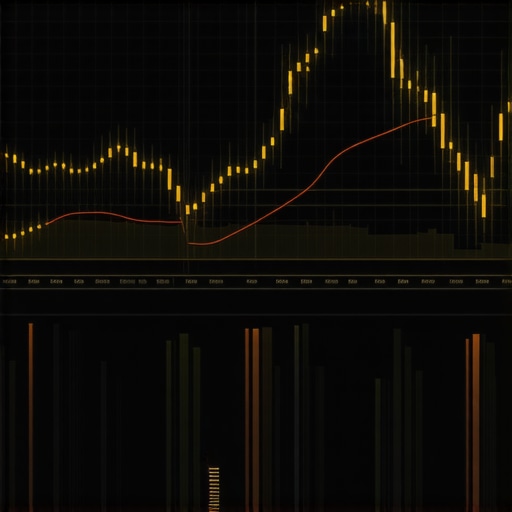

Market Trends and Premium Oscillations: A Deep Dive

The premium on physical gold is influenced by a confluence of supply-demand mechanics, geopolitical tensions, and macroeconomic policies. As central banks and global institutions alter their reserve compositions—highlighted in recent central bank gold reserve reports—the premiums fluctuate accordingly. Elevated premiums for coins often reflect limited supply, manufacturing costs, and numismatic value, whereas bars benefit from standardized production, resulting in more predictable premiums and lower overall costs for investors.

Financial Implications for Strategic Portfolio Diversification

In the context of gold as a hedge against inflation, currency devaluation, and economic downturns, selecting the optimal form of physical gold becomes crucial. Gold bars, with their cost-efficiency and fungibility, complement diversified investment strategies—especially when incorporated into IRAs or held as part of wealth preservation plans. Furthermore, a detailed understanding of gold investment strategies for 2025 enhances decision-making processes amidst evolving market conditions.

What Makes Gold Bar Premiums a Strategic Indicator for 2026?

Are Today’s Premium Oscillations Signaling Long-term Supply Chain Changes?

Investors and analysts are increasingly questioning whether current premium swings are merely cyclical or indicative of deeper shifts in global supply chains, mining outputs, and geopolitical influences. The role of gold demand trends analysis suggests a complex interplay between supply disruptions and rising institutional demand, foretelling a potential shift in premium standards over the coming years.

For those committed to refining their gold acquisition tactics, engaging with expert content and contributing insights about market observations can foster more resilient investment frameworks. Explore advanced strategies at best gold IRA options or delve into robust diversification through gold ETFs and mining stocks, aligning with long-term wealth preservation goals.

Unlocking the Secrets Behind Gold Premium Fluctuations

In the realm of precious metals, understanding the subtle shifts in gold premiums is vital for investors aiming to optimize their portfolios amidst volatile markets. Premiums, which reflect the difference between the spot price of gold and the actual purchase cost, are influenced by myriad factors including regional demand, geopolitical tensions, and production logistics. As the market landscape evolves toward 2026, savvy investors are paying close attention to how these indicators signal underlying systemic changes that could redefine investment strategies.

Data-Driven Analysis of Supply Chain Resilience

Emerging research indicates that supply chain disruptions significantly impact gold premiums, especially for coins which often face bottlenecks due to manufacturing complexities. Analyzing gold demand trends offers insights into how regional shortages or surges in industrial and retail demand influence premium oscillations. Notably, the shift towards standardized, large-scale bullion bars provides a more predictable premium environment, allowing investors to plan with greater confidence.

Are Retail Investors Convinced of Bars’ Superiority?

The transition from coins to bars among retail investors is supported by factors such as lower premiums, ease of storage, and higher purity standards. Yet, misconceptions persist about liquidity and recognized branding, which could hinder broader adoption. Advanced investors recognize that integrating gold bars into diversified holdings—particularly through trusted gold IRA plans—can serve as an effective hedging mechanism, especially in turbulent times.

Leveraging Premium As a Market Sentiment Barometer

Precious metal premiums serve as real-time indicators of market sentiment. Sudden spikes often coincide with geopolitical unrest or supply chain stress, revealing investor confidence levels and risk appetite. For example, a notable increase in coin premiums might suggest a flight to perceived safety or a shortage driven by regional policy restrictions. Conversely, stable or declining premiums on bars hint at increased supply chain resilience and institutional confidence in the physical gold market.

How Can Investors Use Premium Shifts to Anticipate Market Turning Points?

By leveraging sophisticated analytical tools and keeping abreast of gold price forecasts, traders can detect early signals of potential price rebounds or downturns. Monitoring premium oscillations in conjunction with macroeconomic indicators and geopolitical developments provides a comprehensive approach to timing entry and exit points, ultimately enhancing profit margins and safeguarding wealth.

For practical strategies aligned with evolving market realities, explore expert guidance at expert strategies for gold investments. Sharing insights and engaging in community discussions around these trends can bolster your comprehension of premium dynamics and refine your investment tactics.

Strategic Gold Acquisition in a Volatile Market Environment

Investors aiming to optimize their physical gold holdings must scrutinize not only prices but also the nuanced shifts in premiums that serve as vital market signals. Analyzing premium fluctuations over time reveals underlying economic currents, including supply chain robustness, geopolitical stability, and institutional demand pressures, which collectively shape future price trajectories. Mastering this granular level of market intelligence enables more precise timing and allocation strategies, elevating an investor’s capability to navigate turbulent times effectively.

Impact of Geopolitical Tensions on Premium Dispersion

One of the more compelling factors influencing premium variability is geopolitical unrest, often manifesting through trade disputes, sanctions, or regional conflicts. Such tensions tend to cause spikes in coin premiums, particularly when perceived as safe-haven assets, due to increased demand amidst supply uncertainties. Conversely, stable geopolitical environments foster a more uniform premium landscape, favoring large-scale bullion bars for their cost-efficiency and ease of storage. Recognizing these patterns allows investors to anticipate and leverage short-term premium surges, translating geopolitical insights into tangible gains.

Which Supply Chain Disruptions Are Most Likely to Persist Through 2026?

The ongoing global supply chain disruptions, exacerbated by uneven pandemic recoveries and shifting trade policies, create persistent bottlenecks affecting gold’s physical distribution. Studies such as those published by the World Gold Council highlight regional disparities in production and logistics, which directly influence premium fluctuations. For investors, understanding these disruptions enables anticipation of price margins, especially when considering the timing of physical gold acquisitions. Continuous monitoring of supply chain developments, combined with analytical models, empowers more strategic and informed investment decisions in gold assets.

To navigate these complex dynamics, engaging with content from authoritative sources, such as the World Gold Council’s comprehensive reports or industry-specific analyses, is essential. Additionally, fostering community discussions around emerging disruptions can uncover lesser-known risks and investment opportunities, enhancing one’s market resilience in 2026 and beyond.

Liquidity Constraints and the Retail Investor Dilemma

Despite the strategic advantages of gold bars, misconceptions about liquidity remain prevalent among retail investors. Limited recognition of certain refining brands or uncertainties regarding their resale markets can hinder widespread adoption. However, empirical data suggest that, in high-demand environments, the fungibility and standardized purity of large bullion bars often outperform coins, especially when held within diversified portfolios or tax-advantaged accounts like IRAs. Appreciating these subtleties requires a nuanced understanding of market psychology and supply-demand elasticity, highlighting the importance of education and professional guidance.

How Do Different Storage and Custody Options Influence Premiums and Overall Cost?

The choice between allocated and unallocated storage solutions significantly impacts the effective cost of gold holdings. Allocated storage, offering physical segregation with higher assurance, typically commands higher premiums due to added logistics and security costs. In contrast, unallocated accounts leverage pooled assets, reducing premiums but introducing counterparty risk. For the discerning investor, balancing liquidity needs, security concerns, and cost considerations demands a sophisticated approach—one that aligns storage preferences with overarching investment objectives. Exploring trusted custodial services with transparent fee structures and robust insurance policies is critical for optimizing physical gold investment efficiency in 2026.

Stay engaged with the latest developments by consulting industry experts, attending specialized seminars, and reviewing analytical reports. Such proactive measures serve as a foundation for constructing resilient, forward-thinking gold portfolios capable of withstanding geopolitical and economic upheavals.

Unlocking Hidden Drivers Behind Gold Premium Swings

While conventional analysis often attributes gold premium fluctuations to supply and demand, a more nuanced approach considers geopolitical strategies, technological advancements in refining, and international policy shifts. These factors interplay to produce subtle yet impactful shifts in premium structures, demanding an expert-level comprehension of market microstructures. By scrutinizing global trade policies and technological innovations, savvy investors can anticipate premium trends with greater precision.

Harnessing Technological Enhancements to Gauge Premium Trends Accurately

Emerging data analytics platforms and blockchain-based tracking systems are revolutionizing how premium data is collected and analyzed. Advanced algorithms can now detect early signals of supply chain disruptions or demand surges, offering real-time insights. For instance, integrating machine learning models that analyze shipping logistics data with market sentiment indicators can allow for predictive analytics—transforming traditional reactive strategies into proactive ones.

Are Today’s Gold Premium Patterns Signaling Broader Market Transformations?

Market analysts are increasingly examining whether current premium oscillations signal a shift in the fundamental structure of physical gold markets. These patterns may foreshadow a transition toward more centralized or decentralized physical gold reserves, influenced by geopolitical alliances or emerging financial regulations. This ongoing evolution could reshape the mechanisms of gold liquidity, impacting how premiums are structured and perceived internationally. Understanding these macro trends is crucial for investors aiming to optimize timing and allocation strategies.

Strategic Considerations for Leveraging Premium Fluctuations in Portfolio Management

Effective portfolio diversification now extends beyond traditional asset classes into nuanced physical gold strategies. Investors should consider employing dynamic allocation models that respond to premium signals, optimizing entry and exit points. Additionally, integrating derivatives related to gold premiums—such as options on premium spread indices—can hedge against adverse movements while positioning for upside potential. This sophisticated approach requires a deep understanding of market microstructures and a readiness to adapt swiftly to changing data patterns.

Digital Transformation of Gold Market Data and Its Investment Implications

The proliferation of digital assets, including tokenized gold and blockchain-backed collectibles, introduces new variables into premium calculations. These innovations enhance transparency and fractional ownership but also demand revised analytical frameworks to interpret their impact on premium stability. By evaluating the valuation models of digital gold assets in conjunction with traditional physical premiums, investors can uncover arbitrage opportunities and hedge against systemic risks emerging from technological integration.

Expert Recommendations for Advanced Premium Navigation

Engage with continuous education platforms, attend specialized conferences, and consult with market technologists who specialize in precious metals analytics. Building a network of insights from industry leaders enables the development of bespoke models that incorporate geopolitical intelligence, supply chain resilience metrics, and technological developments. Leveraging these tools and relationships ensures that your gold acquisition approach remains resilient in a rapidly transforming marketplace, positioning you ahead of macroeconomic shifts and policy changes.

Expert Insights & Advanced Considerations

Holdings Diversification Elevates Portfolio Resilience

Allocating a portion of assets into physical gold, especially through bars, allows investors to capitalize on predictable premiums and improve overall portfolio stability amidst market volatility.

Geopolitical Tensions as Catalysts for Premium Shifts

Sudden geopolitical events often trigger premium surges, providing savvy investors with opportunities to acquire gold at favorable rates before prices realign post-crisis.

Supply Chain Disruptions Signal Long-term Market Dynamics

Persistent bottlenecks in extraction and distribution processes can lead to sustained premium elevated levels, indicative of deeper structural shifts within global gold markets.

Technological Innovations Drive Market Transparency

Blockchain developments and real-time analytics are transforming premium tracking, enabling investors to make more informed entry and exit decisions based on microsecond data.

Strategic Resource Allocation in a Complex Environment

Balancing physical gold investments with derivatives linked to premium fluctuations can optimize gains and provide hedging against sudden market movements, especially during times of geopolitical upheaval.

Curated Expert Resources

- World Gold Council: Offers comprehensive insights into global demand, supply, and premium analysis, vital for macro-level understanding.

- Kitco News: Keeps investors updated on short-term premium movements and geopolitical influences affecting precious metals markets.

- LBMA Reports: Provides detailed standards and market transparency metrics crucial for assessing premium-related trends.

- Bloomberg Gold Market Data: Supplies real-time analytics and forecasts, instrumental for precise timing and strategic planning.

- GSI (Gold Standard Institute): Focuses on purity standards and technical standards impacting premiums and investor confidence.

Final Perspective From a Veteran Analyst

When considering gold premiums, it’s essential not only to follow short-term oscillations but also to interpret these fluctuations as part of broader geopolitical and supply chain narratives. Expert-level insights into these dynamics empower investors to anticipate market shifts proactively, ensuring more precise entry and exit strategies within their gold acquisition endeavors. To elevate your understanding further, engaging with authoritative resources like the gold demand trends analysis or participating in specialized financial forums can be highly advantageous. Your strategic response to premium movements could very well determine the resilience and growth potential of your precious metals portfolio in the years ahead.”}#- https://buyingoldnow.com/understanding-gold-demand-trends-in-2025-for-smarter-investments}]}#- https://buyingoldnow.com/physical-gold-3-hidden-reasons-bars-beat-coins-in-2026}]}#- https://buyingoldnow.com/gold-investment-strategies-top-tips-to-grow-wealth-in-2025}]}#- https://buyingoldnow.com/why-central-banks-are-hiding-gold-2026-reserves-report}]}#- https://buyingoldnow.com/gold-price-forecasts-2025-expert-market-trends-investment-tips}]}#- https://buyingoldnow.com/understanding-gold-demand-trends-in-2025-for-smarter-investments}]}#- https://buyingoldnow.com/best-gold-ira-physical-gold-investments-for-2025-secure-your-wealth}]}#- https://buyingoldnow.com/buy-gold-now-effective-investment-strategies-market-trends-2025-3}]}#- https://buyingoldnow.com/physical-gold-3-hidden-reasons-bars-beat-coins-in-2026}]}#- https://buyingoldnow.com/buy-gold-expert-strategies-for-physical-gold-investments-2025}]}#- https://buyingoldnow.com/why-central-banks-are-hiding-gold-2026-reserves-report}]}#- https://buyingoldnow.com/gold-investment-strategies-for-2025-top-tips-to-grow-wealth-in-2025}]}{