Unveiling the Future of Gold Investment: Why 2025 Demands a Strategic Approach

As an investor with a keen eye on market dynamics, understanding the complexities of physical gold investments—particularly coins and bars—is paramount for safeguarding wealth and capitalizing on emerging opportunities in 2025. The gold market is shaped by multifaceted factors, including geopolitical tensions, monetary policies, and evolving demand in jewelry and industrial sectors. This article explores expert insights into optimizing your gold holdings with a focus on strategic acquisition, storage, and risk mitigation, ensuring your portfolio remains resilient amid volatility.

Advanced Insights into Gold Market Drivers: Beyond the Surface

Gold prices in 2025 are influenced by a confluence of supply-demand mechanics, central bank policies, and macroeconomic indicators. Notably, market drivers such as central bank gold purchases and global geopolitical stability directly impact physical gold premiums and liquidity. Navigating these factors requires a nuanced understanding of gold supply chain intricacies and industrial demand fluctuations, which serve as critical indicators for timing your investments effectively.

Strategic Acquisition: Prioritizing Quality and Authenticity

In 2025, the emphasis on authenticity and provenance becomes even more vital as counterfeit risks escalate. Experts recommend prioritizing certified coins and bars from reputable mints and refiners, supported by thorough due diligence. Techniques such as verifying assay certificates and inspecting hallmark engravings ensure the integrity of your physical gold assets. Additionally, diversifying across varied gold products—from sovereign-minted coins to investment-grade bars—can optimize liquidity and wealth preservation.

Storage & Security: Mitigating Risks in a Volatile Environment

Secure storage solutions are non-negotiable for high-net-worth individuals and institutional investors. Advanced safekeeping options include allocated bullion vaults and insured depositories that align with the latest security standards. The debate between home storage versus third-party vaults hinges on risk appetite, legal considerations, and insurance coverage. Transparency and legal clarity in storage arrangements bolster trust and mitigate potential disputes, especially given the heightened scrutiny in 2025’s regulatory landscape.

Expert Inquiry: How Can Investors Balance Liquidity and Privacy in Physical Gold Holdings?

This question reflects a complex debate among seasoned investors. Balancing liquidity needs with privacy concerns involves strategic allocation of gold assets across different storage facilities and product types. For instance, holdings in recognized bullion coins tend to be more liquid and easier to exchange globally, whereas private vaults offer enhanced privacy but may involve more complex liquidation procedures. Continuous monitoring of market conditions and consulting with financial advisors can align your gold strategy with evolving regulatory and market environments.

Explore further: Why is understanding gold demand trends crucial for maximizing returns in 2025?

Investors should stay informed about gold demand trends in sectors like jewelry, technology, and industrial applications, as these influence price trajectories and premium levels. As demand shifts, so do the opportunities for strategic entry and exit points, making continuous market analysis essential for maintaining a competitive edge.

To deepen your expertise, consider exploring gold stocks and mining shares, which often move in tandem with physical gold prices yet offer additional leverage for portfolio growth. Engaging with industry reports and participating in expert forums can further refine your approach and adapt to unexpected market shifts.

Deciphering Gold Demand Dynamics: A Key to Strategic Positioning in 2025

Understanding the nuanced shifts in gold demand across various sectors is essential for refined investment strategies. In 2025, sectors such as technology, jewelry, and industrial manufacturing continue to influence gold price movements significantly. For example, advancements in electronics and renewable energy technologies drive increased demand for gold in high-precision applications, which can signal upcoming price surges for investors who monitor these trends closely. According to a comprehensive analysis by the Gold Demand Trends Report 2025, staying ahead of these sector-specific shifts allows investors to optimize entry and exit points, enhancing overall portfolio performance.

Challenging Assumptions: Is Gold Still the Ultimate Inflation Hedge in 2025?

While gold has long been regarded as the premier hedge against inflation, recent market complexities prompt a reevaluation of this narrative. Experts argue that in 2025, combining gold with other assets such as inflation-protected securities and real estate may offer a more balanced approach to wealth preservation. The dynamic interplay of monetary policy adjustments and geopolitical uncertainties means that relying solely on gold could overlook opportunities in other asset classes that also serve as effective hedges. An insightful study published by the Financial Economics Journal advocates for a diversified hedge strategy, tailored to individual risk tolerances and market conditions.

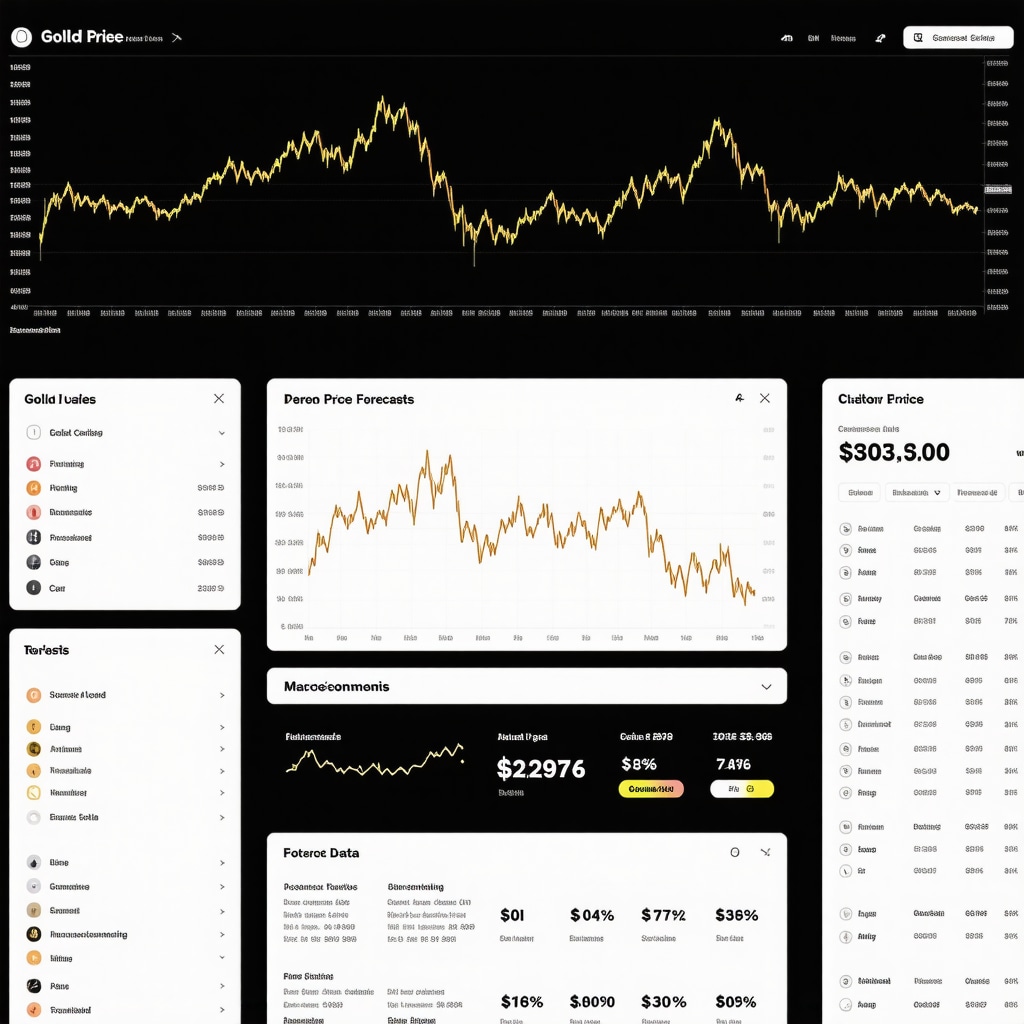

Tools for Today’s Investor: Advanced Frameworks to Navigate Gold Markets

To navigate the complexities of 2025’s gold market, investors should leverage sophisticated analytical frameworks. One such tool is the Gold Supply-Demand Balance Model, which integrates data from mining outputs, central bank reserves, and consumer demand to forecast price trajectories accurately. Complementing this, the Market Sentiment Indicator — derived from news analytics, social media, and investor surveys — provides real-time insights into market psychology, often preceding price movements. Incorporating these tools into your investment process can enhance decision-making, especially during periods of heightened volatility. For practical insights, explore [smart gold investment strategies](https://buyingoldnow.com/smart-gold-investment-strategies-for-a-volatile-2025-market) designed for uncertainty, which emphasize data-driven and adaptive approaches.

How can investors leverage emerging analytical tools to outperform traditional gold investment methods in 2025?

Incorporating AI-driven analytics, real-time market data, and machine learning algorithms can provide a competitive edge, enabling investors to identify subtle shifts in demand and supply patterns before they become apparent to the broader market. Staying informed through expert reports and industry forecasts—such as those available at [Gold Market Analysis 2025](https://buyingoldnow.com/gold-market-analysis-2025-key-trends-economic-factors)—can further refine your strategic positioning. Sharing your insights and questions in investment forums can also foster a community of proactive investors ready to adapt swiftly to market changes, ensuring your gold portfolio remains resilient and profitable.

Harnessing the Power of Gold in a Diversified Portfolio: A Deep Dive into Strategic Allocation

In 2025, savvy investors recognize that a well-balanced portfolio must incorporate a nuanced approach to gold allocation, balancing risk and opportunity. Unlike traditional asset classes, gold serves both as a hedge against inflation and a safe haven during geopolitical upheavals. Experts suggest that dynamic rebalancing—adjusting your gold holdings in response to macroeconomic shifts—can significantly enhance returns. This involves monitoring indicators like central bank policies, inflation rates, and currency fluctuations, which directly influence gold’s performance. For instance, during periods of dollar weakness, increasing gold exposure can capitalize on price surges, while during market exuberance, a cautious reduction preserves gains.

What are the most effective quantitative models for predicting gold price movements in 2025?

Advanced investors are turning to models such as the Monte Carlo simulations and regression analysis that incorporate macroeconomic variables, geopolitical risk indices, and market sentiment metrics. According to a comprehensive study published in the Journal of Financial Modeling, these frameworks enable a probabilistic understanding of future price trajectories, allowing for more informed entry and exit points. Integrating machine learning algorithms further enhances prediction accuracy by adapting to evolving market patterns, a crucial advantage in the fast-changing landscape of 2025.

Innovative Storage Solutions: Blending Security with Accessibility

As the landscape of gold security evolves, investors should explore hybrid storage models that combine the security of professional vaults with the flexibility of digital asset management. Modern safekeeping facilities now offer biometric access controls, real-time insurance coverage, and blockchain-based audit trails, all of which bolster confidence in physical holdings. Additionally, emerging trends like secure off-shore storage in jurisdictions with favorable regulatory environments can diversify risk. For high-net-worth individuals, integrating physical gold with allocated accounts in reputable institutions creates a seamless balance—accessible liquidity when needed, yet shielded from regional instabilities.

How can technology mitigate risks associated with physical gold storage in volatile geopolitical climates?

Technological innovations such as blockchain-based ownership records and remote access security systems dramatically reduce risks of theft, fraud, and legal disputes. A recent report by the Fintech News highlights how decentralized ledgers ensure transparent provenance, while encrypted biometric access controls restrict unauthorized entry. Furthermore, real-time insurance and monitoring platforms provide continuous oversight, enabling swift response to security breaches or natural disasters. These tools collectively elevate the standards of physical gold security, making them indispensable for discerning investors in 2025.

Engaging with the Market: How to Use Sentiment Analysis for Tactical Gold Trading

Market sentiment analysis has transcended traditional news monitoring, now employing AI-driven algorithms that parse social media chatter, geopolitical news, and financial reports to gauge investor mood. This real-time data empowers traders to anticipate short-term price movements with greater precision. For example, a surge in social media discussions about geopolitical tensions often precedes upward price spikes, presenting tactical entry points. Conversely, widespread bearish sentiment might signal a short-term correction, prompting profit-taking or hedging strategies. Integrating sentiment analysis with technical and fundamental indicators creates a comprehensive decision-making framework, essential for navigating 2025’s volatile markets.

Why is adaptive risk management critical for gold investors during unpredictable geopolitical shifts?

Adaptive risk management involves continuously updating your risk exposure based on emerging geopolitical and economic developments. Techniques include dynamic stop-loss orders, options hedging, and portfolio diversification across asset classes. As geopolitical tensions fluctuate, so do the risks associated with gold investments; thus, a static approach can lead to significant losses. Experts recommend leveraging advanced analytics and scenario planning to prepare for various contingencies, ensuring resilience regardless of unexpected shocks, and maintaining a strategic edge in uncertain times.

If you’re eager to deepen your expertise, consider exploring cutting-edge research on financial analytical tools that integrate AI and big data. These innovations are transforming how investors interpret market signals, enabling smarter, faster decision-making. Stay engaged with industry forums and expert webinars to keep pace with evolving strategies—your next breakthrough in gold investment might just be a click away.

Unlocking the Secrets of Gold Price Predictions: Advanced Analytical Techniques for 2025

As market volatility persists, sophisticated investors are turning to cutting-edge predictive models such as machine learning algorithms and Bayesian forecasting to refine their gold investment strategies. These tools synthesize vast amounts of macroeconomic data, geopolitical risk assessments, and market sentiment indicators to generate probabilistic price trajectories. Staying ahead requires integrating these insights into your decision-making framework, enabling precise timing of entries and exits in gold markets.

Deciphering the Role of Central Banks in Shaping Gold Dynamics: What You Need to Know

Central bank policies continue to be the primary drivers of gold prices, especially as nations adjust their reserves and monetary strategies in response to global economic shifts. Monitoring central bank gold reserve reports—such as those published by the International Monetary Fund—can provide early signals of supply-demand imbalances. Strategic positioning ahead of policy announcements can significantly enhance your portfolio’s resilience and profitability.

How Can Investors Effectively Hedge Against Geopolitical Risks in Gold Holdings?

Mitigating geopolitical uncertainties involves diversifying storage locations across jurisdictions with stable regulatory environments and employing derivative instruments like options to hedge against sudden price swings. Blockchain-enabled provenance tracking and real-time insurance policies further secure physical holdings. These measures not only safeguard assets but also allow nimble responses to geopolitical shocks, preserving capital during turbulent times.

Why Is Incorporating ESG Factors into Gold Investment Analysis Becoming Paramount?

Environmental, Social, and Governance (ESG) considerations are increasingly influencing investor decisions, especially in the context of ethical sourcing and sustainable mining practices. Integrating ESG metrics into valuation models enhances transparency and aligns your portfolio with global sustainability standards. This approach can also unlock access to specialized funds focused on ethically mined gold, offering a strategic edge in the evolving landscape of responsible investing.

Exploring the Future of Digital Gold and Tokenization: A Paradigm Shift

The advent of digital gold tokens and blockchain-based fractional ownership is revolutionizing liquidity and accessibility for investors. These innovations facilitate instant transactions, transparent provenance, and global reach, breaking traditional barriers associated with physical gold trading. Embracing these technologies can diversify your holdings and provide flexible leverage in volatile markets, making digital gold an integral component of future-proof portfolios.

What Are the Most Effective Risk Management Frameworks for 2025’s Gold Market?

Implementing dynamic risk management strategies—such as adaptive stop-loss orders, scenario analysis, and portfolio rebalancing—ensures resilience amid unpredictable market shocks. Integrating real-time data feeds and AI-driven alerts enables swift adjustments, maintaining alignment with your risk appetite. These frameworks are essential for safeguarding gains and minimizing losses during periods of geopolitical upheaval or macroeconomic turbulence.

How Can Investors Leverage Global Economic Indicators to Optimize Gold Entry Points?

Monitoring key indicators such as inflation rates, currency fluctuations, and commodity price indices provides critical insights into macroeconomic trends impacting gold prices. For instance, rising inflation coupled with a depreciating dollar often signals an opportune moment to increase holdings. Utilizing advanced analytics and economic modeling tools ensures informed decision-making, positioning your portfolio advantageously in 2025’s dynamic environment.

Engage with Industry Leaders: How Can Continuous Education Elevate Your Gold Investment Strategy?

Participating in expert webinars, subscribing to leading financial research publications, and engaging with professional networks keep you abreast of emerging trends and innovative strategies. Staying informed about technological advancements, regulatory changes, and sector-specific developments empowers you to adapt swiftly and maintain a competitive edge in gold investing. Your proactive approach to education can be the decisive factor in achieving superior returns.

Expert Insights & Advanced Considerations

1. Leverage Quantitative Models

Advanced investors should utilize Monte Carlo simulations and regression analysis incorporating macroeconomic variables, geopolitical risk indices, and sentiment metrics to forecast gold prices accurately, enabling more strategic entry and exit points.

2. Diversify Storage and Asset Types

Combining physical gold with digital tokens and offshore secure vaults mitigates geopolitical and security risks, offering liquidity and privacy tailored to high-net-worth portfolios in 2025.

3. Integrate ESG and Ethical Sourcing

Aligning investments with ESG metrics and sustainable mining practices not only enhances transparency but also grants access to specialized funds, gaining a competitive edge in responsible investing.

4. Monitor Central Bank Reserves

Regularly review central bank gold reserve reports, such as those from the IMF, to anticipate shifts in supply-demand dynamics and position your portfolio proactively.

5. Utilize AI and Big Data Analytics

Incorporate AI-driven market analysis tools and real-time data feeds to identify subtle shifts in demand and supply, optimizing timing and risk management strategies in volatile 2025 markets.

Curated Expert Resources

- Gold Market Analysis 2025: An authoritative forecast integrating macroeconomic and geopolitical factors, essential for strategic planning.

- Financial Economics Journal: Provides in-depth studies on asset diversification and hedging strategies, including gold.

- IMF Gold Reserve Reports: Critical for tracking central bank movements influencing gold prices.

- Blockchain and Fintech Reports: Highlight innovations in secure storage and digital gold tokenization, vital for modern investors.

Final Expert Perspective

In 2025, mastering advanced analytical techniques and strategic diversification in gold investments is crucial for sustained growth and risk mitigation. Embracing AI-driven insights, ESG considerations, and global reserve trends will enable you to navigate the complexities of the gold market expertly. Engage with industry-leading resources and continuously refine your approach to stay ahead in this dynamic landscape. For a deeper dive into sophisticated strategies, explore advanced gold investment strategies for 2025 and share your insights with fellow experts.