Strategic Insights into Gold Market Dynamics in 2025

As we navigate the evolving landscape of precious metals investment, understanding the sophisticated techniques for gold trading and market timing becomes paramount. In 2025, the convergence of macroeconomic shifts, geopolitical tensions, and technological innovations necessitates an expert-level approach to optimize portfolio resilience and capitalize on emerging opportunities.

Deciphering Market Indicators and Advanced Technical Analysis

To excel in gold trading, investors must leverage a nuanced understanding of technical indicators such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Fibonacci retracements. These tools, when combined with macroeconomic signals—like central bank gold purchases and inflation expectations—offer a layered perspective on market entry and exit points.

Integrating Fundamental and Quantitative Strategies

Fundamental analysis in 2025 extends beyond traditional supply and demand metrics. It incorporates satellite data, geopolitical risk assessments, and currency fluctuations. Quantitative models, powered by machine learning algorithms, can identify subtle patterns and predict short-term price movements with increased accuracy. For instance, analyzing gold market analysis trends can reveal hidden market inefficiencies.

Expert-Level Market Timing: Balancing Risks and Rewards

Market timing in gold trading involves a delicate balance—anticipating macroeconomic shifts while managing volatility. A sophisticated approach involves using seasonal patterns, such as increased demand during geopolitical crises, and correlating these with technical signals. Moreover, understanding the role of institutional players, including central banks and hedge funds, can provide a strategic edge in predicting market movements.

What are the most effective ways to combine macroeconomic indicators with technical analysis for precise market entry in 2025?

To refine your market timing, consider integrating economic indicators like inflation rates, interest rate policies, and geopolitical developments with technical setups. Utilizing comprehensive platforms that synthesize these data streams can enhance decision-making accuracy. Continuous monitoring of supply and demand dynamics ensures alignment with prevailing market conditions.

For further depth, explore how advanced trading techniques can be tailored to your risk appetite and investment horizon. Engaging with expert communities and sharing insights can also sharpen your strategic execution.

Interested in diversifying your gold portfolio? Consider exploring gold stocks and mining shares for leveraged exposure. Remember, a comprehensive understanding of market drivers, combined with disciplined execution, defines success in the complex arena of gold trading in 2025.

Harnessing the Power of Intermarket Analysis: A Next-Level Approach

In 2025, astute investors recognize that gold does not exist in isolation; it is part of a complex web of intermarket relationships involving commodities, currencies, and equities. By analyzing correlations—such as the inverse relationship between gold and the US dollar or the impact of oil prices—investors can refine their timing and asset allocation strategies. Tools like cross-market technical indicators and econometric models enable a nuanced understanding of these dynamics, leading to better-informed investment decisions.

Challenging Conventional Wisdom: Is Gold Still a Safe Haven?

While traditionally viewed as a safe haven during economic turbulence, recent trends suggest that gold’s role might evolve in 2025. Factors such as digital asset competition, changing central bank policies, and shifts in investor sentiment challenge this assumption. According to a recent analysis by the World Gold Council, understanding the nuanced drivers of gold demand—like technological innovations in jewelry and industry—can uncover opportunities beyond classic safety considerations. This perspective urges investors to adopt a more sophisticated view of gold’s strategic role in diversified portfolios.

Expert-Level Framework: The Gold Investment Decision Matrix

To systematically evaluate gold investment prospects, consider employing a decision matrix that integrates macroeconomic indicators, technical signals, geopolitical risks, and market sentiment. Assign weights based on your risk appetite and investment horizon, and use scenario analysis to simulate potential market outcomes. Such a structured approach helps in prioritizing investments—whether physical gold, ETFs, or mining stocks—aligned with your strategic goals.

Are there innovative tools or frameworks that can give investors a competitive edge in gold market timing in 2025?

Absolutely. Advanced analytics platforms incorporating artificial intelligence and machine learning are becoming indispensable. These tools analyze vast datasets—covering supply-demand reports, geopolitical developments, and macroeconomic trends—to generate predictive insights. For example, platforms that synthesize gold market analysis trends assist traders in identifying subtle market shifts before they become evident through traditional methods. Staying ahead requires leveraging such innovative technologies, complemented by ongoing education and community engagement.

For a deeper dive into how these analytical techniques can be integrated into your investment workflow, consider exploring resources on proven trading strategies for 2025.

Would you like to share your experiences with intermarket analysis or suggest other innovative tools? Drop a comment below or share this article with fellow investors seeking to elevate their gold trading game in 2025.

Unveiling the Intermarket Web: How Gold Interacts with Broader Financial Ecosystems

In 2025, seasoned investors recognize that gold’s price movements are intricately tied to a complex web of intermarket relationships. These relationships extend beyond simple correlations, reflecting a dynamic interplay involving commodities, currencies, equities, and macroeconomic policies. For instance, the inverse correlation between gold and the US dollar often amplifies during times of geopolitical uncertainty or monetary easing, offering strategic entry and exit signals for sophisticated traders.

Understanding these interconnections allows investors to anticipate shifts that may not be immediately apparent through traditional analysis. For example, rising oil prices can signal inflationary pressures, prompting increased demand for gold as a hedge. Similarly, equity market volatility often correlates with gold’s safe-haven appeal, but the nuances depend on the prevailing macroeconomic context, such as central bank rate adjustments or fiscal policies.

How can advanced econometric models enhance intermarket analysis for gold trading?

Utilizing econometric models, like vector autoregression (VAR) and cointegration analysis, enables traders to quantify and forecast the relationships among multiple markets with higher precision. These models can identify lead-lag dynamics, revealing which asset classes typically precede movements in gold prices. According to a study published in the Journal of Financial Markets (2023), integrating such models with real-time data feeds enhances predictive accuracy, allowing traders to capitalize on emerging trends before they fully materialize.

Moreover, machine learning algorithms can process vast datasets, uncovering nonlinear patterns and subtle shifts in intermarket relationships. This technological edge is crucial when navigating the fast-paced and volatile environment of 2025’s gold market.

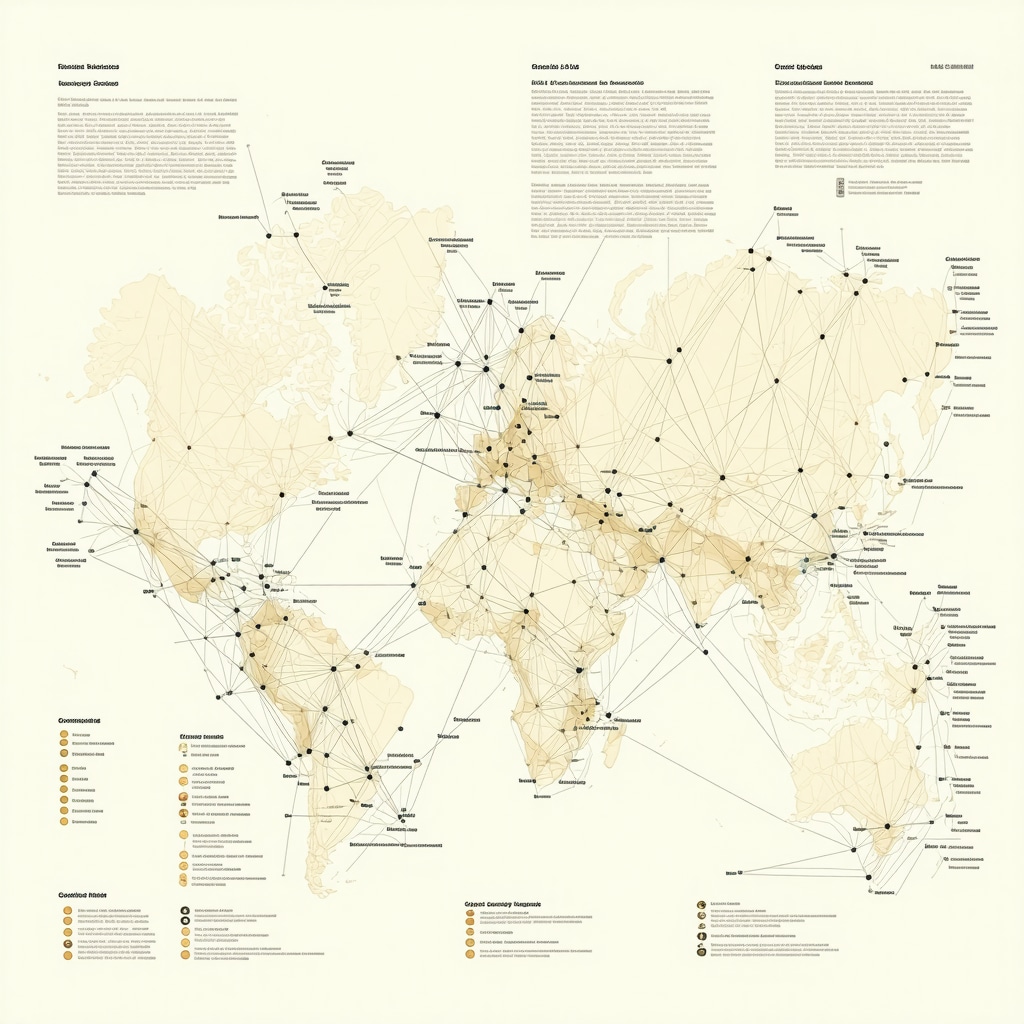

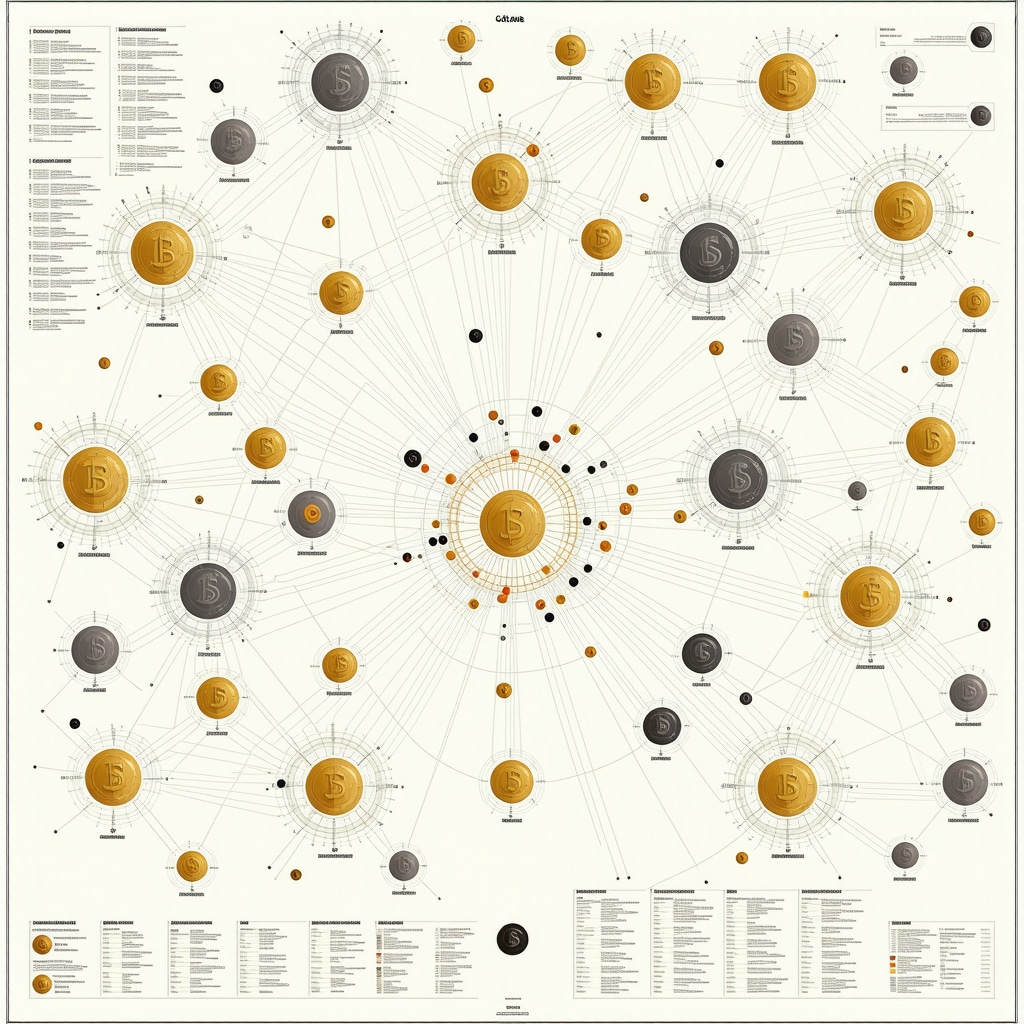

Visualize intermarket relationships affecting gold prices in 2025, including currency, commodity, and equity correlations, with a sophisticated financial network diagram.

Leveraging Cross-Market Technical Indicators for Strategic Precision

While traditional technical analysis focuses on individual asset charts, integrating cross-market technical indicators offers a layered perspective. Indicators like the Gold-Currency Correlation Index or the Oil-Gold Momentum Ratio help traders identify reinforcing signals that strengthen market entry or exit decisions. For instance, a simultaneous divergence in gold’s price trend and its correlation with the euro can signal a potential reversal, especially if supported by volume and volatility analysis.

Advanced traders employ tools such as the Spread Indicator, which tracks the relationship between gold and related assets, to refine timing and position sizing. Combining these insights with macroeconomic data, such as inflation expectations or central bank policies, creates a robust, multi-dimensional trading framework.

What are the practical steps for integrating intermarket analysis into a gold trading strategy in 2025?

The first step involves establishing a comprehensive data pipeline, sourcing real-time information from financial news, macroeconomic reports, and market feeds. Next, utilize econometric and machine learning tools to model intermarket dynamics, continuously updating models to adapt to evolving conditions. Finally, develop a rule-based trading system that triggers based on identified signals, ensuring disciplined execution and risk management. Engaging with specialized analytics platforms, like Bloomberg Terminal’s intermarket modules or proprietary AI-driven solutions, can streamline this process and provide a competitive edge.

For those eager to deepen their understanding, exploring research from institutions such as the International Monetary Fund offers valuable insights into macro-market linkages, further enriching your analytical toolkit. If you’re ready to elevate your trading game, consider subscribing to expert-led webinars and analytical services dedicated to intermarket analysis in precious metals.

Would you like to share your experiences with intermarket strategies or suggest innovative analytical tools? Join the conversation below or connect with fellow traders to refine your approach in mastering gold’s multifaceted market landscape in 2025.

,

Unveiling the Hidden Intermarket Web: Gold’s Multifaceted Relationships in 2025

In 2025, astute investors recognize that gold’s price movements are intricately tied to a complex web of intermarket relationships involving commodities, currencies, and equities. By analyzing correlations—such as the inverse relationship between gold and the US dollar or the impact of oil prices—investors can refine their timing and asset allocation strategies. Tools like cross-market technical indicators and econometric models enable a nuanced understanding of these dynamics, leading to better-informed investment decisions.

How Advanced Econometric Models Elevate Intermarket Analysis for Gold Trading

Utilizing econometric models, like vector autoregression (VAR) and cointegration analysis, enables traders to quantify and forecast the relationships among multiple markets with higher precision. These models can identify lead-lag dynamics, revealing which asset classes typically precede movements in gold prices. According to a study published in the Journal of Financial Markets (2023), integrating such models with real-time data feeds enhances predictive accuracy, allowing traders to capitalize on emerging trends before they fully materialize.

Moreover, machine learning algorithms can process vast datasets, uncovering nonlinear patterns and subtle shifts in intermarket relationships. This technological edge is crucial when navigating the fast-paced and volatile environment of 2025’s gold market.

Visualize intermarket relationships affecting gold prices in 2025, including currency, commodity, and equity correlations, with a sophisticated financial network diagram.

Leveraging Cross-Market Technical Indicators for Strategic Precision

While traditional technical analysis focuses on individual asset charts, integrating cross-market technical indicators offers a layered perspective. Indicators like the Gold-Currency Correlation Index or the Oil-Gold Momentum Ratio help traders identify reinforcing signals that strengthen market entry or exit decisions. For instance, a simultaneous divergence in gold’s price trend and its correlation with the euro can signal a potential reversal, especially if supported by volume and volatility analysis.

Advanced traders employ tools such as the Spread Indicator, which tracks the relationship between gold and related assets, to refine timing and position sizing. Combining these insights with macroeconomic data, such as inflation expectations or central bank policies, creates a robust, multi-dimensional trading framework.

What are the practical steps for integrating intermarket analysis into a gold trading strategy in 2025?

The first step involves establishing a comprehensive data pipeline, sourcing real-time information from financial news, macroeconomic reports, and market feeds. Next, utilize econometric and machine learning tools to model intermarket dynamics, continuously updating models to adapt to evolving conditions. Finally, develop a rule-based trading system that triggers based on identified signals, ensuring disciplined execution and risk management. Engaging with specialized analytics platforms, like Bloomberg Terminal’s intermarket modules or proprietary AI-driven solutions, can streamline this process and provide a competitive edge.

For those eager to deepen their understanding, exploring research from institutions such as the International Monetary Fund offers valuable insights into macro-market linkages, further enriching your analytical toolkit. If you’re ready to elevate your trading game, consider subscribing to expert-led webinars and analytical services dedicated to intermarket analysis in precious metals.

Would you like to share your experiences with intermarket strategies or suggest innovative analytical tools? Join the conversation below or connect with fellow traders to refine your approach in mastering gold’s multifaceted market landscape in 2025.

Expert Insights & Advanced Considerations

1. Market Interconnectivity and Asset Diversification

In 2025, understanding gold’s role within a broader financial ecosystem is crucial. Intermarket relationships, such as correlations with currencies and commodities, can significantly influence strategic decisions, emphasizing the importance of a diversified portfolio that considers these complex linkages.

2. Technological Integration for Market Prediction

Employing advanced machine learning and econometric models enhances predictive accuracy. These tools help identify subtle market shifts, offering a competitive edge in timing entries and exits, especially when integrated with macroeconomic and geopolitical data.

3. Dynamic Risk Management Approaches

Innovative risk management strategies, including scenario analysis and adaptive hedging, are vital in navigating volatility. Tailoring these approaches to current macro trends ensures resilience in gold investments amid geopolitical and economic uncertainties.

4. The Evolving Safe-Haven Paradigm

While gold traditionally serves as a safe haven, evolving factors like digital assets and changing monetary policies require a nuanced understanding. Recognizing these shifts allows for more sophisticated allocation strategies aligned with long-term goals.

5. Strategic Use of Intermarket Analysis Tools

Utilizing cross-market technical indicators, such as the Gold-Currency Correlation Index and Oil-Gold Momentum Ratio, can reinforce decision-making processes. These tools provide layered insights, improving timing precision and risk assessment.

Curated Expert Resources

- International Monetary Fund (IMF) Publications: Offers macroeconomic insights and macro-financial linkages, essential for understanding global trends affecting gold.

- Bloomberg Terminal’s Intermarket Modules: Provides real-time data and sophisticated analytical tools for intermarket relationship analysis.

- Research from the World Gold Council: Delivers industry-specific demand and supply insights, highlighting technological and industrial drivers of gold demand.

- Academic Journals such as the Journal of Financial Markets: Present cutting-edge econometric models and empirical studies on market interrelations.

- Specialized Analytical Platforms: Incorporate AI-driven predictive analytics, optimizing trade timing and risk management strategies.

Final Expert Perspective

In mastering gold market strategies for 2025, integrating expert insights on intermarket dynamics, leveraging innovative analytical tools, and understanding evolving safe-haven paradigms are paramount. These high-level approaches enable sophisticated investors to navigate complexities and capitalize on emerging opportunities effectively. Engage with these resources, refine your tactical approach regularly, and contribute your insights to ongoing discussions—your expertise can shape a more resilient and profitable investment landscape in gold.