Harnessing Advanced Gold Trading Strategies to Mitigate Market Turbulence in 2025

As global economic uncertainties intensify, professional investors recognize gold not merely as a safe-haven asset but as a sophisticated instrument for strategic market navigation. In 2025, the convergence of geopolitical shifts, monetary policy adjustments, and emerging demand trends necessitates a nuanced understanding of effective gold trading techniques. This guide delves into expert-level strategies designed to optimize portfolio resilience amidst heightened volatility.

Deciphering the Role of Market Sentiment and Technical Indicators in Gold Trading

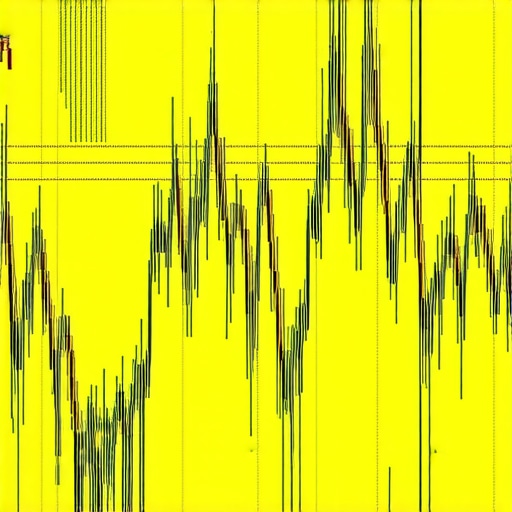

Successful navigation of 2025’s volatile environment hinges on a deep analysis of market sentiment and technical signals. Leveraging tools such as candlestick patterns, moving averages, and volume analysis allows traders to anticipate short-term price movements. Integrating sentiment analysis, derived from news analytics and investor positioning data, enhances decision-making precision, especially during rapid market shifts.

Implementing Derivative Instruments for Hedging and Leverage

Utilizing derivatives like gold futures and options provides traders with leverage and risk management capabilities. Expert traders often employ futures contracts to lock in prices and hedge against adverse movements, while options offer strategic flexibility to capitalize on directional biases or protect positions. Mastery of these instruments necessitates an advanced understanding of market timing and volatility metrics.

How Do Central Bank Gold Purchases Impact Market Dynamics in 2025?

What are the implications of emerging central bank gold buying patterns on market stability and price trends?

In recent years, central bank gold acquisitions have shifted from passive reserves management to active market participation, influencing liquidity and price discovery processes. As detailed in a comprehensive analysis by the World Gold Council, these purchases often act as a counterbalance to geopolitical tensions and dollar fluctuations, thereby shaping supply-demand dynamics and creating strategic entry points for institutional investors. Understanding these patterns enables traders to anticipate long-term price trajectories and adjust their strategies accordingly.

For a thorough exploration of how central bank policies influence gold prices, refer to this detailed report.

Maximizing Portfolio Performance with Gold Futures and Technical Analysis

Combining technical analysis with futures trading forms the cornerstone of expert gold investment in 2025. By identifying key support and resistance levels, traders can optimize entry and exit points. Additionally, deploying technical indicators such as the Relative Strength Index (RSI) and Bollinger Bands helps in assessing overbought or oversold conditions, guiding strategic adjustments in volatile markets.

To deepen your understanding, explore this advanced analysis technique.

Emerging Demand Trends and Their Impact on Future Gold Prices

In 2025, shifting demand patterns—driven by technological innovation, jewelry consumption, and institutional allocations—are reshaping price dynamics. Emerging markets, particularly in Asia, exhibit increasing appetite for gold as a store of wealth, while central banks diversify their reserves. Awareness of these trends allows traders to anticipate long-term price movements and adapt their strategies to capitalize on demand-driven rallies.

Expert Insights: How Can Traders Balance Risk and Reward in Gold Markets?

Balancing risk and reward requires a multi-layered approach—diversification, disciplined trading, and continuous market analysis. Advanced traders often employ a combination of physical gold holdings, ETFs, and derivative products to hedge against systemic risks while maintaining exposure to upside potential. Furthermore, staying informed through reputable sources such as the World Gold Council ensures an up-to-date perspective on market fundamentals.

Explore comprehensive investment strategies at this resource and contribute your insights to the expert community.

Harnessing Quantitative Models for Predictive Gold Trading in 2025

In the rapidly evolving landscape of gold investment, quantitative analysis offers a sophisticated edge. Experts utilize complex algorithms and machine learning models to forecast price movements with higher accuracy, especially amidst unpredictable geopolitical and economic shifts. By integrating historical data, macroeconomic indicators, and real-time market signals, traders can develop predictive models that identify optimal entry and exit points. This approach reduces emotional bias and enhances strategic decision-making, making it an indispensable tool for professional investors aiming for long-term resilience.

What Role Do Geopolitical Risks Play in Shaping Gold’s Future Trajectory?

Geopolitical tensions continue to exert significant influence on gold prices, especially as global conflicts, trade disputes, and policy uncertainties escalate. According to a report by the Council on Foreign Relations, geopolitical risks often trigger flight-to-safety behaviors, temporarily inflating gold demand. However, savvy investors also recognize that prolonged instability can lead to policy responses that alter supply dynamics or currency valuations, ultimately affecting gold’s fundamental value. Therefore, integrating geopolitical risk assessments into your trading framework is crucial for strategic agility in 2025. For a comprehensive understanding of these factors, explore this detailed analysis.

Leveraging Cross-Asset Correlations to Hedge Gold Positions Effectively

Effective diversification extends beyond traditional asset classes, encompassing cross-asset correlations that can amplify returns or mitigate risks. For example, understanding the inverse relationship between gold and the US dollar, or the correlation between gold and inflation-linked bonds, enables traders to construct resilient portfolios. Advanced strategies involve dynamic hedging—adjusting exposure based on real-time correlation shifts—especially during periods of macroeconomic upheaval. Mastering these techniques allows investors to optimize risk-adjusted returns and safeguard wealth amidst volatility.

To deepen your expertise, review this comprehensive guide.

Are Your Gold Investment Strategies Aligned with the Nuanced Realities of 2025’s Market Environment?

In an era where data-driven decision making and macroeconomic awareness define successful investing, aligning your strategies with these complexities is vital. The interplay of technological innovation, policy shifts, and demand trends calls for a multi-layered approach—combining technical analysis with fundamental insights and sentiment metrics. Staying informed through authoritative sources like the World Gold Council ensures your approach remains agile and grounded in market realities. For tailored advice, consider consulting with an expert or engaging with informed communities that focus on high-level gold trading tactics.

Integrating Quantitative Models with Market Sentiment for Superior Gold Predictions

To excel in 2025’s complex gold market, traders are increasingly turning to quantitative models that incorporate a wide array of data sources. These models leverage machine learning algorithms trained on macroeconomic indicators, geopolitical events, and technical signals to generate probabilistic forecasts of gold prices. Combining these forecasts with real-time sentiment analysis—derived from news sentiment, social media trends, and investor positioning—enables traders to refine their entry and exit points with remarkable precision. This dual approach reduces reliance on subjective judgment, mitigates emotional biases, and provides a strategic edge in volatile environments.

The Strategic Impact of Central Bank Gold Policies on Long-Term Price Trends

Central banks’ evolving strategies regarding gold reserves are pivotal to understanding long-term price trajectories. A shift toward active accumulation or divestment signals changing monetary policy stances and influences supply-demand fundamentals. According to a detailed report by the World Gold Council, these central bank actions often precede broad market movements, acting as leading indicators for institutional investors. Analyzing patterns such as frequency, volume, and geopolitical context of central bank transactions offers traders a nuanced perspective on future price directions. Staying attuned to these shifts is crucial for formulating forward-looking trading strategies that leverage institutional activity.

What Are the Nuances of Cross-Asset Hedging in a Multi-Asset Portfolio?

Cross-asset hedging involves understanding and exploiting the correlations between gold and other asset classes to optimize risk management. For instance, during periods of dollar weakness, gold often exhibits a positive correlation, making it a natural hedge against currency depreciation. Conversely, during inflationary surges, bonds and commodities may move in tandem, requiring sophisticated hedging techniques that adjust dynamically based on correlation shifts. Utilizing derivatives such as cross-asset options and futures, along with real-time correlation monitoring, allows traders to construct resilient portfolios that adapt seamlessly to macroeconomic changes.

Incorporating advanced visualization tools—such as heat maps of asset correlations and dynamic portfolio graphs—can significantly enhance decision-making processes. Visual insights enable traders to quickly identify emerging risks and opportunities, facilitating more agile responses in fast-moving markets.

Emerging Geopolitical and Economic Factors Shaping Gold’s Future Trajectory

Geopolitical tensions, trade disputes, and monetary policy shifts remain central to gold’s price dynamics in 2025. For instance, escalating conflicts or sanctions can trigger safe-haven flows, temporarily inflating gold prices. However, prolonged instability may prompt central banks to alter reserve strategies, impacting supply and demand. Additionally, the evolving landscape of digital currencies and fintech innovations presents both threats and opportunities—potentially disrupting traditional gold demand channels or facilitating new investment vehicles. A comprehensive understanding of these factors, supplemented by geopolitical risk indices and macroeconomic forecasts from institutions like the IMF, is essential for crafting resilient trading strategies.

For further insights into how global political and economic developments influence gold markets, explore this authoritative analysis.

Unlocking the Power of Algorithmic Trading in Gold Markets

As technological innovation accelerates, sophisticated algorithmic trading systems have become indispensable for professional investors seeking an edge in gold markets. These systems leverage high-frequency data analysis, incorporating macroeconomic indicators, geopolitical developments, and sentiment metrics to execute trades with precision. By deploying machine learning models trained on vast datasets, traders can identify subtle patterns and anomalies that human analysis might overlook, enabling rapid response to market shifts and enhancing overall portfolio resilience.

How Can Sentiment Analysis Revolutionize Your Gold Trading Approach?

Deep sentiment analysis, utilizing advanced natural language processing (NLP) techniques on news feeds, social media, and investor communications, offers a nuanced understanding of market psychology. This real-time insight can preempt price movements by capturing shifts in investor confidence and fear, especially during geopolitical crises or macroeconomic surprises. Integrating sentiment signals with technical and fundamental data creates a comprehensive decision-making framework, elevating trading strategies from reactive to predictive.

What Are the Critical Considerations When Using Derivatives for Sophisticated Hedging?

Expert traders recognize that derivatives such as options and futures require meticulous risk management, especially when used for complex hedging strategies. Dynamic hedging techniques, such as delta-neutral adjustments, allow for real-time risk mitigation against volatile price swings. Understanding the Greeks—delta, gamma, theta, and vega—is essential for fine-tuning positions, reducing exposure during turbulent periods, and optimizing leverage without compromising safety. Mastery of these instruments demands continuous monitoring and adjustment, particularly in the context of evolving geopolitical risks and monetary policies.

Illustrate advanced algorithmic trading interface with real-time data streams and predictive analytics visualizations to enhance understanding of complex trading strategies.

How Do Macroprudential Policies Influence Gold Market Liquidity and Pricing?

Macroprudential policies, including capital requirements, liquidity ratios, and cross-border regulations, significantly impact gold market liquidity and pricing dynamics. For instance, tightening of financial regulations can restrict leverage in certain asset classes, prompting investors to shift toward physical gold or ETFs. Conversely, easing policies may increase speculative activity, amplifying volatility. Analyzing policy trends from central banks, financial authorities, and international organizations provides context for anticipating short- and long-term price movements, enabling traders to align strategies with regulatory environments.

In What Ways Can Cross-Asset Quantitative Models Enhance Portfolio Diversification?

Innovative models incorporating cross-asset relationships—such as the inverse correlation between gold and the US dollar or the positive correlation with inflation-linked securities—offer sophisticated pathways for diversification. Employing multivariate statistical techniques and machine learning algorithms to dynamically adjust asset weights helps in constructing resilient portfolios capable of weathering macroeconomic shocks. These models can also identify emerging correlation shifts, allowing for preemptive rebalancing that preserves risk-adjusted returns and mitigates systemic risks.

Visualize a multi-asset correlation matrix with real-time updates, facilitating strategic diversification decisions in volatile markets.

What Are the Emerging Trends in Digital Assets and Their Impact on Gold Demand?

The rise of digital assets, including cryptocurrencies and tokenized commodities, introduces new dimensions to gold demand. Blockchain innovations facilitate fractional ownership and ease of transfer, potentially expanding retail and institutional participation. Moreover, central banks exploring digital currencies could influence gold’s role as a strategic reserve asset. Staying abreast of these technological trends, regulatory developments, and adoption patterns is crucial for refining long-term investment strategies, as traditional and digital assets increasingly intertwine in the financial ecosystem.

Explore further insights on this transformative landscape at this authoritative resource.

Expert Insights & Advanced Considerations

1. Diversify with Cross-Asset Correlations

Understanding the inverse relationship between gold and the US dollar, along with correlations with inflation-linked securities, enables sophisticated portfolio management that mitigates risks and enhances returns.

2. Leverage Quantitative and Sentiment Models

Integrating machine learning algorithms with real-time sentiment analysis from news and social media provides a predictive edge, reducing emotional biases and improving decision-making accuracy.

3. Monitor Central Bank Activities

Active analysis of central bank gold reserve adjustments offers early indicators of long-term price trends, allowing strategic entry and exit points aligned with institutional movements.

4. Incorporate Digital Asset Trends

Tracking innovations in cryptocurrencies and tokenized gold expands understanding of evolving demand channels and potential market disruptions or opportunities.

Curated Expert Resources

- World Gold Council: Offers comprehensive market reports, demand analysis, and investment insights, essential for staying informed on global gold trends.

- IMF & International Financial Reports: Provide macroeconomic data and policy updates influencing gold prices and investor strategies.

- Specialized Financial Analytics Platforms: Tools like Bloomberg Terminal or Thomson Reuters for real-time data, correlation matrices, and algorithmic trading insights.

- Academic Journals on Commodity Markets: Research papers and case studies that deepen understanding of complex market dynamics and predictive modeling techniques.

Final Expert Perspective

In 2025, mastering advanced gold trading strategies requires a nuanced understanding of market sentiment, macroeconomic shifts, and technological innovations. Integrating cross-asset correlations, quantitative models, and geopolitical insights positions investors for long-term resilience and growth. Continual learning through authoritative resources ensures that you remain at the forefront of market developments. Engage with these insights actively and consider contributing your expertise to the broader investment community to refine and adapt strategies dynamically.

This post offers a comprehensive overview of advanced strategies that are crucial for today’s volatile gold markets. I especially appreciate the emphasis on integrating quantitative models with sentiment analysis, as I’ve seen firsthand how combining data-driven insights with real-time news sentiment can significantly improve timing on trades. During the recent market turbulence triggered by geopolitical events, I found that deploying algorithmic trading systems that adapt based on macroeconomic shifts and sentiment cues allowed me to respond more swiftly and effectively. One challenge I’ve faced, however, is ensuring the accuracy and relevance of sentiment data, especially from social media sources that can be noisy. Have others found particular tools or methodologies that help filter genuine market signals from the noise? Also, with central banks actively modifying their gold reserves, I’m curious about how traders are adjusting their long-term strategies to account for these institutional moves—any insights or experiences would be greatly valued.