Strategic Foundations: Positioning Gold Trading Within the 2025 Economic Landscape

As we approach 2025, gold trading remains a pivotal avenue for portfolio diversification and wealth preservation amid growing global economic uncertainties. Mastering effective gold trading techniques requires not only understanding price movements but also integrating broader macroeconomic indicators, geopolitical developments, and evolving market structures. Expert traders leverage a multifaceted approach that transcends traditional buy-and-hold tactics, employing analytical rigor and advanced instruments to optimize returns.

Leveraging Market Volatility: Sophisticated Approaches to Timing and Execution

Gold’s inherent volatility, influenced by shifts in inflation expectations, currency fluctuations, and central bank policies, presents both risk and opportunity. Seasoned traders employ technical analysis tools such as Fibonacci retracement levels, moving average convergence divergence (MACD), and volume profile to identify high-probability entry and exit points. Complementing this, algorithmic trading strategies calibrated to real-time data enhance precision and speed, essential in navigating fast-moving gold futures markets. Incorporating smart gold trading strategies for volatile markets ensures adaptability and risk mitigation.

How Can Traders Integrate Supply-Demand Analytics to Enhance Gold Trading Performance?

Analyzing global gold supply-demand dynamics has become indispensable for expert traders seeking an informational edge. This entails monitoring mining outputs, recycling rates, and central bank purchases—factors that directly influence price trajectories. For instance, increased central bank acquisitions, as detailed in central bank gold purchases impact on 2025 prices, can signal bullish momentum. Additionally, tracking jewelry demand fluctuations, especially in emerging markets, offers predictive insights into medium-term price adjustments. Integrating these indicators with technical signals refines trade timing and portfolio allocation decisions.

Advanced Risk Management: Utilizing Hedging and Diversification Within Gold Portfolios

Effective gold trading transcends speculation, demanding robust risk management frameworks. Diversification through gold ETFs, mutual funds, and selective mining stocks reduces idiosyncratic risk, as highlighted in exploring gold ETFs and mutual funds for diversified portfolios. Moreover, strategic use of options and futures contracts provides hedging capabilities against adverse price swings and geopolitical shocks. An expert-level approach involves scenario analysis and stress testing to anticipate market disruptions, enabling proactive adjustments that preserve capital and exploit emerging opportunities.

Incorporating Technological Innovations: Algorithmic and Data-Driven Gold Trading

The advent of machine learning and big data analytics has transformed gold trading methodologies. Cutting-edge models analyze vast datasets, including sentiment analysis from news feeds and social media, to forecast price movements with heightened accuracy. Traders adopting these technologies gain a competitive advantage by detecting subtle market signals and executing trades with algorithmic precision. For those seeking to deepen technical expertise, resources such as the Journal of Commodity Markets provide peer-reviewed insights into quantitative gold trading strategies (Journal of Commodity Markets).

Explore related expert content and contribute your insights on advanced gold trading at BuyingGoldNow.com to engage with a community of professional investors.

Behavioral Finance Insights: Decoding Investor Psychology in Gold Markets

Understanding behavioral finance principles can significantly enhance gold trading strategies by revealing how cognitive biases and emotional responses influence market dynamics. Traders often encounter phenomena such as herd behavior, loss aversion, and overconfidence, which distort price movements beyond fundamental values. Expert traders integrate sentiment analysis and contrarian indicators to anticipate irrational market phases and capitalize on them.

For example, during periods of geopolitical tension or economic uncertainty, panic buying can inflate gold prices temporarily. By combining quantitative data with qualitative assessments of investor sentiment, traders develop a holistic view that guides strategic entry and exit decisions. This nuanced approach aligns with advanced methodologies discussed in gold price forecast 2025: key factors influencing trends, which emphasizes the interplay between market psychology and price action.

Integrating ESG Factors: The Emerging Role of Sustainable Gold Investing

Environmental, Social, and Governance (ESG) considerations are increasingly shaping gold investment paradigms. Responsible sourcing and ethical mining practices impact supply chains, influencing investor preferences and regulatory landscapes. Experts recognize that ESG-compliant gold can command premium valuations, reflecting growing demand from institutional investors prioritizing sustainability.

By analyzing ESG ratings of mining companies and tracking certifications like the Responsible Gold Mining Principles (RGMP), traders and portfolio managers can anticipate shifts in supply-demand balance driven by ethical considerations. This layer of analysis enriches traditional fundamental and technical frameworks, offering a competitive edge in portfolio construction and risk management.

What Advanced Analytical Tools Are Essential for Predicting Gold Price Movements in 2025?

Sophisticated forecasting requires a blend of quantitative and qualitative tools. Time series models such as ARIMA and GARCH capture volatility clustering and mean reversion in gold prices. Machine learning classifiers analyze complex interdependencies among macroeconomic indicators, geopolitical events, and market sentiment. Additionally, scenario simulations incorporating central bank policies, inflation trajectories, and currency fluctuations provide probabilistic assessments of future price paths.

Experts often combine these techniques with real-time data feeds and alternative data sources, including satellite imagery of mining activity and social media sentiment scores, to refine predictions. For comprehensive methodologies, the ResearchGate publication on advanced forecasting methods for gold price prediction offers valuable insights.

Engage with our community at BuyingGoldNow.com by sharing your experiences or questions on integrating these advanced tools into your gold trading arsenal. Your contributions help foster a collaborative environment for continuous learning and innovation.

Quantitative Modeling Meets Geopolitical Intelligence: A Dual-Lens Approach to Gold Trading

In the rapidly evolving landscape of gold trading, reliance on isolated analytical frameworks is no longer sufficient. Expert traders are increasingly integrating quantitative financial models with geopolitical analytics to forecast price movements with greater precision and agility. This dual-lens approach harnesses econometric techniques to quantify historical price behaviors while simultaneously interpreting geopolitical narratives that can trigger abrupt market shifts.

For instance, regime-switching models capture the nonlinear dynamics of gold prices across different market states, such as stable periods versus crisis episodes. When combined with real-time geopolitical risk indices—such as the Global Peace Index or geopolitical event trackers—these models help traders anticipate regime transitions more effectively. A seminal study published in the Journal of Commodity Markets elucidates the efficacy of integrating geopolitical risk measures into gold price forecasting, underscoring how sudden policy announcements or conflicts can amplify volatility beyond conventional expectations.

How Can Machine Learning Models Incorporate Complex Geopolitical Variables Without Overfitting in Gold Trading Forecasts?

One of the nuanced challenges in deploying machine learning for gold price prediction lies in encoding complex, qualitative geopolitical variables into quantitative inputs without succumbing to overfitting. Expert practitioners employ feature engineering techniques such as embedding geopolitical events into sentiment scores derived from natural language processing (NLP) of news streams and social media discourse. These embeddings transform textual data into continuous numerical features that can be fed into models like Long Short-Term Memory (LSTM) networks or Gradient Boosting Machines.

Moreover, cross-validation and regularization strategies are critical to maintaining model generalization. Techniques such as dropout layers in neural networks or L1/L2 regularization prevent excessive model complexity. Integrating domain knowledge to select relevant geopolitical indicators also streamlines the feature set, reducing noise and enhancing predictive stability. This sophisticated synthesis of machine learning and geopolitical analysis empowers traders to navigate the opaque interplay between global events and gold market reactions.

Exploiting Cross-Asset Correlations: Advanced Strategies for Gold Portfolio Optimization

Beyond standalone gold trading, advanced investors explore cross-asset correlations to optimize portfolio performance and hedge systemic risks. Gold’s traditional role as a safe haven is nuanced by its correlations with other asset classes such as equities, bonds, and cryptocurrencies. Dynamic correlation models, including the Dynamic Conditional Correlation (DCC) GARCH framework, quantify time-varying relationships and inform adaptive portfolio rebalancing strategies.

For example, during periods of heightened inflation fears, gold and Treasury Inflation-Protected Securities (TIPS) may exhibit complementary behaviors, suggesting strategic co-allocation. Conversely, in deflationary scenarios, gold’s correlation with risk assets like equities might strengthen, challenging conventional diversification assumptions. Incorporating these insights, traders can implement volatility targeting and risk parity approaches, thereby enhancing risk-adjusted returns.

Empirical evidence from CFA Institute research highlights how dynamic correlation analysis supports tactical asset allocation decisions involving gold amidst fluctuating macroeconomic regimes.

Harnessing Real-Time Alternative Data Sources: From Satellite Imagery to Blockchain Analytics

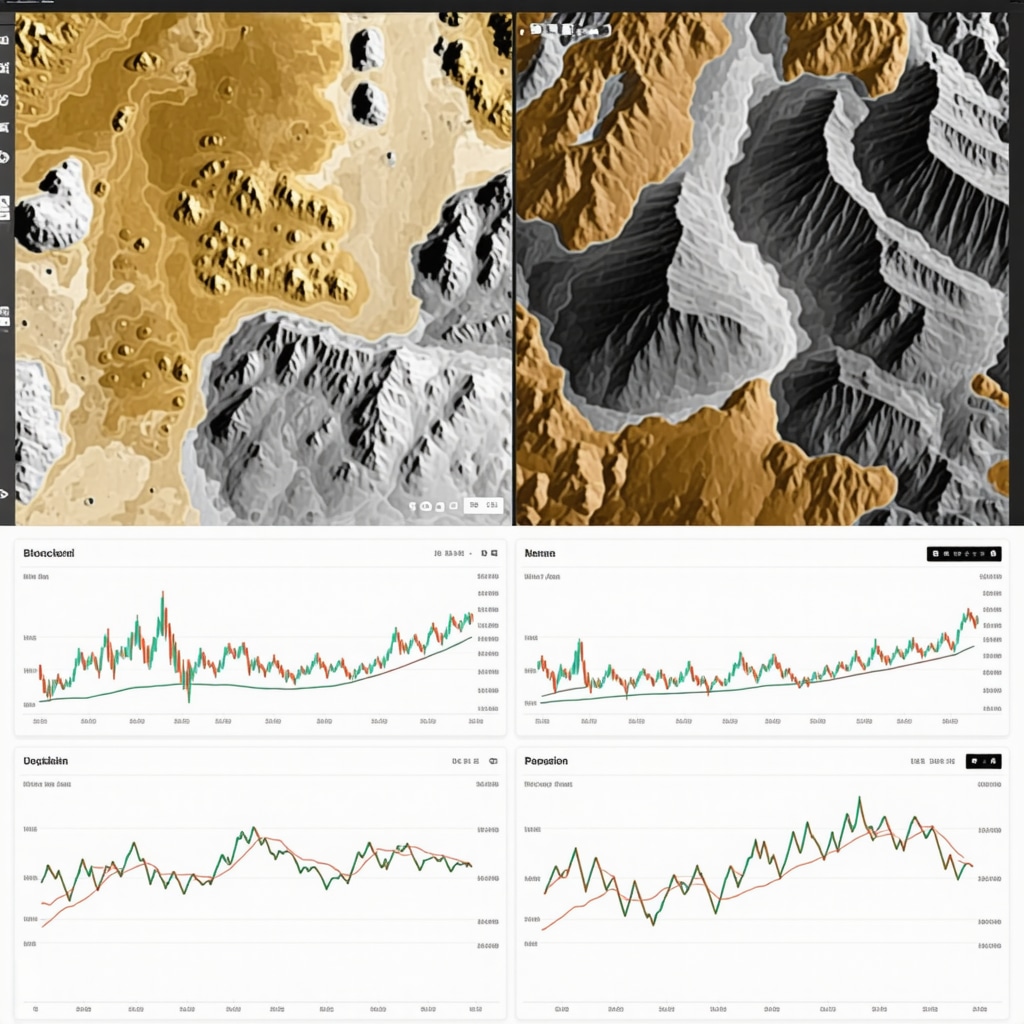

Cutting-edge gold traders leverage alternative data streams to gain early insights into supply chain disruptions, mining outputs, and market sentiment. Satellite imagery analysis, powered by machine vision algorithms, enables near real-time monitoring of mining activity and stockpile levels at major gold-producing regions. Such granular data can precede official production reports, offering a valuable edge.

Simultaneously, blockchain analytics provide transparency into gold-backed digital tokens and vault holdings, illuminating flows that may impact physical gold demand. By synthesizing these diverse datasets, traders develop a multidimensional perspective, enhancing both short-term tactical trades and long-term strategic positioning.

What Are the Best Practices for Integrating Satellite and Blockchain Data into Gold Trading Algorithms?

Effective integration begins with rigorous data validation and normalization to ensure consistency across heterogeneous sources. Data fusion techniques combine satellite-derived metrics with blockchain transaction volumes, creating composite indicators that reflect real-world supply-demand imbalances. Implementing anomaly detection algorithms helps identify outliers or irregular activity that could signal market-moving events.

Moreover, collaboration with data providers specializing in geospatial and blockchain intelligence enhances data quality and contextual interpretation. Periodic model retraining incorporating these alternative data streams maintains predictive accuracy as market conditions evolve. Together, these best practices form the backbone of a resilient, data-driven gold trading infrastructure.

For practitioners eager to deepen their expertise, exploring resources like the NASA Landsat Program’s applications in mining and blockchain analytics whitepapers from industry leaders offers valuable technical insights.

Engage with our expert community at BuyingGoldNow.com to share your experiences or inquire about implementing these advanced data strategies. Continuous dialogue fosters innovation and sharpens competitive advantage in the dynamic gold trading arena.

Decoding the Future: Synergizing Artificial Intelligence with Geopolitical Forecasting in Gold Markets

In the sophisticated realm of gold trading, the fusion of artificial intelligence (AI) methodologies with geopolitical intelligence is rapidly redefining predictive analytics. Advanced traders are now employing hybrid models that combine deep learning architectures, such as Transformer-based networks, with real-time geopolitical event feeds to anticipate sudden market movements triggered by international conflicts, policy shifts, or trade negotiations. This integration demands meticulous feature engineering to translate qualitative geopolitical narratives into quantitative signals, ensuring robust model interpretability and resilience against regime changes.

Harnessing Quantum Computing Potential for Ultra-High-Frequency Gold Trading Strategies

Quantum computing, though nascent, promises transformative capabilities in processing complex optimization problems intrinsic to gold trading algorithms. By leveraging quantum annealing and variational quantum eigensolvers, expert traders can solve portfolio optimization and risk parity models with unprecedented speed and accuracy, especially under volatile conditions. The quantum advantage also extends to enhancing Monte Carlo simulations for value-at-risk (VaR) estimations, thus refining hedging strategies in dynamic environments.

How Can Quantum-Inspired Algorithms Mitigate Latency and Computational Bottlenecks in Real-Time Gold Trading?

Quantum-inspired algorithms, designed to run on classical hardware, offer a pragmatic approach to circumvent current quantum hardware limitations while capitalizing on quantum computing principles. Techniques such as quantum approximate optimization algorithm (QAOA) analogues and tensor network methods help streamline combinatorial problems, reducing latency in signal processing and decision-making. Implementing these algorithms within FPGA-accelerated trading infrastructures enhances throughput, enabling ultra-high-frequency gold trade executions with minimized slippage.

Augmenting Sentiment Analysis with Multilingual NLP for Global Gold Market Insights

Given gold’s global nature, incorporating multilingual natural language processing (NLP) frameworks elevates sentiment analysis accuracy by capturing nuanced investor sentiments across diverse regions and languages. Advanced models utilize cross-lingual embeddings and transformer-based multilingual architectures to parse news articles, social media, and policy announcements, extracting sentiment polarity and intensity relevant to gold demand and supply narratives. This granular sentiment data integrates with quantitative models to enhance forecast robustness.

Exploring the Role of Decentralized Finance (DeFi) in Democratizing Gold Exposure

Decentralized finance platforms are increasingly facilitating fractionalized and transparent gold investments through blockchain tokenization. These innovations disrupt traditional gold trading by enabling peer-to-peer transactions, liquidity pooling, and programmable smart contracts that automate yield generation on gold-backed assets. Experts analyze DeFi protocols’ security, regulatory compliance, and market impact to harness emerging arbitrage opportunities and mitigate systemic risks within gold portfolios.

Elevating Portfolio Resilience: Utilizing Multi-Scenario Stress Testing with Macroeconomic and Climate Change Scenarios

Modern portfolio management incorporates sophisticated stress testing frameworks that simulate complex macroeconomic shocks alongside climate change scenarios affecting gold mining operations and supply chains. Scenario generators integrate stochastic modeling of inflation spikes, monetary tightening cycles, geopolitical conflicts, and environmental disruptions such as extreme weather events. This multidimensional approach informs dynamic asset allocation adjustments, ensuring portfolio robustness against multifactorial risks.

What Are the Cutting-Edge Methodologies for Integrating Climate Risk Analytics into Gold Trading Models?

Integrating climate risk analytics involves coupling geospatial data on mining regions with environmental impact assessments and regulatory trend analyses. Techniques such as spatial econometrics and machine learning-driven climate scenario forecasting enable traders to quantify risks related to water scarcity, carbon pricing, and supply chain disruptions. Incorporating these metrics into stochastic gold price models facilitates proactive risk mitigation and aligns investment strategies with emerging sustainability mandates. Resources from the Task Force on Climate-related Financial Disclosures (TCFD) offer authoritative frameworks supporting such advanced integration.

We invite seasoned traders and analysts to explore these frontier methodologies and share practical insights on BuyingGoldNow.com, fostering a platform for collaborative innovation in gold trading excellence.

Expert Insights & Advanced Considerations

Navigating Gold’s Multifactorial Price Drivers Requires Integrated Analytical Frameworks

Gold trading in 2025 demands a synthesis of quantitative models, geopolitical intelligence, and behavioral finance insights. Traders who blend econometric forecasting with real-time geopolitical risk assessment and sentiment analysis gain superior market timing and risk management capabilities. This holistic approach transcends reliance on isolated indicators, enabling more resilient strategies amid volatile macroeconomic conditions.

Alternative Data and Technological Innovation Are Game-Changers for Tactical Advantage

Utilizing satellite imagery to monitor mining operations and blockchain analytics for gold-backed token flows provides traders with early, actionable intelligence ahead of official reports. Coupled with AI-powered multilingual NLP sentiment models, these alternative data sources enrich decision-making precision. Embracing these innovations is essential to maintaining a competitive edge in increasingly complex gold markets.

Climate and ESG Integration Is No Longer Optional but Strategic

Incorporating environmental and social governance criteria into gold investment and trading models reduces exposure to regulatory and reputational risks. Advanced climate scenario stress testing and ESG ratings analysis help anticipate supply chain vulnerabilities and shifts in institutional demand. This forward-looking perspective aligns gold trading with sustainability imperatives, enhancing portfolio resilience.

Quantum and Quantum-Inspired Algorithms Will Accelerate Ultra-High-Frequency Execution and Optimization

Though quantum computing remains emergent, quantum-inspired algorithms already offer practical benefits in solving complex optimization problems and reducing latency in real-time gold trading. Forward-thinking traders investing in these technologies position themselves to capitalize on ultra-fast decision-making and enhanced portfolio risk management as hardware capabilities mature.

Cross-Asset Correlation Dynamics Demand Adaptive Portfolio Construction

Understanding gold’s evolving correlations with equities, bonds, cryptocurrencies, and inflation-protected securities enables dynamic rebalancing that optimizes risk-adjusted returns. Utilizing models such as Dynamic Conditional Correlation GARCH empowers traders to anticipate regime shifts and capitalize on nuanced diversification benefits beyond traditional safe-haven roles.

Curated Expert Resources

- Journal of Commodity Markets – Offers rigorous peer-reviewed research on quantitative and geopolitical gold price forecasting methodologies, essential for mastering advanced analytical frameworks.

- Task Force on Climate-related Financial Disclosures (TCFD) – Provides authoritative frameworks and best practices for integrating climate risk analytics into investment and trading models.

- CFA Institute Research – Features empirical studies on dynamic cross-asset correlations involving gold, supporting tactical allocation and risk management strategies.

- NASA Landsat Program Applications – Demonstrates practical use cases of satellite data in mining and supply monitoring, a crucial resource for traders leveraging alternative data.

- ResearchGate Publication on Advanced Gold Price Forecasting – A comprehensive source detailing machine learning and econometric models tailored for gold market predictions.

Final Expert Perspective

Mastering gold trading in 2025 requires an expert-level fusion of multidisciplinary insights, from cutting-edge technology and alternative data integration to climate-conscious investment frameworks and sophisticated quantitative-geopolitical models. The evolving gold market landscape rewards those who adopt flexible, data-driven strategies underpinned by deep domain knowledge. We encourage seasoned investors and analysts to deepen their expertise by engaging with advanced resources and contributing insights at BuyingGoldNow.com. By cultivating a collaborative community focused on innovation and rigor, gold trading professionals can navigate complexity and capitalize on emerging opportunities with confidence.

What really stood out to me in this comprehensive overview is how crucial supply-demand analytics are in shaping effective trading strategies for 2025. Monitoring central bank purchases and jewelry demand, especially in emerging markets, seems to be a game-changer for timing entries and exits accurately. I’ve been experimenting with integrating mining output data and ESG ratings into my models, and I’ve noticed that incorporating geopolitical stability indices offers an additional layer of predictive power. It’s fascinating how technological advancements, like machine learning and satellite imagery, are now central to proactive risk management. Do others here have experience using satellite data to anticipate supply shifts? I wonder how scalable that approach is for individual traders versus institutional players. Overall, this post underscores the importance of combining traditional fundamental analysis with cutting-edge tech — a strategy I believe will define successful gold trading in the coming years.

This is an incredibly comprehensive overview of how AI, geopolitical analytics, and innovative data sources are shaping the future of gold trading. I especially appreciate the focus on integrating satellite imagery and blockchain analytics, as these alternative data streams can provide early signals that aren’t available through traditional indicators. Personally, I’ve started experimenting with satellite data to monitor mining activity, and I’ve found that combining this info with sentiment analysis from social media tends to improve short-term prediction accuracy.

One challenge I’ve encountered is validating the satellite data and ensuring its consistency across different regions. Has anyone here developed best practices for corroborating geospatial data with on-the-ground reports or other datasets? Also, as individual traders enter this space, I wonder about the accessibility and cost of high-quality satellite imagery—do you think these tools will become more affordable and widespread soon? Overall, leveraging these advanced technologies seems vital for staying ahead in a rapidly evolving market. I’m curious—what other innovative data sources have you found valuable for gold forecasting in 2025?