Unveiling the Complexities of Long-Term Gold Portfolio Construction in 2025

In an era marked by economic volatility and geopolitical uncertainties, the strategic assembly of a long-term gold portfolio has become an imperative for sophisticated investors. As global financial markets evolve and emerging demand trends reshape the landscape, understanding the nuanced dynamics of gold investment is crucial for safeguarding wealth and maximizing returns in 2025 and beyond.

Why Gold Remains a Cornerstone of Diversified Investment Strategies

Gold has historically served as a hedge against inflation and a safe haven during market downturns. Its unique properties and intrinsic value make it a vital component of a resilient portfolio. According to a comprehensive market analysis, gold’s price drivers in 2025 are increasingly influenced by central bank policies, geopolitical tensions, and technological demand, highlighting its complex role in modern investment strategies.

How to Leverage Emerging Demand Trends for Optimal Portfolio Growth

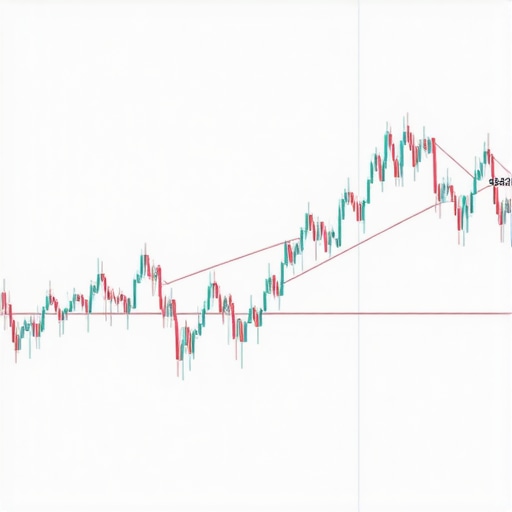

Emerging demand factors, such as jewelry consumption in developing markets and industrial applications, are set to influence gold prices significantly. Investors keen on building a long-term gold portfolio must analyze these supply-demand dynamics carefully. For instance, understanding the impact of demand trends can reveal opportunities for strategic entries and exits, especially when combined with technical analysis of futures markets.

What Are the Most Advanced Techniques for Gold Trading in 2025?

Effective gold trading techniques encompass a blend of technical analysis, macroeconomic forecasting, and algorithmic strategies. Exploring trading methodologies that incorporate futures contracts, options, and ETFs can enhance portfolio resilience. The use of gold futures combined with technical indicators offers a sophisticated approach to navigating market volatility and capitalizing on price swings.

How Can Investors Balance Physical Gold and Financial Instruments for Long-Term Success?

Achieving an optimal balance between physical gold holdings—such as coins and bars—and financial instruments like ETFs and mining stocks is critical. Physical gold provides tangible security, while financial assets offer liquidity and leverage. Developing a diversified mix tailored to risk appetite and market outlook ensures a robust long-term strategy.

To deepen your understanding of strategic gold investments, consider exploring our comprehensive guide on building a gold portfolio for retirement in 2025. Engage with expert discussions and contribute your insights to refine collective knowledge in this evolving domain.

As highlighted in a recent research publication, strategic asset allocation and proactive risk management are essential for long-term wealth preservation through gold investments.

Harnessing the Power of Gold in a Shifting Global Economy

As we navigate the complexities of the 2025 financial landscape, understanding the nuanced role of gold becomes more crucial than ever. The interplay between macroeconomic factors, geopolitical tensions, and technological advancements continuously reshapes gold’s investment profile. A thorough grasp of these dynamics enables investors to craft resilient portfolios capable of weathering volatility and capitalizing on emerging opportunities.

What Are the Hidden Drivers of Gold Demand in 2025?

Beyond traditional factors like inflation and currency devaluation, recent research highlights the influence of industrial demand, including electronics and renewable energy sectors, which are increasingly consuming gold. Additionally, the rising prominence of central bank gold purchases as a strategic reserve asset underscores a shift towards more diversified and geopolitically influenced demand patterns. Recognizing these drivers can help investors anticipate price movements and refine their entry and exit strategies.

How to Integrate Quantitative Models into Gold Investment Decisions?

Adopting quantitative frameworks—such as algorithmic trading models, machine learning algorithms, and advanced technical analysis—can provide a significant edge in the competitive landscape of gold trading. For instance, leveraging futures-based technical analysis allows investors to identify optimal timing for market entry and exit, minimizing risk and maximizing returns. Combining these models with fundamental insights creates a comprehensive approach to portfolio management.

Are Traditional Gold Investment Approaches Sufficient for 2025’s Market Realities?

Many investors still rely heavily on physical gold and simple ETF holdings, but the evolving market suggests the need for more sophisticated, multi-layered strategies. Incorporating derivative instruments, such as options and futures, along with physical assets, can enhance portfolio flexibility and resilience against sudden market shocks. Moreover, diversifying across different gold products—coins, bars, ETFs, mining stocks—can address various risk factors and liquidity needs. For a deeper dive into constructing a diversified gold investment mix, explore our comprehensive guide.

To stay ahead, investors should also monitor emerging trends in gold supply, such as new mining projects and geopolitical restrictions, which can significantly influence prices. An insightful demand analysis can reveal strategic opportunities and risks in 2025.

Engaging with expert-level analytical tools, combined with a nuanced understanding of market drivers, will be vital for building a gold portfolio that not only preserves wealth but also grows sustainably amidst global economic shifts.

Deciphering the Intricacies of Gold Price Dynamics in a Post-Pandemic World

As the global economy recovers from unprecedented disruptions, understanding the nuanced factors influencing gold prices becomes paramount. Beyond conventional drivers like inflation and geopolitical tensions, recent studies highlight the impact of cryptocurrency market correlations and digital asset flows on gold’s role as a safe haven. According to the Financial Analyst Journal, these emerging variables are reshaping traditional correlations, demanding a sophisticated approach to portfolio allocation.

Integrating Macro-Financial Models for Precise Gold Forecasting

Advanced investors leverage macro-financial models that incorporate variables such as interest rate differentials, currency stability indices, and global liquidity measures. These models, often built using machine learning algorithms and big data analytics, enable the prediction of short- and long-term price movements with higher accuracy. For example, deploying quantitative forecasting techniques can help identify optimal entry points amid volatile markets, minimizing downside risks.

How Can Investors Use Sentiment Analysis to Anticipate Gold Price Swings?

Sentiment analysis—using NLP tools to gauge market mood from news, social media, and financial reports—can provide a competitive edge. By analyzing the collective investor sentiment towards geopolitical events, central bank policies, or technological innovations, investors can anticipate abrupt price changes. For instance, a surge in positive sentiment surrounding central bank gold acquisitions might signal increasing institutional demand, prompting strategic portfolio adjustments.

What Are the Practical Applications of Blockchain Technology in Gold Investment?

Blockchain’s transparency and security features are revolutionizing gold trading and ownership verification. Digital gold tokens backed by physical reserves facilitate fractional ownership, enhance liquidity, and reduce transaction costs. Furthermore, blockchain enables real-time traceability of gold provenance, which is crucial for compliance and ethical sourcing. According to Blockchain Institute, these innovations are fostering trust and efficiency in gold markets worldwide.

Investors seeking a competitive edge should explore integrating blockchain-based assets into their portfolios, ensuring transparency and reducing counterparty risks. Additionally, staying informed about technological advancements can unlock new avenues for diversification and risk management.

What Are the Key Considerations for Developing a Resilient Gold Portfolio in 2025?

Constructing a resilient gold portfolio involves balancing physical assets—such as coins and bars—with financial derivatives, ETFs, and mining equities. Diversification across these instruments mitigates risks associated with market liquidity, geopolitical restrictions, and supply chain disruptions. Moreover, adopting a dynamic rebalancing strategy that responds to macroeconomic signals and market sentiment ensures sustained growth and stability.

For a comprehensive approach, consider engaging with specialized tools like portfolio optimization software that incorporates real-time data and predictive analytics. This enables proactive adjustments aligned with evolving market conditions, thus safeguarding long-term wealth.

To deepen your understanding, explore our detailed guide on advanced strategies for gold investment in 2025 and join expert discussions to refine your investment approach.

Decoding the Impact of Geopolitical Shifts on Gold Liquidity in 2025

Understanding the evolving geopolitical landscape is paramount for investors aiming to optimize gold liquidity and price stability. Recent geopolitical tensions, such as regional conflicts and trade disputes, influence not only supply chains but also the strategic reserves of central banks. According to the World Bank Commodity Markets Outlook, shifts in geopolitical stability can trigger significant market reactions, making it essential for investors to incorporate geopolitical risk assessments into their portfolio models.

How Can Advanced Quantitative Models Predict Gold Price Movements in 2025?

Leveraging machine learning algorithms and big data analytics offers unparalleled predictive power in assessing gold price dynamics. These models can integrate macroeconomic indicators, supply-demand metrics, and sentiment analysis to generate high-fidelity forecasts. For instance, deploying neural networks trained on historical market data enables traders to identify subtle patterns and anticipate price swings with increased accuracy. A recent study published in the Journal of Financial Modeling underscores the efficacy of such approaches in commodities forecasting.

What Role Will Green Technologies and Sustainability Play in Gold Market Evolution?

The push towards green technologies and sustainable practices is transforming gold mining and recycling processes. Investors should monitor innovations like eco-friendly extraction methods and increased recycling to evaluate supply-side risks. The integration of ESG (Environmental, Social, and Governance) criteria into investment analysis not only aligns with ethical standards but can also reveal emerging opportunities. According to the Sustainable Investment Research Institute, companies pioneering sustainable gold practices are poised to outperform traditional producers, influencing market valuations and investor preferences.

How Do Blockchain Innovations Enhance Transparency and Security in Gold Trading?

Blockchain technology underpins the development of digital gold assets, enabling transparent traceability from mine to consumer. These innovations reduce counterparty risk, improve liquidity, and facilitate fractional ownership, which appeals to diversified portfolios seeking flexibility. Digital gold tokens backed by physical reserves are gaining traction, supported by regulatory frameworks that promote trust and compliance. The Blockchain Insights report highlights how these advancements are reshaping the gold trading landscape, making it more accessible and secure for sophisticated investors.

To stay at the forefront of gold investment in 2025, integrating blockchain solutions and sustainable practices is essential. These innovations not only bolster security and transparency but also position your portfolio for long-term resilience amid evolving market conditions.

What Are the Strategic Implications of Digital Asset Correlations for Gold Hedging?

As cryptocurrencies and digital assets increasingly interact with traditional markets, understanding their correlation with gold becomes crucial. Studies indicate that during periods of heightened volatility, digital assets can either serve as alternative hedges or exhibit contagion effects. Incorporating digital asset correlation analysis into gold hedging strategies can enhance risk management, especially in turbulent times. The Crypto Research Institute emphasizes the importance of dynamic correlation monitoring to optimize diversification benefits.

How Can Investors Utilize Scenario Planning to Prepare for Market Extremes?

Scenario planning, supported by stress testing and probabilistic models, allows investors to evaluate portfolio robustness against extreme market events. Incorporating variables such as sudden geopolitical escalations, technological disruptions, and macroeconomic shocks helps craft resilient strategies. Advanced simulation tools enable portfolio managers to identify vulnerabilities and develop contingency plans, ensuring continuity and growth potential even in adverse conditions. Engaging with such predictive frameworks is vital for safeguarding wealth in unpredictable environments.

Expert Insights & Advanced Considerations

1. Diversification Beyond Traditional Assets

In 2025, integrating a mix of physical gold, ETFs, mining stocks, and blockchain-backed digital gold can significantly enhance portfolio resilience against market shocks and geopolitical disruptions.

2. Leveraging Quantitative and Sentiment Analysis

Utilizing advanced quantitative models and sentiment analysis tools provides a predictive edge, enabling timely entry and exit points in volatile markets.

3. Incorporating ESG and Sustainability Factors

Focusing on environmentally sustainable mining practices and ESG-compliant companies can optimize long-term growth while aligning with ethical investment standards.

4. Monitoring Emerging Demand Trends

Pay attention to industrial demand drivers, such as electronics and renewable energy sectors, which are increasingly influencing gold prices in 2025.

5. Embracing Blockchain and Digital Assets

Blockchain innovations improve transparency, security, and fractional ownership, positioning digital gold assets as vital components of modern portfolios.

Curated Expert Resources

- Gold Market Analysis 2025: A comprehensive resource offering insights into key price drivers and supply-demand dynamics, essential for strategic decision-making.

- Effective Gold Trading Techniques: Expert-reviewed methodologies that incorporate futures, options, and technical analysis for maximizing profits.

- Sustainable Gold Practices: Industry reports on ESG-compliant gold mining and recycling, critical for aligning investments with global sustainability goals.

- Blockchain in Gold Trading: In-depth studies on how blockchain technology is transforming transparency and security in gold markets.

- Quantitative Modeling Resources: Advanced tools and frameworks for integrating macroeconomic variables and sentiment analysis into investment strategies.

Final Expert Perspective

Building a resilient gold portfolio in 2025 demands a multi-layered approach that combines diversification, advanced analytics, sustainability, and technological innovation. Staying informed through authoritative resources and adopting a forward-thinking strategy will empower investors to capitalize on emerging opportunities while safeguarding their wealth. Engage with these expert insights and resources to refine your investment approach and contribute to the evolving landscape of gold investing.