Understanding the Dual Drivers of Gold Demand: Industrial Applications and Consumer Consumption

Gold’s unique properties have long cemented its status as a multifaceted asset with demand stemming from both industrial sectors and consumer markets. The intricate balance between these two forces shapes the global gold market dynamics and price trajectories. Grasping the nuanced distinctions between industrial gold use—encompassing electronics, medical devices, and emerging technologies—and consumer-driven demand—primarily jewelry and investment bullion—is essential for investors and industry professionals aiming to anticipate shifts in gold valuation and supply chain pressures.

Industrial Gold Usage: Technological Innovation and Material Efficiency

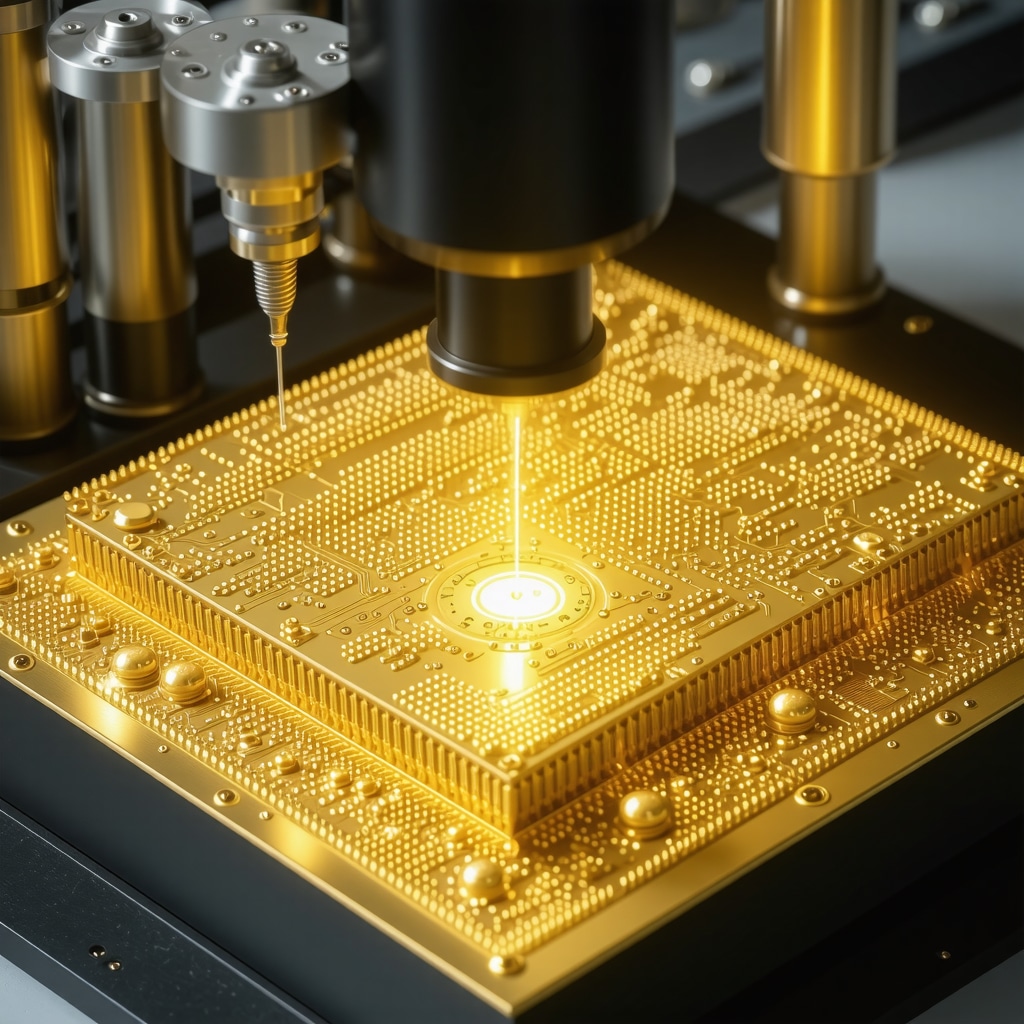

Industrial demand for gold is characterized by its unparalleled electrical conductivity, corrosion resistance, and malleability, making it indispensable in high-precision electronics, aerospace components, and cutting-edge medical equipment. Recent advances in nanotechnology and the proliferation of 5G infrastructure have incrementally increased gold consumption in microchips and connectors, despite ongoing efficiency efforts to minimize material usage. Furthermore, sustainable manufacturing trends encourage recycling of gold from electronic waste, subtly influencing net industrial demand. These technological and environmental factors introduce complexity when forecasting industrial gold requirements.

How Do Shifts in Industrial Innovation Affect Gold Demand Forecasts?

Industrial demand for gold is not static; it fluctuates with technological advancements and regulatory standards. For example, the rise of electric vehicles (EVs) and renewable energy technologies has expanded gold’s role in battery and photovoltaic applications, potentially offsetting reductions elsewhere. However, the push towards miniaturization and alternative materials may constrain growth. Thus, comprehensive demand forecasting must integrate sector-specific innovation trajectories, material substitution risks, and recycling rates to accurately model industrial gold consumption trends.

Consumer Gold Demand: Cultural Significance and Investment Behavior

On the consumer front, jewelry remains the predominant driver of gold demand, deeply rooted in cultural and socio-economic factors across regions such as India, China, and the Middle East. Seasonal festivals, weddings, and wealth preservation customs elevate consumer purchasing patterns, often independent of short-term price fluctuations. Moreover, investment demand through physical bullion and gold-backed financial products reflects broader economic sentiments, particularly in times of inflation or geopolitical uncertainty. Notably, the interplay between consumer demand for ornamental versus investment-grade gold introduces layers of complexity in market analysis.

Interrelation of Industrial and Consumer Needs: Market Implications and Price Sensitivity

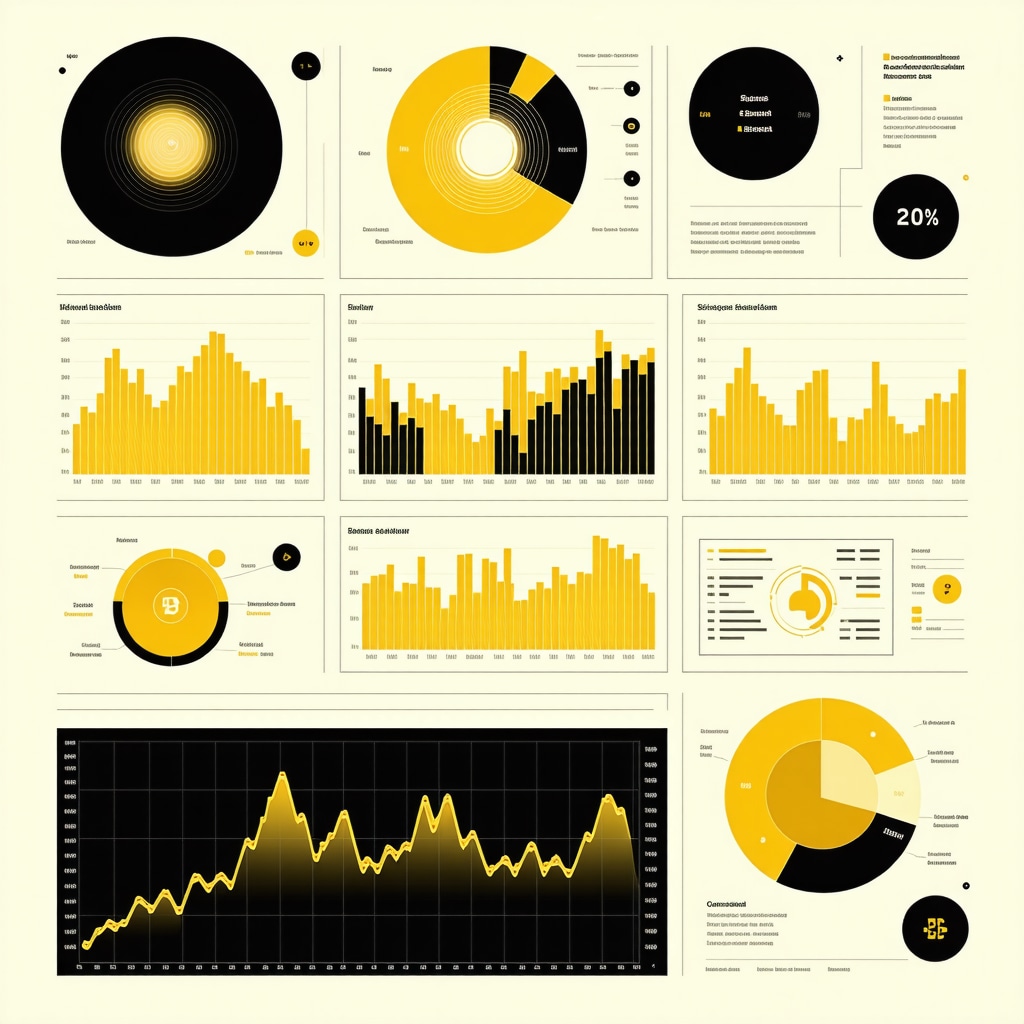

The relative weight of industrial versus consumer demand influences price elasticity and market stability. Consumer demand tends to exhibit price sensitivity; elevated gold prices can dampen jewelry sales but may simultaneously boost investment interest as a perceived safe haven. Conversely, industrial demand, while more inelastic in the short term, responds to economic cycles and technological shifts. Strategic investors must monitor these interdependencies to navigate volatile markets effectively.

For a deeper dive into how jewelry demand drives gold prices and impacts market behavior, explore understanding gold demand trends and jewelry’s influence.

What Are the Emerging Risks and Opportunities in Balancing Industrial and Consumer Gold Demand?

Emerging risks include supply chain disruptions affecting industrial gold availability, regulatory changes imposing stricter environmental controls, and shifts in consumer preferences towards alternative luxury goods or digital assets. Conversely, opportunities arise from technological breakthroughs that expand gold’s industrial applications and evolving investment products that cater to diversified consumer profiles. Investors and analysts must maintain vigilance on these evolving parameters to optimize portfolio strategies.

To stay informed on comprehensive gold demand trends and their implications for savvy investors, visit gold demand trends insights for savvy investors.

Expert Insights and Further Reading

For authoritative analysis on global gold demand fundamentals, the World Gold Council provides invaluable research reports illuminating the nuanced interplay of industrial and consumer sectors. Their publication, Gold Demand Trends, offers rigorous data and expert commentary essential for market participants.

Explore more expert-level content and contribute your professional insights to the evolving discourse on gold market dynamics by visiting our specialized guides and analysis at BuyingGoldNow.

Technological Disruption and Its Ripple Effects on Gold Demand

Beyond the surface, emerging technologies continuously reshape gold’s industrial utility, with quantum computing and flexible electronics poised to redefine material demands. These innovations may necessitate gold’s unique conductive and inert properties in novel configurations, compelling reevaluation of supply chains and production methodologies. Investors must appreciate these disruptive forces as catalysts altering the traditional industrial-consumer demand equilibrium.

Consumer Preferences in Transition: Digital Assets Versus Physical Gold

The rise of digital assets such as cryptocurrencies presents a nuanced challenge to conventional gold investment. While gold’s tangible nature and historical role as a wealth preserver remain compelling, younger demographics increasingly explore diversified portfolios incorporating digital holdings. This shift in investment psychology could moderate physical gold demand growth, particularly in developed markets, yet simultaneously encourage hybrid investment vehicles that combine gold’s stability with blockchain efficiencies.

How Can Investors Strategically Balance Industrial and Consumer Gold Demand Risks?

Strategic portfolio management requires a multi-dimensional approach that integrates real-time industrial demand indicators—such as semiconductor production rates and renewable energy deployment—with consumer sentiment analyses reflecting cultural trends and macroeconomic stressors. Dynamic allocation between physical bullion, ETFs, and mining equities can optimize exposure while mitigating sector-specific volatility. Continuous monitoring of supply chain constraints, recycling trends, and geopolitical developments enhances risk-adjusted decision-making.

For a comprehensive framework on evaluating gold mining stocks amidst market fluctuations, refer to our detailed guide how to evaluate gold mining stocks for maximum returns.

Geopolitical and Environmental Influences on Gold Market Dynamics

Geopolitical tensions and environmental regulations increasingly influence gold supply and demand. Trade disputes can disrupt mining operations and logistics, while stricter environmental policies may constrain production capacities or increase costs. These factors contribute to price volatility and necessitate a forward-looking perspective incorporating geopolitical risk assessments alongside traditional economic indicators.

According to the World Gold Council’s Gold Demand Trends report, gold’s resilience as a strategic asset is closely linked to its multifaceted demand drivers and the evolving global economic landscape.

Integrating Market Intelligence for Enhanced Gold Investment Strategies

Leveraging advanced analytics and market intelligence tools empowers investors to forecast demand shifts more precisely. By synthesizing data on technological adoption rates, consumer behavior patterns, and geopolitical developments, stakeholders can identify emerging opportunities and threats. This integration fosters adaptive strategies that align with both the cyclical and structural elements influencing gold markets.

Engage with our expert community by sharing your insights or questions on balancing industrial and consumer gold demand in the comments below. Explore additional resources to deepen your expertise on understanding gold demand trends for smart investors.

Quantum Leap: How Cutting-Edge Technologies Are Reshaping Gold’s Industrial Footprint

The technological landscape is undergoing transformative shifts that profoundly affect gold’s industrial demand. Quantum computing, for instance, demands materials with extraordinary conductive and resistance properties to sustain qubit stability and error correction. Gold’s exceptional inertness and conductivity position it as a candidate for specialized interconnects in quantum devices, potentially driving niche but strategic demand increments. Simultaneously, the advent of flexible electronics—wearable devices and foldable displays—requires gold in ultra-thin, malleable layers, promoting innovation in gold deposition techniques and material science.

These advancements not only elevate gold’s functional value but also impose new supply chain challenges, as precise purity and form factors become critical. Manufacturers must balance cost-efficiency with performance, incentivizing research into gold recycling methods tailored for high-tech applications. This evolving industrial demand profile underscores the importance of cross-disciplinary expertise for investors and producers alike.

What Are the Quantifiable Impacts of Emerging Technologies on Gold Demand Projections?

Quantifying the impact of emergent technologies on gold demand requires integrating multifactorial data: projected semiconductor manufacturing volumes, adoption rates of quantum and flexible electronics, and technological substitution risks. For example, a recent analysis by the World Gold Council indicates that while traditional electronics constitute the majority of industrial demand, emerging tech could contribute up to a 5% incremental increase over the next decade, contingent on innovation adoption curves and production scalability (World Gold Council, Gold Demand Trends 2024).

Moreover, the substitution potential of alternative conductive materials—like graphene or conductive polymers—introduces volatility in forecasts. Investors must, therefore, adopt scenario-based modeling that accommodates both optimistic and conservative technology penetration rates to anticipate supply-demand imbalances effectively.

Shifting Sands: The Intersection of Cultural Evolution and Digital Asset Adoption on Consumer Gold Demand

Consumer preferences are no longer monolithic; a generational and cultural shift is redefining gold’s role. While traditional markets such as India and the Middle East maintain strong cultural affinities for gold jewelry, younger consumers in developed economies increasingly view digital assets as complementary or alternative investment vehicles. This bifurcation creates a complex demand landscape where physical gold’s allure coexists with blockchain-enabled financial products like tokenized gold.

Investment behaviors are evolving, with hybrid portfolios incorporating physical bullion alongside gold-backed cryptocurrencies, leveraging blockchain’s transparency and liquidity. This trend challenges traditional distribution and marketing models, compelling gold retailers and financial institutions to innovate engagement strategies that resonate with tech-savvy demographics without alienating legacy consumers.

Integrative Strategies for Managing the Dualities of Gold Demand in Modern Portfolios

Given the multifaceted nature of gold demand, strategic investors must deploy integrative analytics combining industrial production indicators, consumer sentiment analysis, and geopolitical risk assessments. Advanced machine learning models can process real-time data streams—from semiconductor fabrication rates to social media sentiment on gold investment—to generate predictive insights with greater granularity.

Dynamic portfolio allocation, balancing physical bullion, exchange-traded funds (ETFs), and equities in gold mining companies, allows for nuanced risk management. Particularly, mining equities offer leveraged exposure to gold price movements but require vigilance regarding operational and regulatory risks. Investors should continuously recalibrate allocations in response to innovation-driven demand shifts and evolving consumer trends.

For an expert perspective on optimizing gold mining equity investments amid these complexities, consult our comprehensive analysis how to evaluate gold mining stocks for maximum returns.

Engage with our expert community to dissect these sophisticated dynamics further and refine your investment approach.

Gold Demand Complexity: Navigating the Nexus of Innovation and Consumer Trends

The multifaceted nature of gold demand necessitates a granular understanding of intersecting forces driving its industrial and consumer utilization. As technological breakthroughs redefine gold’s applications, and evolving consumer preferences reshape investment paradigms, market participants must synthesize these dynamics to anticipate nuanced demand trajectories.

Precision Analytics: Harnessing Data Science to Decode Gold Demand Patterns

Emerging big data methodologies and machine learning algorithms enable unprecedented insights into gold demand fluctuations. By integrating heterogeneous datasets—ranging from semiconductor fabrication indices to social sentiment analytics—analysts can construct predictive models that accommodate volatility, substitution risks, and geopolitical factors simultaneously. This quantitative approach empowers stakeholders to transition from reactive to proactive strategy formulation in gold asset management.

How Do Advanced Predictive Models Enhance Risk Mitigation in Gold Investment Portfolios?

Advanced predictive analytics facilitate dynamic risk assessment by modeling scenario-based outcomes that reflect technological adoption rates, regulatory shifts, and fluctuating consumer behaviors. For instance, machine learning models can identify early signals of supply chain disruptions or shifts in consumer sentiment toward digital assets, allowing investors to recalibrate exposure promptly. Such models transcend traditional statistical methods by capturing nonlinear dependencies and temporal patterns critical to gold’s dual demand structure.

Integrating Sustainability: Environmental Considerations as a Market Catalyst

Environmental stewardship increasingly influences gold mining and recycling practices, impacting supply reliability and cost structures. The push for responsible sourcing—embodied in initiatives like the Responsible Gold Mining Principles (RGMP)—is reshaping production methodologies, with implications for industrial supply chains and consumer perceptions alike. Incorporating sustainability metrics into demand forecasts and investment models is becoming indispensable for holistic market analysis.

Disruptive Synergies: Blockchain Innovations and Tokenized Gold Markets

Blockchain technology’s advent has propelled tokenized gold products, merging physical asset security with digital liquidity. These hybrid financial instruments democratize gold investment access, enhance transactional transparency, and introduce new liquidity dynamics. The interplay between tokenized gold and traditional bullion markets necessitates refined valuation frameworks that account for regulatory compliance, counterparty risk, and technological adoption rates.

According to the World Gold Council’s Gold Demand Trends 2024, the integration of blockchain-enabled gold investment avenues is poised to incrementally influence overall demand patterns, particularly among younger, digitally native investors.

Engage with our advanced insights and elevate your strategic positioning by exploring further resources and expert analyses on the evolving gold demand landscape. Share your perspectives or inquiries within our professional community to foster enriched discourse and collaborative expertise.

Expert Insights & Advanced Considerations

Technological Evolution as a Catalyst for Incremental Industrial Gold Demand

Cutting-edge sectors such as quantum computing and flexible electronics are subtly but steadily expanding gold’s industrial footprint. Their demand profiles emphasize ultra-pure, precision-engineered gold components, challenging traditional supply chains and driving innovation in recycling and material efficiency. Investors should monitor these niche growth areas as potential long-term demand stabilizers amid broader market fluctuations.

Consumer Demand’s Transformation Amid Digital Asset Integration

The interplay between cultural affinity for physical gold and the rising prominence of tokenized gold and cryptocurrencies introduces a dualistic consumer demand landscape. This bifurcation demands adaptive investment strategies that account for demographic shifts and hybrid portfolio preferences, recognizing that digital assets may moderate yet also complement traditional bullion investments.

Advanced Analytics as a Strategic Imperative in Gold Demand Forecasting

Harnessing machine learning and big data analytics enables a sophisticated understanding of demand drivers across industrial and consumer sectors. These tools facilitate scenario modeling that incorporates substitution risks, geopolitical volatility, and sentiment dynamics, empowering stakeholders to anticipate market inflection points and optimize portfolio allocation dynamically.

Sustainability and Regulatory Trends Shaping Supply and Perception

Environmental regulations and responsible sourcing initiatives are increasingly integral to gold market dynamics. Integrating sustainability metrics into investment models enhances risk assessment by addressing potential supply constraints and evolving consumer preferences for ethically sourced gold, thus influencing both price stability and brand value within the sector.

Curated Expert Resources

World Gold Council – Gold Demand Trends: A comprehensive repository of data and expert analyses detailing global gold demand patterns, technological impacts, and consumer behavior nuances essential for informed decision-making.

BuyingGoldNow’s Guide on Evaluating Gold Mining Stocks: An advanced resource offering strategic frameworks and financial metrics crucial for navigating mining equities amid evolving market conditions (how to evaluate gold mining stocks for maximum returns).

BuyingGoldNow’s Insight on Understanding Gold Demand Trends: Offers a deep dive into the dual forces of jewelry and industrial gold demand, elucidating their impact on price dynamics and investment strategies (understanding gold demand trends insights for smart buyers).

World Gold Council Research Hub: A portal providing ongoing updates on supply chain sustainability, blockchain innovations in gold markets, and geopolitical influences shaping gold’s strategic value.

BuyingGoldNow’s Gold Price Forecasts and Market Analysis: Timely reports and expert commentary on inflation effects, geopolitical risks, and emerging trends for proactive market positioning (gold price forecast 2026 inflation effects and predictions).

Final Expert Perspective

Gold demand today reflects a complex nexus of innovation-driven industrial needs and evolving consumer behaviors shaped by cultural traditions and digital asset adoption. Mastery of this multifaceted landscape requires integrating advanced analytical tools, sustainability considerations, and adaptive investment approaches that transcend conventional paradigms. For professionals seeking to navigate these dynamics, continuous engagement with expert insights and authoritative resources is paramount. To deepen your strategic understanding and contribute to the discourse on gold market evolution, we invite you to explore further advanced analyses and share your perspectives within our expert community.

This post provides a comprehensive overview of the multifaceted nature of gold demand, especially highlighting how technological advances like quantum computing and flexible electronics are subtly shaping industrial demand. As someone involved in the supply chain logistics of precious metals, I find the emphasis on recycling from electronic waste particularly compelling, because it reflects a growing push toward sustainability that could stabilize supply amidst increasing industrial needs. The shift toward hybrid investment strategies combining physical gold and digital assets also resonates with current market trends, especially among younger investors seeking liquidity and transparency.

One aspect I wonder about is how regional regulations and geopolitical influences might accelerate or hinder these technological adoption rates. For example, stricter environmental policies in major mining countries could impact supply more significantly than anticipated, thereby affecting both industrial and consumer demand. How do others see these geopolitical factors interacting with technological and consumer demand trends in shaping gold’s future? It seems like a complex web that requires constant monitoring to avoid unexpected shocks.