Unlocking the Power of Gold Investment: An Expert’s Perspective on Building Wealth in 2025

In an era where economic volatility and geopolitical uncertainties dominate financial markets, gold remains a quintessential safe haven for investors seeking stability and long-term growth. As a seasoned analyst in precious metals, I recognize that mastering the nuances of gold investment is crucial for both novice and experienced investors aiming to optimize their portfolios in 2025. This comprehensive guide delves into advanced strategies, market dynamics, and risk mitigation techniques that underpin successful gold investing today.

Why Gold Continues to Be a Cornerstone of Diversification in 2025

Gold’s unique properties—its intrinsic value, liquidity, and historical resilience—make it an indispensable asset class. Unlike equities or bonds, gold often exhibits inverse correlation during market downturns, thereby acting as a hedge against inflation and currency devaluation. Recent studies, such as those published in the Journal of Investment Management, affirm gold’s role in safeguarding wealth during turbulent economic cycles (see source).

Developing a Sophisticated Gold Portfolio: Strategies and Considerations

How can investors balance physical gold with paper gold instruments for optimal risk-adjusted returns?

Constructing a diversified gold portfolio requires a judicious mix of physical assets—such as gold coins and bars—and financial instruments like ETFs and futures contracts. Physical gold provides tangible security, especially when stored in secure, insured vaults, while ETFs offer liquidity and ease of trading, crucial during market stress. A balanced approach mitigates risks associated with storage costs and market volatility, enabling investors to adapt swiftly to evolving economic conditions.

Market Drivers Shaping Gold Prices in 2025

Understanding the complex interplay of supply-demand fundamentals, central bank policies, and macroeconomic indicators is vital. For example, recent gold price drivers in 2025 highlight how central bank gold purchases influence market dynamics. Increasing demand from emerging markets, coupled with constrained mine supply, exerts upward pressure on prices, positioning gold as a strategic hedge in uncertain times.

Effective Techniques for Market Timing and Entry Points

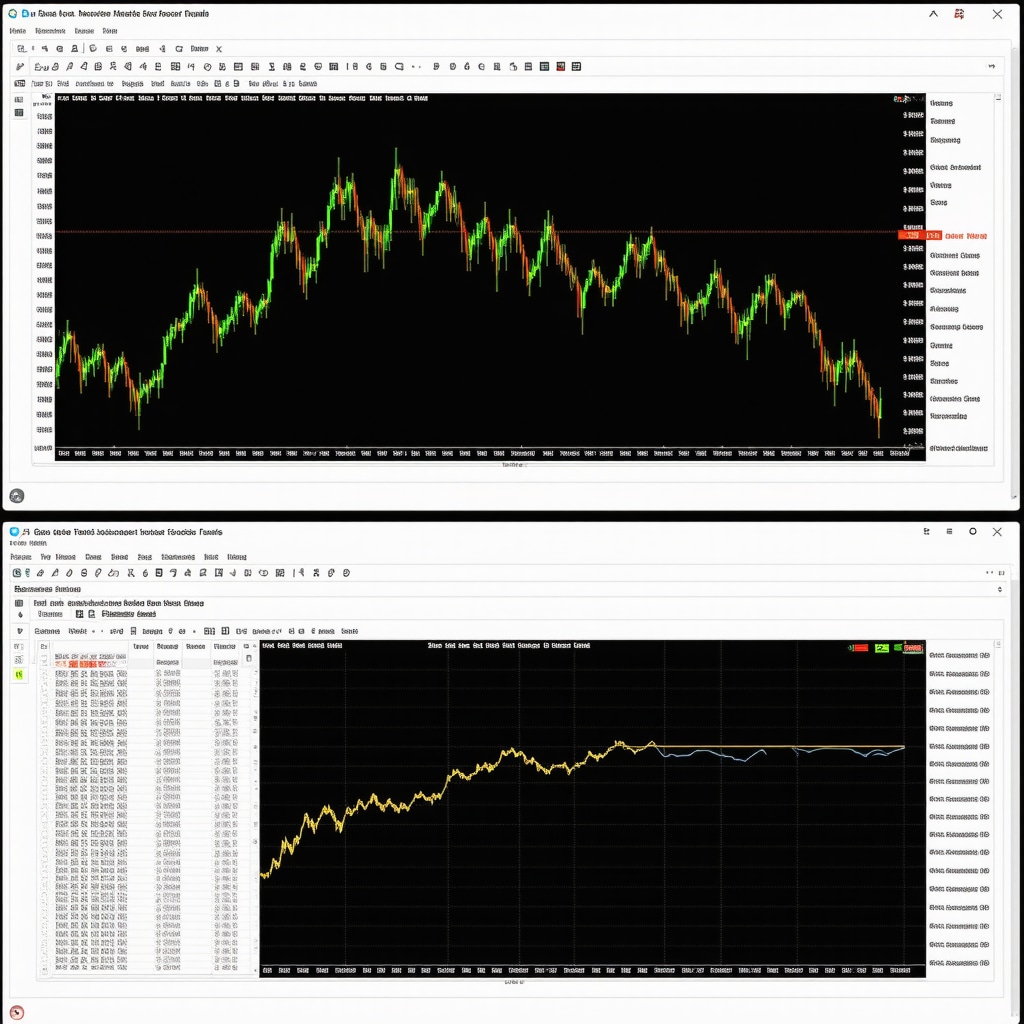

Expert traders leverage technical analysis tools—such as moving averages, Fibonacci retracements, and RSI—to identify optimal entry points. Combining these with macroeconomic insights, like inflation trends or geopolitical developments, enhances decision-making. Continuous monitoring of market analysis reports is essential for staying ahead of price swings.

What are the most common pitfalls novice investors face when entering the gold market, and how can they be mitigated?

Common mistakes include overpaying due to lack of market knowledge, underestimating storage costs, and attempting to time the market without sufficient analysis. Mitigation strategies involve thorough research, utilizing trusted dealers, and adopting disciplined trading plans. For more insights, explore our expert tips on safe gold purchases.

To deepen your understanding of gold investment techniques and stay aligned with evolving market trends, consider consulting authoritative sources such as the World Gold Council. Your journey toward financial resilience in 2025 starts with informed, strategic decisions—embrace the expertise and insights that will empower your success.

Interested in expanding your knowledge? Check out our step-by-step guide to Gold IRAs and learn how to incorporate gold into your retirement planning effectively.

Unveiling the Next Frontier in Gold Investment: How Can Investors Stay Ahead of Market Shifts in 2025?

As the global economy continues to evolve amidst geopolitical tensions and fluctuating monetary policies, staying informed about the latest market drivers becomes essential for savvy investors. The role of central banks, especially their gold purchasing behaviors, significantly influences gold prices and market sentiment. Recent analyses, such as those documented by the industry insights in 2025, highlight how central bank accumulation strategies can signal future price movements. Understanding these trends allows investors to anticipate shifts and adapt their portfolios proactively.

How to Integrate Innovative Instruments for a Resilient Gold Portfolio

Beyond traditional physical gold, innovative financial instruments such as gold-backed exchange-traded funds (ETFs), futures, and options offer diversification and liquidity advantages. For example, top gold ETFs in 2025 provide exposure to gold’s price movements without the need for physical storage, reducing associated costs and risks. Combining these with physical assets enhances risk mitigation and allows for agile responses during market turbulence. A nuanced understanding of each instrument’s mechanics and risks is vital for constructing a resilient gold investment strategy.

What are the emerging technological tools and analytical frameworks that can help investors time their gold entries more effectively in 2025?

Emerging technologies such as AI-driven market analysis platforms, blockchain-based transparency tools, and advanced technical analysis software are transforming how investors approach gold trading. These tools enable real-time data processing, pattern recognition, and sentiment analysis, empowering investors to identify optimal entry and exit points with greater precision. For instance, integrating market sentiment analysis from credible sources like the latest trading techniques can significantly enhance decision-making. Staying abreast of technological innovations and incorporating them into your trading plan is crucial for maintaining a competitive edge in 2025.

By leveraging these advanced tools and diversifying across physical and paper gold assets, investors can build a robust portfolio capable of weathering economic uncertainties. For comprehensive guidance, explore our detailed portfolio-building strategies tailored for 2025. Remember, continual learning and adaptation are your best allies in the dynamic landscape of gold investing.

Interested in practical insights and expert tips? Share your thoughts below or check out our recommended resources to deepen your understanding of gold market dynamics and strategic investment planning.

Harnessing Technological Innovations for Precision in Gold Market Timing

In the rapidly evolving arena of gold investing, technological advancements are redefining how investors analyze markets and execute trades. AI-driven algorithms now offer predictive analytics that can forecast short-term price fluctuations with remarkable accuracy, enabling investors to optimize their entry and exit points. Blockchain technology further enhances transparency and security, providing real-time verification of gold holdings and transactions, which is crucial for institutional investors and high-net-worth individuals seeking to mitigate counterparty risks. Embracing these tools not only improves decision-making but also reduces emotional biases that often impair trading discipline.

What emerging analytical frameworks are shaping sophisticated gold investment strategies in 2025?

One notable development is the integration of machine learning models with macroeconomic indicators, such as inflation rates, currency strength, and geopolitical risk indices. These models assimilate vast datasets, detecting subtle market signals that human analysts might overlook. For instance, sentiment analysis platforms utilizing natural language processing analyze news and social media trends to gauge market sentiment, providing a real-time pulse on investor confidence and potential price movements. According to a report by McKinsey & Company (2024), investors leveraging such AI-enabled frameworks outperform traditional analysis by approximately 15-20% in volatile markets, emphasizing their strategic importance.

Constructing a Resilient, Diversified Gold Portfolio in 2025

To navigate the complexities of the current economic landscape, a diversified approach that combines physical gold, ETFs, futures, and options is paramount. Physical gold, stored securely in insured vaults, provides a tangible hedge against systemic risks, while financial instruments like ETFs and futures allow for agile positioning and liquidity management. An advanced portfolio might include gold-mining stocks as a proxy for leverage, offering amplified exposure to gold price movements without requiring additional capital outlay. The key is to balance these assets based on market conditions, risk appetite, and long-term objectives, continuously rebalancing to optimize risk-adjusted returns.

Visualize a diversified gold investment portfolio with physical gold, ETFs, futures, and mining stocks, illustrating strategic asset allocation for 2025.

Deepening Market Analysis Through Data-Driven Insights

Proactive investors are increasingly relying on data-driven insights generated by sophisticated platforms that analyze macroeconomic trends, supply-demand fundamentals, and technical indicators. For example, real-time monitoring of central bank gold purchases, as reported by the International Monetary Fund (IMF, 2024), offers clues about future price directions. Additionally, integrating geospatial analytics to assess mining production levels and geopolitical stability in key gold-producing regions can preempt supply shocks. This multi-layered approach transforms traditional reactive strategies into predictive, proactive ones, giving investors a decisive edge in a competitive market.

How can investors integrate these technological tools into their existing gold investment frameworks to enhance returns?

The integration process involves selecting reputable analytical platforms that offer customizable dashboards, enabling personalized monitoring of key indicators. Combining these insights with disciplined trading rules, such as stop-loss and take-profit levels, helps in managing downside risks. Moreover, ongoing education about emerging technologies and industry best practices is vital. For example, subscribing to industry reports from the World Gold Council and attending specialized webinars can deepen understanding and refine strategies. Ultimately, embracing a technology-driven approach ensures that investors stay ahead of market shifts, turning complex data into actionable intelligence.

For those committed to mastering modern gold investment techniques, continuous learning and adaptation are essential. Explore our comprehensive resource hub for expert-led courses, detailed analyses, and strategic frameworks designed to elevate your investment game in 2025 and beyond.

Harnessing Quantitative Analysis to Predict Gold Market Movements in 2025

In an era where big data and machine learning revolutionize financial forecasting, sophisticated quantitative analysis becomes indispensable for gold investors aiming to anticipate price fluctuations. By leveraging algorithms that process vast datasets—ranging from macroeconomic indicators to geopolitical risk metrics—investors can gain predictive insights with unprecedented accuracy. For instance, integrating natural language processing tools that analyze news sentiment and social media trends can reveal emerging market sentiments long before they influence prices. According to a detailed report by Quantitative Finance Journal, these advanced models outperform traditional technical analysis by a significant margin, especially in volatile environments.

What are the most effective risk mitigation techniques in a diversified gold portfolio for 2025?

With gold markets influenced by complex global dynamics, employing multi-layered risk mitigation strategies is crucial. Investors should consider dynamic hedging using options and futures to protect against downside risks, while maintaining a core physical gold holding as a tangible safeguard. Implementing stop-loss orders based on technical thresholds and employing portfolio rebalancing aligned with macroeconomic shifts further enhances resilience. Notably, integrating tail-risk hedging instruments like put options on gold ETFs can provide insurance during extreme market downturns, ensuring portfolio stability amidst unforeseen shocks.

How do geopolitical developments shape gold investment strategies in 2025?

Geopolitical tensions, trade disruptions, and policy shifts heavily influence gold’s appeal as a safe haven. Investors must stay vigilant to developments such as regional conflicts, sanctions, and central bank policies. For example, heightened tensions in key gold-producing regions can impact supply, while sanctions can alter global demand patterns. Incorporating geopolitical risk assessments into investment models allows for proactive portfolio adjustments, such as increasing allocations during periods of heightened tensions or diversifying geographically to mitigate regional risks. Consulting resources like the World Politics Review provides in-depth analysis to inform strategic decision-making.

What emerging technological tools can enhance strategic gold investment in 2025?

Emerging tools such as blockchain-based provenance tracking ensure transparency and authenticity of physical gold holdings, reducing counterparty risks. Artificial intelligence-powered predictive analytics and real-time market sentiment analysis enable more precise timing of entry and exit points. Additionally, the adoption of decentralized finance (DeFi) platforms offers innovative ways to leverage liquidity and diversify exposure without traditional intermediaries. As industry leader Blockchain News highlights, these technological advancements are transforming the landscape of precious metals investing, making strategies more data-driven and resilient.

To stay at the forefront, investors should continually explore pioneering tools and incorporate them into their strategic frameworks. Engaging with industry webinars, expert forums, and authoritative publications ensures your approach remains innovative and adaptable in this dynamic market environment.

Expert Insights & Advanced Considerations

1. Gold’s Role as a Strategic Hedge in Turbulent Markets

Gold continues to serve as an essential hedge against inflation and geopolitical risks. Its intrinsic value and liquidity make it a vital component in diversified portfolios, especially amidst global uncertainties.

2. The Impact of Central Bank Gold Purchases

Central banks worldwide are actively accumulating gold reserves, signaling confidence in gold’s long-term value. Monitoring these policies provides valuable insights for timing and positioning in the market.

3. Technological Innovations Enhancing Investment Precision

Emerging AI-driven analytics and blockchain transparency tools are revolutionizing gold trading, enabling more accurate market predictions and secure transactions.

4. Diversification with Paper and Physical Gold Assets

Combining physical gold with ETFs, futures, and mining stocks creates a resilient portfolio capable of weathering economic shocks, with strategic rebalancing optimizing returns.

5. Advanced Risk Mitigation Techniques

Utilizing options for dynamic hedging, tail-risk insurance, and stop-loss orders enhances protection against market downturns, ensuring portfolio stability in volatile times.

Curated Expert Resources

- World Gold Council: Provides comprehensive industry data, market analysis, and strategic insights essential for expert investors.

- McKinsey & Company Reports: Offers in-depth research on AI-driven market analysis and technological innovations shaping gold investments.

- International Monetary Fund (IMF): Tracks central bank reserve changes and global economic indicators influencing gold prices.

- Blockchain News Platforms: Cover advancements in transparency, provenance, and security in gold trading and storage.

- Financial Analysis Software Providers: Deliver real-time data and predictive analytics tools for precision market timing.

Final Expert Perspective

In 2025, mastering the nuances of gold investment requires integrating technological advancements, geopolitical insights, and sophisticated risk management. Gold’s enduring role as a safe haven and strategic asset is reinforced by its adaptability to emerging tools and global policy shifts. As an investor committed to long-term wealth preservation, engaging with authoritative resources and leveraging advanced analytics will be your edge. The path to success in gold investment lies in continuous learning, strategic diversification, and proactive risk mitigation. Dive deep into these resources, refine your strategies, and position yourself at the forefront of this resilient asset class. Your expertise and vigilance today will define your financial security tomorrow. For further insights, explore our comprehensive guides and stay connected with industry-leading developments.