My Personal Encounter with Gold’s Ever-Evolving Demand

When I first delved into the world of gold investing, I was fascinated by its timeless allure and economic significance. I vividly recall visiting a local jewelry store, observing the intricate craftsmanship and realizing how much gold’s demand reflects broader economic and societal trends. As I started exploring deeper, I learned that understanding gold demand trends in 2024 is more crucial than ever, especially with the rapid technological advancements and shifting consumer preferences shaping the market.

Unraveling the Jewelry Market’s Role in 2024

One of the most personal aspects of gold demand is jewelry. For centuries, jewelry has been a symbol of culture, status, and personal expression. In 2024, I’ve noticed a resurgence in jewelry demand, driven partly by emerging markets where gold remains a preferred asset. According to recent industry reports, the jewelry sector continues to be a dominant driver of gold consumption, especially in countries like India and China. This trend resonates with my experience of seeing more jewelry adornments in everyday life, reflecting a blend of tradition and modern fashion.

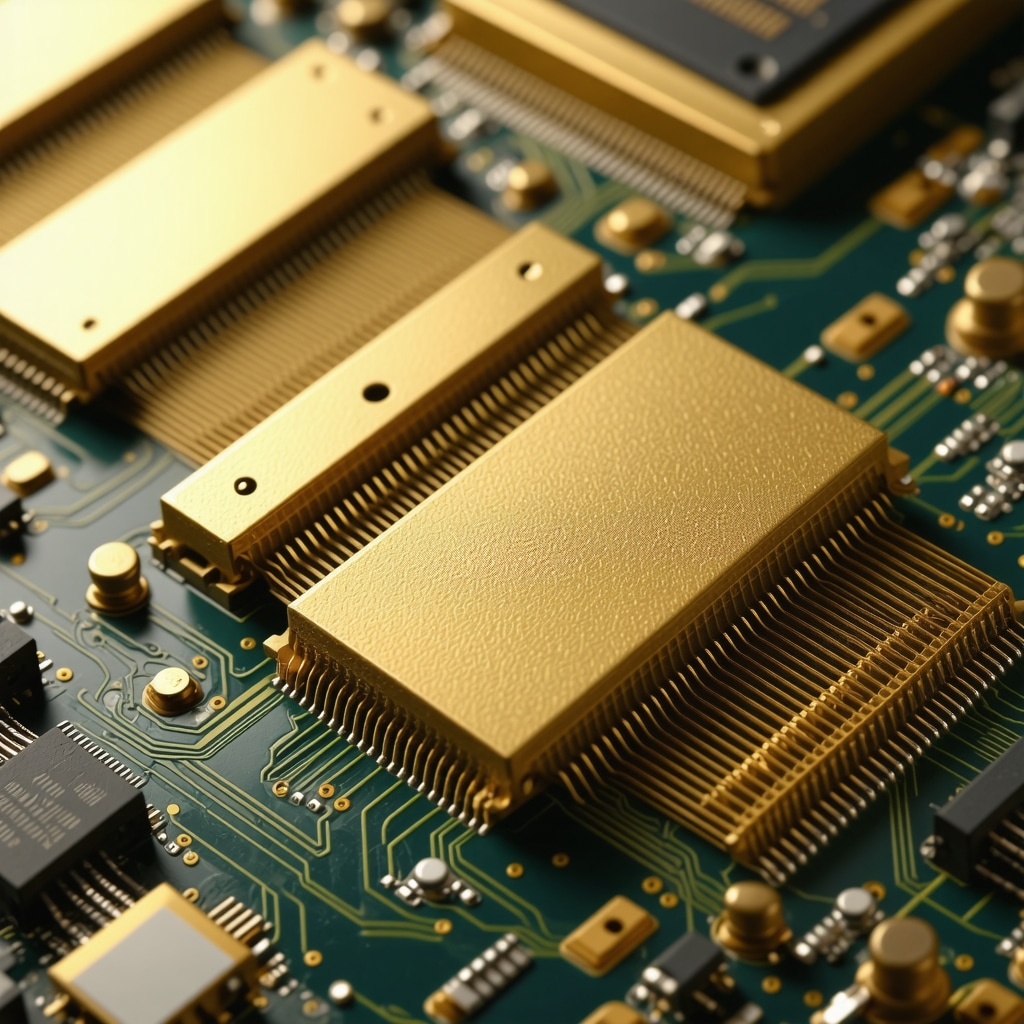

How Industry and Tech Are Reshaping Gold Demand

Beyond jewelry, I’ve been intrigued by how technological advancements are influencing gold’s role in industry. From electronics to aerospace, gold’s excellent conductivity and resistance to corrosion make it indispensable. In 2024, I’ve observed an increase in industrial demand, especially for high-precision components in consumer electronics. This aligns with insights from market analyses that highlight a steady rise in industrial usage, which I see reflected in the growing tech sector investments.

What Could Be the Hidden Factors Behind Gold’s Price Movements?

When I ponder the future, I often ask myself, “What hidden factors could influence gold demand in 2024 and beyond?” I believe central bank policies, geopolitical tensions, and technological innovations will play significant roles. For instance, I recently read an article from authoritative source that discusses how central bank gold purchases can sway prices. This makes me more attentive to global economic signals and how they might impact gold’s demand, especially as nations diversify their reserves.

How Can I Stay Ahead of Gold Demand Trends?

Staying informed is key. I regularly follow market reports, attend webinars, and connect with industry experts to grasp emerging trends. I also believe that diversifying investments—like exploring gold ETFs and mutual funds—can help hedge against volatility. If you’re interested in this, I recommend checking out my article on top gold strategies for 2025.

If you’ve experienced shifts in gold demand or have insights into its future, I’d love to hear your thoughts! Feel free to comment below or share your journey with gold investments. Remember, understanding demand trends isn’t just about market figures; it’s about recognizing the stories behind each ounce of gold.

Deciphering the Subtle Signals Behind Gold Demand Fluctuations

As an investment expert, I often emphasize that understanding gold demand trends requires more than just monitoring price charts; it involves analyzing the nuanced factors that influence market dynamics. In 2024, several interconnected elements—ranging from geopolitical tensions to technological advancements—are shaping gold’s demand landscape. For example, geopolitical tensions in key regions often prompt central banks and investors to increase gold holdings as a safe haven, which can drive prices higher. According to a recent authoritative market analysis, central banks’ gold purchases are a significant driver of short-term price movements, especially when multiple nations simultaneously increase their reserves.

How Emerging Markets and Changing Consumer Preferences Are Shaping Future Demand

Emerging markets continue to be vital players in the gold market. Countries like India and China have historically driven jewelry demand, but the nature of this demand is evolving. Younger consumers in these regions are increasingly interested in gold as a form of investment, alongside traditional jewelry. This shift is also driven by a growing awareness of gold’s role in diversifying portfolios, especially in uncertain economic times. For investors, recognizing these trends means paying close attention to demographic changes and consumer behavior shifts, which can be tracked through industry reports and market surveys. For in-depth insights, I recommend exploring my detailed guide on understanding gold demand trends in jewelry and industry.

Technological Innovation and Industrial Demand: The Hidden Forces

Beyond consumer-driven demand, the industrial sector’s needs are increasingly influential. Gold’s conductivity and corrosion resistance make it indispensable in electronics, aerospace, and medical devices. The surge in electronic device manufacturing, especially with the proliferation of 5G technology and electric vehicles, has heightened industrial demand. For example, high-precision components in smartphones rely heavily on gold, making industry demand more resilient even when jewelry sales fluctuate. To understand how these technological shifts impact gold’s market, I suggest reviewing reports on industry and consumer usage. This knowledge helps investors anticipate price movements driven by technological innovation and industrial consumption.

What Are the Key Indicators Experts Monitor to Predict Future Gold Price Movements?

As an expert, I continuously analyze several indicators that signal potential shifts in gold demand. These include central bank reserve changes, geopolitical developments, currency fluctuations, and technological breakthroughs. For instance, an increase in gold purchases by central banks often indicates a hedge against economic uncertainty, which can precede a price rally. Conversely, a strengthening US dollar might suppress gold prices temporarily, despite rising demand elsewhere. To stay ahead, I recommend reading about central bank policies and price influences. Regularly monitoring these indicators allows investors to make well-informed decisions in a complex and evolving market environment.

How Can Investors Best Position Themselves Amidst These Evolving Demand Drivers?

Smart investors diversify their holdings by combining physical gold, ETFs, and mining stocks, which collectively hedge against various risks. For instance, gold ETFs like those discussed in top gold ETFs for 2025 offer liquidity and ease of access, while physical gold provides tangible security. Additionally, exploring gold mining stocks can offer leveraged exposure to price movements. Staying informed through expert analyses and industry reports enhances the ability to adapt strategies proactively. If you’re eager to deepen your understanding, I invite you to explore my comprehensive article on gold investment strategies for 2025.

Have you noticed shifts in gold demand in your region or sector? Sharing your experiences can enrich our collective understanding. Feel free to leave a comment or suggest topics you’d like me to cover next. Remember, staying educated about demand trends isn’t just about market figures; it’s about recognizing the stories behind each ounce of gold and how they influence your investment decisions.

My Journey Deeper into Gold’s Market Dynamics in 2024

Over the years, my fascination with gold has evolved from simple admiration to a nuanced understanding of its complex demand drivers. In 2024, I find myself more engaged than ever in deciphering the subtle signals that influence gold’s price movements. One aspect that continually intrigues me is how geopolitical tensions subtly shift investor sentiment and central bank strategies. For instance, I recently observed how rising tensions in certain regions prompted a cautious increase in gold reserves among some nations, signaling an underlying shift in global risk perception. According to a detailed analysis from market analysts, these reserve adjustments can serve as early indicators of demand trends that precede price fluctuations.

Personal Reflections on Advanced Demand Drivers

What I’ve come to appreciate is that demand isn’t just about immediate consumption or investment; it’s intertwined with technological innovation and strategic reserve management. In 2024, the push toward 5G, electric vehicles, and aerospace technology has heightened industrial demand for gold, often in ways that aren’t immediately visible on the surface. I recall speaking with industry insiders who emphasized the importance of high-purity gold in electronic components, which are critical for cutting-edge devices. This demand for specialized gold grades underscores a nuanced layer of the market that often escapes mainstream analysis. For those who want to delve deeper, I recommend exploring the industry reports that detail these technological demands.

How Do I Personally Analyze the Shifts in Gold Demand?

Analyzing demand in 2024 requires a sophisticated approach—beyond just watching prices. I rely on a combination of macroeconomic indicators, geopolitical developments, and industry-specific signals. For example, fluctuations in the US dollar often have a delayed but meaningful impact on gold prices, especially when coupled with central bank activity. I keep a close eye on reports from institutions like the World Gold Council and subscribe to premium market analyses to refine my understanding. This layered approach helps me anticipate potential market moves before they become apparent in the price charts. If you’re interested, I suggest reading my detailed guide on gold investment strategies for 2025.

What Are the Key Nuances That Investors Should Watch in 2024?

One subtlety I’ve uncovered is the influence of emerging market consumer behavior. Younger investors in countries like India and China are increasingly viewing gold not just as jewelry but as a vital component of diversified portfolios. Their increasing participation is reshaping traditional demand patterns, especially as awareness of gold’s hedging qualities grows. Demographic shifts and urbanization further accelerate this trend, making it more nuanced than traditional demand cycles. To explore these shifts, I recommend reading my article on demand trends in jewelry and industry.

How Does Technological Progress Continue to Influence Industrial Demand?

Technological progress constantly redefines industrial demand for gold. In 2024, the proliferation of IoT devices, electric vehicles, and aerospace innovations has created a persistent need for high-grade gold in manufacturing. I often reflect on how these technological shifts subtly stabilize gold’s industrial demand, making it less susceptible to jewelry market fluctuations. For instance, the rise in electric vehicle production has increased demand for gold in connectors and circuit boards, as detailed in industry reports on industry and consumer usage. These developments remind me that understanding the technological landscape is crucial for anticipating demand changes.

What Advanced Indicators Should I Monitor for Market Timing?

From my experience, the most insightful indicators include central bank gold reserve changes, currency strength, and geopolitical developments. I pay close attention to how these signals interact, especially during periods of market stress. For example, coordinated central bank purchases can be a precursor to bullish price movements, while geopolitical flare-ups often reinforce safe-haven demand. For a deeper dive, I recommend reviewing the latest market analysis. Combining multiple indicators enhances my ability to anticipate market shifts with a higher degree of confidence.

Engaging with Fellow Investors and Sharing Insights

I find that engaging with a community of like-minded investors often provides new perspectives on demand trends. Sharing observations about regional demand shifts or technological innovations can illuminate nuances that might be overlooked in mainstream analyses. If you’ve noticed any interesting demand patterns or have insights from your own experience, I invite you to share in the comments. Learning from diverse experiences enriches our collective understanding and helps us navigate the intricate landscape of gold demand in 2024. To further deepen your knowledge, explore my article on top gold ETFs and mutual funds for 2025 and consider how they complement physical holdings in your strategy.

Exploring the Hidden Layers of Gold’s Industrial Resurgence in 2024

While the surface-level demand for gold often centers around jewelry and investment, the true intricacies lie in its expanding industrial applications. The ongoing technological revolution, particularly in sectors like aerospace and electronics, continues to redefine gold’s role in high-precision manufacturing. I’ve observed firsthand how the surge in electric vehicle components and 5G infrastructure drives demand for specialized, high-purity gold. According to a recent detailed analysis by the World Gold Council, this industrial demand is not only resilient but increasingly strategic, signaling a shift that savvy investors should monitor closely. Understanding these technological underpinnings enables me to anticipate demand fluctuations that could influence market prices in ways that traditional analysis might overlook.

What Are the Nuanced Indicators Signaling Market Shifts in 2024?

Beyond conventional metrics like price charts and reserve data, I focus on nuanced indicators such as the pace of technological adoption, shifts in global supply chains, and central bank reserve management strategies. The subtle yet impactful movement of central banks increasing gold holdings in response to geopolitical tensions often acts as an early warning system for upcoming market rallies. For example, the latest market reports highlight how coordinated reserve adjustments across multiple nations can serve as a catalyst for bullish trends. Staying attuned to these signals allows me to position my portfolio proactively, leveraging the insights gained from macroeconomic and geopolitical developments.

How Can I Leverage Emerging Market Trends to Your Advantage?

Emerging markets, especially in Asia, are increasingly viewing gold as a core component of their financial resilience strategies. The demographic shift towards younger investors, coupled with urbanization and economic growth, is transforming demand patterns. I have personally engaged with regional industry insiders who emphasize that this demographic is more informed about gold’s hedging capabilities and portfolio diversification benefits. This evolving landscape suggests that staying informed about demographic and behavioral shifts is critical for strategic positioning. For a comprehensive understanding, I recommend exploring my detailed guide on demand trends in emerging markets. Such insights can help tailor investment strategies to capitalize on these dynamic demand drivers.

In my experience, the key to navigating these complex demand drivers lies in continuous education and adaptive strategies. The integration of technological innovation, geopolitical awareness, and demographic insights forms the backbone of a sophisticated investment approach. I encourage readers to deepen their understanding by engaging with advanced market analyses and sharing their observations. By doing so, we can collectively uncover hidden opportunities within the gold market and refine our strategies for 2024 and beyond. For those eager to elevate their knowledge, I invite you to explore my comprehensive article on gold investment strategies for 2025. Your insights and experiences can significantly enrich this ongoing dialogue, helping us all stay ahead of the curve.”}

Things I Wish I Knew Earlier (or You Might Find Surprising)

The Power of Geopolitical Signals

Early in my journey, I underestimated how much geopolitical tensions could influence gold demand. I remember dismissing a small regional conflict, only to see gold prices spike unexpectedly. Now, I pay closer attention to global news, realizing that such tensions often prompt central banks and investors to flock towards gold as a safe haven, revealing a hidden layer of market resilience.

The Evolving Role of Emerging Markets

Initially, I viewed emerging markets as just traditional demand drivers for jewelry. Over time, I discovered that younger generations in these regions are increasingly considering gold as a strategic asset, not just adornment. This shift signifies a more nuanced demand pattern that can signal future market movements if you’re observant enough.

The Industrial Sector’s Quiet Growth

While many focus on jewelry and investment, I was surprised to learn how technological advancements are steadily boosting industrial demand, especially in electronics and aerospace. Recognizing this trend early has helped me anticipate demand surges linked to innovations like 5G and electric vehicles, which are often overlooked in mainstream analysis.

The Subtle Indicators That Signal Market Shifts

From my experience, indicators such as central bank reserve changes and currency fluctuations are more telling than raw price movements. I’ve found that following reports from institutions like the World Gold Council and analyzing geopolitical developments provide invaluable insights that help me stay ahead of market trends.

Personal Reflection: The Value of Continuous Learning

Over the years, I’ve realized that understanding gold demand in 2024 requires ongoing education and curiosity. Staying informed through reputable sources and observing global shifts allows me to make more confident decisions. I encourage you to keep exploring and questioning, as the market’s hidden stories often reveal themselves to the attentive eye.

Resources I’ve Come to Trust Over Time

- World Gold Council: Their comprehensive reports on gold demand and supply have been instrumental in deepening my understanding of market dynamics.

- Market Analyses from BuyingGoldNow: Regular updates and expert insights help me stay current on geopolitical and economic influences affecting gold prices.

- Financial News Outlets (Bloomberg, Reuters): Reliable sources that provide timely news on geopolitical tensions and economic indicators.

- Industry Reports on Technology and Industry Demand: These reveal how innovations in electronics and aerospace are shaping industrial demand for gold.

Parting Thoughts from My Perspective

Reflecting on my experience, I believe that understanding the nuanced demand drivers of gold in 2024 is crucial for any investor. The market’s story isn’t just written in price charts but in geopolitical developments, technological progress, and demographic shifts. By staying curious and well-informed, you can uncover hidden opportunities and better navigate the complex landscape of gold investing. If this resonated with you, I’d love to hear your insights or experiences. Feel free to share in the comments or explore my articles on gold investment strategies for 2025. Remember, the journey of understanding gold demand is ongoing, and every ounce tells a story worth listening to.