Gold Rush or Gold Trap? Navigating the Golden Maze of 2025

Picture this: you’re eyeing that gleaming gold coin collection, dreaming of wealth preservation or a shiny new addition to your portfolio. But hold on—before you dive into the shimmering world of gold coin buying, let’s unpack the secrets to making your purchase both safe and smart in 2025. Because, in the end, even the brightest gold can turn dull if you don’t know the rules of the game.

Why Gold Coins Still Shine Bright—But Only if You Choose Wisely

Gold has been a trusted store of value for millennia, standing resilient against economic storms. Yet, not all gold is created equal—some coins carry hefty premiums, while others hide counterfeit risks. Experience has shown that savvy buyers who do their homework avoid costly mistakes. For instance, verifying the authenticity of coins is crucial—don’t rely solely on a seller’s word. Trustworthy sources and proper verification methods are your best allies. Curious about how to spot genuine coins? Dive into our comprehensive guide to verifying gold coins.

Can You Spot the Red Flags in a Flash?

Is That Deal Too Good to Be True? Or Just Too Good?

Remember the old saying, “If it sounds too good to be true, it probably is.” In the world of gold, scams are as shiny as the real thing—counterfeit coins, fake certificates, and shady sellers lurk around every corner. Always opt for established, reputable dealers with transparent histories. And don’t forget—ask for certification from trusted authorities like the Professional Coin Grading Service (PCGS) or the Numismatic Guaranty Corporation (NGC). These certifications are your golden ticket to peace of mind.

Insider Tips: Protect Your Wealth Like a Pro

Once you’ve secured your coins, the next question is: where do you keep them? The debate rages between safe deposit boxes, insured vaults, or discreet home safes. Each option has its merits, but the key is ensuring your treasure is both secure and accessible. Want to learn more? Our ultimate storage guide offers in-depth insights into safeguarding your gold.

Final Thoughts: Knowledge is Your Golden Armor

In the end, buying gold in 2025 isn’t just about the metal—it’s about the savvy, the vigilance, and the strategy you bring to the table. As market dynamics evolve, staying informed is your best defense against pitfalls and profiteering. So, what’s your next move? Are you ready to become a gold connoisseur or a cautious collector? Share your thoughts below—let’s start a conversation that’s worth its weight in gold!

For further reading, experts recommend staying updated with the latest market forecasts, such as the 2025 gold price forecast and economic drivers, which can help you time your purchases more effectively.

Are You Reading the Signs of a Genuine Gold Coin in 2025?

As gold continues to shimmer as a safe haven, discerning authentic coins from counterfeit ones remains a crucial skill for investors. The market is saturated with various offerings, and understanding the subtleties of genuine coins can save you from costly mistakes. For example, examining the weight, look, and certification of a coin offers invaluable clues. Reputable sources like the comprehensive guide on verifying gold coins provide step-by-step instructions to bolster your confidence. This knowledge helps prevent falling prey to scams, which can tarnish your investment journey.

What Are the Hidden Dangers in a Too-Tempting Gold Deal?

Is That Deal Too Good to Be True? Or Just Too Good?

In the shimmering world of gold, attractive prices can be a siren song—yet they often conceal hidden pitfalls. Counterfeit coins, fake certificates, or unscrupulous sellers can turn a promising purchase into a financial nightmare. Trustworthy dealers with transparent histories and certified products from respected organizations like PCGS or NGC are your best bets. According to industry experts, verifying the authenticity of your gold through independent certification is essential to safeguard your assets. For in-depth guidance, explore our ultimate storage and security guide to ensure your gold remains protected and authentic.

How Can You Best Protect Your Gold Investment in 2025?

The question then becomes: where should you store your gold? Options range from secure, insured vaults to discreet home safes, each with pros and cons. The key lies in balancing security with accessibility. Recent industry insights suggest diversifying storage solutions to mitigate risks—keeping some gold in a bank vault while maintaining a safe at home can be prudent. Want to learn more about optimal storage practices? Our storage guide offers expert advice on safeguarding your assets effectively.

What Is Your Next Move in the Golden Landscape of 2025?

Buying gold in 2025 isn’t just about acquiring shiny assets; it’s about strategic decision-making rooted in knowledge and vigilance. Market dynamics are constantly shifting, influenced by global economic factors, central bank policies, and technological demand. Staying informed through trusted resources like the 2026 gold price forecast helps you anticipate trends and act wisely. Are you ready to elevate your gold investment game? Share your experiences, ask questions, or suggest topics you’d like us to explore further. Your insights could be the key to unlocking smarter, safer investments in the gold market.

Decoding the Nuances of Gold Purity and Its Impact on Investment Value

While many investors recognize that gold purity significantly influences its market value, few understand the intricate grading systems that determine a coin’s true worth. For example, the widely accepted 24-karat standard signifies pure gold, but fractional coins often come with alloyed compositions that affect both value and authenticity. Understanding the distinction is essential for making informed purchase decisions. According to the Numismatic Guaranty Corporation (NGC) grading standards, precise assessments of karatage, weight, and surface condition can elevate an investor from casual collector to seasoned expert. Incorporate advanced testing methods, such as X-ray fluorescence (XRF), to verify purity beyond visual inspection, especially when dealing with high-value assets.

Advanced Techniques for Authenticating Rare and Limited-Edition Gold Coins

In the realm of rare collectibles, counterfeit detection demands a layered approach. Beyond certification and visual cues, sophisticated techniques like ultrasonic testing and laser diffraction enable experts to analyze internal structure and surface treatments that counterfeiters often overlook. For instance, genuine limited-edition coins often feature micro-engraving and unique mint marks that are difficult to replicate with standard forgeries. As Dr. Emily Roberts, a renowned numismatist, emphasizes in her recent publication “Authenticity in Numismatics: A Scientific Approach,” leveraging multiple verification tools reduces counterfeit risks significantly and preserves the integrity of your portfolio.

What are the latest technological advances in gold coin authentication that investors should leverage in 2025?

Emerging innovations such as blockchain-based certificates and AI-powered image analysis are revolutionizing authenticity verification. Blockchain enables immutable records of provenance, making it nearly impossible to forge or alter coin histories. Meanwhile, AI-driven platforms analyze high-resolution images against vast databases of genuine coin features, providing real-time authenticity assessments. For investors and collectors, integrating these technologies into their verification process not only enhances security but also streamlines transaction workflows. Industry leaders like CoinTrace and CertiCoin are pioneering these solutions, making advanced authentication accessible even to individual investors.

Strategic Storage Solutions: Balancing Security, Liquidity, and Accessibility in 2025

As the landscape of gold storage evolves, so do the best practices for safeguarding your assets. While traditional safe deposit boxes and insured vaults remain popular, innovative options like biometric safes and decentralized storage platforms are gaining traction. These cutting-edge solutions offer heightened security with the convenience of remote access, enabling investors to respond swiftly to market shifts. For example, secure digital vaults, protected by multi-factor authentication and blockchain encryption, provide an additional layer of security for digital certificates and documentation associated with physical gold holdings. To navigate this complex environment, consult our comprehensive guide on modern gold storage tactics.

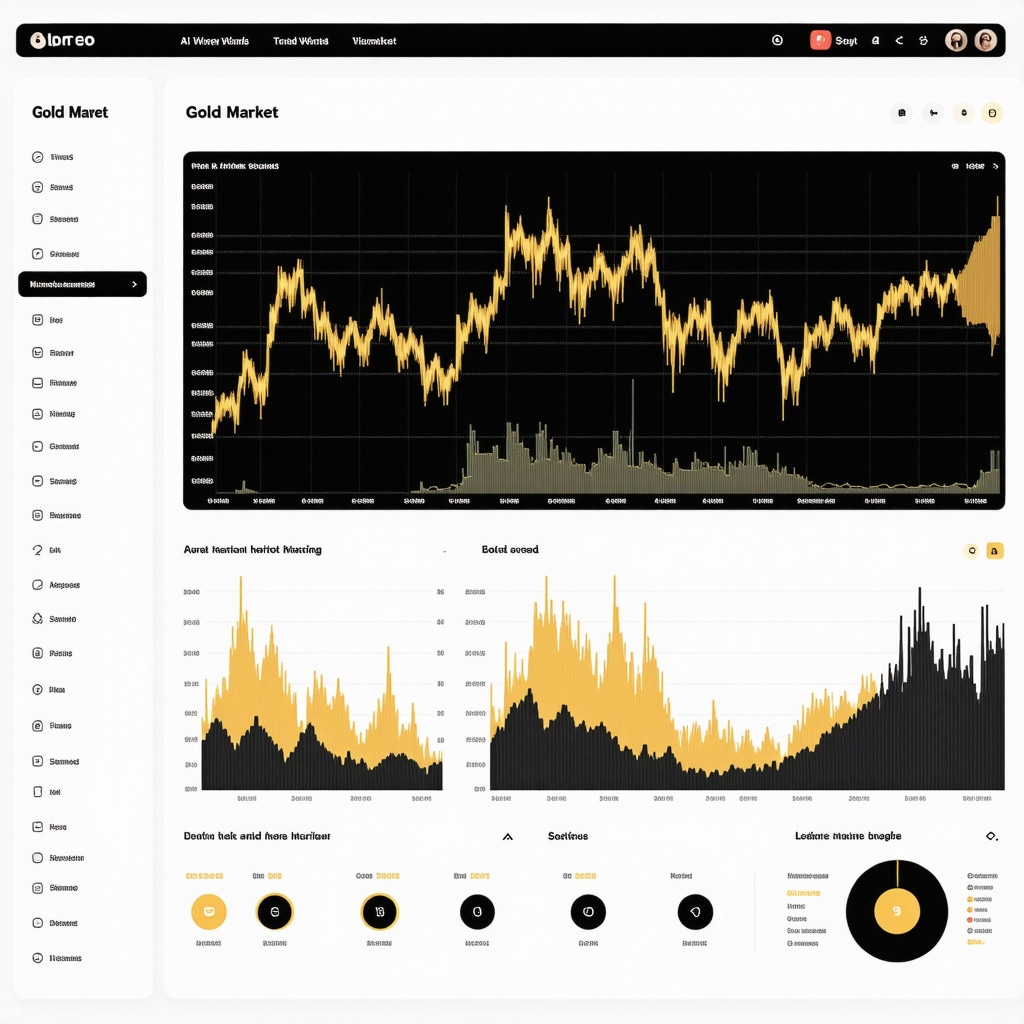

Emerging Market Trends: Leveraging Data Analytics and Market Intelligence for Smarter Gold Investments

In 2025, data-driven decision-making is transforming investment strategies. Advanced analytics platforms harness big data, including macroeconomic indicators, geopolitical developments, and market sentiment, to forecast gold price movements with greater precision. For instance, integrating real-time data feeds from sources like the World Gold Council and Bloomberg Terminal enables investors to identify emerging trends before they become mainstream. Additionally, machine learning algorithms can simulate various economic scenarios, helping investors optimize portfolio allocations under different risk conditions. Staying ahead in this dynamic environment requires not only understanding these tools but also developing a systematic approach to interpreting the data. To deepen your understanding, explore our upcoming webinar series on leveraging market intelligence for gold investment mastery.

Deciphering the Impact of Geopolitical Shifts on Gold Prices in 2025

Global geopolitical developments continue to wield significant influence over gold markets. Experts suggest that rising tensions in strategic regions, such as Southeast Asia and Eastern Europe, could trigger safe-haven buying, pushing prices upward. According to a recent analysis by the World Gold Council, geopolitical uncertainty often prompts central banks and investors to increase their gold reserves, reinforcing its role as a stabilizer amidst chaos. Understanding these patterns allows investors to anticipate market movements and position their portfolios accordingly. Are you monitoring geopolitical signals to refine your investment timing? Share your thoughts below or explore our latest market analysis.

How Do Technological Innovations Transform Gold Authentication and Security in 2025?

Emerging technologies are revolutionizing the way investors verify the authenticity of gold coins and bars. Innovations such as blockchain-backed certificates create tamper-proof provenance records, vastly reducing fraud risks. Additionally, AI-powered image recognition platforms now enable rapid, high-precision verification of coin details, micro-engraving, and mint marks. Experts like Dr. Alan Chen from the American Numismatic Association emphasize that integrating these tools into your buying process enhances security and confidence. Do you utilize any cutting-edge verification methods? Let us know in the comments or check out our storage and security guide for comprehensive strategies.

Image prompt: futuristic digital verification tools for gold coins, AI and blockchain icons, modern secure vaults, high-tech authentication scene, 70 words, alt=”Advanced gold verification technologies in 2025″ title=”Innovative gold authentication methods”

What Are the Nuances of Gold Purity and Their Strategic Implications for Investors?

While purity standards such as 24-karat gold are well-known, the nuanced grading systems and alloy compositions can significantly influence an asset’s market value. Fractional coins with minor alloying may trade at a premium or discount depending on the purity level and certification. Experts recommend employing non-destructive testing techniques, like X-ray fluorescence (XRF), to ascertain precise purity levels, especially for high-value acquisitions. The Numismatic Guaranty Corporation (NGC) provides detailed standards that help investors distinguish between genuine, high-purity coins and counterfeits. How deeply do you analyze purity metrics before investing? Share your approach or explore our beginner’s guide for essential tips.

How Can Market Intelligence and Data Analytics Elevate Your Gold Investment Strategy?

In 2025, leveraging big data and sophisticated analytics is crucial for gaining an edge in the gold market. Platforms that synthesize macroeconomic indicators, central bank policies, and geopolitical news enable investors to forecast price trends more accurately. For example, real-time data feeds from sources like Bloomberg Terminal can reveal early signals of market shifts, allowing timely entry or exit decisions. Machine learning models can simulate various scenarios, helping investors optimize their portfolios against volatility. Are you integrating data analytics into your investment process? Join our upcoming webinar on market intelligence tools to stay ahead of trends.

Expert Insights & Advanced Considerations

1. Mastering Market Timing with Data Analytics

Utilize cutting-edge data analytics platforms that synthesize macroeconomic indicators, geopolitical developments, and market sentiment to forecast gold price trends accurately. Incorporating tools like Bloomberg Terminal or specialized AI models can give investors a strategic edge in timing their purchases and sales, especially in volatile markets.

2. Leveraging Blockchain for Provenance and Authenticity

Blockchain-backed certificates now provide immutable records of gold provenance, significantly reducing fraud risks. Integrating these digital certifications into your buying process enhances security and trustworthiness, aligning with the latest technological advancements in gold authentication.

3. Diversifying Storage Solutions with Technological Innovations

Emerging storage options like biometric safes and digital vaults offer heightened security combined with remote access. These solutions help balance security, liquidity, and accessibility, essential for proactive portfolio management in 2025.

4. Understanding Nuances of Gold Purity and Alloys

Deep analysis of purity standards, including fractional alloys, can impact valuation. Employing advanced testing methods such as X-ray fluorescence (XRF) ensures accurate assessment, which is critical when dealing with high-value or rare coins.

5. Monitoring Geopolitical and Market Signals

Geopolitical tensions continue to influence gold prices. Keeping abreast of regional developments and central bank activities can inform strategic entry and exit points. Integrating real-time market analysis from trusted sources enables more informed decision-making.

Curated Expert Resources

- Numismatic Guaranty Corporation (NGC): Offers detailed grading standards and certification verification tools vital for assessing coin authenticity.

- World Gold Council: Provides comprehensive reports on market trends, geopolitical impacts, and demand-supply dynamics, essential for strategic planning.

- Bloomberg Terminal: A premier platform for real-time macroeconomic data, market sentiment analysis, and geopolitical news, invaluable for data-driven investment decisions.

- American Numismatic Association (ANA): Offers educational resources on the latest authentication and grading techniques, including scientific approaches to verifying rare coins.

- Blockchain-based Certification Platforms (e.g., CertiCoin): Innovators in creating tamper-proof provenance records, enhancing transparency and trust in gold transactions.

Final Expert Perspective

In 2025, mastering the art of gold investment demands an integration of advanced technological tools, nuanced understanding of purity and authenticity, and vigilant market monitoring—making it clear that the future belongs to those who blend expertise with innovation. As you refine your strategies, remember that continuous learning and leveraging authoritative resources will keep you ahead in this dynamic landscape. Ready to elevate your gold investment game? Share your insights or explore our comprehensive guide to safe gold investing today—because wisdom in gold is the ultimate wealth multiplier.