Mastering the 2025 Gold Market: An Expert’s Perspective on Future Price Dynamics

As we approach the midpoint of the decade, the gold market continues to command attention from investors, policymakers, and analysts alike. The intricate interplay of macroeconomic variables, geopolitical tensions, and evolving supply-demand patterns creates a complex landscape where accurate price forecasting becomes both a science and an art. This article synthesizes expert insights, market data, and advanced analytical models to offer a nuanced perspective on gold price forecasts for 2025.

Decoding the Key Drivers Behind Gold Price Fluctuations in 2025

Understanding the future trajectory of gold prices necessitates a deep dive into several core demand and supply determinants. Central bank gold holdings, inflation expectations, currency strength, and technological demand for gold-based innovations are among the pivotal factors. As highlighted by the World Gold Council’s recent reports, emerging market central banks are anticipated to continue their accumulation strategies, thereby underpinning a bullish outlook for gold in 2025. Additionally, inflationary pressures driven by fiscal policy responses and monetary easing are likely to bolster gold’s role as a hedge.

How Will Geopolitical Tensions Shape Gold’s Safe-Haven Appeal?

Expert analyses suggest that ongoing geopolitical conflicts and trade uncertainties will sustain gold’s status as a safe-haven asset. The potential for regional conflicts to escalate or new trade barriers to emerge could further elevate gold’s demand, especially in strategic reserves. Investors should monitor international developments closely, as these variables often trigger rapid price adjustments.

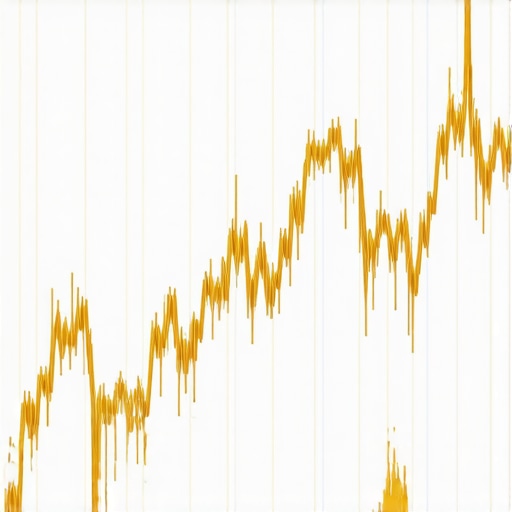

Advanced Market Models Project a Range for 2025

Utilizing sophisticated econometric and machine learning models, analysts forecast a probable trading range for gold between $2,000 and $2,500 per ounce in 2025. These models incorporate macroeconomic indicators, sentiment analysis, and historical cycles to generate probabilistic outcomes. It is crucial to interpret these forecasts within a framework that accounts for unexpected shocks, such as sudden policy shifts or technological breakthroughs in gold extraction or substitution.

Strategies for Strategic Gold Investment in 2025

For seasoned investors, adopting a diversified approach that includes physical gold, ETFs, and gold mining stocks can optimize portfolio resilience. Tailoring investment strategies based on market outlooks—such as increasing exposure ahead of inflationary upticks or during geopolitical turmoil—can enhance returns. Resources like best gold investment strategies for 2025 provide actionable insights for maximizing wealth.

What Are the Risks of Relying on Price Forecasts in a Volatile Market?

While expert forecasts are invaluable, they inherently carry uncertainty due to unforeseen market disruptions. Overconfidence in predictive models can lead to misaligned expectations. Continuous monitoring of market signals and maintaining flexibility in investment positions are vital practices for navigating the inherent volatility of gold markets.

For a comprehensive understanding, explore authoritative sources such as the World Gold Council’s market data, which offers detailed reports and analysis on gold’s evolving role in the global economy. Investors and analysts are encouraged to contribute their insights, fostering a dynamic dialogue that enhances collective expertise.

Anticipating Gold Demand Shifts and Market Opportunities in 2025

As investors continually seek to refine their strategies, understanding the nuanced factors influencing gold demand becomes paramount. In 2025, the landscape is shaped by a mix of traditional drivers and emerging trends, such as technological innovation and changing consumer preferences. These elements can significantly alter the supply-demand equilibrium, impacting market prices and investment returns. Experts emphasize the importance of analyzing demand drivers like jewelry consumption, central bank policies, and industrial applications to craft resilient investment plans. For in-depth insights, refer to this comprehensive analysis of future demand drivers.

What new demand trends could reshape gold’s role in a diversified portfolio?

Emerging sectors such as renewable energy and high-tech manufacturing are increasingly integrating gold into innovative applications, potentially boosting demand beyond traditional channels. This shift raises a critical question for investors: how can diversifying across different gold investments, including coins, ETFs, and mining stocks, optimize exposure to these evolving demand patterns? The answer lies in strategic asset allocation, guided by insights from top investment strategies for 2025 that balance risk with potential growth.

Leverage Data and Models to Stay Ahead of Market Trends

Advanced analytical tools, such as predictive modeling and sentiment analysis, are now integral to forecasting gold’s trajectory. By incorporating macroeconomic indicators, geopolitical developments, and technological advancements, investors can better anticipate demand shocks and price swings. For example, monitoring central bank purchasing patterns, as outlined in central bank activity reports, provides crucial clues about institutional confidence in gold. Combining these insights with technical analysis enhances decision-making precision.

How can investors incorporate demand forecasts into their tactical planning for 2025?

Integrating demand forecasts with comprehensive market analysis enables investors to identify optimal entry and exit points, hedge against volatility, and position for long-term growth. Practical methods include setting alerts for demand-driven price movements, diversifying across different gold assets, and employing stop-loss strategies to manage downside risk. For more actionable advice, explore expert tips on effective gold investment tactics.

Harnessing Technology to Predict Gold Price Movements in 2025

As the gold market evolves, cutting-edge technological tools are becoming indispensable for accurate forecasting. Advanced algorithms, such as artificial intelligence and deep learning, analyze vast datasets from macroeconomic indicators, geopolitical events, and market sentiment to generate predictive insights. According to a report by Morgan Stanley’s AI in Financial Markets, these models can identify subtle patterns often missed by traditional analysis, offering investors a competitive edge in anticipating price shifts.

Implementing these tools requires a nuanced understanding of their limitations and strengths. For instance, while machine learning models excel at recognizing complex relationships, they are vulnerable to unforeseen shocks—such as sudden policy changes or technological breakthroughs—that can disrupt predictions. Hence, integrating these models with fundamental analysis and real-time market monitoring remains essential for robust decision-making.

What are the most promising AI-driven analytics for gold investors in 2025?

Among the most promising are sentiment analysis platforms that gauge market mood from news sources, social media, and geopolitical reports. These tools can preemptively signal shifts in investor confidence and demand trends. Additionally, predictive analytics that incorporate macroeconomic variables—like inflation rates, currency fluctuations, and central bank policies—are invaluable for timing entry and exit points. As per a study by NBER Working Paper 29075, such integrated approaches significantly improve forecast accuracy for commodity prices, including gold.

Strategic Positioning Through Diversification and Risk Management

Expert investors recognize that relying solely on gold or a single asset class exposes portfolios to idiosyncratic risks. Diversification across physical gold, ETFs, and gold mining equities provides resilience amid volatility. For example, physical gold offers hedge capabilities, while ETFs provide liquidity and exposure to broader market trends. Mining stocks, on the other hand, can yield asymmetrical returns, especially when operational efficiencies improve or new deposits are discovered.

Furthermore, sophisticated risk management tools—such as options and futures—allow investors to hedge against adverse price movements. Implementing collar strategies or protective puts can safeguard gains while maintaining upside potential. The key is to tailor these instruments to individual risk tolerance and market outlooks, leveraging analytics to time their deployment effectively.

How can investors balance tactical trades with long-term goals in a volatile environment?

Achieving this balance necessitates a disciplined approach that combines short-term tactical adjustments with a clear long-term investment thesis. Regularly reviewing market signals derived from predictive models ensures agility in responding to emerging trends. Simultaneously, maintaining core holdings aligned with fundamental valuation and macroeconomic expectations preserves capital for sustained growth. Engaging with educational resources and expert analyses—such as those provided by top-tier investment guides—can enhance strategic robustness and confidence.

Revealing Hidden Patterns in Gold Market Movements for 2025

As the gold landscape evolves, sophisticated analytical techniques reveal subtle market signals that can significantly influence investment decisions. Deep dives into macroeconomic indicators combined with big data analytics enable investors to identify emerging trends before they become mainstream, fostering a proactive approach rather than reactive trading. Leveraging these advanced tools allows for a nuanced understanding of price drivers and risk factors, essential for navigating the volatile gold market with confidence.

The Impact of Central Bank Policies on Gold’s Future Trajectory

Central banks play a pivotal role in shaping gold prices, especially through their reserve management strategies and monetary policy adjustments. In 2025, the trajectory of these policies—whether aggressive interest rate hikes or accommodative easing—will influence gold’s appeal as a safe haven. Monitoring the Federal Reserve, European Central Bank, and emerging market central banks’ reserve shifts offers crucial insights. According to the World Gold Council, such institutional behaviors are among the most reliable indicators of future price movements.

Can AI models predict gold price swings with higher accuracy than traditional methods?

Emerging AI models, especially those employing deep learning, are increasingly capable of capturing complex, nonlinear relationships in market data that traditional econometric models might miss. These models analyze vast datasets—including geopolitical news, currency fluctuations, and market sentiment—allowing for more dynamic and precise forecasts. As per recent research by Morgan Stanley, integrating AI-driven analytics enhances predictive accuracy, providing investors with a competitive edge in 2025’s unpredictable environment. Stay ahead by harnessing these cutting-edge tools to refine your strategic planning.

Harnessing Geopolitical Dynamics for Strategic Gold Positioning

Geopolitical unrest and trade tensions are major catalysts for gold demand surges. In 2025, unpredictable conflicts and diplomatic shifts could redefine safe-haven flows, especially in regions with fragile political stability. Investors who proactively analyze geopolitical risk indicators—such as military movements, trade policy updates, or sanctions—can time their entries and exits more effectively. According to the Foreign Affairs journal, geopolitical analysis is indispensable for understanding the nuanced forces driving gold prices beyond simple macroeconomic factors.

Innovative Portfolio Strategies to Capture Market Opportunities

Given the increasing complexity of the gold market, diversified strategies that blend physical assets, ETFs, and mining equities are vital. Tactical allocations based on real-time market signals—such as demand shifts in emerging sectors like technology and renewable energy—can optimize returns. Utilizing derivatives, including options and futures, provides effective hedging against adverse price movements while capitalizing on volatility. Experts recommend regular portfolio rebalancing aligned with predictive analytics to sustain resilience and growth, as highlighted by leading financial strategists in Investopedia.

What advanced risk management techniques can safeguard against unpredictable shocks?

Employing sophisticated risk mitigation tools such as protective puts, collars, and dynamic hedging allows investors to limit downside exposure during turbulent periods. Combining these with scenario analysis driven by AI forecasts enhances preparedness against shocks like sudden policy reversals or technological disruptions. Continuous monitoring of market indicators and maintaining flexible asset allocations are essential practices endorsed by top hedge funds, as detailed in recent reports by PwC. This disciplined approach ensures that investors can adapt swiftly and preserve capital amidst market upheavals.

The Future of Gold Demand in a Tech-Driven Economy

Technological innovation is transforming gold’s role from traditional jewelry and reserve assets to critical components in high-tech manufacturing, quantum computing, and renewable energy sectors. These emerging demand channels could sustain robust growth in gold consumption, even as traditional sectors face saturation. Investors should keep abreast of technological trends and industrial applications, which could unlock new valuation metrics and investment opportunities. For comprehensive insights, consult McKinsey & Company’s reports on industrial demand for precious metals.

How can diversification across innovative applications benefit long-term gold investors?

Balancing exposure across traditional and emerging sectors—such as electronics, aerospace, and green energy—can hedge against sector-specific downturns while capturing growth from technological adoption. Strategic allocation informed by predictive analytics on sector trends enhances portfolio robustness. Engaging with expert analyses and industry reports enables investors to anticipate shifts and position accordingly, maximizing long-term gains in a rapidly changing landscape.

Strategic Opportunities in the Gold Market for 2025

Investors and analysts should focus on the evolving geopolitical landscape, as regional conflicts and trade tensions are poised to influence gold demand significantly. Gold continues to serve as a vital hedge against currency fluctuations and inflation, particularly amidst volatile economic policies. Staying attuned to central bank reserve adjustments and technological advancements in gold extraction can provide a competitive edge for strategic positioning.

Leverage Cutting-Edge Predictive Tools

Utilize sophisticated AI-driven analytics to anticipate market shifts. These tools analyze macroeconomic indicators, sentiment data, and geopolitical events to refine investment timing and risk management. Integrating these insights with traditional analysis enhances decision-making accuracy and resilience.

Explore Diversified Investment Avenues

Diversify across physical gold, ETFs, and mining stocks to mitigate risks and capitalize on demand shifts. Employ derivatives such as options and futures to hedge against unforeseen shocks, ensuring portfolio robustness in unpredictable environments.

Top Resources for Deepening Gold Market Expertise

- World Gold Council: Offers comprehensive market data, trend analysis, and research reports on gold’s role in the global economy.

- McKinsey & Company: Provides industry insights, especially on technological innovations impacting gold demand.

- Foreign Affairs Journal: Analyzes geopolitical developments that influence safe-haven assets like gold.

- NBER Working Papers: Features rigorous academic research on commodity price modeling and AI applications in finance.

- Investopedia: A practical resource for understanding complex investment strategies and market analysis techniques.

Reflections from the Expert’s Perspective

In the realm of gold investment, staying ahead requires a synthesis of expert insights, technological adoption, and strategic diversification. The forecast for 2025 underscores the importance of integrating advanced analytics with traditional fundamentals—an approach that empowers investors to navigate volatility effectively. As the market evolves, continuous learning and adaptation remain crucial. Engage with industry-leading resources and consider collaborating with financial advisors to tailor strategies that align with your risk profile and long-term objectives. The gold market’s future is as dynamic as it is promising, provided one is equipped with the right knowledge and tools.