Harnessing Macroeconomic Indicators for Strategic Gold Investment in 2025

In the complex landscape of 2025, savvy investors must interpret a confluence of macroeconomic signals—interest rate trajectories, inflationary pressures, and geopolitical tensions—to formulate potent gold investment strategies. Gold, long regarded as a hedge against systemic risk, demands a nuanced understanding of global fiscal policies and monetary developments. For instance, central bank gold purchases, as analyzed in recent reports, are pivotal in shaping supply-demand dynamics and influencing price trajectories (source).

Deepening Portfolio Diversification via Gold-Related Financial Instruments

Beyond physical gold, integrating gold ETFs and mutual funds—such as those detailed here—can optimize liquidity and mitigate storage risks. These financial instruments, aligned with market volatility, enable dynamic rebalancing. An expert approach involves leveraging correlation analysis between gold and other asset classes, including equities and bonds, to craft resilient, risk-adjusted portfolios.

What Are the Cutting-Edge Techniques for Gold Trading in 2025?

Expert Inquiry: How can algorithmic trading and technical analysis maximize gold returns amidst unpredictable market swings?

Advanced traders employ algorithm-driven strategies, utilizing real-time market data and machine learning models to identify short-term price anomalies. Technical indicators such as RSI, MACD, and Fibonacci retracements, integrated with automated trading platforms, offer a competitive edge—especially in volatile markets where traditional analysis falters. For in-depth insights, see this resource.

Long-Term Perspectives: Building a Sustainable Gold Investment Strategy for 2025 and Beyond

Expert investors advocate a phased, disciplined approach, emphasizing periodic review of supply-demand trends, geopolitical developments, and technological innovations in gold extraction and refining. Developing a resilient strategy involves balancing physical gold holdings with derivative instruments, ensuring liquidity and safeguarding against market shocks.

To deepen your understanding of market drivers, consider consulting this comprehensive analysis.

Explore related content or contribute your insights to our community of seasoned investors, fostering a collaborative environment for refining gold investment techniques in 2025.

Harnessing New Data Analytics and Predictive Models for Gold Investment in 2025

In the rapidly evolving landscape of 2025, investors are increasingly turning to sophisticated data analytics and predictive modeling to inform their gold investment decisions. By integrating big data sources—ranging from geopolitical news to macroeconomic indicators—analysts develop nuanced forecasts that surpass traditional analysis. These models leverage machine learning algorithms to identify subtle market signals, enabling investors to anticipate price movements with higher precision. For a comprehensive overview of how technological innovation enhances gold market analysis, see this detailed report.

The Role of Geopolitical Risk Assessment in Shaping Gold Prices

Geopolitical tensions continue to influence gold prices significantly in 2025. Sophisticated risk assessment frameworks, combining real-time news sentiment analysis with geopolitical event tracking, help investors gauge potential market impacts. These tools provide actionable insights, allowing for dynamic portfolio adjustments. For example, increased tensions in major regions often trigger safe-haven flows into gold, temporarily boosting prices. Expert analysis from sources such as market analysts emphasizes the importance of integrating geopolitical risk metrics into strategic planning.

Is Gold Still the Ultimate Hedge Against Systemic Risks in 2025?

Given the increasing complexity of global markets, a critical question arises: does gold maintain its status as the premier hedge against systemic risks in 2025? While historical data underscores gold’s resilience during crises, recent trends suggest a nuanced picture. Factors such as rising interest rates, alternative safe-haven assets, and technological innovations in digital assets challenge gold’s dominance. However, expert consensus, including insights from industry leaders, affirms that gold remains a vital component of diversified risk management strategies, especially when complemented with emerging financial instruments like gold ETFs and digital gold platforms.

Are There Emerging Trends That Could Redefine Gold’s Investment Role in 2025?

Emerging trends such as the rise of central bank digital currencies (CBDCs), increased environmental scrutiny on gold mining, and advances in gold extraction technologies could reshape the investment landscape. These developments influence supply-demand dynamics and investor perceptions, potentially creating new opportunities or risks. Staying ahead requires a forward-looking approach, integrating insights from industry reports that analyze these transformative forces.

Share your thoughts or experiences with innovative gold investment techniques in 2025. Engaging with a community of experienced investors can provide practical insights and refine your strategies.

Integrating Geopolitical Dynamics and Macro Indicators for Precision Gold Trading

In 2025, the intricate web of macroeconomic indicators and geopolitical developments demands a sophisticated analytical approach. Investors must synthesize data from interest rate policies, inflation forecasts, currency fluctuations, and geopolitical events—such as regional conflicts or trade disputes—to craft a resilient gold investment blueprint. Advanced tools like multi-factor models and scenario analysis enable investors to simulate various macroeconomic environments, assessing potential impacts on gold prices with remarkable precision. For example, integrating geopolitical risk scores—derived from real-time sentiment analysis—can reveal latent market vulnerabilities that traditional indicators might overlook (source).

The Nuances of Gold Price Correlation with Macro Variables in Volatile Times

Understanding the subtle correlations between gold and macro variables is crucial, especially during periods of heightened volatility. While gold traditionally exhibits inverse correlation with the US dollar, recent trends suggest that during economic crises, correlations with emerging market currencies or bond yields may become more pronounced. Investors leveraging advanced econometric techniques—such as vector autoregression (VAR) and cointegration analysis—can better anticipate shifts in these relationships. For instance, during the 2022 inflation surge, gold’s correlation with real interest rates shifted unexpectedly, underscoring the importance of dynamic, model-based analysis (source).

How can machine learning enhance the predictive accuracy of macroeconomic models for gold?

Machine learning algorithms, including neural networks and ensemble methods, excel at capturing complex, non-linear relationships within vast datasets. By training models on historical macroeconomic data, market sentiment, and geopolitical events, investors can generate probabilistic forecasts for gold prices with increased confidence. Continuous model refinement—using real-time data streams—further improves predictive robustness. For instance, deploying reinforcement learning techniques can help adapt strategies dynamically as macro conditions evolve (source).

Deepening Portfolio Resilience through Adaptive Asset Allocation Techniques

Portfolio diversification in 2025 hinges on adaptive strategies that respond swiftly to macroeconomic signals. Techniques such as dynamic hedging, volatility targeting, and risk parity allow investors to recalibrate exposure to gold and correlated assets in real time. For example, during sudden inflation shocks, increasing allocation to physical gold or gold-backed derivatives can mitigate downside risk. Moreover, integrating behavioral finance insights—like investor sentiment indices—can help identify timing opportunities for entry and exit, enhancing overall resilience (source).

Anticipating Future Market Disruptions: The Role of Big Data and Predictive Analytics

As data sources expand exponentially, predictive analytics powered by big data analytics emerge as critical tools for preempting market disruptions. Combining satellite imagery of mining operations, social media analytics, and supply chain data creates a comprehensive situational awareness framework. Such multi-dimensional insights help investors identify emerging supply constraints or demand surges, which can influence gold prices significantly. Embracing these technologies positions investors to stay ahead of market shifts, turning data into actionable intelligence (source).

Conclusion: Harnessing Multi-Layered Analysis for 2025 and Beyond

In the fast-evolving landscape of 2025, sophisticated analysis integrating macroeconomic indicators, geopolitical risk assessment, machine learning, and big data analytics is essential for a competitive edge. By adopting a multi-layered approach—balancing quantitative models with qualitative insights—investors can craft resilient, forward-looking gold strategies. The journey toward mastery involves continuous learning and technological adaptation, ensuring your portfolio remains robust amid uncertainty. To deepen your understanding of these advanced techniques, engage with industry-leading research and join expert forums dedicated to macroeconomic-driven gold investing.

Unveiling the Impact of Global Monetary Policies on Gold’s Future Trajectory

In 2025, understanding the nuanced influence of global monetary policies—such as quantitative easing measures, currency devaluations, and interest rate adjustments—becomes paramount for strategic gold investing. Central banks’ evolving stance on gold reserves, especially in emerging markets, can significantly alter supply-demand dynamics. Recent analyses from the International Monetary Fund highlight how shifts in reserve allocations are shaping gold’s role as a monetary asset (IMF report).

The Rise of Digital Asset Integration in Gold Portfolio Diversification

Beyond traditional physical and ETF holdings, the integration of digital assets such as tokenized gold and blockchain-based gold-backed securities is revolutionizing diversification strategies. These innovative instruments offer increased liquidity, transparency, and fractional ownership, aligning with the demands of sophisticated investors. Exploring platforms that facilitate direct ownership and seamless transfer of digital gold can enhance portfolio agility in volatile markets.

How Can Quantitative Models and AI Drive Precision in Gold Price Forecasting?

Question: What advanced quantitative techniques best improve gold price prediction accuracy amidst market volatility?

Machine learning models, including deep neural networks and ensemble algorithms, trained on extensive macroeconomic, geopolitical, and sentiment data, enable high-frequency, adaptive forecasting. These models outperform traditional econometric methods by capturing complex, non-linear relationships and providing probabilistic forecasts. For instance, reinforcement learning techniques can dynamically adjust trading strategies based on real-time market feedback, enhancing returns in unpredictable environments (Financial Innovations Journal).

Expert Techniques for Navigating Gold’s Correlation with Macro Variables in Turbulent Times

Understanding and exploiting the shifting correlations between gold and macroeconomic indicators—such as real interest rates, inflation expectations, and currency indices—are crucial during crises. Advanced econometric tools like regime-switching models and copula functions allow investors to detect changes in dependency structures, informing tactical asset allocation. For example, during the 2022 inflation surge, gold’s correlation with emerging market currencies intensified, signaling new hedging opportunities.

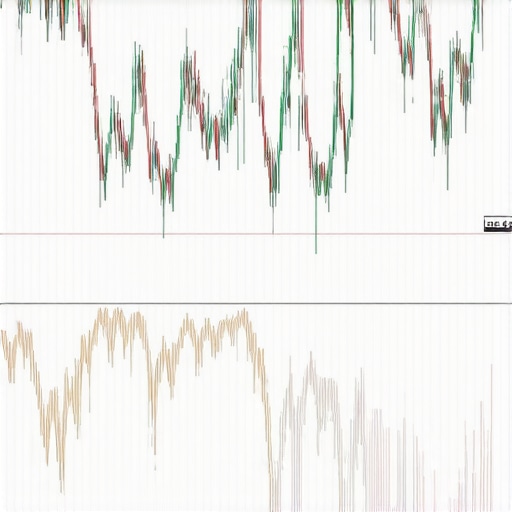

An illustrative graph depicting gold’s correlation shifts with macro variables during economic crises, highlighting the importance of dynamic analysis.

The Strategic Role of Geopolitical Risk Analytics in Shaping Gold Investments

Combining real-time geopolitical event tracking with sentiment analysis tools provides a granular view of potential market disruptions. Advanced risk models incorporate satellite imagery, social media data, and trade flow analytics to forecast supply chain vulnerabilities and demand spikes. For instance, monitoring regional conflicts and their impact on supply chains can inform timely investment decisions and risk mitigation strategies.

Emerging Financial Innovations Redefining Gold’s Investment Landscape in 2025

Innovations such as central bank digital currencies (CBDCs), environmentally sustainable gold mining practices, and enhanced supply chain transparency are poised to reshape gold’s investment profile. These developments influence market perceptions, supply availability, and regulatory frameworks. Staying ahead requires continuous engagement with industry reports and technological developments, such as those from the World Gold Council (World Gold Council).

Harnessing Big Data and Predictive Analytics for Proactive Gold Investment Strategies

The proliferation of big data sources—including satellite imagery, social media sentiment, and supply chain analytics—enables the development of comprehensive predictive models. These models facilitate early detection of supply disruptions, demand surges, and geopolitical shocks, empowering investors to act proactively. Advanced data integration techniques, such as multi-modal machine learning, are critical for extracting actionable insights from heterogeneous data streams (Data Insight Journal).

Conclusion: Embracing a Multi-Dimensional Approach to Gold Investment in 2025

To excel in 2025, investors must synthesize macroeconomic data, geopolitical risk assessments, cutting-edge AI models, and innovative financial instruments into a cohesive strategy. Continuous learning and technological adaptation are essential to navigate the evolving landscape and capitalize on emerging opportunities. Engage with leading research and expert communities to refine your approach and stay at the forefront of gold investment excellence.

Expert Insights & Advanced Considerations

1. The Evolving Role of Digital Gold in Diversification Strategies

In 2025, integrating digital gold assets, such as tokenized gold and blockchain-backed securities, is revolutionizing portfolio diversification. These innovations provide enhanced liquidity, transparency, and fractional ownership, enabling sophisticated investors to optimize asset allocation amid volatile markets. Staying ahead requires continuous engagement with emerging platforms and regulatory developments.

2. Macro-Market Interdependencies and Algorithmic Trading

Advanced traders leverage multi-factor models, combining macroeconomic indicators with machine learning algorithms, to identify non-linear relationships influencing gold prices. Algorithmic trading platforms employing real-time data and AI-driven decision-making can capitalize on fleeting market opportunities, especially during geopolitical upheavals or macroeconomic shocks.

3. The Impact of Geopolitical Risk Analytics on Safe-Haven Asset Allocation

Utilizing sophisticated geopolitical risk assessment tools—integrating sentiment analysis, satellite imagery, and supply chain analytics—allows investors to preemptively adjust holdings. Recognizing latent vulnerabilities in regional stability can mitigate downside risks and enhance strategic resilience.

4. Integrating Environmental, Social, and Governance (ESG) Factors into Gold Investment Decisions

Emerging ESG considerations, driven by technological advances in sustainable mining and regulatory shifts, influence supply-demand dynamics. Incorporating ESG metrics into investment frameworks ensures alignment with long-term value creation and risk mitigation.

5. Embracing Big Data and Predictive Analytics for Market Forecasting

Harnessing heterogeneous data sources, including satellite imagery, social media sentiment, and supply chain analytics, enhances predictive accuracy. Multi-modal machine learning models facilitate early detection of market disruptions, enabling proactive investment strategies.

Curated Expert Resources

- World Gold Council: Provides authoritative research on sustainable gold mining practices, market trends, and innovative investment products, essential for informed decision-making.

- IMF Reports on Gold Reserves: Offers comprehensive analysis of global monetary policies and their influence on gold as a reserve asset, crucial for macroeconomic strategy.

- Financial Innovations Journal: Publishes cutting-edge research on AI, machine learning, and blockchain applications in commodity trading, fostering technological adoption in investment strategies.

- Data Insight Journal: Specializes in big data analytics and predictive modeling techniques, vital for developing advanced forecasting tools.

- Regulatory Frameworks for Digital Assets: Guides investors through evolving legal landscapes impacting tokenized gold and digital securities, ensuring compliance and strategic agility.

Final Expert Perspective

In the realm of gold investment for 2025, a multi-dimensional approach—integrating digital assets, macroeconomic analysis, geopolitical risk assessment, and ESG factors—is paramount. Mastery of these advanced insights, coupled with leveraging authoritative resources, positions investors to navigate complex markets with confidence. Engage actively with expert communities and innovative tools to refine your strategies continuously, transforming challenges into opportunities for sustained wealth growth.