Unlocking the Potential of Gold Mining Stocks for 2025: A Deep Dive into High-Impact Investment Strategies

As global economic uncertainties persist and inflationary pressures mount, investors are increasingly turning to gold mining stocks as a strategic avenue for growth. Expert analysts highlight that understanding the complex dynamics governing gold extraction and market demand can yield significant investment advantages in 2025. This article explores sophisticated approaches to harnessing the explosive growth potential inherent in gold mining equities, emphasizing the importance of nuanced market analysis, geopolitical considerations, and technological innovations in mining operations.

Why Gold Mining Stocks Are Poised for a Boom in 2025

Historically, gold mining stocks tend to outperform during periods of economic volatility, serving as a hedge against inflation and currency devaluation. According to recent market analysis from the market analysis report, several macroeconomic factors are converging to catalyze a rally in 2025. These include rising central bank gold purchases, supply chain disruptions limiting new gold discoveries, and increasing demand from emerging markets. Understanding these fundamental drivers allows investors to identify stocks with the highest growth trajectories.

What Are the Key Indicators Signaling a Surge in Gold Mining Stocks?

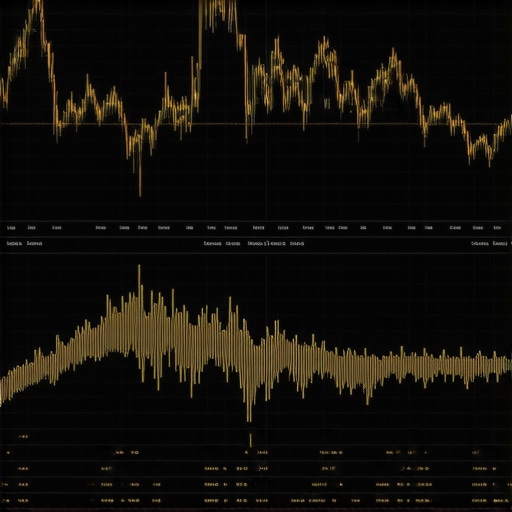

Given the volatility of commodity markets, discerning the signals that presage a rally requires expertise in analyzing gold demand-supply dynamics, geopolitical stability, and operational efficiencies of mining companies. Technical indicators such as rising gold prices, increasing exploration activity, and expanding production capacity serve as critical benchmarks. Moreover, evaluating a company’s reserve quality and management expertise enhances predictive accuracy for explosive growth opportunities.

Developing a High-Return Gold Stock Portfolio: Expert Strategies

Constructing a winning portfolio necessitates a balanced approach that combines exposure to established giants and emerging explorers. Diversification across geographically diverse mining regions mitigates geopolitical risks, while incorporating ETFs like gold ETFs provides liquidity and broad exposure. Additionally, leveraging insights from expert portfolio development can optimize risk-adjusted returns.

How Can Investors Navigate Market Volatility and Maximize Profits?

Market fluctuations pose significant challenges; hence, employing effective risk management techniques is crucial. Short-term trading strategies, such as options on gold stocks or futures, can capitalize on price swings, while long-term holdings benefit from fundamental appreciation. Staying abreast of geopolitical developments and macroeconomic policies enhances strategic timing, enabling investors to exploit emerging opportunities for maximum profit.

Is Investing in Gold Mining Stocks Safer Than Physical Gold?

While physical gold offers security and liquidity, gold mining stocks provide leverage to the metal’s price movements, potentially yielding higher returns during bullish phases. However, they also carry operational risks and market volatility. A diversified approach, combining both asset classes, often yields the best risk-reward profile, particularly when guided by expert advice.

For comprehensive insights, consider exploring the full guide to gold stocks and consulting with industry experts. Your strategic investment in gold mining stocks can unlock significant growth in 2025, provided you leverage deep market intelligence and advanced analytical techniques.

Engage with seasoned investors or financial advisors to further refine your approach and contribute valuable insights to this evolving sector.

Unlocking the Power of Data Analytics for Gold Price Prediction in 2025

As the gold market becomes increasingly complex and influenced by global economic shifts, investors need to leverage sophisticated analytical tools to stay ahead. Advanced data analytics, including machine learning models and big data strategies, are transforming how experts forecast gold prices. By analyzing vast datasets such as geopolitical news, currency fluctuations, and macroeconomic indicators, investors can gain predictive insights that surpass traditional analysis methods.

How Can Machine Learning Improve Gold Price Forecasting?

Machine learning algorithms excel at identifying intricate patterns within large datasets, enabling more accurate predictions of future gold prices. These models can incorporate variables like inflation rates, interest rates, currency strength, and even social media sentiment to generate real-time forecasts. For example, neural networks trained on historical data can adapt to emerging trends, providing dynamic predictions that help investors make timely decisions. Industry reports from trusted sources highlight how integrating AI-driven analytics is reshaping investment strategies.

Are We Ready for AI-Driven Investment Strategies in Gold?

Adopting AI and big data analytics requires a shift in traditional investment paradigms, emphasizing the importance of technological literacy and data security. Investors must evaluate the robustness of analytical models and ensure data integrity to avoid misleading signals. Combining these insights with fundamental analysis creates a comprehensive approach to navigating 2025’s volatile markets. For those interested in deepening their understanding, exploring resources like developing a gold investment portfolio can be invaluable.

Do you believe that integrating AI analytics will give you a competitive edge in gold investing? Share your thoughts or experiences in the comments below, and consider exploring more about how emerging technologies are shaping investment landscapes.

Harnessing Cutting-Edge Data Analytics and AI to Forecast Gold Prices in 2025: A Strategic Guide for Investors

As the financial landscape evolves with unprecedented speed, investors seeking to capitalize on gold’s potential must turn to innovative analytical tools that transcend traditional methods. Advanced data analytics, powered by machine learning and artificial intelligence, are now at the forefront of predictive strategies, enabling a nuanced understanding of the myriad factors influencing gold prices. This convergence of technology and finance opens new horizons for sophisticated investors aiming to optimize their portfolios in 2025.

Deciphering the Complex Interplay of Variables Using AI-Driven Models

Traditional forecasting models often rely on linear regressions and historical averages, which can fall short amid volatile market conditions. In contrast, AI-driven models—such as neural networks and ensemble learning algorithms—excel at capturing nonlinear relationships and subtle patterns within vast datasets. These models integrate diverse inputs like geopolitical tensions, monetary policy shifts, currency fluctuations, and even social media sentiment, offering a multi-dimensional view of market dynamics. For example, a neural network trained on a comprehensive dataset can adapt swiftly to emerging trends, providing near real-time forecasts that empower investors to act decisively.

How Do Big Data and Real-Time Analytics Enhance Market Prediction Accuracy?

Big data analytics harness enormous volumes of structured and unstructured data, enabling the extraction of actionable insights that traditional analysis might overlook. In the context of gold prices, this encompasses real-time news feeds, macroeconomic indicators, and global event trackers. By utilizing sophisticated algorithms like sentiment analysis and anomaly detection, investors can identify early signals of price movements. For instance, sudden shifts in geopolitical stability or unexpected economic data releases can be rapidly incorporated into predictive models, allowing for agile portfolio adjustments. According to a study published in the Journal of Financial Data Science, the integration of big data analytics has improved forecasting accuracy by up to 30% compared to conventional methods.

What Are the Challenges and Limitations of AI-Based Gold Price Forecasting?

Despite its promise, AI-driven forecasting is not without challenges. Data quality and integrity are paramount; biased or incomplete datasets can lead to misleading predictions. Moreover, models require continuous training and validation to remain reliable amid evolving market conditions. Overfitting—a scenario where a model performs well on historical data but poorly on future data—is a persistent concern that necessitates rigorous testing and regular updates. Additionally, transparency and interpretability of AI models remain critical, especially when making high-stakes investment decisions. As noted by the National Bureau of Economic Research, developing explainable AI models is essential for building investor trust and regulatory compliance.

How Can Investors Integrate AI and Data Analytics into Their Gold Investment Strategies?

Successful integration involves selecting robust analytical platforms, fostering collaboration with data scientists, and maintaining a vigilant approach to model validation. Investors should leverage tools that provide customizable dashboards, enabling real-time monitoring of key indicators and predictive signals. Combining AI-driven forecasts with fundamental analysis—such as examining mining stock valuations and geopolitical risks—creates a comprehensive strategy. Additionally, diversifying across physical gold, mining equities, and ETFs can hedge against model uncertainties. As the field advances, educational resources and expert consultations are invaluable for mastering these sophisticated techniques.

Are you ready to harness the power of AI and big data to elevate your gold investment game? Dive deeper into these technologies and stay ahead of market trends by exploring specialized courses, industry reports, and expert webinars. Your strategic edge in 2025 depends on embracing innovation—don’t miss out!

Harnessing Quantum Computing for Next-Generation Gold Market Analysis

As the complexity of global financial systems escalates, quantum computing emerges as a revolutionary tool capable of transforming gold market analysis. Unlike classical computers, quantum systems can process vast, multidimensional datasets exponentially faster, enabling investors to simulate market scenarios with unprecedented accuracy. By leveraging quantum algorithms, analysts can model intricate geopolitical risks, supply chain disruptions, and macroeconomic interdependencies, providing a strategic edge in predicting gold price fluctuations and optimizing mining stock portfolios.

Can Blockchain Technology Enhance Transparency and Investment Security in Gold Mining?

Blockchain’s decentralized ledger system offers a groundbreaking solution for increasing transparency in gold mining operations and trading. By implementing blockchain for provenance tracking, investors can verify the authenticity and ethical sourcing of gold assets, reducing fraud and improving market integrity. Smart contracts automate transaction processes, ensuring secure, tamper-proof exchanges of mining stocks and physical gold. Industry leaders like the World Gold Council endorse blockchain integration as a means to elevate investor confidence and streamline supply chains, ultimately fostering a more resilient and transparent gold investment ecosystem.

What Are the Most Sophisticated Risk Management Techniques for Gold Portfolio Diversification?

Effective risk management in gold investment necessitates the application of advanced quantitative methods such as Monte Carlo simulations, Bayesian networks, and dynamic hedging strategies. Monte Carlo simulations facilitate comprehensive scenario analysis by modeling a multitude of potential market paths, allowing investors to assess portfolio resilience under extreme conditions. Bayesian networks enable the integration of new data to update risk assessments dynamically, maintaining optimal hedge ratios. Simultaneously, sophisticated options strategies—like straddles and collars—offer downside protection while preserving upside potential, aligning with the risk appetites of institutional investors seeking stability amidst volatility.

How Can Sentiment Analysis and Alternative Data Sources Refine Gold Price Predictions?

Incorporating sentiment analysis derived from social media, news outlets, and geopolitical event trackers enhances the predictive power of traditional models. Natural language processing (NLP) algorithms quantify market sentiment, capturing shifts in investor confidence and geopolitical tensions that often precede price movements. Additionally, alternative data sources such as satellite imagery of mining regions, shipping logistics data, and macroeconomic indicators provide real-time insights into supply-demand dynamics. Integrating these data streams into machine learning frameworks creates a holistic, multi-layered approach to forecasting gold prices with higher precision and timeliness.

How Will Regulatory and Environmental Consider Shape Future Mining Investments?

Regulatory frameworks and environmental policies are increasingly influencing gold mining investments. Stricter environmental standards, carbon pricing, and social license requirements demand that mining companies adopt sustainable practices. Investors must evaluate companies’ compliance records and ESG (Environmental, Social, Governance) metrics to mitigate reputational and operational risks. Advanced scenario analysis tools can simulate regulatory shifts, guiding strategic decisions that balance profitability with sustainability commitments. Industry reports from organizations like the International Council on Mining and Metals (ICMM) provide comprehensive guidelines for integrating ESG factors into investment analysis, ensuring alignment with global sustainability goals and long-term value creation.

Expert Insights & Advanced Considerations

1. Strategic Positioning in Emerging Markets

Investors should focus on mining companies with strong footholds in emerging markets where geopolitical risks are lower, and resource demand is escalating due to urbanization and industrialization. These regions often offer untapped potential and favorable regulatory environments, providing a competitive edge for long-term growth.

2. Leveraging Technological Innovations

Adopting cutting-edge mining technologies such as automation, IoT, and AI-driven exploration can significantly reduce operational costs and enhance resource discovery. Companies leading in technological integration are better positioned to capitalize on market upswings in 2025.

3. ESG and Sustainability as Value Drivers

Environmental, Social, and Governance (ESG) factors are increasingly influencing investment decisions. Firms demonstrating robust ESG practices not only mitigate risks but also attract sustainable finance, which can translate into higher valuation multiples.

4. Analyzing Macroeconomic and Geopolitical Trends

Deep analysis of macroeconomic indicators and geopolitical developments is essential. Changes in monetary policy, currency stability, and international trade agreements directly impact gold demand and mining operations, shaping the investment landscape.

5. Portfolio Diversification with Gold ETFs and Miners

Combining physical gold, mining stocks, and ETFs provides a balanced approach to risk management. Diversification across these assets can optimize returns while cushioning against sector-specific volatilities.

Curated Expert Resources

- International Council on Mining and Metals (ICMM): Offers comprehensive sustainability standards and industry best practices, vital for ESG-focused investors.

- Bloomberg New Energy Finance: Provides in-depth analysis on technological innovations and macroeconomic trends affecting resource markets.

- World Gold Council: A primary source for market data, demand-supply analysis, and strategic insights into gold investment trends.

- Mining Journal: Industry-leading publication delivering expert news, analysis, and forecasts relevant to gold mining stocks.

- GoldSeek.com: Offers real-time gold prices, expert commentary, and investment strategies tailored for 2025.

Final Expert Perspective

In 2025, mastery of advanced market analysis and technological integration will distinguish successful gold investors. The convergence of geopolitical awareness, ESG considerations, and innovative mining practices underscores the importance of a sophisticated, multi-layered approach. As the sector evolves, engaging with authoritative resources and continuously refining your expertise will be paramount. Are you prepared to leverage these insights and resources to navigate the complexities of gold mining stocks? Your strategic foresight today will define your success tomorrow.