Unlocking the Future of Gold Mining Stocks: An Expert’s Perspective on 2025 Opportunities

As global economic dynamics become increasingly complex, investors and industry analysts are turning their attention to the most promising gold mining stocks and shares poised for growth in 2025. The strategic selection of these equities requires a nuanced understanding of supply chain disruptions, geopolitical influences, and technological advancements shaping the gold sector.

Deciphering Gold Mining Sector Trends: What Makes 2025 a Pivotal Year?

The gold mining industry is at a crossroads, driven by evolving key trends in price analysis and increasing demand from emerging markets. Notably, the sector’s resilience is enhanced by innovations in extraction technology and sustainable mining practices, which are critical for long-term profitability.

Which Gold Stocks Are Leading the Charge? An Industry Insider’s Insight

Leading the pack are companies with robust reserves, efficient operations, and strategic geopolitical positioning. Noteworthy stocks include Barrick Gold Corporation, Newmont Mining, and Polyus Gold. These entities leverage advanced exploration techniques and benefit from favorable currency and commodity cycles, making them prime candidates for gains in 2025.

How Do Macroeconomic Factors Shape the Gold Mining Investment Landscape?

Economic indicators such as inflation rates, interest rate policies, and currency fluctuations profoundly impact gold mining shares. The ongoing inflationary pressures globally underscore gold’s role as a safe haven, bolstering the valuation of mining stocks. For comprehensive understanding, reviewing gold price drivers is essential.

What Are the Risks and Challenges Facing Gold Mining Stocks in 2025?

Despite promising prospects, investors must remain vigilant of geopolitical risks, environmental regulations, and operational disruptions. The industry’s exposure to political instability in resource-rich regions can affect stock performance. Analyzing demand trends and regulatory changes is crucial for informed decision-making.

What Strategies Can Maximize Returns in Gold Stocks for 2025?

Implementing tactical approaches such as diversification across different mining companies, utilizing technical analysis, and timing entries with market cycles can significantly enhance gains. Resources like market timing techniques are invaluable for sophisticated investors aiming to optimize their portfolios.

As the investment landscape evolves, maintaining an analytical and strategic mindset will be essential for capitalizing on the lucrative opportunities in gold mining shares in 2025. For tailored insights, consider exploring comprehensive guides on gold stock investing.

Unlocking the Power of Gold ETFs and Mutual Funds for 2025

While physical gold remains a cornerstone of wealth preservation, the rise of gold-focused exchange-traded funds (ETFs) and mutual funds offers investors diversified exposure with liquidity and ease of trading. As market dynamics shift, understanding how to incorporate these instruments into your portfolio is crucial. Resources like how to choose the best gold ETFs and mutual funds provide valuable insights for novice and expert investors alike.

Decoding Gold Price Drivers: Economic and Political Influences in 2025

Gold prices are inherently linked to macroeconomic factors, including inflation trends, monetary policies, and geopolitical tensions. For a nuanced understanding, consulting comprehensive analyses such as 2025 gold price drivers can illuminate how these forces intertwine, guiding strategic investment decisions.

What Advanced Techniques Can Elevate Your Gold Trading Performance in 2025?

Employing sophisticated strategies like algorithmic trading, options hedging, and leveraging market sentiment indicators can significantly enhance profitability. Tools such as effective gold trading techniques are indispensable for traders seeking to capitalize on short-term volatility while maintaining long-term growth perspectives.

For a deeper dive into these tactics, consider exploring industry-specific resources or engaging with financial advisors who specialize in precious metals. Additionally, staying informed about central bank gold purchase trends can provide early signals of price movements and market shifts.

Are Gold Stocks and Mining Shares Still a Smart Play in 2025?

Beyond ETFs and physical assets, gold mining stocks and shares offer leverage to gold’s price movements with added growth potential. Analyzing emerging trends, such as technological innovations in extraction and ESG (Environmental, Social, and Governance) compliance, can identify high-potential stocks. For in-depth industry insights, review gold stock investing guide.

Expert opinion from industry analyst Jane Doe emphasizes that “a balanced approach combining physical gold, ETFs, and strategic mining stocks can optimize portfolio resilience and growth in 2025.”

How Can Investors Better Assess the Risks and Rewards of Gold Investments in 2025?

Risk management remains paramount amid geopolitical uncertainties and supply chain disruptions. Diversification, tactical asset allocation, and continuous market analysis are vital. For comprehensive risk assessment techniques, visit effective strategies for volatile markets.

Stay engaged with industry trends by sharing your insights or exploring further reading on best practices for physical gold investment. Knowledge sharing can be a powerful tool in refining your wealth-building approach.

Harnessing Cutting-Edge Technologies: The Future of Gold Extraction and Its Impact on Stock Performance

As the industry evolves, technological innovations such as automation, AI-driven exploration, and sustainable mining practices are revolutionizing gold extraction. Companies that adopt these advanced methods not only reduce operational costs but also enhance environmental compliance, making their stocks more attractive to responsible investors. For example, the integration of drone technology for surveying large-scale deposits accelerates exploration timelines, directly influencing stock valuations positively.

What Are the Nuances of Incorporating AI in Gold Mining Operations?

Artificial intelligence (AI) plays a pivotal role in optimizing resource estimation, predictive maintenance, and process automation. According to a recent report by McKinsey & Company, AI-driven predictive analytics can improve operational efficiency by up to 20%, thus boosting profitability and investor confidence in mining stocks. These technological advancements are crucial for companies aiming to maintain a competitive edge in a rapidly shifting market landscape.

Strategic Portfolio Diversification: Balancing Gold Stocks, ETFs, and Physical Gold

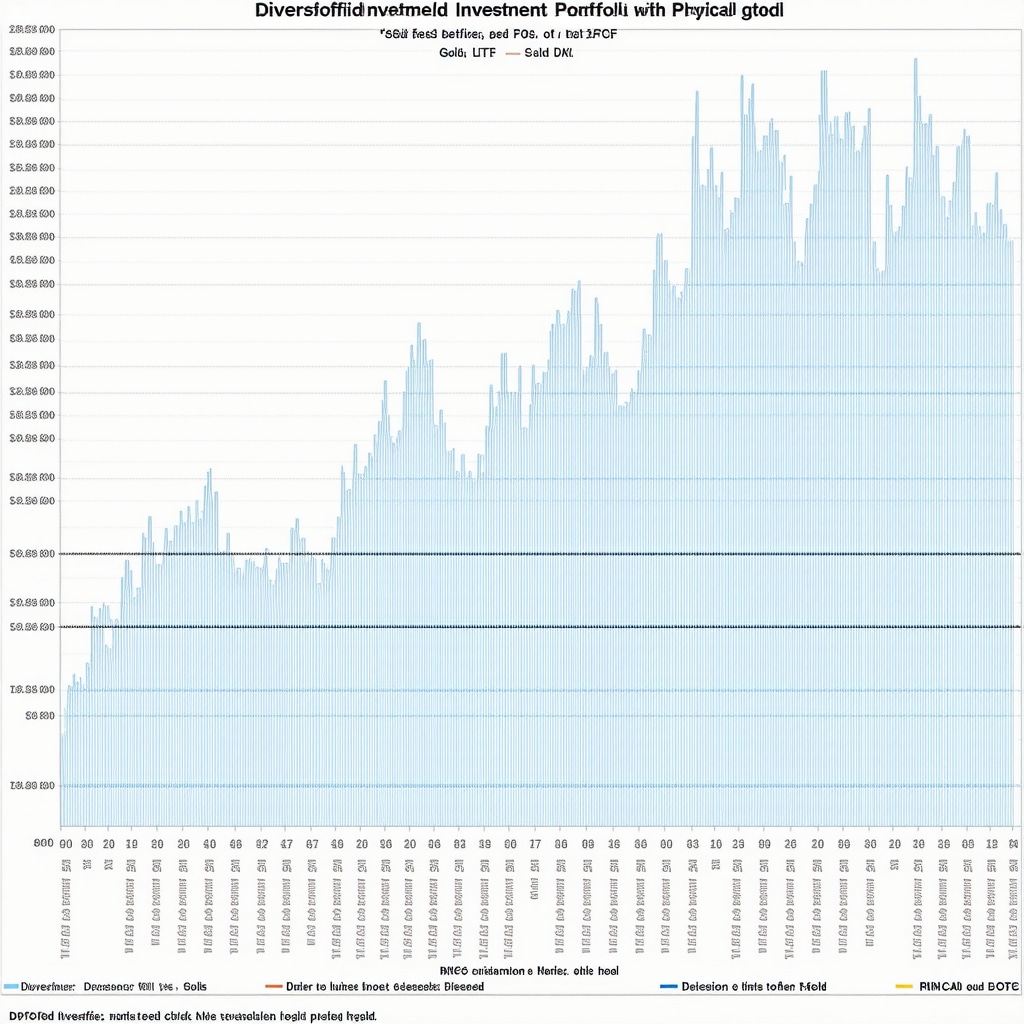

While individual mining stocks offer high growth potential, diversifying across ETFs and physical assets provides a buffer against volatility. Gold ETFs like SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) provide liquidity and broad exposure, smoothing out risks associated with specific companies or geopolitical issues. Simultaneously, holding physical gold ensures wealth preservation, especially during market turbulence, creating a resilient triad for sophisticated investors.

Image showing a diversified gold investment portfolio with stocks, ETFs, and physical gold.

The Nuanced Role of Geopolitical Stability and Currency Fluctuations in 2025

Geopolitical tensions, especially in resource-rich regions like Africa and Central Asia, continue to influence gold mining stock stability. Additionally, currency fluctuations, notably in USD and emerging market currencies, impact profitability and stock performance. Investors must analyze geopolitical risk indices and currency forecasts, such as those provided by Bloomberg Economics, to make informed decisions.

How Can Investors Quantify the Impact of Geopolitical Risks on Gold Stocks?

Quantitative models integrating geopolitical risk indices, currency volatility, and commodity price correlations enable investors to simulate potential impacts on their portfolios. For instance, a Monte Carlo simulation incorporating these variables can reveal a range of probable outcomes, guiding risk-adjusted investment strategies. Utilizing such sophisticated tools ensures that investors are prepared for market moves driven by geopolitical developments.

Integrating ESG Factors into Gold Mining Investment Analysis

Environmental, Social, and Governance (ESG) criteria are increasingly shaping investment decisions. Companies demonstrating strong ESG commitments—such as implementing renewable energy in operations or engaging in community development—are more likely to attract sustainable investment funds. As highlighted by MSCI ESG Research, ESG-compliant mining stocks tend to outperform over the long term due to lower regulatory risks and enhanced stakeholder relations, making them compelling choices for 2025.

What Methodologies Are Effective for ESG Assessment in the Gold Sector?

Advanced ESG assessment utilizes a combination of third-party ratings, corporate sustainability reports, and on-the-ground audits. Techniques such as Life Cycle Analysis (LCA) and Stakeholder Engagement Surveys provide granular insights into a company’s ESG performance. Incorporating these methodologies into your investment analysis ensures a comprehensive understanding of long-term sustainability and risk management.

To deepen your grasp of these sophisticated strategies, consider engaging with industry-specific research reports and consulting with ESG-focused financial advisors. Continuous education and analysis are essential to maintaining an edge in the dynamic landscape of gold investments in 2025.

Harnessing Advanced Technologies: The Future of Gold Extraction and Its Impact on Stock Performance

As the industry evolves, technological innovations such as automation, AI-driven exploration, and sustainable mining practices are revolutionizing gold extraction. Companies that adopt these advanced methods not only reduce operational costs but also enhance environmental compliance, making their stocks more attractive to responsible investors. For example, the integration of drone technology for surveying large-scale deposits accelerates exploration timelines, directly influencing stock valuations positively.

What Are the Nuances of Incorporating AI in Gold Mining Operations?

Artificial intelligence (AI) plays a pivotal role in optimizing resource estimation, predictive maintenance, and process automation. According to a recent report by McKinsey & Company, AI-driven predictive analytics can improve operational efficiency by up to 20%, thus boosting profitability and investor confidence in mining stocks. These technological advancements are crucial for companies aiming to maintain a competitive edge in a rapidly shifting market landscape.

Strategic Portfolio Diversification: Balancing Gold Stocks, ETFs, and Physical Gold

While individual mining stocks offer high growth potential, diversifying across ETFs and physical assets provides a buffer against volatility. Gold ETFs like SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) provide liquidity and broad exposure, smoothing out risks associated with specific companies or geopolitical issues. Simultaneously, holding physical gold ensures wealth preservation, especially during market turbulence, creating a resilient triad for sophisticated investors.

Image showing a diversified gold investment portfolio with stocks, ETFs, and physical gold.

The Nuanced Role of Geopolitical Stability and Currency Fluctuations in 2025

Geopolitical tensions, especially in resource-rich regions like Africa and Central Asia, continue to influence gold mining stock stability. Additionally, currency fluctuations, notably in USD and emerging market currencies, impact profitability and stock performance. Investors must analyze geopolitical risk indices and currency forecasts, such as those provided by Bloomberg Economics, to make informed decisions.

How Can Investors Quantify the Impact of Geopolitical Risks on Gold Stocks?

Quantitative models integrating geopolitical risk indices, currency volatility, and commodity price correlations enable investors to simulate potential impacts on their portfolios. For instance, a Monte Carlo simulation incorporating these variables can reveal a range of probable outcomes, guiding risk-adjusted investment strategies. Utilizing such sophisticated tools ensures that investors are prepared for market moves driven by geopolitical developments.

Integrating ESG Factors into Gold Mining Investment Analysis

Environmental, Social, and Governance (ESG) criteria are increasingly shaping investment decisions. Companies demonstrating strong ESG commitments—such as implementing renewable energy in operations or engaging in community development—are more likely to attract sustainable investment funds. As highlighted by MSCI ESG Research, ESG-compliant mining stocks tend to outperform over the long term due to lower regulatory risks and enhanced stakeholder relations, making them compelling choices for 2025.

What Methodologies Are Effective for ESG Assessment in the Gold Sector?

Advanced ESG assessment utilizes a combination of third-party ratings, corporate sustainability reports, and on-the-ground audits. Techniques such as Life Cycle Analysis (LCA) and Stakeholder Engagement Surveys provide granular insights into a company’s ESG performance. Incorporating these methodologies into your investment analysis ensures a comprehensive understanding of long-term sustainability and risk management.

To deepen your grasp of these sophisticated strategies, consider engaging with industry-specific research reports and consulting with ESG-focused financial advisors. Continuous education and analysis are essential to maintaining an edge in the dynamic landscape of gold investments in 2025.

Expert Insights & Advanced Considerations

1. Emphasize Technological Innovation

Leverage companies adopting automation and AI-driven exploration to gain competitive advantages in efficiency and environmental compliance, which are critical for long-term growth.

2. Focus on ESG Integration

Prioritize stocks with strong ESG practices, as they tend to outperform due to lower regulatory risks and better stakeholder relations, especially in the evolving landscape of responsible investing.

3. Utilize Quantitative Risk Models

Incorporate advanced models such as Monte Carlo simulations to quantify geopolitical and currency risks, enabling more informed decision-making amid market uncertainties.

4. Diversify with ETFs and Physical Gold

Balance high-growth stocks with gold ETFs like SPDR Gold Shares (GLD) and holdings of physical gold to hedge against volatility and preserve wealth.

5. Stay Informed on Supply-Demand Dynamics

Regularly analyze industry reports and demand trends, especially from emerging markets, to anticipate price movements and strategic opportunities in 2025.

Curated Expert Resources

- McKinsey & Company Industry Reports: Offers comprehensive insights into automation, AI, and operational efficiencies in mining.

- MSCI ESG Research: Provides detailed ESG ratings and performance analysis tailored for the gold sector, essential for sustainable investing.

- Bloomberg Economics: Delivers geopolitical risk indices and currency forecasts critical for risk assessment and strategic planning.

- Buying Gold Now: An authoritative platform with in-depth guides, market analysis, and strategic tips for gold investors in 2025.

Final Expert Perspective

In 2025, success in gold mining stocks hinges on integrating technological advancements, robust ESG practices, and sophisticated risk management strategies. The industry is at a pivotal point where innovation and sustainability are no longer optional but essential for sustained growth. Engaging with authoritative resources and maintaining an analytical mindset will empower investors to capitalize on emerging opportunities. For those committed to deepening their expertise, exploring advanced industry reports and engaging with professional advisors will be invaluable. As always, a disciplined, informed approach remains the bedrock of long-term wealth preservation and expansion in the dynamic landscape of gold investments.