Unlocking the Strategic Value of Gold Investment for 2025: A Deep Dive into Long-Term Wealth Preservation

As global economic uncertainties persist and geopolitical tensions influence market stability, gold continues to stand out as a resilient asset class. For investors aiming to safeguard wealth over the long term, understanding the nuanced dynamics of purchasing gold bars and coins in 2025 is paramount. This guide synthesizes expert insights, market trends, and sophisticated investment tactics to empower informed decision-making.

The Strategic Significance of Gold in Diversified Portfolios

Gold’s historical role as a hedge against inflation and currency devaluation remains unchallenged. In 2025, emerging factors such as shifts in economic and political influences are anticipated to affect gold prices significantly. Consequently, integrating physical gold, particularly bars and coins, into a diversified portfolio offers strategic stability amid volatility.

Deciphering the Complexities of Gold Supply and Demand in 2025

Understanding the supply-demand dynamics, especially in the mining industry, is crucial for long-term investors. As outlined in industry analyses, factors like mining output and consumer demand influence gold prices. Recognizing these elements allows investors to anticipate market movements and time their purchases effectively.

Advanced Insights into Gold Price Drivers and Market Influences

Market trends suggest that central bank gold purchases, geopolitical tensions, and macroeconomic policies will continue to steer gold prices in 2025. For instance, increased holdings by central banks, as discussed in recent white papers, could signal bullish trends. Savvy investors monitor these indicators to optimize acquisition timing.

How to Strategically Acquire Gold Bars and Coins in 2025

Expertly purchasing physical gold involves selecting reputable dealers, understanding resale value, and considering the purity and authenticity of bullion. Leveraging insights from best practices ensures optimal investment security. Additionally, diversifying across coin types and bar sizes can enhance liquidity and long-term growth prospects.

What are the most effective techniques for maximizing returns from gold investments in 2025?

Employing technical analysis, market timing strategies, and leveraging derivatives like futures can amplify gains. For example, trading techniques such as options hedging and short-term tactical entries are crucial in a fluctuating market landscape.

For continued mastery, explore our comprehensive resources on gold bullion investing strategies and stay engaged with industry forums to share insights with fellow investors.

In conclusion, strategic gold acquisition in 2025 hinges on a sophisticated understanding of macroeconomic trends, supply-demand mechanics, and tactical market entry methods. As the gold market evolves, staying informed and adaptable remains the cornerstone of long-term wealth preservation.

For expert opinions and to contribute your insights, visit our main resource hub.

Unveiling the Hidden Forces Behind Gold Price Fluctuations in 2025

While many investors focus on supply-demand dynamics, understanding the nuanced influences of macroeconomic factors and geopolitical tensions on gold prices offers a distinct advantage. In 2025, key elements such as inflation rates, currency fluctuations, and international conflicts are poised to shape the gold market significantly. For example, recent analyses on economic and political influences highlight how inflation fears and dollar strength directly impact gold’s valuation. Recognizing these underlying drivers enables investors to anticipate price movements more accurately and refine their entry and exit strategies.

Decoding Market Sentiments and Investor Behavior in 2025

Market sentiment plays a pivotal role in gold price volatility, especially as institutional and retail investors adjust their portfolios in response to shifting economic signals. In 2025, behavioral patterns such as flight-to-safety during geopolitical crises or profit-taking during bullish runs can lead to rapid price swings. Monitoring investor sentiment indices, sentiment analysis tools, and news flow becomes essential for proactive decision-making. Furthermore, understanding how traders interpret macroeconomic reports, such as employment data or inflation reports, can provide an edge in timing market entries—whether through physical assets like coins and bars or derivatives like futures and options.

Expert Insight: How Will Central Bank Policies Shape Gold in 2025?

Central bank gold purchases and reserves management strategies remain a critical factor influencing market prices. According to industry experts, including those referenced in white papers on central bank activities, increased accumulation by major economies can signal confidence in gold’s long-term value and potentially trigger bullish trends. Conversely, tapering or selling by central banks could exert downward pressure. For investors, tracking central bank policies, reserve reports, and geopolitical developments provides valuable foresight into future price trajectories, enabling more informed asset allocation decisions.

What innovative tools or analytical frameworks can elevate your gold investment strategy in 2025?

Advanced analytical tools, including algorithmic trading models, sentiment analysis algorithms, and macroeconomic scenario simulations, are transforming how investors approach gold markets. Incorporating these technologies into your strategy can enhance market timing, risk management, and portfolio diversification. For example, leveraging best practices for buying gold combined with real-time data analytics enables a more dynamic approach to asset acquisition and sale. Additionally, staying informed through trusted industry reports and expert insights can help you adapt to evolving market conditions and capitalize on emerging opportunities.

To deepen your understanding, explore our detailed analysis on gold demand trends in industry and consumer markets, which provides vital context for price movements and investment timing. Share your thoughts or questions in the comments to join a community of informed investors dedicated to mastering gold investment strategies in 2025.

Harnessing Macro-Financial Models to Predict Gold Price Trends in 2025

As investors seek to anticipate the nuanced movements of gold prices in the complex economic landscape of 2025, employing macro-financial modeling becomes indispensable. These models integrate variables such as inflation trajectories, currency exchange rates, geopolitical risk indices, and central bank policies to generate predictive analytics that inform strategic entry and exit points. By leveraging tools like econometric simulations and machine learning algorithms, sophisticated investors can identify subtle market signals, enabling proactive portfolio adjustments that maximize returns while mitigating risks.

Interplay of Global Monetary Policies and Gold Valuation: A Deep Dive

Central bank policies worldwide are pivotal in shaping gold’s trajectory. Quantitative easing, interest rate adjustments, and reserve management strategies create ripples across commodity markets. For instance, the tapering of asset purchases by major economies could lead to a scarcity effect that elevates gold prices. Conversely, aggressive rate hikes might strengthen fiat currencies, exerting downward pressure on gold. Analyzing central bank reserve reports, such as the IMF’s COFER data, alongside geopolitical developments, allows investors to decode monetary policy signals and position themselves advantageously.

What Are the Most Advanced Analytical Frameworks for Gold Market Forecasting in 2025?

Emerging frameworks such as integrated agent-based models and real-time sentiment analysis platforms provide granular insights into market dynamics. Agent-based models simulate interactions among diverse market participants, capturing feedback loops and emergent phenomena that traditional models overlook. Meanwhile, sentiment analysis harnesses natural language processing to interpret news flow, social media trends, and policy statements, offering a real-time pulse on investor psychology. Combining these frameworks with traditional technical and fundamental analysis creates a multidimensional approach that enhances predictive accuracy and strategic agility.

How Can Investors Effectively Incorporate These Advanced Methods into Their Gold Investment Strategies?

Integrating these sophisticated analytical tools requires a nuanced understanding of both financial theory and technological implementation. Investors should consider partnering with data scientists or utilizing platforms that offer integrated analytics dashboards. Regularly updating models with new data, calibrating assumptions based on evolving geopolitical tensions, and maintaining a diversified portfolio are essential practices. For example, deploying scenario analysis to test various macroeconomic conditions can reveal potential vulnerabilities and opportunities, enabling dynamic adjustments to holdings in gold coins and bars.

To deepen your mastery, explore authoritative resources such as the IMF’s recent research on monetary policy and commodities and stay connected with industry-specific analytics providers. Your proactive engagement with these advanced tools will position you as a forward-thinking investor capable of navigating the complexities of the gold market in 2025 and beyond.

Decoding the Impact of Geopolitical Shifts on Gold’s Long-Term Value

In 2025, geopolitical tensions continue to serve as catalysts for gold price fluctuations. Sophisticated investors analyze geopolitical risk indices, international conflict zones, and diplomatic developments to forecast long-term trends. For example, rising tensions in key regions such as the South China Sea or Eastern Europe often prompt increased central bank and institutional gold purchases, reinforcing gold’s role as a global hedge. Staying ahead requires monitoring real-time geopolitical risk assessments from reputable sources like the Council on Foreign Relations (CFR) and integrating this data into strategic asset allocation models.

Leveraging Quantitative Easing and Interest Rate Policies for Strategic Acquisition

The interplay between monetary policy and gold prices is complex yet predictable with advanced modeling. Quantitative easing (QE) programs expand central bank balance sheets, often leading to currency devaluation and increased gold demand. Conversely, rising interest rates can strengthen fiat currencies, exerting downward pressure on gold. Investors utilize econometric models and scenario simulations, such as vector autoregression (VAR) and Monte Carlo analyses, to project future price movements. Deep understanding of these mechanisms enables precise timing of gold bar and coin acquisitions, optimizing long-term returns.

What Are the Cutting-Edge Analytical Tools Transforming Gold Market Forecasts in 2025?

Emerging analytical frameworks like machine learning-based predictive models and real-time sentiment analysis platforms are revolutionizing gold market forecasting. These tools process vast datasets—including macroeconomic indicators, social media sentiment, and news analytics—to identify subtle market signals. For instance, natural language processing algorithms can detect shifts in investor mood ahead of macroeconomic releases, providing a competitive edge. Integrating these technologies into your investment strategy enhances responsiveness and risk management, positioning you advantageously in the evolving 2025 gold landscape.

How to Incorporate Advanced Financial Engineering Techniques into Your Portfolio?

Financial engineering methods such as dynamic hedging, options-based strategies, and portfolio optimization algorithms can significantly amplify gains from gold investments. Employing delta-neutral strategies or implementing protective puts on gold ETFs and futures can hedge against downside risks. Portfolio optimization models leveraging Markowitz mean-variance analysis or Black-Litterman frameworks help balance risk and reward, especially when diversifying across physical gold, ETFs, and derivatives. These techniques demand a sophisticated understanding but offer unparalleled control over investment outcomes, particularly amid volatile macroeconomic conditions.

What are the most effective ways to utilize these advanced tools for maximum ROI in gold assets?

To maximize ROI, investors should combine quantitative models with qualitative insights, continuously calibrate their assumptions, and maintain flexibility in asset allocation. Engaging with financial data platforms such as Bloomberg Terminal or FactSet provides access to real-time analytics and predictive models. Additionally, collaborating with quantitative analysts or financial engineers can refine your strategies, ensuring they adapt dynamically to market shifts. By integrating these advanced methods, you position yourself at the forefront of gold investment innovation, capitalizing on emerging opportunities in 2025.

Explore authoritative resources like the World Gold Council (WGC) for comprehensive data and insights, and join expert forums to exchange advanced strategies with fellow investors committed to mastering the complexities of gold markets.

Harnessing the Power of Macro-Financial Models for Predictive Precision

Macro-financial modeling synthesizes variables such as inflation expectations, currency exchange rates, and global risk indices to generate accurate price forecasts. Techniques like Bayesian inference and deep learning neural networks facilitate nuanced predictions, allowing investors to anticipate market moves with higher confidence. These models incorporate policy shifts, geopolitical developments, and market sentiment, providing a holistic view that informs strategic decisions on physical gold purchases and sales.

How Do Emerging Global Monetary Trends Influence Gold’s Future Valuation?

Global monetary trends, including reserve currency dynamics, digital currency adoption, and central bank reserve adjustments, profoundly influence gold’s valuation. The gradual shift toward digital and alternative currencies may diminish fiat currency dominance, bolstering gold’s appeal as a stable store of value. Monitoring reports from institutions like the IMF and BIS (Bank for International Settlements) enables investors to decode the implications of these trends and position their portfolios accordingly. Staying informed ensures proactive engagement with the evolving monetary landscape, safeguarding long-term wealth preservation.

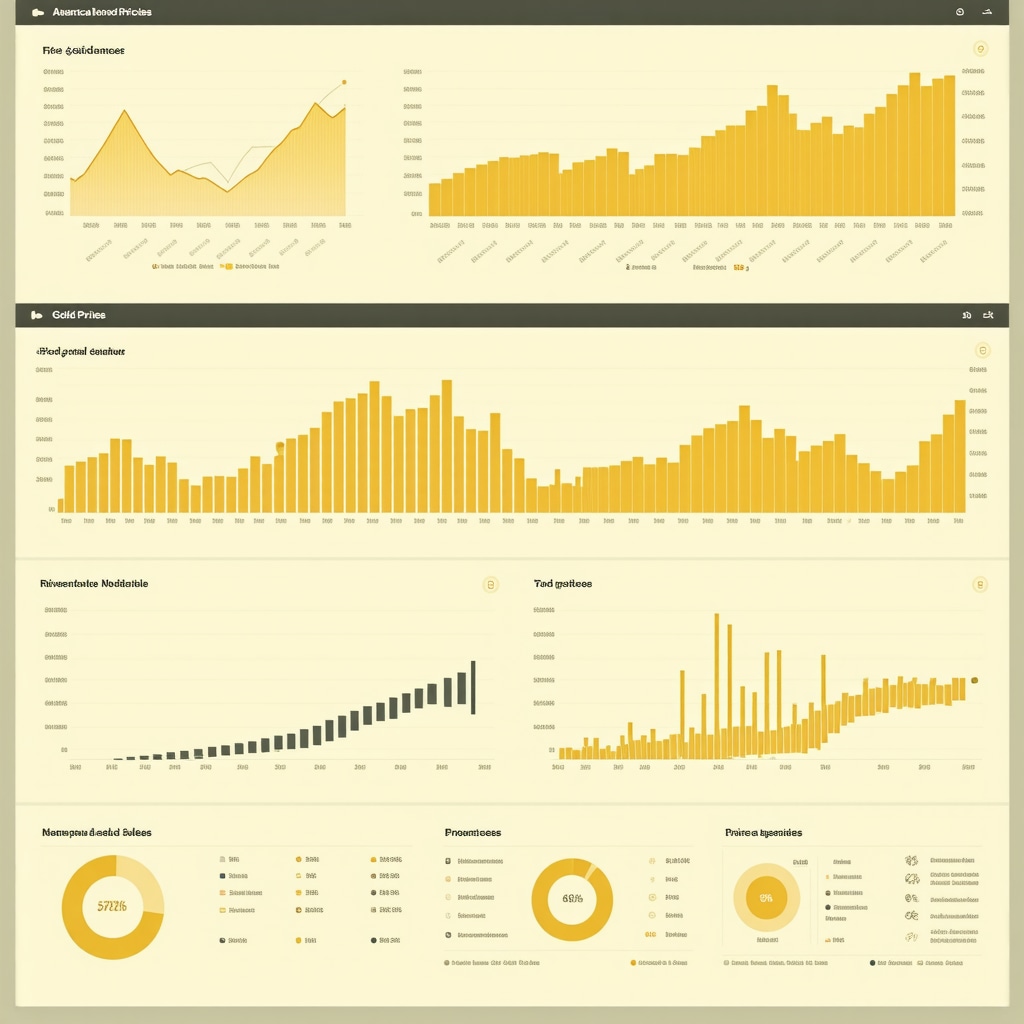

Image prompt: Advanced financial modeling tools illustrating macro-financial variables influencing gold prices in 2025, with graphs and digital dashboards.

Expert Insights & Advanced Considerations

Innovative Market Dynamics

Leading analysts emphasize the importance of integrating macroeconomic models with real-time sentiment analysis to anticipate gold price movements. This approach enables investors to adapt swiftly to geopolitical shifts and monetary policy changes, ensuring more precise entry and exit points.

Supply Chain and Mining Industry Trends

Understanding the evolving landscape of gold mining—such as new reserves, technological advancements, and geopolitical influences—can provide a competitive edge. Staying informed through industry reports enhances strategic decision-making and risk mitigation.

Impact of Digital Currencies and Reserve Diversification

The increasing adoption of digital currencies and shifts in reserve allocation by central banks influence gold’s role as a safe haven. Recognizing these trends allows for better portfolio diversification and long-term wealth preservation strategies.

Curated Expert Resources

- World Gold Council: Offers comprehensive data, market analysis, and strategic insights—an essential resource for high-level investors.

- IMF Reserve Data: Provides authoritative information on global reserve trends and monetary policy impacts that influence gold valuation.

- Bank for International Settlements (BIS): Tracks digital currency developments, reserve diversification, and macrofinancial trends impacting gold markets.

Final Expert Perspective

In 2025, mastering the nuances of gold investment requires a sophisticated understanding of macro-financial models, geopolitical risks, and technological innovations. Staying ahead involves leveraging authoritative data and advanced analytical tools to navigate an increasingly complex market landscape. Engage actively with leading resources and contribute your insights to foster a deeper collective expertise—your strategic advantage in the evolving realm of gold investment begins here.