Unveiling the Strategic Landscape of Gold in 2025: A Deep Dive into Market Dynamics

The gold market in 2025 stands at a complex intersection of macroeconomic forces, geopolitical tensions, and evolving investor sentiment. As an expert in precious metals investment, I recognize that understanding the nuanced interplay of these elements is essential for forging resilient, data-driven strategies. This analysis synthesizes current trends, economic indicators, and market forecasts to provide a comprehensive view of gold’s trajectory over the coming year.

Deciphering the Underlying Drivers of Gold Price Movements in 2025

How Will Inflation and Real Interest Rates Shape Gold’s Outlook?

Historically, gold has served as a hedge against inflation. In 2025, inflationary pressures, fueled by fiscal stimuli and supply chain disruptions, are expected to persist, compelling investors to consider gold as a safe haven. Simultaneously, real interest rates—adjusted for inflation—remain critical; negative real rates tend to bolster gold’s appeal by reducing the opportunity cost of holding non-yielding assets. For a detailed analysis, see how gold as a hedge can protect your portfolio in 2025.

Central Bank Policies and Their Impact on Gold Pricing

Central bank gold acquisitions are a pivotal indicator of market confidence and monetary policy stance. As noted in recent reports, central banks have increased their gold reserves in 2025, signaling a strategic shift towards diversification amid ongoing currency volatility. This trend, examined in the context of how central bank gold purchases impact prices in 2025, suggests a sustained bullish sentiment for gold, potentially driving prices higher.

Market Sentiment and Investor Behavior: A Sophisticated Perspective

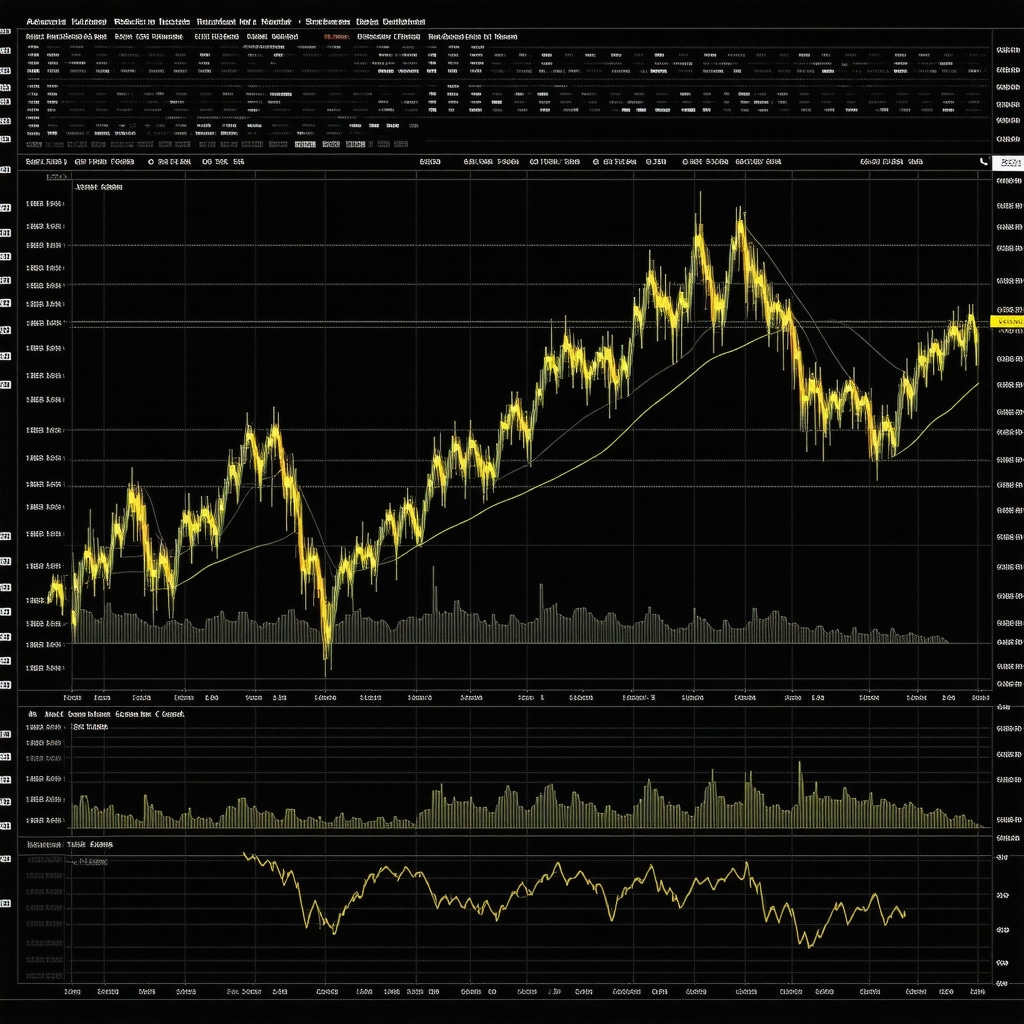

Beyond macroeconomic fundamentals, investor sentiment, technical analysis, and geopolitical developments significantly influence gold prices. The current environment of geopolitical tensions and uncertain economic growth prospects encourages diversification into precious metals. Advanced traders are leveraging proven trading techniques for 2025 to optimize entry and exit points, ensuring their portfolios are resilient against volatility.

Expert-Driven Strategies for Navigating 2025’s Gold Market

For institutional and retail investors alike, adopting a layered strategy that incorporates physical gold, ETFs, and gold mining stocks can enhance diversification. Moreover, understanding supply-demand dynamics, especially in the context of industry demand from jewelry and technology sectors, is fundamental. Exploring gold demand trends and industry insights in 2025 will inform more nuanced investment decisions.

What Are the Critical Indicators to Watch for Gold in 2025?

Key economic indicators include inflation rates, U.S. dollar strength, and geopolitical risk indices. Monitoring these indicators helps anticipate short-term price fluctuations and long-term trends. For an in-depth understanding, consult gold price forecast 2025: key market trends & economic signals.

As the landscape evolves, professional investors are encouraged to explore comprehensive resources and contribute insights into this dynamic market. For a detailed guide on building a resilient gold portfolio, see step-by-step guide to starting your gold IRA in 2025.

Harnessing Sophisticated Tools to Decode Gold’s Future in 2025

As the gold market continues to evolve amid fluctuating macroeconomic conditions, investors must leverage advanced analytical frameworks to stay ahead. One such approach involves integrating machine learning models with traditional technical and fundamental analysis, providing a nuanced view of potential price trajectories. For instance, predictive analytics that incorporate geopolitical risk indices, currency volatility, and inflation expectations can unveil hidden patterns that inform strategic entry and exit points.

Challenging Conventional Wisdom: Is Gold Still the Ultimate Safe Haven?

While gold has historically been the go-to asset during times of crisis, emerging asset classes and technological innovations challenge this paradigm. Digital assets like gold ETFs and mutual funds now offer liquidity and diversification benefits that physical gold cannot match. Moreover, considering the environmental, social, and governance (ESG) factors influencing gold mining companies can reshape how investors evaluate gold’s sustainability and long-term viability.

What Are the Implications of Market Disruptions on Gold’s Role as a Hedge?

In a world increasingly susceptible to market shocks—from geopolitical conflicts to cyber threats—how resilient is gold as a hedge? Experts suggest that understanding the impact of central bank gold purchases on market liquidity and price stability is crucial. Simultaneously, stress testing portfolios against hypothetical crises, using scenario analysis frameworks, can prepare investors for unforeseen disruptions.

To deepen your strategic toolkit, explore proven trading techniques for 2025, and consider how combining physical gold with derivatives can optimize risk-adjusted returns.

Join the Conversation: Share Your Insights or Discover More Expert Strategies

What advanced tools have you found most effective in navigating gold investments in 2025? Share your experiences or ask questions in the comments below. For further reading on diversifying your portfolio with gold, visit how gold mining stocks enhance diversification.

Harnessing Quantitative Analysis: Machine Learning as a Game-Changer in Gold Market Predictions

As the complexity of global economic interactions intensifies, traditional analytical methods may no longer suffice for discerning subtle market signals. Advanced investors are increasingly turning to machine learning models that integrate a multitude of variables—such as geopolitical risk indices, currency fluctuations, and macroeconomic indicators—to forecast gold prices with unprecedented accuracy. These models employ algorithms like neural networks and random forests, enabling the detection of nonlinear patterns and potential turning points that escape conventional analysis.

For example, recent studies published in the Journal of Financial Data Science highlight how combining deep learning techniques with real-time economic data can improve predictive performance for precious metals markets. This approach not only enhances decision-making precision but also facilitates dynamic risk management, allowing investors to adapt swiftly to market shifts.

Decoding Gold’s Resilience Amidst Market Disruptions: Scenario Planning and Stress Testing

In an era where cyberattacks, geopolitical conflicts, and economic shocks are increasingly prevalent, understanding gold’s role as a resilient hedge requires sophisticated scenario analysis. Investors should utilize scenario planning frameworks that simulate various crises—such as a sudden currency devaluation or a global conflict—to assess portfolio robustness.

Stress testing tools, grounded in historical data and hypothetical scenarios, enable investors to evaluate how their gold holdings and related assets perform under stress. For instance, scenario analysis might reveal that during a hypothetical cyber warfare escalation, gold prices could surge due to safe-haven demand, but liquidity constraints might also emerge, affecting transaction execution. Preparing for such complexities ensures resilience and informed decision-making.

Expert Q&A: How Can Investors Balance Physical Gold and Digital Assets for Optimal Diversification?

Q: Given the rise of gold ETFs, mutual funds, and digital assets like cryptocurrencies linked to gold, how should investors balance physical gold and these digital or paper assets to optimize diversification and liquidity?

A: The optimal strategy involves a nuanced understanding of each asset class’s unique attributes. Physical gold provides tangible security and privacy, while ETFs and mutual funds offer liquidity and ease of trading. Digital assets, such as tokenized gold, combine the benefits of digital convenience with blockchain transparency but also introduce new risks related to cybersecurity and regulatory uncertainty.

Experts recommend a layered approach: maintain a core holding of physical gold for long-term stability, supplement with ETFs for liquidity needs, and cautiously explore digital assets for tactical allocations. Regular portfolio reviews and risk assessments are essential to adapt to evolving market conditions and technological developments.

To deepen your understanding, explore authoritative sources such as the World Gold Council’s reports on digital gold innovation and the International Monetary Fund’s analyses of monetary policy impacts on gold assets.

Future Outlook: Integrating ESG Factors into Gold Investment Strategies

Environmental, social, and governance (ESG) considerations are reshaping investment landscapes across all asset classes, including gold. Investors increasingly scrutinize the sustainability of gold mining operations, favoring companies with transparent ESG practices. This shift influences not only the valuation of gold mining stocks but also the perception of gold as a sustainable asset.

Emerging frameworks, such as ESG scoring systems tailored to mining companies, enable investors to incorporate sustainability metrics into their decision-making process. As ESG criteria become mainstream, the integration of these factors will likely influence long-term gold price trajectories, making it imperative for investors to stay informed about industry standards and evolving best practices.

Conclusion: Building a Resilient, Data-Driven Gold Portfolio in 2025

In a landscape characterized by rapid technological advances and geopolitical uncertainties, leveraging sophisticated analytical tools and diversified asset structures is key to optimizing gold investments. The integration of machine learning models, scenario planning, and ESG considerations will empower investors to navigate volatility with confidence. To stay ahead, continuous education and engagement with authoritative industry insights are vital—consider subscribing to specialized financial research platforms or consulting with expert advisors to refine your strategy.

Unlocking the Power of Quantitative Models to Forecast Gold Prices in 2025

In the ever-evolving landscape of precious metals, sophisticated quantitative models—such as ensemble machine learning algorithms—are revolutionizing how investors forecast gold’s trajectory. These models synthesize macroeconomic indicators, geopolitical risk metrics, and real-time currency fluctuations, providing a nuanced predictive framework that surpasses traditional analysis. By leveraging deep neural networks, investors can identify nonlinear patterns and potential inflection points, enabling more precise timing for entry and exit strategies.

How Can Scenario Planning and Stress Testing Fortify Gold Investment Portfolios?

In an environment where geopolitical upheavals, cyber threats, and economic shocks are increasingly prevalent, scenario planning becomes indispensable. Advanced investors utilize comprehensive stress testing tools that simulate extreme events—such as currency devaluations or global conflicts—to evaluate portfolio resilience. These frameworks incorporate historical data and hypothetical crises, revealing vulnerabilities and guiding strategic rebalancing to mitigate risks. Such proactive measures ensure that gold holdings serve as effective hedges during turbulent periods.

What Are the Emerging Trends in Digital Gold Assets and Their Integration into Diversified Portfolios?

The rise of tokenized gold and blockchain-based platforms offers unparalleled liquidity and transparency. These digital assets bridge the gap between physical gold’s security and the convenience of trading on digital exchanges. Smart contracts and decentralized finance (DeFi) protocols facilitate seamless asset transfer and collateralization, transforming gold investment paradigms. A balanced approach—combining physical holdings, ETFs, and digital tokens—enhances diversification while managing liquidity needs and regulatory risks.

How Should Investors Incorporate ESG Criteria into Gold Mining and Refining Operations?

Environmental, social, and governance considerations are increasingly influencing gold’s valuation. Investors are now scrutinizing mining companies’ ESG scores, favoring those with transparent sustainability practices, reduced carbon footprints, and responsible labor policies. Incorporating ESG metrics into investment decisions not only aligns portfolios with ethical standards but also mitigates long-term risks associated with regulatory penalties and reputational damage. Industry initiatives, such as the Responsible Gold Mining Principles, serve as valuable guides for discerning ESG-compliant assets.

Exploring the Future: Integrating Digital and Traditional Assets for a Resilient Gold Portfolio

As digital assets gain prominence, the challenge lies in harmonizing them with traditional physical gold and ETFs. A strategic allocation that balances tangible assets with blockchain-enabled tokens can optimize liquidity, security, and diversification. Advanced portfolio optimization algorithms, including mean-variance analysis augmented with ESG and risk-adjusted return metrics, facilitate this integration. Continuous monitoring and adaptive rebalancing ensure resilience amid market volatility and technological evolution.

What Are the Key Indicators to Monitor for Gold Market Stability in 2025?

Critical indicators include global inflation rates, U.S. dollar strength, geopolitical risk indices, and central bank policies. Tracking these metrics helps predict short-term price fluctuations and emerging long-term trends. For comprehensive insights, consult resources such as the World Gold Council’s research reports, which provide in-depth analyses of market fundamentals.

Engage with these cutting-edge insights to elevate your gold investment approach—ongoing education and strategic adaptation are vital in navigating 2025’s complex market environment.

Expert Insights & Advanced Considerations

1. Integrating Machine Learning for Market Prediction

Leveraging AI-driven models such as neural networks allows investors to identify nonlinear patterns in macroeconomic and geopolitical data, enhancing predictive accuracy for gold price movements and timing strategies.

2. ESG Factors Shaping Long-Term Valuations

Understanding the impact of environmental, social, and governance criteria on gold mining companies can inform sustainable investment choices, aligning portfolio growth with ethical standards and regulatory trends.

3. The Role of Digital Gold Assets in Diversification

Tokenized gold and blockchain-based platforms are revolutionizing liquidity and transparency, providing new avenues for portfolio diversification that complement traditional physical gold holdings.

4. Scenario Planning for Portfolio Resilience

Employing comprehensive stress testing frameworks simulating crises like cyber threats or geopolitical conflicts helps assess and strengthen gold’s role as a safe haven under extreme conditions.

5. Combining Quantitative and Fundamental Analysis

Integrating advanced quantitative models with fundamental market signals offers nuanced insights, enabling proactive decision-making in the dynamic 2025 environment.

Curated Expert Resources

- World Gold Council Research Reports: In-depth analyses of market trends, ESG integration, and supply-demand dynamics.

- Journal of Financial Data Science: Cutting-edge research on machine learning applications in financial forecasting.

- International Monetary Fund (IMF) Reports: Insights into macroeconomic policies and their impact on precious metals.

- Responsible Gold Mining Principles: Frameworks for ESG compliance and sustainable practices in gold mining.

- Blockchain and Tokenized Gold Platforms: Industry-leading platforms exemplifying digital asset integration into gold investing.

Final Expert Perspective

In the evolving landscape of gold investment for 2025, mastering advanced analytical tools—such as machine learning, scenario analysis, and ESG assessment—will be pivotal for discerning sophisticated strategies. These insights not only deepen understanding but also empower investors to build resilient, forward-looking portfolios. Engage with these resources and contribute your expertise to shape the future of gold investing—your strategic edge begins with informed action today.